Updated 3/6/2024

Looking for a place on the internet to get a detailed portfolio snapshot of the world’s greatest investors, all regularly and for free? These documents are called 13F filings, and we can find them at SEC.gov.

Using the 13F filing makes it easy and free to find what some companies your favorite investors or fund managers are buying or selling. The 13F is a fantastic source of investment ideas, and did I mention it all for free?

We can use the 13F to source investment ideas and portfolio construction. Using these filings helps you see what kinds of concentrations our gurus use and at what prices they buy their companies.

I have used these filings to help me find some great investment ideas from Monish Pabrai, Warren Buffett, Guy Spier, Charlie Munger, and many more.

Today’s article will discover how to find these 13F filings and how to use that knowledge for your investment ideas; also, we will discover the power of cloning these investments.

What are 13F Filings?

What is a 13F filing, you ask? Well, according to Investopedia:

“SEC Form 13F is a quarterly report that institutional investment managers file with at least $100 million in equity assets under management. It discloses their U.S. equity holdings to the Securities and Exchange Commission (SEC) and provides insights into what the smart money is doing.”

According to the SEC.gov website:

“In general, an institutional investment manager is (1) an entity that invests in or buys and sells securities for its account; or (2) a natural person or an entity that exercises investment discretion over the account of any other natural person or entity. Institutional investment managers can include investment advisers, banks, insurance companies, broker-dealers, pension funds, and corporations.

Form 13F must be filed within 45 days of the end of a calendar quarter. The report requires disclosure of the institutional investment manager that files the report and, with respect to each section 13(f) security over which it exercises investment discretion, the name and class, the CUSIP number, the number of shares as of the end of the calendar quarter for which the report is filed, and the total market value.

The securities institutional investment managers must report on Form 13F are “section 13(f) securities.” Section 13(f) securities generally include equity securities that trade on an exchange (including the Nasdaq National Market System), certain equity options and warrants, shares of closed-end investment companies, and certain convertible debt securities. The shares of open-end investment companies (i.e., mutual funds) are not Section 13(f) securities.”

Here are a few key takeaways from all that info above:

- All investors with portfolios over $100 million must file a 13F filing with the SEC

- It must be filed 45 days after the end of a calendar quarter.

- All securities they purchase must be listed, including stocks, bonds, warrants, and the number of shares purchased.

This information is useful for us because it enables us to see exactly what our gurus are buying or selling and at what prices.

How Do I Find 13F Filings?

Now that we understand what 13F filings are, how do we find them?

First, we need to locate the name of the fund or management company. For example, if you go to SEC.gov and type “Warren Buffett,” you will find nothing.

We must research before going to the SEC website; we should use our old friend, Google. We can search for fund and management companies to find the best-known managers using Google search.

For example, Mohnish Pabrai, one of my favorites, has a management company called Pabrai Investment Funds, which we find by typing in his name plus management company.

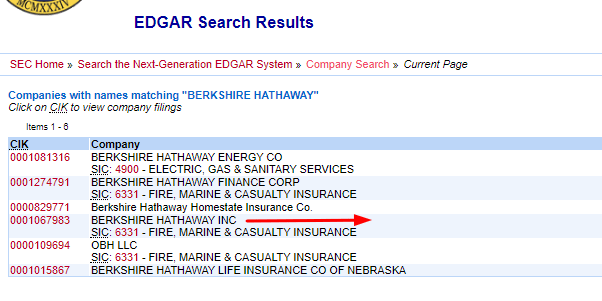

Another example would be everybody’s favorite investor, Warren Buffett. If you search for Berkshire Hathaway, Buffett’s company, you get four different companies; three names contain “Berkshire Hathaway,” and the right one is Berkshire Hathaway Inc.

Once we have the name of the fund or management company, we enter that info on the SEC.gov page and the search query; we will get the listing of all the forms that the asset manager has filed.

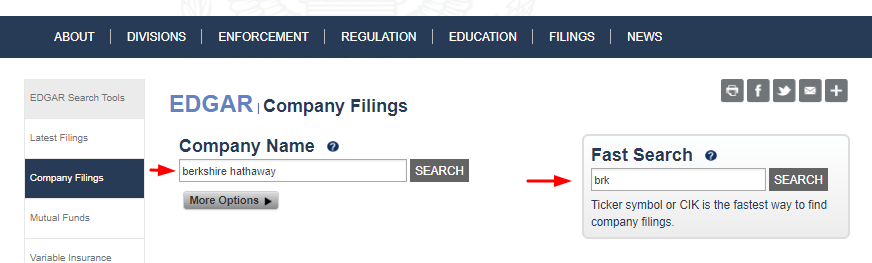

Once we click the company filings page, we will go to the EDGAR company filings page to type in either the ticker symbol or the company name.

