The quick ratio is a worst-case scenario metric. It helps you project if a company could survive if revenues were to dry up. The quick ratio compares the short term assets and liabilities of a company.

In general, an ideal quick ratio is one above 1.

But that doesn’t tell the entire story, because for some companies, a quick ratio below 1 is still ideal, and for others, a quick ratio of 1 might be risky.

You have to ask yourself 3 questions in determining the ideal quick ratio for the stock you are considering:

- What kind of a business is this?

- How stable are the revenues for this business?

- Are there “hidden” items to consider?

Before we make an interpretation for these questions, let’s cover an overview of what the quick ratio formula is, then look at examples of good and bad quick ratios (within each of the questions above).

To skip past this introduction, you can click any of the 3 questions above to go to its relevant section below.

The Quick Ratio Formula

To calculate the quick ratio for any company, you need to look at its balance sheet. Each of the metrics you need will be in there. The formula is:

Quick Ratio = Current Assets – Inventories / Current Liabilities

Remember that current assets and current liabilities refer to those available (or due) within a 1-year time frame, in contrast to long term assets or liabilities. Inventories is a metric that you will find within Current Assets.

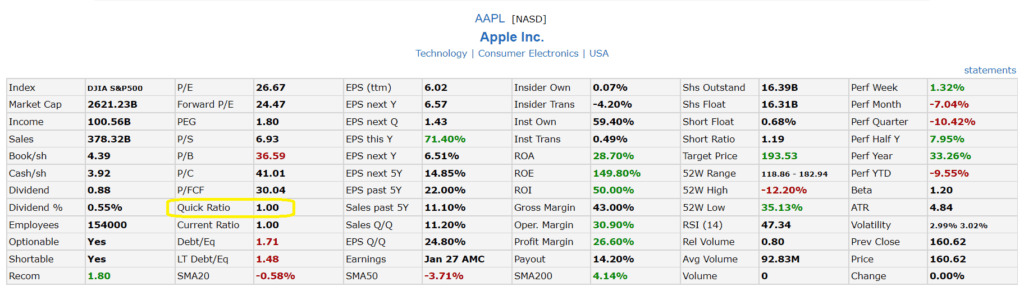

If you’re looking for a free quick ratio calculator tool, you can use something like finviz to enter the stock ticker and immediately view its quick ratio:

Now, to calculate this ratio yourself, you need to look at a company’s balance sheet either in their annual report or through a financial statements website like quickfs.net.

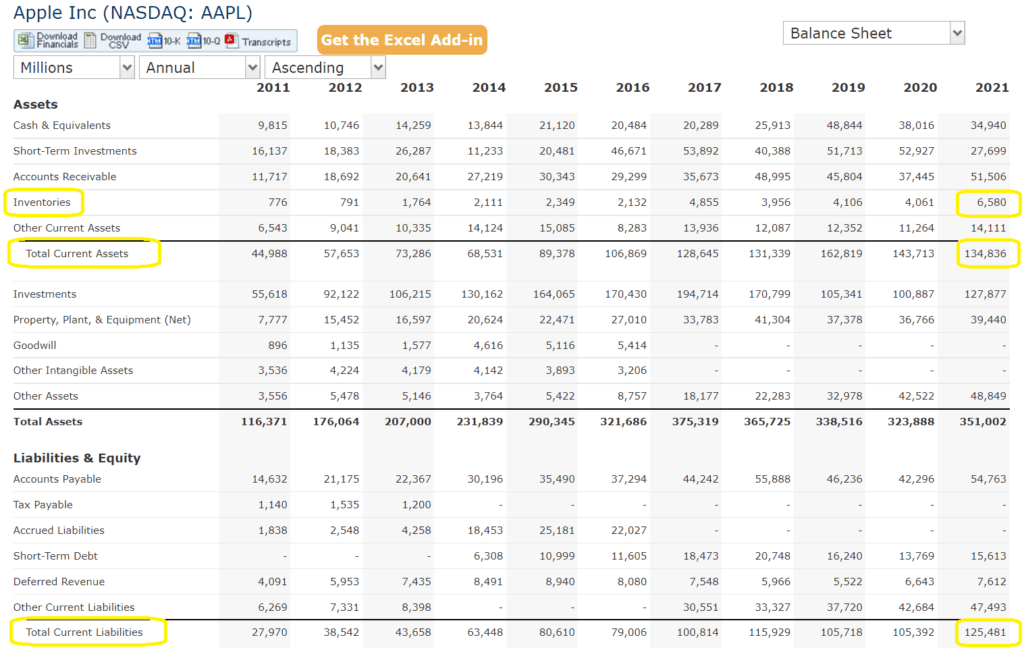

Sticking with our Apple (ticker: AAPL) quick ratio example, we can use the tab in the upper right to select Balance Sheet, and then find $134,836 million in Current Assets, $6,580 million in Inventories, and $125,481 million in Current Liabilities for Fiscal Year 2021.

The quick ratio calculation becomes:

= (134,836 – 6,580) / (125,481)

= 1.02

Right about what finviz told us.

