Are you stressed about your company not offering a 401K retirement plan? Don’t worry, there are tons of 401k alternatives for you to choose from.

There are many phases we go through as humans. The first thing we all think about is getting our driver’s license. Then it moves on to moving out of our parent’s house and having our first legal drink. Then you start working and counting down the years until retirement.

It’s hard to have all the answers when you’re 25 years old, but to seriously plan for retirement, you must have a fairly set in stone plan from the beginning. How much money do you think you’ll spend in retirement? How early do you want to retire? How long do you expect to live?

As you can see, these aren’t the easiest questions in the world to answer, but you must do your best. Nowadays, the big thing is a company match 401K. That means whatever amount of money you give to your retirement account, the company will match up to a certain percent or dollar amount.

The company match 401K is a fantastic incentive. You should be contributing to your 401K already, so hypothetically it is as close to free money as you’ll ever see. I know for me, when I started to investigate different jobs, it was a huge factor to consider.

If you average $120,000/year for a 35-year working career, that is $252,000 (assuming a 6% match) of cash the company is giving you. Not to mention most of these retirement accounts are giving returns anywhere from 5-10 percent annually.

However, not everyone has access to this type of opportunity and may be looking at 401k alternatives. Maybe someone is self-employed, works as a contractor employee, or just works for a company that doesn’t offer a retirement plan. You may be looking for a retirement plan and need different options.

You’re in luck because as you likely suspected, company offered 401k’s are not the only retirement plan option. Although they are popular, there are plenty of 401k alternatives that I will discuss in detail below.

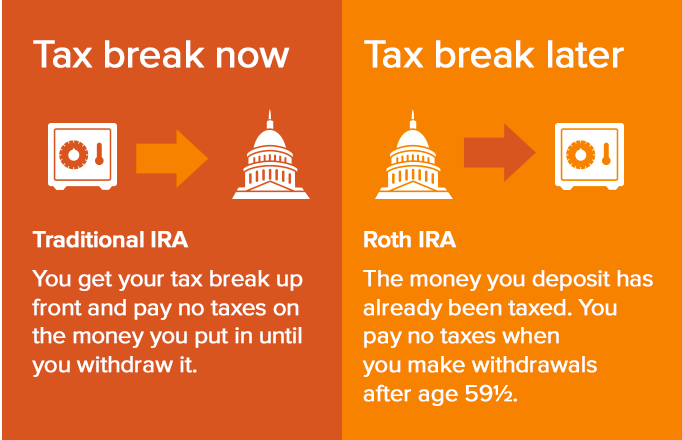

Traditional IRA

One of the most popular 401k alternatives is a Traditional IRA account. These accounts allow anyone with a job to put money in an account and allow the money to grow tax-deferred. These contributions are considered before-tax dollars, and you pay the taxes only once you decide to withdraw the money at the time of retirement.

One of the biggest benefits of a Traditional IRA is you can deduct contributions to your account from your taxable income, thus avoiding any taxes on that portion of your income. Having a Traditional IRA set up as a 401k alternative (even if you have a company offered 401k plan) is a great idea come tax time anyway.

If you are flirting with a different tax bracket, you can contribute to a Traditional IRA account and bring down your overall AGI (adjusted gross income). In one year of taxes for myself personally, I was able to contribute $2,000 to a Traditional IRA and gain nearly $2,500 in a tax return because of moving into a lower bracket.

The only drawback to a Traditional IRA is you are limited on the dollar amount you can contribute each year. For 2021, it was $6,000 for anyone under the age of 50 and $7,000 for anyone older than that.

If a Traditional IRA is your only 401k alternative, there is a chance you won’t be able to put enough money away in a year.

Roth IRA

There is another type of IRA account that has become a well-known 401k alternative used by many. That plan is a Roth IRA. This plan is the same idea as a Traditional IRA but has some vast differences.

A Roth IRA still allows your money to grow tax-free, but you’ll be able to withdraw it at the time of retirement completely tax-free. You must be thinking, that seems too good to be true.

Yes and no. While you get to withdraw the money completely tax-free, the contributions into the account will be on an after-tax basis. What does that mean? You are paying your taxes ahead of time on a Roth IRA account, where in a Traditional IRA account, you’re paying the taxes when you withdraw it.

The big benefits to a Roth IRA are the tax-free growth and withdrawals, as well as flexibility for where contributions can go. Before retirement, you can use Roth money for college expenses, a first-time home purchase, and a few other items without penalty.

I utilize a Roth IRA for my children’s college plans. I have 529’s set up for them but have a Roth IRA as well. That way if one of them would happen to get a big scholarship or decide to not go to college, I don’t have to pay all the penalties to take the money out of a 529.

The drawbacks to a Roth IRA are the same as the Traditional. You are limited to so much contribution in a year. The other drawback of a Roth IRA is that you are limited by income. If you make more than $198,000 as a married filer (for 2021), you can’t contribute to a Roth without knowing a few tricks, which is an entirely separate article.

SEP IRA

When looking at 401k alternatives, there are a lot of things to consider. The first two alternatives I have provided are more for a working-class person who wants to establish a retirement account, or someone with a company-sponsored 401k who wants to put back a little more each month.

Another option is a SEP IRA or a Simplified Employee Pension IRA. These accounts are for small business owners or people who have “side hustle” income. The rules of a SEP IRA are very similar to a Traditional IRA, with the major difference being the contribution allowance.