Once we type in the company name or symbol, it will take us to the next page, where we will pick out the company we are trying to find.

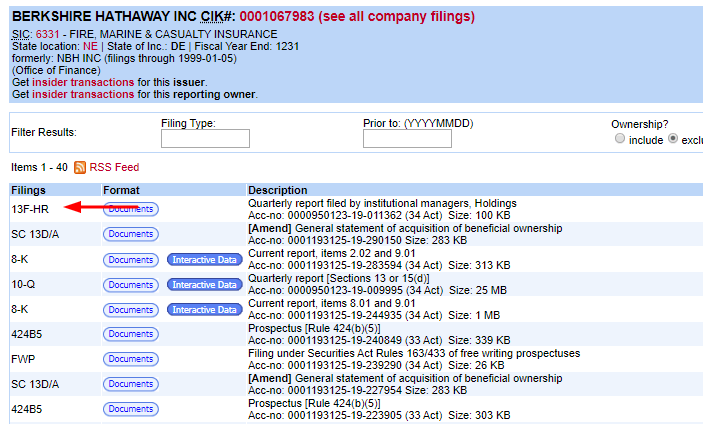

Once we have our company, click on the highlighted link to go to the filings page, which will list everything from 10-q to 10-k to 8-k.

The one we are looking for is 13F-HR.

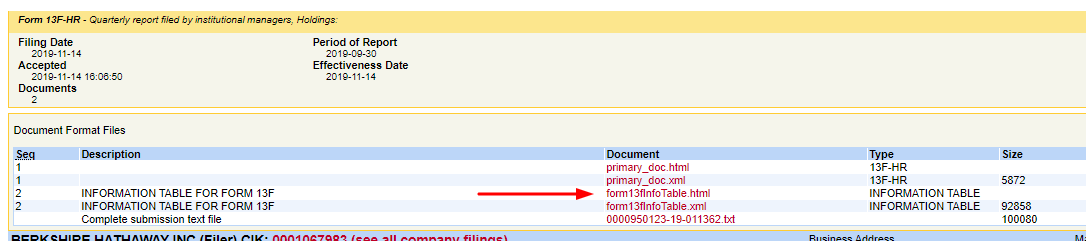

Now we are here, let’s click on the documents page and see what it reveals.

We are looking for the highlighted document, which reveals all of Buffett’s stocks.

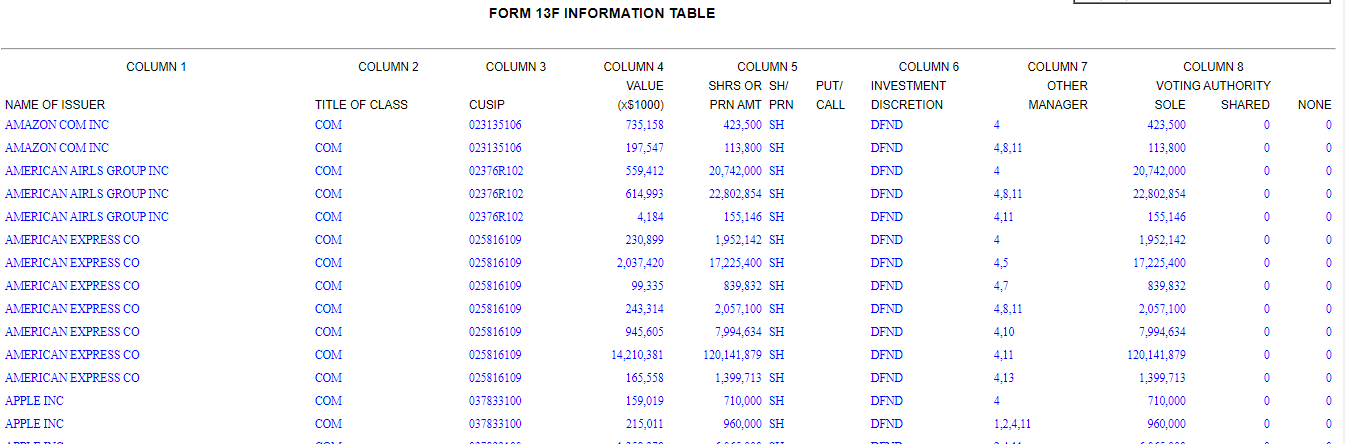

The above picture is a small snapshot of Buffett’s holdings; it contains every stock he currently holds plus lots of other information, such as the number of shares, the value of the purchase, and more.