Is Apple’s quick ratio of 1 an ideal quick ratio for the company? Well that all depends on the 3 questions we must ask, which we will cover below (and you can skip to by clicking here).

Does the Quick Ratio Actually Work?

You might wonder if the quick ratio really works since it’s only a “worst-case scenario” metric. Most of the time, the “worst-case” doesn’t happen.

Well let me offer one example: the Circuit City bankruptcy.

I covered the details of the Circuit City bankruptcy at length here, but in a nutshell, the company had all the trappings of a great company…

- They were opening stores in the double digits per year

- Long Term Debt to Equity was 0.04 (seems riskless!)

- Current Ratio was 1.52 (considered safe!)

Yet underneath the surface was a quick ratio of only 0.54, which ISN’T a problem with some companies but was a deep problem for a highly cyclical company like Circuit City.

As an investor, you’d understand that if you asked yourself the 3 simple questions.

1—What Kind of a Business is This?

Continuing on with the Circuit City bankruptcy example, a simple examination of the company’s business model would shed some light on if the company’s quick ratio was ideal at the time.

For those of you who didn’t know—Circuit City was a major electronics retailer.

Electronics tends to be tied to consumer spending, it is a “discretionary expense”. Those type of companies tend to be cyclical.

In other words, when the economy is strong, customers are willing to splurge on fancy electronics and Circuit City prospers.

But when the economy weakens, non-essential spending like fancy electronics is one of the first things consumers tend to cut, and so that can put pressure on those retailers.

Though the company had lots of short term assets (indicated by their Current Ratio of 1.52), much of this was inventory.

Inventory only works as a true asset if it is sold.

So if demand disappears, companies with large inventories can see assets which can’t easily be converted to cash, which can create a cash “crunch” if the company’s quick ratio is below 1. Remember, the quick ratio excludes inventory (subtracting from Current Assets), so a quick ratio of 1 or above is better especially for companies that rely on cyclical forces like discretionary consumer spending.

Company with an Ideal Quick Ratio Below 1

Let’s look at an example where a quick ratio below 1 ISN’T risky. Consider a stalwart like Procter and Gamble.

What kind of a business is P&G?

P&G sells essential households and personal products. These are also known as “consumer staples”. They are called this because they are purchased regardless of the state of the economy.

P&G’s products and brands include:

- Baby diapers (Pampers, Luvs)

- Feminine products like Tampax

- “Family” products like Bounty, Charmin

- Cleaning (Tide, Downy, Dawn, Cascade)

- Hygiene (head & shoulders, Pantene, Old Spice, Gillette, Venus, Crest, Oral-B)

- Others (Vicks, NyQuil, Pepto Bismol, etc)

It’s hard to see consumers cutting many of these essential products even if they were laid off from their jobs. Sure, there’s always the risk of cheaper substitute products, but a consumer is much less likely to stop buying their Charmin or Tampax than they would be the latest consumer electronics gadget.

This means that the inventory risk for companies in industries like consumer staples is much less than a highly cyclical company.

A company like that can get away with a lower quick ratio because more of their inventory is likely to be sold (in which case, a better risk metric to use is the Current Ratio).

Calculating the quick ratio for P&G using their Balance Sheet from quickfs.net (Fiscal Year 2021):

- Current Assets = $23,091 million

- Inventories = $5,983 million

- Current Liabilities = $33,132 million

According to this, P&G’s quick ratio is 0.52. Is this ideal?

Their Current Ratio (Current Assets/ Current Liabilities) comes out to 0.70. This is still less than 1, but could still be ideal depending on the answer to the next 2 questions to consider.

2—How Stable Are the Revenues for This Business?

It’s easy to say that a non-cyclical like consumer staples companies should have stable revenues.

But that could be a dangerous assumption too.

Going back to our Procter and Gamble example, they would be a much safer company than one with just a single product, maybe a “premium” shaving razor as an example.

Though you’d qualify both companies as “consumer staples”, they are not likely to have the same stability of revenues, especially if consumers tend to cut spending on premium razors during recessions like they would discretionary items.

There’s no perfect way to measure this, but I’d recommend looking at a company’s historical revenues for a better answer to the ideal quick ratio.

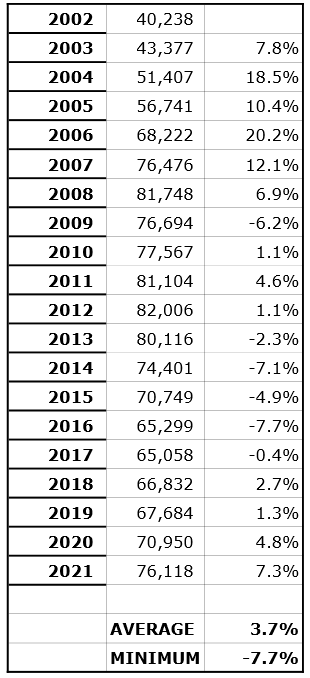

I like to do this using my premium subscription for quickfs.net. Taking the historical figures for P&G I see the following, with the percent change a line-item I added in Excel:

With revenues not dropping much in any given year, even through recessions, P&G’s revenues look incredibly stable over the last 20 years.

Be careful: you don’t want to take these figures at blind face value either.

