It’s time to finally write about the infamous topic of penny stock investing. Chances are, you’ve heard or seen them peddled before. Scammers and fraudsters seem to be attracted to the topic like white on rice. Penny stocks have a somewhat bad rep. But here’s what I think.

Penny stock investing draws a wide lure because they prey on the common human emotion of greed. The chance of “making it big” seems so much greater in penny stocks because you are starting so small.

The definition of penny stocks is any stock that is trading at less than $5, and often even less than $1. You typically see these stocks trading on an OTC, or over the counter, market. This is in contrast to the big Wall Street stocks, who trade on national exchanges such as the New York Stock Exchange (NYSE) or the NASDAQ.

At first glance the exchange might seem like a minor detail. But in fact, the exchange a stock trades on can play a massive role in just how risky a stock is.

Stocks that trade on the NYSE and NASDAQ are federally regulated by the SEC. This requires companies to submit audited financial results to the general public, which allows us to make smart and profitable investing decisions.

Stocks that trade on OTC exchanges such as the OTCBB have much lower SEC regulation requirements. Stocks trading on “Pink Sheets” aren’t regulated by the SEC at all. It’s important that you know that a lot of stocks that have gone bankrupt have gone through a stage of being listed in a major exchange, to having its share price crash, to being traded exclusively on Pink Sheets, to finally becoming worthless. Pink Sheets are like a stock market graveyard, you must avoid it at all costs or else you’ll be buried too.

That’s not to say that penny stock investing is a lost cause. On the contrary, you can find a lot of great deals with penny stocks. You just have to know what you are doing, and reading this article is the first step.

Beware of Pump and Dump Schemes

Before we continue with this penny stock investing guide, you must understand the additional risks. Because these stocks are so small, they are more easily manipulated. Though it is against the law, many penny stocks have been promoted in pump and dump schemes.

What happens in a pump and dump is that a promoter buys a bunch of shares of a certain penny stock, then convinces his audience to buy those shares. While investors think they are getting a good deal or a good investment, the promoter waits for the stock price to shoot up and then sells his shares to make a handsome profit. The promoter will often say whatever he can to get those shares higher.

In even more elaborate schemes, the promoter will sell early access to his stock pick. He releases his recommendation to the high paying clients first, then release a recommendation to his free audience.

The high paying clients will see a nice bump in the share price, but the last victims will be stuck with bad shares as the promotion ends and the stock price returns to normal levels. This type of pump and dump is very convincing because investors often see early success initially. Of course, it never lasts long and it tails off as the scheme plays out.

Penny Stock Investing: Risks/Rewards

These are the major risks behind penny stock investing. To review, let’s look at the pros and cons in a nice consolidated table.

Penny Stock Investing Risks

- Easily manipulated

- Highly volatile

- Pump and Dump schemes

- Low regulation

- OTCBB and Pink Sheets very risky

Penny Stock Investing Rewards

- Can make very high gains

- Don’t need a lot of money

What if there was a way to achieve all of the pros of penny stocks without most of the cons? I think it’s very possible, if you pay attention to what I’m about to say.

Now the SEC formally categorizes a company as a penny stock if it trades under $5 and is not traded on a major exchange. But remember that the whole reason penny stocks are attractive is because they are priced so low. Also remember how I said there are stocks on the NYSE and NASDAQ that trade under $5, there just aren’t as many.

This is how to trade penny stocks without all of the risks. Don’t buy what the SEC classifies as a “penny stock”, but instead buy one that’s trading on a major exchange!

By buying from a major exchange, you remove the easily manipulated stocks that are often victims of pump and dump schemes. You receive all of the benefits of full regulation that the stocks on Wall Street trade at, but with stocks at much lower prices. And you get rid of the exposure to the bloodbath that is known as the pink sheets and OTCBB.

How to Find Penny Stocks

The next step is finding major exchange penny stocks.

There’s many ways to do this but I’ll show you exactly what I do. I’ve done it to buy a “penny stock” from the NYSE before, and I do it for every single one of my investments.

