Pre-2020, cloud stocks were never anything that I really even looked at investing in. The numbers just absolutely never made any sense to me but we have just seen some massive returns in 2020 and it’s made me think – is now the time to invest in cloud stocks?

Like I mentioned, the math just never, ever made sense to me. The valuation ratios are bonkers! It’s not uncommon to see a P/S that is above 50 and a negative P/E! That’s really the opposite of what we are supposed to do as value investors.

Normally I would never even look at any of these stocks but my mindset has changed a little bit – I now have a small portion of my portfolio that I allow myself to engage in speculative investing and I have found that this keeps me rational in the large remainder of my portfolio as well as giving me some “fun money” to make sure that I’m not getting caught up in FOMO.

And trust me, the FOMO is real – when I didn’t have this speculative investing/fun money in place, I would get frustrated with my investments. I would see a prototypical value stock that just didn’t generate the same type of returns as some of these high momentum growth stocks generate, such as the cloud stock industry.

Now, that also means that they’re not going to see the major drops either, so you take your pros and cons with them, but it’s helped me be a better investor as a whole!

Introduction to Cloud Computing

First off – what even is cloud computing?

It’s not something that’s easy to understand and it has taken a ton of time for me to even scratch the surface of trying to understand, but I am a firm believer that expanding our circle of competence is one of the most important things that an investor can do!

To understand, I wanted to take this straight from Investopedia because I think that they do a great job explaining the industry:

“Cloud computing is the delivery of different services through the Internet. These resources include tools and applications like data storage, servers, databases, networking, and software.

Rather than keeping files on a proprietary hard drive or local storage device, cloud-based storage makes it possible to save them to a remote database. As long as an electronic device has access to the web, it has access to the data and the software programs to run it.

Cloud computing is a popular option for people and businesses for a number of reasons including cost savings, increased productivity, speed and efficiency, performance, and security.”

If you’re like me and learn better from video/visual learning, then I’d recommend checking out this three minute video from Amazon that helps explain cloud computing.

I’m not someone that normally has a “technical” mind, but I do think this is very interesting and it seems like it’s the way that the world is moving!

There are a ton of different cloud stocks that you can invest in, many of which you have likely heard before:

- Microsoft

- Apple

- Amazon

- IBM

- Salesforce

- Oracle

Then there are other companies that might not seem as obvious but are some of the “up and comers”

- Workday

- Datadog

- Fastly

- Okta

- Five9

Are you familiar with any of these companies in the second set? If so, do you actually know what they even do?

I am, but just as of recently, and am still wanting to uncover even more about the industry. So, do you know what I do? I take steps towards investing rather than just going all in.

1 – learn as much as I can about the industry

I will literally do anything I can to research cloud stocks. I listen to podcasts, pay special attention on CNBC, read blogs, google search – anything! Anything that I can to help myself understand the industry a little bit more, I will do it.

I don’t need to know everything about the industry, and I don’t have to agree with everything being said, but the differing opinions will help make me a more knowledgeable person. The Motley Fool has a lot of podcasts that talk about the cloud and they’re also just a fan favorite of mine, so I’ve heavily relied on them through this process.

2 – once I am feeling comfortable in the industry, I will start to look at some individual companies

I will basically repeat the same exact process as with #1 but this time it’s more tailored to specific companies. Now, the information is going to be harder to find but I will use different resources such as Seeking Alpha or even looking for Twitter users that talk about these stocks a lot and then seeing if they have a website or publication on them.

It’s just about making an active effort to learn more about the companies. That doesn’t have to mean reading 10k’s (although I do that, too), but it means that you’re going out of your way to learn about something specific.

Maybe instead of listening to Fast Money every night when you’re working out (I do this), you should try to find different cloud podcasts.

Maybe instead of going to ESPN.com during your lunch hour (I do this), you should read a little bit about the cloud companies you’re looking at.

It doesn’t have to be some lifechanging thing to dedicate hours to, but every little bit helps! And honestly, I think that learning a little bit each day is going to help you learn more effectively. Just like in college, you don’t actually learn when you cram before a test – you need to know the subject material by consuming it frequently over a long period of time.

