Post updated: 6/16/2023

The sweetest source of returns in the stock market are compounding dividends. To generate serious wealth from investing, you need compound interest; and dividends provide you with the best of it.

To understand this magic, you must understand the power of compound interest.

In this post, we will discuss:

- Simple Explanation of Compound Interest

- Compound Interest in the Stock Market

- The Power of Reinvested Dividends

- Compounding Dividends and the S&P 500

- Additional Resources on Compounding Dividends

It’s a lot to unpack, but very worth it. Imagine changing the course of your financial future for the rest of your life!

Take some time and learn these principles, and you just might!

Simple Explanation of Compound Interest

Compound interest causes money to multiply.

It’s like a tree. Notice how the branches of a tree all sprout from each other. It started with a seed, which grew to a trunk, which started to sprout branches, and those branches sprouted branches, and on and on.

I again implore you to examine the branches of a tree closely.

You can see that a branch takes many routes to get back to its base finally. And the higher and further a tree grows, the farther and further it can continue until it reaches a massive size.

The same happens with your wealth with compound interest.

When you receive a return on your investments and immediately reinvest that money into more investments, it’s like a branch that sprouts multiple more branches.

As time goes on, that reinvested money earns its own return, which then also earns a return and multiples in a virtuous cycle.

Let’s look at a visual example of this.

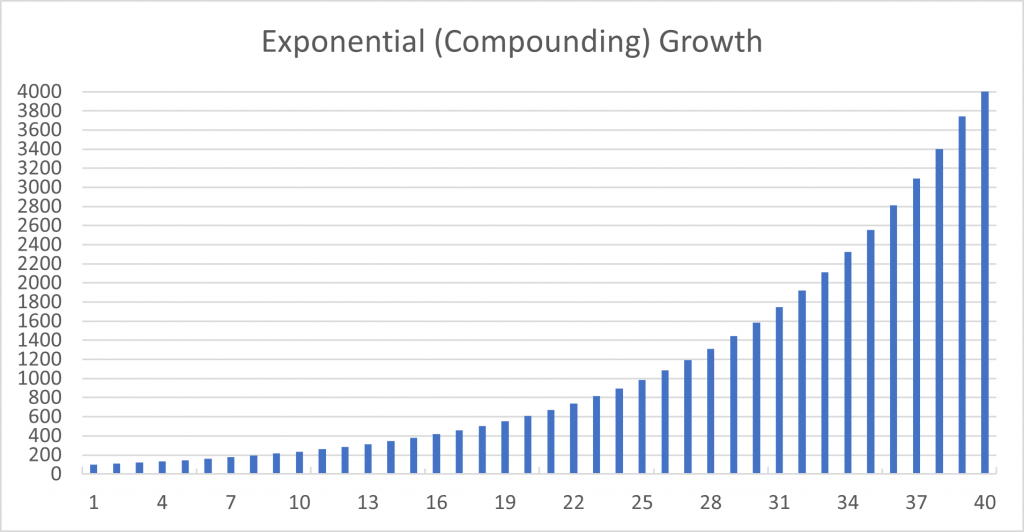

The feat of compounding can also be expressed by what’s called an “exponential curve”:

You see, if I were to make 10% on my $100, I would have $110. But if I reinvest that $110 rather than spend it, and make another 10%, I’d make $11 instead of $10. This is because my extra dollar earns its own return—and my money starts compounding.

The longer that you can reinvest and let money compound, the greater it can multiply, in exponential fashion. Here’s what $100 looks like after 10 years of compounding at 10%:

- $100.00

- $110.00

- $121.00

- $133.10

- $146.41

- $161.05

- $177.16

- $194.87

- $214.36

- $235.79

Notice by year 10, we’re making $23.57 on a 10% returns rather than just $10.

Want to see some real magic?

Let that $100 money tree roll at 10% until retirement, say 40 years from now, and this is how much you’ll have:

- $4,114.48

Not bad for $100 that you let sit and compound; certainly much better than a savings account.

