Question for you? Do you think companies practice to deceive investors by practicing financial shenanigans or intentionally set up financial statements to deceive investors? Unfortunately, the answer is yes.

A prime example of financial shenanigans is Enron. In 2011, Enron defrauded investors to the tune of $74 billion! Enron decided to deceive investors by practicing such accounting practices as hiding billions of dollars of debt from investors and using fraudulent accounting practices to inflate earnings.

Another example of financial shenanigans is Lehman Brothers, who defrauded investors of $60 billion through illegally added toxic debt as revenue on the income statement.

Recently, Luckin Coffee admitted that they had fraudulently “created” revenues by simply making them up.

Financial Shenanigans happen, fortunately, not often, but they do happen. One of our jobs as the Sherlock Holmes of investors is investigating each company we analyze for fraudulent activity.

In today’s post, we will discuss some takeaways from the fantastic book Financial Shenanigans by Howard Schlitt.

- Examples of Financial Shenanigans

- Why Do Companies Involve Themselves in Financial Shenanigans?

- The Usual Suspects of Financial Shenanigans

- The Seven Types of Financial Shenanigans

- Six Ways to Analyze Financial Reports for Fraud

- Ratio Analysis for Possible Fraud

Ok, let’s dive in and learn more about financial shenanigans.

Examples of Financial Shenanigans

The book Financial Shenanigans highlights some of the dark tricks that corporate accountants utilize to make businesses look much better than they truly are.

The purpose of financial accounts is “to provide information about the results of operations, financial position, and cash flows of an organization.”

Problems arise from situations when companies like Enron and Lehman Brothers decide to misrepresent reality in a way that misleads investors.

Not all shenanigans are necessarily fraudulent; sometimes, it means that a company stretches the rules a bit or interprets the rules a tad too loosely.

Besides the Enron and Lehman Brothers shenanigans, another example of fraud on a large scale was WorldCom – one of the largest bankruptcies of all time.

WorldCom cooked the books because the owner, Bernie Ebbers, had borrowed $400 million from Bank of America to cover margin calls while using his WorldCom shares as collateral.

WorldCom inflated its net income and cash flow by recording its expenses as investments. WorldCom, through its manipulations, was able to capitalize its expenses such that it created exaggerated profits of $3 billion for 2001, and $797 million for the first quarter of 2002, resulting in a $1.4 billion profit instead of net loss.

Once the company filed for bankruptcy, it came to light that the auditor, Arthur Andersen, had shredded documents related to its audit and ignored memos indicating the inflation of the income.

Another example, fabricating revenues by “creating” new products was AIG, the insurance giant. AIG created a new product called “finite insurance,” which would allow companies to ensure earnings shortfalls would never happen by guaranteeing growing earnings for any company.

Unfortunately, this wasn’t a “real” insurance product and produced bogus revenues for AIG. Insurance contracts require a transfer of risk, which was absent from the contracts in AIG’s case.

Why do Companies Involve Themselves in Financial Shenanigans?

Why would companies agree to subscribe to any potential fraud in its financial statements?

There are two primary ways that companies manipulate the earnings of their businesses.

- The first is to inflate current earnings by inflating the current earnings or deflate current expenses.

- The second is to deflate current earnings by deflating current earnings or inflating current expenses.

Now, for example, one makes sense to me. Inflating earnings grow the bottom line by increasing revenues or by deflating expenses, which grows the earnings.

There are several reasons why a company would want to increase its earnings, such as going public soon and wants to look better to potential IPO investors. Or maybe the company is in financial trouble and needs to borrow money; they would increase its earnings to appear more attractive.

The biggest reason for inflating earnings is often management’s incentives are tied to the financial performance of the company, and they stand to make millions by inflating the earnings.

The second reason is a little more confusing: why would management want to deflate its earnings? A great example, the company might want to squirrel away some earnings for a rainy day. If the company performed better than expected one quarter, they might inflate its expenses to reduce the earnings, and the next quarter may reduce the expenses to inflate the earnings.

The reason for manipulating earnings in this manner is simple: Wall Street hates fluctuations in earnings; rather, it LOVES steadiness or rising earnings. And by manipulating expenses, by prepaying the expenses one quarter and deflating the next, allows for those steady earnings Wall Street loves, which in turn creates more share appreciation and likewise boosts management bonuses.