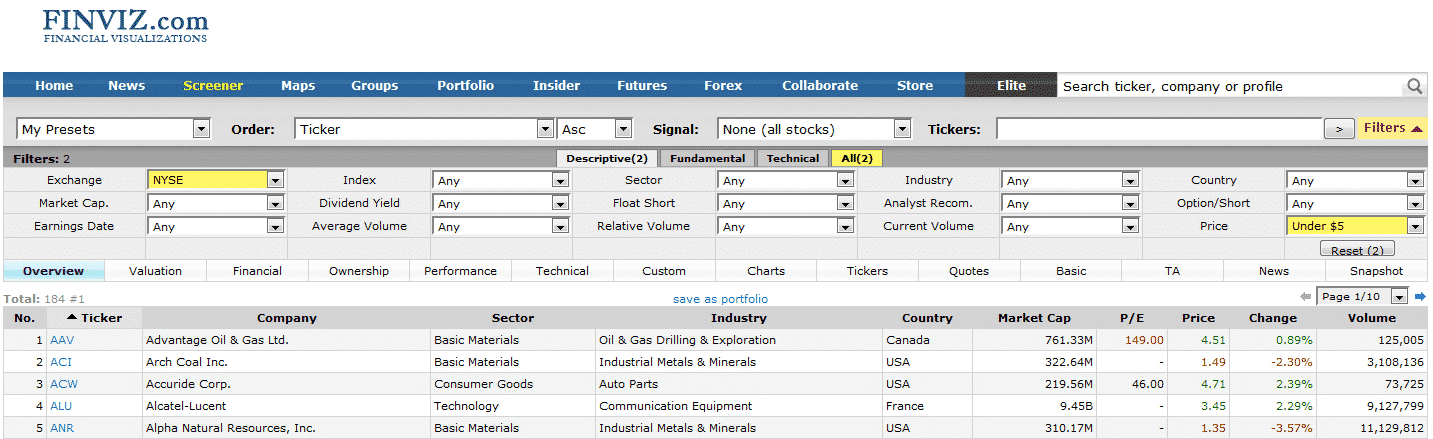

The place to go is a free website called finviz.com. They have financial data for every stock traded on a major exchange. Finviz will show you every stock available to you, as well as let you quickly sort between stocks.

Click on the link to go to their website. Once you are there, click on the “Screener” tab. Now you will see some filters. Under Price in the far lower right corner, click on “Under $5”. Under Exchange on the top left, click on either “NYSE” or “NASDAQ”.

This will give you all the penny stocks available to trade on each major exchange. Now before you start blowing your life savings, let me give you some quick rules to live by.

5 Rules for Penny Stock Investing

1. Never put all of your money on 1 stock

Every successful investing plan requires diversification. Even the best stock pickers in the world make mistakes, and nobody can predict the future. Aim for a portfolio of around 20 stocks.

2. Never buy a stock with negative earnings

A company that is losing money is a huge red flag. Trust me, I’ve done countless hours of research on stock market bankruptcies and what makes them happen. Negative earnings is the most shared attribute. You’ll know a stock has negative earnings if the P/E shows a – sign.

3. Try to get a stock that pays a dividend

The best way for management to show that they are on your team is by paying a dividend. It shows that they care to attract sensible investors who want to make money. Besides, this is the best way you will create wealth. A good long term investment with dividends will show you the power of the 8th wonder of the world, compounding interest.

4. Use trailing stops

This single rule will solve the problem of never knowing when to sell. The principle behind a trailing stop is that it lets your winners ride while cutting your losses short. By trailing your gains, you can participate in most of a stock’s gains while protecting your downside. I use a 25% trailing stop. Read more about trailing stops here.

5. Research as much as you can

You need to learn what all of the ratios on finviz mean. Success in penny stocks requires the same dedication and research as success in regular stocks. Find mentors who know what they are talking about. Look at what successful investors like Warren Buffett have done.

I hesitated sharing all of this with you because this is powerful ammunition. You must be cautious when it comes to the stock market and leave your greed at the door.

Small stocks in particular can quickly be wiped out like flicking a pesky fly. Stocks trading at low prices often do go bankrupt or face heavy investor losses. This is why it’s so important to equip yourself with the best knowledge and research.

In fact, I’ve been burned personally myself from penny stocks, as I talked about in this Youtube video:

To the prospective penny stock investor, I leave you these two fantastic quotes. I hope you’ve learned a lot from this guide.

“Many an opportunity is lost because a man is out looking for four-leaf clovers.” –Anonymous

“Risk comes from not knowing what you’re doing.” –Warren Buffett

Related posts:

- Do you Trade Volatile Penny Stocks? A common pitfall that I often see new investors fall into is that they get sucked into the “get rich quick” mantra that they think...

- Should Investors Care if a Stock gets Delisted? With all the fanfare going on in the news about Chinese stocks being delisted from U.S. exchanges, many investors are currently wondering what will happen...

- Hey Andy – What Happens When a Stock Splits? Have you ever wondered what actually happens when a stock splits? Chances are there are two groups of people reading this right now – 1...

- More Thoughts on How to Analyze a Stock’s Growth If you listened to Andrew and Dave’s recent episode dividend growth investing, or maybe your even read my post that talked a little bit more...