Compound Interest in the Stock Market

Now let’s move to the stock market—my bread and butter. The stock market is a fantastic place to build wealth because you don’t have to deal with tenants, you don’t have to store bulky objects, and you get to participate in the upside of the business world without all of your efforts.

In fact, the stock market is basically a savings machine that drives up your account value, as long as you’re doing it correctly.

Remember our “40 bagger” from before? Our $100 turned to $4,000+?

That was a great example because 10% is actually the long-term average return of the stock market over many decades.

The reason for that general trend is that the stock market grows with the economy because the stock market is the place to buy partial ownership of some of the biggest businesses in the economy.

Now, the stock market is also volatile.

It swings up and down every year, it could go up 20%+ or down -50% (or more) in a single year because, like the economy, it follows cycles of prosperity and despondence.

But if you’re to hold stocks over the long term—like 5, 10, 20 years, or longer—your chances of earning close to that 10% average greatly improve, as businesses and the economy have always grown over the long term.

You’ve got really great chances, especially if you hold stocks with compounding dividends.

Dividends and Stock Market Returns

This 10% average stock market return number has two components to it:

- Stocks going up

- Dividends paid and reinvested

Because when you buy a stock, you have two ways to earn a return. One is to buy a stock and sell it at a higher price, and the other is through the dividends you receive when holding the stock.

A dividend payment is simply a transfer of profits from a business to its owners (shareholders). Each shareholder, or owner of a share of stock, gets an equal amount of dividends per share which come out of a company’s profits (net income).

These dividend payments tend to rise year after year, especially for growing businesses, and so as a long-term shareholder, you can get an income that increases all on its own!

Combine this growth with the additional growth you can get by reinvesting your dividends, and you get dual compounding forces that boost your income from future dividends to grow even faster.

The Power of Reinvested Dividends

Remember how in our tree example, branches create additional branches, which create additional branches. Reinvested dividends work in the exact same way—the more dividends you reinvest, the higher your future dividend payments.

For investors with enough patience to reinvest their dividends rather than spend them, the results from this extra compounding can be significant.

Take an investment in Home Depot as a great example.

Say you purchased the stock in 2011, back when it was a great, dominant company whose dominance continues today.

If you were to buy the stock on 7/18/11 and sell on 7/9/21, your $51.81 stock would be worth $322.10. In other words, $100 in Home Depot at $27.53 would be $621.69 today.

That’s a fantastic return and represents a 20% return annually.

But, say that you instead reinvested your dividends from Home Depot so that they could compound for even greater gains over the long term.

Instead of $620.73, your $100 would instead be worth $1,127.95 for an annual return of 27.47%– all because those dividends you patiently reinvested have compounded into additional shares of Home Depot.

The numbers become really staggering if you continue a process like this for 20 years or 40 years; a 40 year investment with reinvested dividends in Home Depot would’ve turned $100 into $1.9 million.

Now, of course Home Depot is a one-of-a-kind business phenomenon, but the principles of compounding dividends and their contribution to greater long term returns are still apply to every investment.

Compound interest is simple math.

Small amounts become great amounts as they are multiplied over time.

Compounding Dividends and the S&P 500

Another great feature of finding great dividend compounders in the stock market is that they tend to produce higher dividend growth rates than the S&P 500 as a whole.

You can always invest in the S&P 500 by buying an index ETF that tracks the market such as $SPY.

But, not every company in the S&P 500 will pay a dividend, and you’ll tend to see more lower quality companies who cut their dividend during a tough economic cycle than if you select good dividend compounders.

As a result, the effect of compounding dividends on a portfolio solely invested in the S&P 500 might not be as great as a portfolio of well-run dividend growth companies, especially if you can pick the right ones.

What’s really great about it is how your stocks that underperform can make a comeback, simply through the power of higher rates of growth of compounding dividends.

Example: Severe Underperformance Leading to Outperformance

Picture this—you hold a stock for 5 years and the price goes nowhere. It stays flat. If we were to look at the S&P 500 over the past 5 years, it is up 102.16%. Looking at an investment like this you might think it were an utter failure.