Another reason for earnings manipulations is the idea of cleaning up the balance sheet by manipulating revenues or expenses or reporting losses greater than actual results. By cleaning up the balance sheet, the company can look more profitable in the future.

Buffett compares earnings manipulations to shooting an arrow and then drawing the bullseye exactly where the arrow landed.

The earnings manipulations available to companies are scary, and it is frightening how easy it is to adjust the earnings any way they want to show different results to shareholders.

The Usual Suspects of Financial Shenanigans

There are multiple situations that companies are in that might lead to financial shenanigans. The following is a list of situations to be on the lookout. When encountering any companies engaging in any of these activities, run, run far away.

Making lots of acquisitions

If a company is buying up lots of weaker companies, it may be trying to cover up for its weakness. There is a huge difference between growth from acquisitions or organic growth from the core business.

Not all acquisitions are bad; for example, Microsoft has a history of acquiring technology to accelerate its products such as Excel and Internet Explorer.

But companies such as Valeant, the pharma company that was a serial acquirer to cover up the fact that they were failing to create any new products of their own, lead to over-purchasing companies and eventually failing.

Dumb incentives for managers

Most companies set up bonuses with incentives designed to encourage better performance. If the incentives are favorable, this can create value for shareholders by encouraging good behavior.

However, stupid incentives can appear such as the example of Heinz from the book, where the company created an incentive- based on net profits. But Heinz made the goal such that it had a threshold, and once achieving the threshold; there was no more incentive to improve.

Management then deflated earnings in the current period once the threshold was reached, thereby deceiving investors on the true performance of the company.

Private companies

Private companies, because they are not public, don’t have the same requirement to have their books audited. Meaning that if it is about to go public, it has no constraints to prevent it from inflating the earnings to appear more attractive.

Recently changed business models

Changing business models is always a bad sign, as it indicates the core business is no longer viable, but it also provides additional opportunities for fraudulent activities.

Be especially extra cautious if the business model changes from a simple one to one far more complex, which lends additional opportunities to manipulate the books. These are all signs of red flags, and you should avoid them at all costs.

Having operational problems

A company that is having operational problems is probably the big kahuna of financial shenanigans. If the company is exhibiting these signs, beware:

- Sales growth and profits are declining

- Large amounts of receivables or inventories in relation to sales

- Operating cash flow is declining in relation to its earnings.

The Seven Types of Earnings Financial Shenanigans

The following is a list of the seven most common earnings financial shenanigans companies engage in most frequently to fool shareholders.

- Recording revenues too soon, or of questionable quality

From FASB, “revenues should be recorded after the earnings process has been completed, and exchange has occurred.”

The book mentions numerous companies jumping the gun on recording revenues early, which is a cardinal sin. A great example was the company Microstrategy, an early internet company in 1994, encouraged customers to sign contracts before the end of the quarter to record revenues for that quarter, even though its services were not performed.

If I haven’t suggested this yet, you must read this book; my post is just an overview; there are so many different examples I could write a book on the examples alone.

- Recording bogus revenue

Below are a few examples of how companies can record bogus revenue:

- Recording revenues from transactions that lack economic substance.

- Recording revenues from transactions that lack a reasonable arm’s length process.

- Recording revenue on receipts from non-revenue-producing transactions.

- Recording revenue from appropriate transactions, but at inflated amounts.

A great example of recording bogus revenue is the Chinese coffee company, Luckin Coffee, who recently was busted for creating revenues out of thin air.

The company boosted its revenues by $300 million months before it went public, to boost its stock price. An investigation uncovered attempts to create fraudulent transactions using third parties with ties to the company to funnel funds into the company to support the transactions.

- Boosting income from one-time gains

IBM boosted its income in 1999; see it is not just the small, unknown companies that practice some of these measures.

IBM reported in its 10-k that annual COGS increased by 9.7%, and revenues increased by 7.2%, but operating and pre-tax profits grew 30%. How was this possible?

One thing that stood out in the income statement was a decrease in SG&A expenses of 11%, which is a huge decrease. To boost this decrease in expenses, IBM booked a gain from selling its Global Network business to AT&T and included that gain as a reduction in the SG&A expenses, curiously.

