Dividend-paying companies are the backbone of value investing. Besides the fact that they are consistently delivering a dividend payment, most of the time they are also raising their annual dividend payment.

Also, although most investors believe that great dividends come with expensive price tags, the truth of the matter is that often the market cap is irrelevant of the dividend payment.

Editor’s Note: This is a guest contribution by Christina Pomoni.

What is a Dividend Champion After All?

Dividend champions are companies that have raised their dividend payment for 25+ consecutive years and are different than dividend aristocrats, which are all members of the S&P500 index.

The dividend champions is a list of 98 companies, released by the DRiP Investing Resource Center, which includes large caps and mid-caps that are 25+ consecutive dividend increasers. The list also includes the special dividends paid and information on which companies are offering a dividend reinvestment plan (DRIP).

Dividend Champions Are Strong, Yet Not Necessarily Large

Large caps are more likely to deliver a dividend in a consistent way. Why? Because they have a global brand name, and they generate strong economic results with the potential to attract more investors. As more people are trusting their money with a stock, the price of the stock rises.

However, in practice, there are many overvalued stocks that trade way above their fair value exactly because investors have massively believed in them.

On the other hand, evidence shows that there are mid-cap companies with the potential to even outperform the large caps in their dividend payments. Don’t forget that delivering a dividend is a combination of three factors: strong earnings, low debt, and growth.

So, a mid-cap growth-oriented company, which is primarily financed by equity and generates strong results can also deliver a high dividend.

Mid-Caps Can Be Great Dividend-Paying Companies

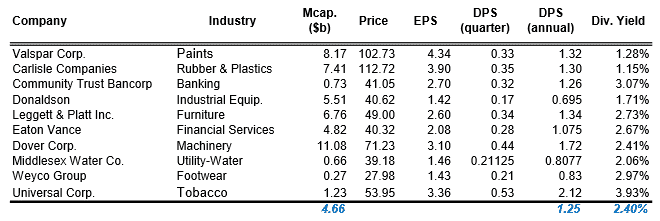

The table below shows ten dividend champions mid-cap companies, which trade in different industries. Their average market cap is near $5 billion, their average annualized dividend is $1.25 per share, and their average dividend yield is 2.40%. The dividend yield is an important indicator of a firm’s financial stability as a dividend yield over 2% often indicates a company that pays out a dividend for an extended period of time, thereby making up a safe investment.

The average dividend payout ratio (DPR) of these stocks is 49.5%. The dividend payout ratio gives you an idea of how the company is managing its capital and growth.

DPR is calculated by dividing DPS over EPS. Hence, a DPR close to 50% suggests that the company distributes 50% of its retained earnings to its shareholders and invests the remaining 50% in a new product, in lowering its debt or in entering a new market. In addition, evidence shows that as companies mature, they tend to increase their DPR.

The last column is indicative of the consistency in dividend payments. Even companies that have a dividend yield lower than 2%, such as Valspar or Carlisle and a dividend payout ratio lower than 50%, deliver a dividend payment for more than 30 years in a row.

So, at the end of the day, it’s not only the brand name that counts, but also the capital structure, the fundamentals, and the dividend policy of a company.

The Magic of Dividend Payments

Let’s assume that you have selected the above dividend-paying stocks for your portfolio. First, have in mind that great earnings do not come overnight, and even if they do, they do not last. As a value investor, you seek to construct a diversified portfolio of carefully selected stocks that can provide you with a steady stream of income on a regular basis. Dividends are your way of building wealth, instead of buying and selling “trendy’ stocks.

Consider this example:

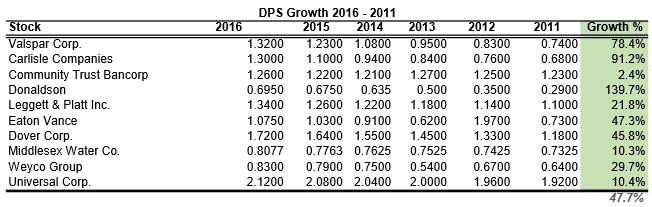

You may not realize it, but maintaining these stocks in your portfolio for five years (which is mid-term, not even long-term investing), you get a dividend growth of almost 50%. These stocks, as well as any dividend-paying stock, have a tremendous growth potential that may not be instantly identified, but it’s there.

All you should do is be patient, and realize the potential of dividend investing. It is, in fact, magic.

Related posts:

- Dividend Ratios Pt. 2: How to Identify Sustainable Dividend Growth As we discussed in part 1 of this dividend mini-series, there is much focus on the past dividend growth of a stock– yet this doesn’t...

- High Dividend Stocks: The Risks and Double Compounding Potential A stock that can grow their dividend payments over time consistently provides compounding like no other opportunity. Naturally, investors try to maximize this compounding by...

- Dividend Ratios Pt. 1: Evaluating the Dividend History of a Stock One of the most disturbing trends on Wall Street that I’ve noticed over the last 100 years is the movement away from an emphasis on...

- Dividend Aristocrats are OVERRATED! Check Out This Dividend Kings List! Chances are that you have heard of Dividend Aristocrats before and chances are that you have been told that they are the bees’ knees. Well,...