We will dive into those elements in the next section. I hope you feel confident you can locate the 13F filing for your favorite investors.

How to Read 13F Filings?

Now that we understand the 13F and how to find it, let’s explore what information we can extract from it.

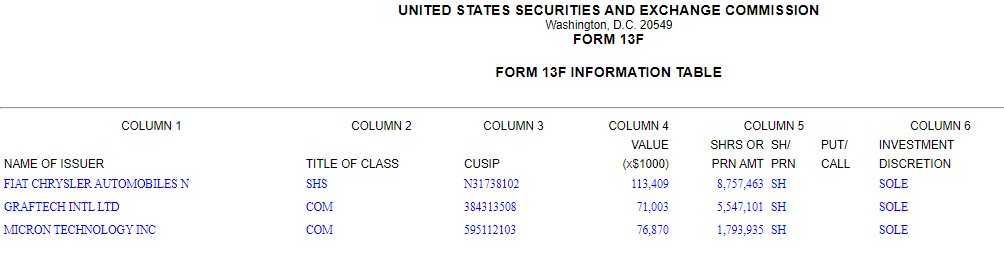

Let’s look at the 13F of Mohnish Pabrai and his fund, Dalal Street, LLC.

Pabrai’s portfolio is extremely concentrated in the U.S.; he does have investments overseas, particularly in India, South Korea, and Japan. However, those don’t follow our reporting guidelines, so we will concentrate on his U.S. portfolio.

Ok, let’s break the form down a little bit. First, notice a few different columns listed here. We will focus on columns 1, 4, and 5. These contain the info we need the most; column 3 has some value because it functions as a bar code for security identification. The CUSIP identifies all registered U.S. publicly traded companies and all U.S. government and municipal bonds.

Moving to column 1, we see it lists the securities bought or sold. In other 13F filings, you will notice other listings of the same security, indicating additional purchases of the particular security through the years.

As we will see with other 13F filings, they may have multiple purchases of the same security over the years. For example, Buffett bought American Express multiple times.

Looking at column 4 next, we see the common value x $1000, helping us see how much they pay for the particular security. To calculate the price paid, multiply the listed value by $1000.

For example, for Fiat Chrysler, we take the listed value of $113,409 and multiply it by $1000 to get $113,409,000. That’s pretty simple, and notice that we are not talking about chump change here.

Finally, column five lists the number of shares purchased for that security.

Now that we have all this information, we can determine the price for that security during this 13F.

Using Fiat Chrysler again, we take the total price paid earlier of $113,409,000, and now we divide it by the total shares purchased of 8,757,463.

Once we perform the calculation, we see Mohnish paid $12.95 per share. To take the analysis further, we can compare Fiat’s current price to see if the stock remains undervalued or is a deal.

Looking at gurufocus.com, I can see that the current market price of Fiat Chrysler is $15.58.

Now, what does the 13F tell us? It tells us that Mohnish bought Fiat Chrysler at a lower price and has continued to hold Fiat even with the recent death of its CEO.

Does Mohnish’s continued holding of Fiat mean it is a good investment right now? We cannot easily answer that question, as we still need to do our due diligence before buying Fiat.

Please never purchase a company based solely on the information discovered on a 13F filing. As with any screening tool, we must do our work before making a purchase; otherwise, we risk making a bad decision and losing our shirt.

The Value of 13F Filings

Now that we have seen how to find a 13F and what information it contains, why would we want to go to this effort?

Several reasons pop to mind:

- The 13F remains a fantastic learning tool; you can learn a great deal by studying the investment portfolios of our gurus. If you follow the 13F filing of your favorite managers regularly (every quarter), you will see how their holdings change from quarter to quarter and how their strategy has changed during the past quarter. For example, when you see the positions in bank stocks held by a fund tripled in the past quarter, you can conclude that the manager got quite bullish on banks.

- 13F filings remain a great source of investment ideas; observing what the greats buy and sell allows you to develop ideas independently. Will you find your next great investment idea? Maybe digging into the 13F helps you turn over another rock to find out.

Are there possible negatives of the following 13Fs? Oh, absolutely! The number one drawback remains outdated information because all 13Fs are filed 45 days after starting a new quarter.

So, the usefulness of the 13F form for your trading and decision-making is limited by the significant lag between the fund manager making a trade and the trade reflected in the report.