Making sure you fully understand the industry, and then a specific company, is key before ever considering investing in that company, and this is even more so true to a growth stock like these cloud stocks.

To show the importance of this, let’s just look at an example. Datadog (DDOG) is a fan favorite cloud stock in 2020, and understandably so! The stock is up 119% from $36.70 to $80.36 as of 9/13/20. But there has been A TON of volatility mixed in there:

Sure, that is a pretty dang nice ride up on the year, but if you don’t even know what the company does and you’re investing in it, you’re going to be much more likely to sell at the low point and then buy back in at a higher price! You’re not even engaging in speculative investing – you’re just gambling!

It’s just a pure gamble. That’s it.

The stock actually topped out recently at $98.99. If you had bought in at that point, which some people obviously did, then you’re down 19% on your investment.

So, what would you do now? Buy more or sell?

You can’t even make a smart decision because you have no idea what the company does or anything about the industry!

I might sound preachy right now, but this is soooo important for investors to understand. Don’t get caught up in the hype and get overwhelmed by FOMO.

Considering Cloud ETFs

I have literally spent months trying to learn about the industry. Like honestly almost an entire year now. And I am just getting to the point where I feel comfortable with individual companies. And that’s only a very, very few that I’ve looked into.

But first, I made sure I understood the industry. At that point, when I had conviction about where things were headed, I bought into an ETF, WCLD.

Just as I would with a stock, I did a lot of research on what type of ETF to buy. There are many different cloud ETFs but I found that I liked WCLD the most because of the companies that were contained within it:

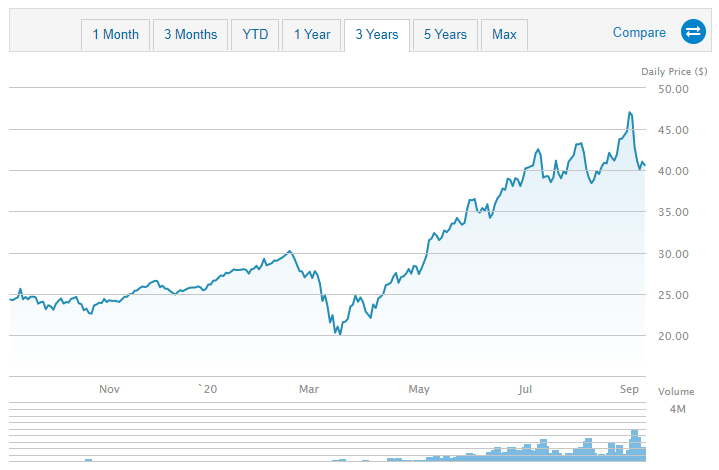

If you go to ETF.com, you can see many different facts about the ETF including the .45% ratio, the entire list of holdings in the ETF (rather than just the top 10 that I listed above), the MSCI rating and the performance, as shown below:

As you can see, the ETF only started in October/November, but it has had some pretty dang nice returns in the last year.

The reason that I liked this ETF is because it was really meant to mimic cloud companies that are emerging rather than the ones that have been around for a while. I view cloud as a really new market and I think that as more companies come into this space and disrupt it, you’re going to see a lot of companies with very niche markets that will start to own that area.

There are many other cloud ETFs such as CLOU and SKYY that each have their own niche, so it’s really just up to you to find out the best ETF that matches what you’re looking for. Like I said, I wanted an ETF that was going to emerge to prominence, so that’s why I started with WCLD.

If you’re struggling to find an ETF, think about some of the companies that you have heard over and over again. If you go to ETF.com then you can actually search for ETFs that have exposure to a certain stock, therefore giving you some exposure but also making sure that you’re diversified among that ETF.