The question you have to ask yourself is…

Does this stock have a chance of coming back? The problem with compounding is that it makes coming back very hard to do. Gains and losses will magnify themselves in the stock market over time.

Going back to our example, if the S&P 500 returned another 100% in 5 years, it would take our stock a 32% annual gain just to break even with the S&P’s 14.9% over 10 years.

But that’s not the whole story. We also have dividends.

What I find curious is that even as the S&P 500 has returned close to 15% per year over the last 5 years, the dividend growth for an ETF which follows the S&P (like $SPY) has only been 4.9%. A wildly prosperous time in the stock market, but yet these S&P companies aren’t giving much compounding in the way of dividends.

Let me ask you this—if the stock market were to crash over the next year, say down to March 2020 levels, how helpful was the fact that the S&P 500 at one time returned 15% a year??

It’s not.

All you have when paper gains are wiped away are the dividends you’ve received and reinvested. Let’s take our example further.

Say our flat stock has at least grown its dividend by 10% per year over 5 years. We’ve been getting some compounding, though it’s not showing fruit yet because those reinvested dividends aren’t propelled by a higher stock price.

But let’s say the company commits to keeping the same dividend growth rate for a long time, and the business grows enough to support it, and the stock price eventually rises to reflect the business’s growth.

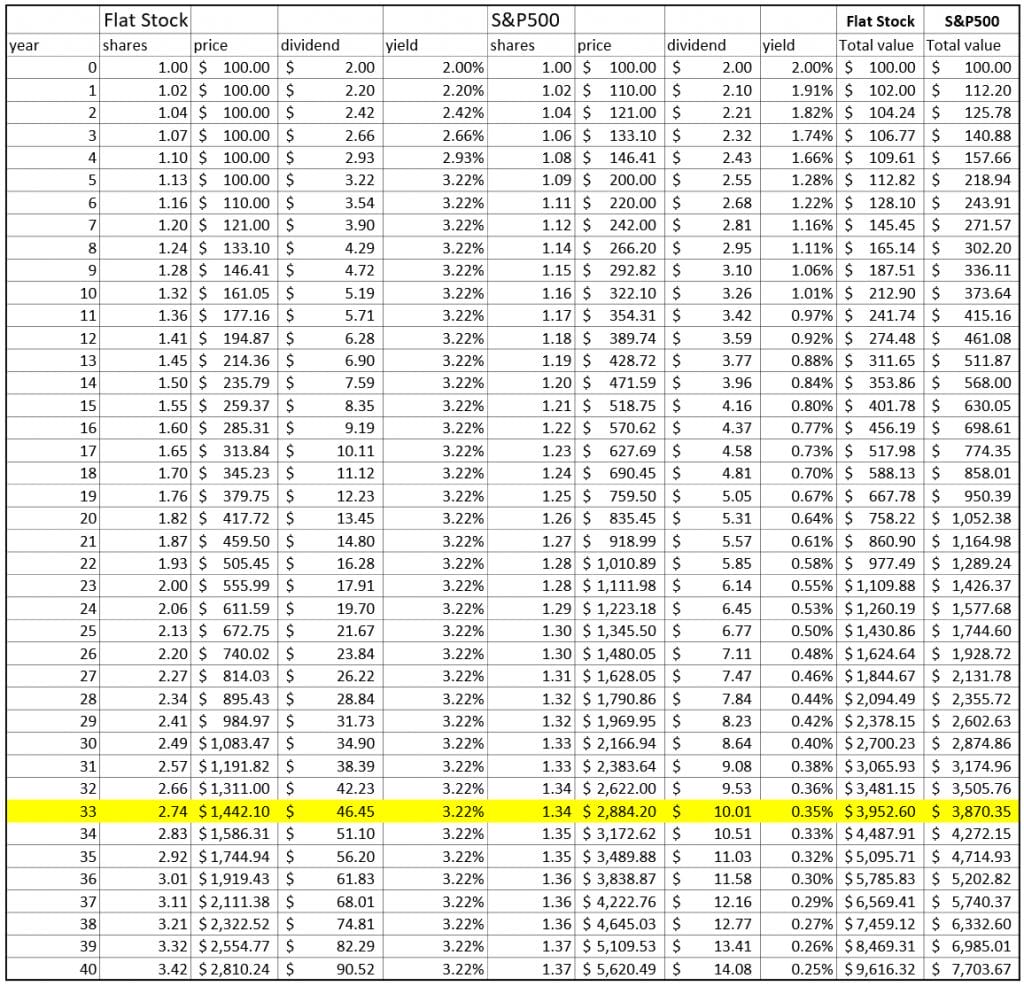

Say the S&P 500 keeps its 5% per year dividend growth over the long term. And finally, let’s assume that both the price of the S&P 500 and our stock increase by 10% over the long term from here.

If our stock was worth $100 and the S&P 500 was worth $200 after 5 years, our stock has a lot of catching up to do. If both our stock and the S&P 500 started with a 2% yield, paying a $2 dividend per year…

After 40 years our stock will have paid $975 in dividends while the S&P 500 paid $255. Of course, the huge head start for the S&P 500’s price helped its compounding significantly—by year 40 it would be worth $5,620 while our stock is only worth $2,810.

Remember though, it’s total return and not just stock price return which really matters to investors.

Not only is the total return bigger for us when factoring dividends, but if those dividends were reinvested, you’d be talking about a difference of 3.4 shares versus 1.7 shares, or $9,616 in total value vs $7,703.

This is the power of dividend compounding versus just share price compounding!

Of course it’s easy to see why nobody wants to focus on this. We can see and measure share price gains—dividend gains come much more slowly (and in small proportions).