Participants in 2021 of a SEP IRA could put back up to $58,000 or 25 percent of their eligible compensations, whichever was less. That is a huge benefit to the SEP when considering 401k alternatives.

However, there are a few setbacks. The 25 percent earnings limitation can be a concern, especially for a side hustle that may not bring in a ton of money. Additionally, any other employees working for the business must receive the same contribution. So, if you are doing a start-up with three employees and only two are owners, the third would be entitled to the same contributions in a SEP IRA.

The bottom line: if you are running a good-sized business with just yourself and maybe one other person, this is a good option. It can be a difficult 401k alternative other than that.

Health Savings Account

One of the 401k alternatives that not everyone will always think about is a health savings account. Even though the initial design of such an account was to help offset high-deductible health plans, it can be another great strategy for your retirement plan.

You do have to qualify for a health savings account; your healthcare plan has to be considered high deductible which means your health plan has a minimum deductible of $1,400 individual coverage ($2,800 family coverage) and maximum out-of-pocket costs of $7,000 individual ($14,000 family). There is also a limitation on contributions which is $3,600 for an individual and up to $7,200 for a family. Employees who are over the age of 55 can contribute an additional $1,000 per year.

Throughout the life of the account, you can withdraw your earnings for eligible medical expenses with zero penalties. Remember, the interest or earnings on the account are tax-free again.

What some people don’t realize is that after you hit retirement age (65), you can withdraw the money you need. Even if your employer doesn’t offer a health savings account, you can set one up on your own.

At my old company, they offered a high deductible health plan that came with an HSA. The company would give you a dollar amount each year, and then you could contribute as well. When I was married and didn’t have kids, I had this plan and maxed out the HSA contribution. By the time I had a family and started having some medical bills, I had a ton stashed away to pay for a lot of medical bills.

The downside to a health savings account is the money becomes taxable income on non-medical withdrawals after age 65. You typically won’t have as big of a return on the money sitting in this type of account, because you want it to be very liquid in the case of an emergency.

I know another downside in my case was how fast the savings can go with medical bills. I had nearly $10,000 put away that was just a bonus retirement account. Two kids later, it’s nearly gone. A health savings account can be a strong retirement option as a 401k alternative, but should not be your only solution.

Brokerage Account

One last idea of a 401k alternative is just your standard brokerage account. This would be an account where you invest your own money in any type of stock that you would like.

The good thing about this is you can invest as much or as little money per year as you would like. Over the long-term, it is estimated that you should earn around 10 percent on your money each year, assuming you are being somewhat responsible. These types of accounts are easy to set up and you can manage them completely as you wish.

The biggest downside to a brokerage account as a 401k alternative is there is no tax break. You are contributing after-tax dollars and would be responsible for capital gain taxes (anything you make over the initial investment) when you go to withdraw your money.

If investing in the stock market catches your fancy, I certainly recommend opening a brokerage account and contributing some money. Invest how you please and plan on using the money for later in life. It’s always best to invest and let the money sit.

However, if you are truly trying to plan a full retirement, this likely isn’t your best option. There is a lot of risk in managing your own money, and stocks compared to a typical retirement account are not nearly as resilient.

The bottom line: “What is the best option for 401k alternatives?” is an extremely loaded question. While a lot of options exist as noted above, my opinion is that not one of these alternatives is the sole solution to planning for retirement.

Truthfully, even if you have an employee-funded 401k, you should consider other supplemental ways of supporting your retirement. What I have personally done is use each of these 401k alternatives to grow a more rounded retirement portfolio.

My company does provide me with a six percent match 401k option. I max that out and take every free dollar they give me. On top of that, I have a Traditional IRA that I use for my spouse. She does some freelance work and doesn’t have any employer contribution.

I then utilize a Roth IRA as a retirement/college education fund. My plan is to use this for my kid’s college education, but it’s also a great retirement option should I not need it all for college (one can hope right?).

A health savings account is also a great benefit to have. I utilized this until I was no longer eligible. Once you have children and have the option for a low deductible plan, there really is no other option (in my opinion) so I’m no longer eligible for an account.

The same goes for a brokerage account. Having a small amount of money is a great 401k alternative for some fun and retirement. I have a small amount of money in a brokerage account that I’m fine if I lost it all, but I also enjoy making trades and watching my money grow by itself.

Don’t let this be overwhelming to you all. I have just listed five different accounts that I recommend contributing money to. It doesn’t have to be a large amount of money to be impactful. I give $100 to each of my IRA’s a month, and only contribute to my brokerage account when I have some extra money laying around.

It’s important to have money set aside for retirement but be sure to not rob yourself of a good life while you’re young. Remember, you can’t take your money with you when you’re gone.

Related posts:

- What are the Best Types of IRA for My Retirement Goals? Updated 3/26/2024 When I first started investing, trying to understand all of the lingo and complicated methods was simply overwhelming. Many of us have likely...

- Everything you Need to Know: Traditional IRA Pros and Cons Traditional IRA accounts don’t have to be utilized just for retirement funds. Check out Traditional IRA pros and cons to see if an account makes...

- Sure I Save Taxes, but is the 401k Worth It? Updated 3/28/2024 The 401k is one of the most popular tools for investing for retirement because so many employers offer it. But, believe it or...

- Worst 401k Mistakes – The Biggest One will SHOCK You A 401k is a wonderful thing as long as you’re using it correctly. Something that I have learned over the years is that so many...