Ladies and Gentlemen – tonight you are in for a matchup of the ages –10K vs. 10Q!!

Standing over in the left corner is the World Champion Heavyweight in the world! This heavyweight really packs a punch and only fights once/year, but when they fight, the fights really have a ton of meaning behind them!

They will be taking on the World Champion Featherweight in an epic battle tonight! The Featherweight fights four times each year, so you have to take each fight with a grain of salt as they fight much more frequently, so things aren’t as impactful as you’ll see a new fight in a few months!

Alright, was that an awful analogy and drawn out a little

bit too long? Maybe Yes. But it

still stands! So, what exactly is a 10K

and a 10Q?

The SEC, which is the actual entity that requires the 10K and 10Q, defines the 10K as a “comprehensive overview of the company’s business and financial condition and includes audited financial statements.”

A 10Q, on the other hand, is very similar but it is required to be filed three times each year, with the company being allowed to omit the 10Q for their last quarter as they will be required to submit a 10K that is all encompassing of the entire year.

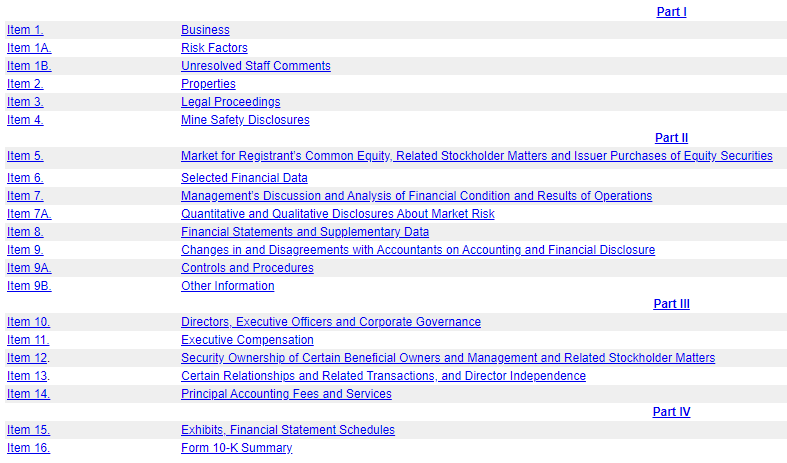

For Apple, they break their 10K up into 4 different parts, as you can see below per my screenshot from their 2018 10K:

As you can see, each of these parts has extremely specific data about the company and other dealings of their business that you would want to know as an investor.

So, what are some of the key differences in the 10K and the 10Q?

- Timing – 10K is required once/year while the 10Q is required once/quarter

- Detail – the detail of the 10Q, specifically the financial data, is typically much less detailed. The financial data also isn’t required to be audited so there is a greater potential for human error in the 10Q

There are other differences between the two such as the time that the company has to file each report but as an investor, that is not important to you.

So, the question for you as an investor should be when to use each report, right?

For the most part, you should really only be looking at the 10K in my opinion. The 10K is much more detailed and is going to provide you much more of the information that you need as an investor.

In general, the way that I view the 10K and the 10Q is that the 10K is good to utilize when I am first beginning to evaluate a stock. It’s going to provide you a much more thorough, overall picture.

In addition to that, to be quite honest, I really don’t need to know how the company has performed from quarter to quarter.

I am much more interested in the long-term of the company which will make me more interested in the longer-term historical success of the company that I am evaluating as well.

On one of my recent posts I talk about why looking at the long-term for investing is the right mindset to have, and that’s not only my opinion, but I outline why it’s the opinion of some of the greatest investors of all time.

So, if you’re looking at the past 7-10 years of history like I recommend, you don’t need to know what happened each individual quarter in those 7-10 years, and if you would read all of the 10Q and 10K documents then the 10K would be somewhat repetitive and reading the 10Q’s would be an inefficient use of your time.

For those reasons, stick with the 10Ks when evaluating stocks to purchase.

Once you have bought the stock, I continue to like to evaluate the 10K’s, but I also will pay attention to the 10Q’s. Why do I pay attention to them now?

Well, a couple of reasons:

- When I buy stock of a company, I view myself as a true partial owner of the company. If I was going to own a company and go an entire year without knowing what is going on with the business, then I’d be a pretty crappy owner

- The 10Q gives the company a good opportunity to tell their story and what they see on the horizon much more frequently, so I can see some shorter-term trends that might help me in my investing

- It is briefer and quicker to read. For instance, let’s look at the most recent

10K and 10Q for AAPL:

- 10K – 71 pages

- 10Q – Press release that can be read in less than 5 minutes and 3 pages of financial data

One of these sounds much faster to read than the other, agreed? I think it’s a good 30 minutes to spend each quarter just to evaluate you still like how things are trending with the company and make sure that everything looks good.

I would almost never decide to sell off a 10Q, but it could be a very good ‘caution flag’ for me to look out for potential pitfalls in the future.

I urge you to maybe start with some of the companies that you already own and take a look at their most recent 10K. You can quickly find this by just going to the company website and looking at their investor relations page. Or, if that doesn’t work, you can google AAPL 10K or AAPL 10Q and it will likely be one of the first links to come up.

Luckily for you, this is all public information that the companies have to disclose so they are not trying to hide it from their investors.

At the end of the day, you can’t go wrong with evaluating either of these documents, and by even considering looking at them you’re already ahead of the average investor that’s out there buying Crypto because they think it’s the new thing (I’m not knocking buying Crypto necessarily, I’m knocking trend buying your investments). So why are you waiting?

Go out there and become an active owner of the company rather than one that just sits on their butt!

Related posts:

- Cisco 10Q Summary Third Quarter 2020 Cisco reported quarter ending results for April 25, 2020, on May 13, 2020. The following report is a summary of those results, no opinion on...

- Charles Schwab 10Q Summary First Quarter 2020 Charles Schwab (SCHW) announced their first-quarter results on April 15, 2020. The following report is a summary of those results; no opinion will be offered,...

- Nike 10Q Summary Fourth-Quarter 2020 Nike (NKE) announced results for the fourth quarter of 2020 on May 31, 2020. The following report is a summary of those results for Nike...

- Markel 10Q Summary First-Quarter 2020 Markel 10Q Summary Markel (MKL) reported first-quarter earnings on April 28, 2020, for the quarter ending March 30, 2020. The following report is a summary...