But like the bamboo tree which after watered daily for 5 years can finally grow to 90+ feet, our dividend stocks will provide superior compounding as long as the business can grow to support above average dividend increases.

We really should celebrate dividend increases more than stock price increases, but nobody wants to do that because it takes too long.

It would’ve taken our stock 33 years to break even with the S&P because of its late start, but the difference in return really compounds after that.

So don’t be discouraged by stocks underperforming the S&P 500 in the short term. As long as the business hasn’t deteriorated where above average dividend growth is no longer likely in the long term… have patience!

The best can come to those who wait, especially in the stock market.

Additional Resources on Compounding Dividends

I hope by now I’ve convinced you on the many benefits of compounding through dividends. I wonder if dividends and dividend reinvestment (and DRIP) are something that instantly makes sense to people or not.

I know I’d love if everyone understood the power of them, so that they could build wealth for themselves and their families in the most powerful (and sustainable) way.

However, if you’re still not convinced, there’s plenty of case studies, examples, and lessons to learn about dividends. Give some of these a chance as well:

- 7 Reasons to Prioritize DRIP Investing in Your Portfolio

- Should Dividends Be Reinvested? Handy Andy’s Lessons!

- The Big Guide to Little Dividends

- 5 Dividend Investing Success Stories

- High Dividend Stocks: The Risks and Double Compounding Potential

Dividend investing isn’t the most exciting, but it’s very reliable, and it helps me sleep at night.

Like the tortoise that beat the hare—slow and steady wins the race.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- The Big Guide to Little Dividends Dividends are one of the best ways companies can return value to shareholders. Share buybacks have become all the rage in the investing world, pushing...

- 6 (Secret Sauce) Lessons From My First Stock – a 10 Bagger Are you looking for the grand secret sauce to turn every stock pick into a 10 bagger (10x return), and are you trying to do...

- The High Yield Potential from REIT Dividends: Considering Taxes and Safety Many investors look for companies with great dividend yields and distribute great dividends, and REITs are one of the best sources of dividend payers and...

- Dividend Reinvestment Plan Example — When Total Return Multiplies The compounding from dividends can be an incredible force. I have a dividend stock I’ve held and reinvested dividends in for over 5 years. I...