There can be one-time events that impact a company’s historical revenues which might not be likely to continue. The pandemic in 2020 for example, might’ve crushed a company’s revenues for a year or two but don’t reflect the actual long term stability of the company because of its business model.

The bottom line…

Combining questions #1 and #2, what is the business model and how stable are revenues, should give you a superior picture for your quick ratio interpretation of a company.

Remember they are similar questions but might not have a similar answer.

Your last step should be to comb for any “hidden” items that could make a quick ratio analysis a bad measure of a company’s true risk. You can only do this by looking through the company’s annual report (or “10-k”).

3—Are There Hidden Items to Consider?

During the financial crisis of 2008/2009, many financial institutions either went bankrupt or reached the brink of insolvency in no small part due to “Off-Balance Sheet” exposure.

Without getting too into the weeds, some companies took on huge risks through complex financial derivatives that don’t always show up on a balance sheet (at least not certainly at that time).

However, there are other ways a company could have huge hidden risks.

One example I did a deep dive on was a company called Monaco who went bankrupt in 2009; Monaco had both a low quick ratio and significant contractual obligations.

Another example is debt principal payments (for bonds as an example).

Bonds are corporate debt, and they often differ from consumer debt like credit cards or mortgages because their principal tends to be due in a lump sum. For example, if a company issues a $500 million bond due in 10 years, they might pay only interest each year and then have to pay the entire $500 million in year 10.

A company stuck with a large bond principal payment upcoming AND an economic crisis might find themselves unable to pay the debt as lenders are less likely to refinance them.

This isn’t publicized much but Washington Mutual ran into this exact problem, owing $47.4 billion within one year of their 2007 annual report filing, which was huge for a company which earned less than $4 billion in both 2006 and 2005.

To find these hidden risks with companies you’re looking to invest in, I recommend starting with the company’s 10-k, and the contractual obligations and Off-Balance Sheet sections. Here are 3 articles we have on the site to help you with each step:

- How to Read SEC Filings – Dissecting the 10-k Annual Report

- Explaining Management Discussion and Analysis (MD&A); 10-k Overview

- Interpreting Off-Balance Sheet Items: Analyzing Risks in the Finance Industry

Hidden risks are important to take a look for, because they can uncover something that the quick ratio can’t.

A quick ratio above 1 isn’t ideal if the company has other risks.

When a Quick Ratio below 1 ISN’T risky because of “hidden” credit availability

This one also just requires a deeper look at a company’s 10-k.

In short, companies keep “revolving lines of credit” handy in case of short term cash crunches. Just like you can have a line of credit or credit card at the bank, these let you borrow money fast without needing additional lender approval.

That can mean the difference in times of turbulence; we saw many companies tap their “revolvers” when the 2020 pandemic first hit.

To find a company’s credit availability, search for something like “credit agreement”, “revolving line of credit”, “revolvers”, “credit facilities”, or anything related of the sort.

There, the company should provide details on how much credit they have outstanding, and how much additional credit is available for immediate withdrawal. You could add this availability to your quick ratio calculation for a better signal on a company’s risk in a worst-case scenario.

Remember…

The quick ratio is a very helpful tool in summarizing short term risk, but it’s not a panacea; there are times when short term risks aren’t present in the balance sheet but show up in other places.

That’s why you need to ask yourself all 3 questions, and work through the steps to determine if the quick ratio is indeed ideal or not.

Investor Takeaway

Company risk is an important factor to evaluate for long term investors.

The quick ratio is a fantastic tool for uncovering some short term risks that are hiding out in plain sight, even with some of the biggest and more profitable and growing companies.

That said, calculating the quick ratio is just the first step.

You have to ask yourself the 3 questions above, which tell you the likely short term “liquidity” risk for the business.

And then from there, you need to look at the long term, or “solvency”, risk of the business in order to take into account their overall level of indebtedness and interest payment risk.

We have a few blog posts to help you with that as well:

- What’s a Good Debt to Equity Ratio? The Ultimate Guide for Beginners

- Ratio Analysis: Easy Way for All Investors to Determine Company Health

- The 3 Important, Main Components of Debt Analysis (+Metrics)

You can never be too careful when it comes to investing your money. Hopefully this post has inspired you to take a deeper look at the risks in the companies you’re looking to invest in for the long term—both those risks that are hidden, and hidden in plain sight.

Related posts:

- How the Piotroski Score Identifies Strong Businesses in the Stock Market Updated 4/28/2023 One of the biggest challenges when determining whether or not to invest in a company is determining each company’s financial strength. Enter the...

- What’s a Good Debt to Equity Ratio? The Ultimate Guide for Beginners The debt to equity ratio is a great formula for investors to use as a rule of thumb for determining the riskiness of a stock,...

- Everything to Know on ROA, with Average ROA by Industry Data Post updated: 5/5/2023 The return on assets remains a useful measure for investors to understand. The formula offers a great way to measure the performance...

- 5 Key Metrics: Balance Sheet vs Income Statement (Example with $AAPL) Financial statements can look intimidating. There can be many line items. To learn how to navigate a company’s balance sheet and income statement– break it...