By hiding this sale in the expenses, IBM was able to hide its failing operations from investors.

By adjusting these expenses, IBM was able to show a gain for the year, but when you back that gain out, we see from the graph on page 75 that IBM had a 20% change in reported versus actual.

- Shifting current expenses to a later or earlier period.

From FASB, “an enterprise should capitalize costs incurred that produce a future benefit and expenses that produce no such benefit.”

When a company invests in any assets that will produce profits over an extended period, the companies can push any expenses related to the assets to the balance sheet.

The rule allows companies to capitalize on the expenses instead of directly adding them to the income statement and affecting revenues directly.

While this all seems fair, it is extremely easy to mess with the interpretations of this rule, either capitalizing expenses that are operating in nature or writing down assets slower than is reasonable.

- Failing to record or properly reducing liabilities

Liabilities are a sacrifice, exchanged for a future benefit, and this is one of the easiest manipulations out there. Simply act like you never received an invoice or pretend you never saw it, and voila, liability is not acknowledged.

A great example of manipulating liabilities is the adjustments of leases. Deere & Company reduced the gap between the depreciation of its assets, tractors, and leasing those tractors to customers. For example, in 2012, Deere estimated the residual value of its equipment at 55%, which allowed 45% for depreciation of the expense. But in subsequent years, that gap rose to 63%, which reduced its depreciation expense on the income statement, which boosted the gross income and net income.

- Shifting current revenues to a later period.

Getting back to the earlier point, why would a company shift revenues to a later period? In many cases, if the company has a great period, they may want to save some pennies for a rainy day.

Consider a company that is growing fast but is unsure of the future, the temptation to shift the revenues to a future period is immense, as Wall Street rewards companies for continued growth and stability.

One of the most common examples of this style of manipulation is improperly accounting for derivatives or recording current period sales in a later period.

During the late 1990s, Microsoft was under a ton of scrutiny over anti-competitive practices, and in response, Microsoft started squirreling away funds to save for a rainy day.

Microsoft started growing its unearned income account by hundreds of millions of dollars each quarter from March 1998 to March 1999; it suddenly stopped. When in September 1999, the revenue started to decline, Microsoft began releasing the deferred revenue to inflate the revenues.

- Shifting future expenses to the current period as a special charge.

“Expenses should be charged in the period in which the benefit is received.”

A key to highlight this manipulation is looking at the line item for special charges; if the company is using it every single year, then it is obviously not a special charge anymore; rather, it is an expense.

Also, be on the lookout for companies that write down the costs associated with an acquisition quickly.

Nvidia used an impairment charge to improve its earnings by 70% one quarter by claiming that the value of some of its products was obsolete and needed to impair them. But the estimates that Nvidia made were too high, and the reversing of that impairment boosted the earnings.

Six Ways to Analyze Financial Reports for Fraud

Ok, now that we have a good understanding of the methods of financial shenanigans of companies, let’s take a look at some ways we can use our Sherlock Holmes on these companies.

Auditor’s Reports

The first go-to has to be the auditors report that you will find in the quarterly or annual reports. Look to ensure that the auditor is a reputable one; most companies use a small selection of auditors.

Next, look for an absence of opinion or a qualified opinion of the report. The auditor spends quite a lot of time analyzing the report, so their opinion matters.

Proxy Statements

Great place to judge the tenor of management, plus you will find more information about management pay, incentives, and stock options.

Plus, there is more information regarding any outstanding lawsuits and any other contingencies related to the company. Look for either proxy statements or DEF14 filings on SEC.gov.

Footnotes

My favorite place to dig for nuggets regarding the company in question is the footnotes. Here you will find everything nagging you about the company ranging from topics such as debt, investments, segment performance, and earnings.

Also, be on the alert for any changes in accounting policies, usually listed as the first section of the notes.

A great quote about the importance of footnotes:

“They bury the bodies where the fewest people know how to find them – in the fine print.”

President’s Report

A great place to help you judge the CEO or leader of your company, but take everything with a grain of salt. As the captain of a ship would never sink his own ship, or a pilot crash his own plane, the CEO is never going to say anything detrimental to his own company.