Form 13F shows holdings at the end of each quarter, but investors publish them on the SEC website several weeks later – around the middle of the next quarter. Therefore, when, for example, Warren Buffett doubles his position in WFC in October, you have a chance to know only by mid-February – and by this time, Buffett might have already sold the position. Despite the big lag, you should not hope merely buying the stocks the big smart guys file in their 13F will make you money, which could offer a big possible risk.

Does analyzing the 13F offer another benefit? In fact, yes. Studies have shown that cloning the portfolios of investing greats can be quite successful.

This is based on the great book by Meb Faber, Invest with the House, which presents some great case studies showing how cloning portfolios can offer a great way to invest. Best of all, it is all free, eliminating commission fees, and Meb’s book is free, too!

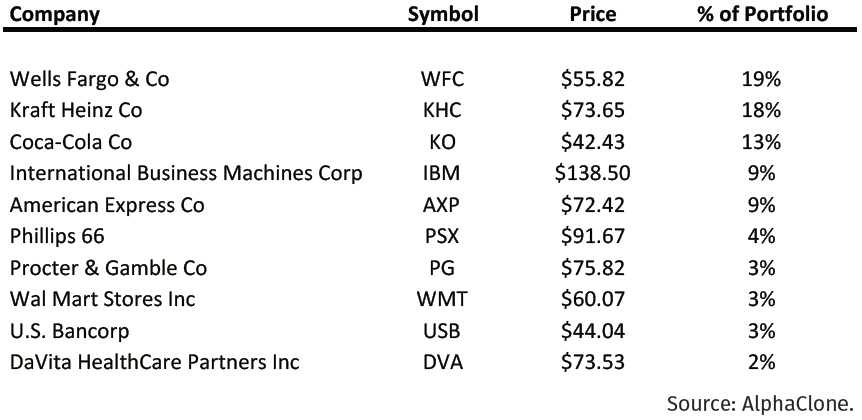

We will delve much deeper into the cloning system in my next article, but for now, let’s examine Buffett’s portfolio with Berkshire and use some data from Meb’s book to tell a story.

Meb uses 2000 to 2014 as a sample to compare Berkshire’s performance to the S&P 500 as a benchmark. Over that period, Berkshire beat the S&P by quite a bit:

- Clone portfolio 10.53%

- S&P 500 4.31%

So, that is quite a success! By buying the companies Buffett has bought, you can create your hedge fund, and in today’s no-fee settings, it creates a huge advantage.

What stocks does Buffett own:

One trick to applying this technique remains to clone long-only fund managers like Buffett, Munger, Pabrai, etc. If the fund manager constantly buys or sells companies, the strategy will be more difficult because the staleness of the data will make it challenging to use.

Faber replicates the portfolio by taking the ten largest positions and equal weighting them with 10 percent of each stock. You can also use the fund manager’s weighting. Every quarter, he reads the 13F filing and rebalances as needed. He either adds or deletes positions as they happen.

Determining portfolio weighting can be a lot of work. Still, you are in luck because multiple websites do all this work for us, deciphering the 13F filings and listing all the securities held and their weighting.

Several of the websites you can use to help you with your cloning portfolios:

Both sites provide all the information you need to help you decide whether to try this strategy. Best of all, they are free!

Final Thoughts

The 13F filings are a fantastic source of investment ideas; they are fairly easy to locate and find what information is listed on them. The biggest trick is locating the fund managers’ company to enter.

As we discovered, the 13F can be a rich source of investment ideas, and the best part is that it is free and easy to access.

Additionally, we discovered some other potential benefits to using this information.

Cloning our favorite gurus can be profitable, as we have seen with the brief look at what Meb Faber had presented. Also, Mohnish Pabrai, on his wonderful blog, Chai with Pabrai, has tackled this topic.

I appreciate you reading this article, and I hope you found some value to help you with your investing journey.

Please don’t hesitate to reach out if you have any questions, concerns, or comments.

Take care,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Is Cloning Top Fund Managers and Their Portfolios a Good Way to Go? In Alice Schroeder’s biography of Warren Buffett, The Snowball: Warren Buffett and the Business of Life, Buffett admits that much of his early success resulted from...

- How To Read Earnings Reports & What To Look For Wall Street and investors do the earnings report season dance every four quarters. But how do we read earnings reports, and what can they tell...

- What We Can Learn From Warren Buffett’s Four Pillars of Investing Warren Buffett has covered every aspect of investing over the years. Whether in one of his letters to shareholders, an interview, or an essay, a...

- What Malkiel’s Random Walk Got Wrong about Pricing Efficiency There’s many different trains of thought when it comes to the stock market. Among those is the idea by Burton Malkiel that you can’t beat...