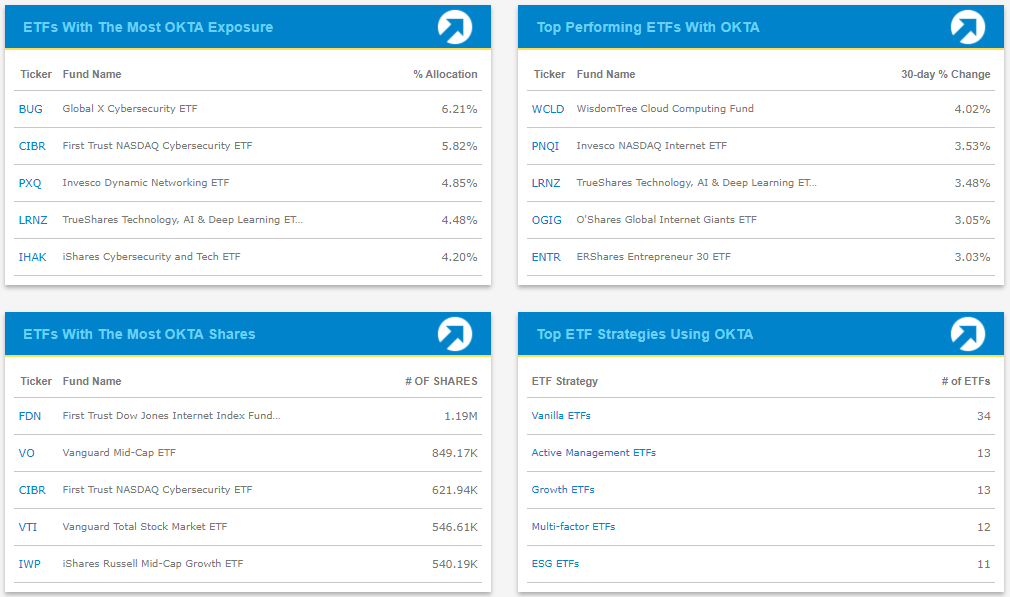

For instance, let’s pretend that the company that you love is OKTA. When I go to the stock finder on ETF.com then I can search OKTA and find ETF exposure:

Before you know it, you’re going to be down a rabbit hole looking at tons of ETFs and trying to find the best one to invest in. I want to stress that in my opinion, the most important thing about finding an ETF is being knowledgeable. Be knowledgeable about the industry and about the goal that you’re wanting the ETF to achieve.

You don’t need to know everything about every single company. That’s the point of the ETF! You can put your money to work and still maintain a relatively high margin of safety, depending on the type of ETF, without needing to know a ton about each individual company.

Eventually, if you continue to learn and research the industry and follow the performance of your ETF, you’re eventually going to get some favorite companies and maybe even spark a love connection with some of them!

Getting Skin in the Game – Next Steps

One of the companies that I fell in love with was Fastly (FSLY). I didn’t overdo myself in research as I really trusted the industry and I just bought a couple shares to “dabble” in. Since then, I have researched the company more and more because now that I had some money at play, it was much more fun to learn about the company.

I really do think that once you get some skin in the game then you’re going to learn better but the key is to do some analysis first. For instance, I made sure that I really understood the industry and then bought into the ETF. Then, I started to look at some of the companies that were included in that ETF before buying more.

Personally, I think that cloud stocks are going to have a huge role in our future and that’s a main reason that I am making sure that I have some exposure in my portfolio. It’s still definitely going to remain in my speculative investing bucket, which is a very small percentage of my overall portfolio, but that’s just until my comfort with those companies grows and then I can reevaluate!

For me, the way that I become more comfortable with a company or industry is by continuing to learn more about it and do my own analysis. Andrew wrote an awesome blog on PPE Accounting and its impact on the cloud, and I think it’s definitely worth the read!

Related posts:

- Can You Get Rich Only by Sector Investing? I feel like the debate of sector investing is one that has lasted ages and so many people have different opinions on the practicality of...

- Do you Trade Volatile Penny Stocks? A common pitfall that I often see new investors fall into is that they get sucked into the “get rich quick” mantra that they think...

- Where to Put Your Money? Large Cap vs. Small Cap Stocks! Where to Put Your Money? Large Cap vs. Small Cap Stocks! I love listening/watching CNBC whenever I have free time, solely for the entertainment factor,...

- Investable Themes for 2020 Stocks and ETFs So, 2020 is finally upon us! First of all, congrats to everyone for making it through another decade and hopefully you’re a decade closer to...