The MD&A Section of Quarterly or Annual Reports

In these sections of the financial reports, you will find management’s thoughts on the performance and future prospects of their company. I use this section to track how truthful the management is and whether they follow through on their plans.

A great place to analyze the management’s honesty: if they try spinning bad news in a way that is not honest or truthful, buyer beware. Also, notice the length of top management’s tenures with both the company and their current positions. High management turnover is always a bad sign.

Form 8K

For those of you not familiar with the form 8-k, this is the form that each company must send out in the event of any changes that occur with the company. For example, when a company issues bonds to raise funds, it sends out an 8-k announcing the issuance.

Beware of any changes in auditors, companies use the same auditors for years, and a change is a HUGE red flag.

All of the above are fantastic methods of using your Sherlock Holmes skills to analyze any company; I recommend you put all these ideas as part of your system to analyze companies; I know I have since reading this great book.

Ratio Analysis for Possible Fraud

Using ratio analysis is a great visual way to ferret out possible fraud or financial manipulations. At the very least, it is a great way to find questions related to the finances of the company.

There are two methods to utilize when considering analyzing the company via ratios.

- Vertically

- Horizontally

There are several ways to go about analyzing companies using ratios. The first method is to use a database such as gurufocus.com or quickfs.net. The other method is to create your charts using the data from the sec filings.

The easier and quicker option is to use one of the databases from above, which is the method I utilize.

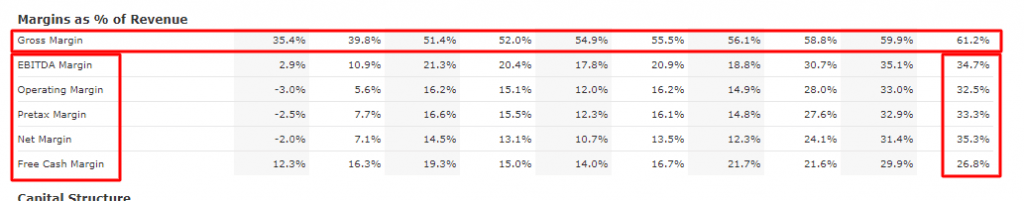

For example, if you are analyzing a company, say, Nvidia. With quickfs.net, you have access to ten years of data, which makes analyzing the company much easier.

They have a tab that allows you to see ratios over those tens years for both versions of ratio analysis.

If we look at the chart above, the first step to analyze Nvidia for manipulations will look at the gross margin across the ten years, looking for any numbers that stand out as out of the ordinary.

As we can see, the numbers are fairly steady, with the margins growing over the years.

Next, we would look at the margins over one year, down vertically from gross margins to free cash margin, and as we can see, the numbers all look pretty representative of a well-run company.

And once we have looked at Nvidia, a great addition to that analysis is to look at related companies to see how those numbers compare. Not only from a performance basis but on a potential financial shenanigans basis.

Again, this is a great exercise to add to your list of processes when analyzing any company.

Final Thoughts

Financial shenanigans is a potentially dangerous situation because fraud can either hide financial weakness and management that is fraudulently attempting to boost performance for its gain.

The book Financial Shenanigans is an easy read, with loads of practical examples that lay out all of the ideas of manipulations that the author has observed.

I would strongly encourage you to add this book to your library; I have read through it twice now, and pick up new tidbits every time I read it.

That will wrap up our discussion today, and as always, thank you for taking to time to read this post, and I hope you find something of value on your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Financial Statement Footnotes: Treasure Trove of Information from the 10-k Reading the 10k of a company is required reading if you want to invest in the company, and part of that reading is scouring the...

- Depreciation and Amortization – A Complete Financial Statements Guide Updated 8/7/2023 Buying businesses and equipment for operations is a part of business, and using depreciation and amortization is how companies account for those purchases....

- Net Investment Income: Its Significance for Many Financial Companies Updated 4/21/2023 Continuing our discussion on investment portfolios for companies like Amazon, Microsoft, Prudential, and Apple. Today’s post covers the line item from the income...

- Inconsistency with Shares Outstanding in Company 10-K Annual Reports There are a few obstacles that can come up when using fundamental analysis to find stocks with both a solid business model and an adequate...