Every now and then I will have someone tell me that they’re choosing to forego their 401K employer match because of something else like paying off debt, a vacation, or some other inadequate reason. I wrote a post recently on the biggest 401K mistakes you can make, and I included not maxing out your match, but maybe I haven’t done a good enough job…so here, time to let you see it yourself with this 401K employer match calculator.

Honestly, I thought that I did a pretty good job (pat on the back lol) but even after I had sent it to some people, I was told that I was wrong…

I know that I am not wrong – not even close. So, let me say this again – Not maxing out your 401K employer match is the BIGGEST mistake that you can make.

It should come before any debt (mathematically speaking credit cards included, but I understand if you want to pay off a credit card first). It should come before saving for a home. Definitely comes before a vacation.

What does it not come before? Your immediate needs as a family – food, water and shelter. But, if you’re not maxing out your 401K, you better be living a minimalist lifestyle on those things. So…

- Food – rice and beans with maybe a little bit of on-sale meat. That’s all!

- Water – tap water. You know, the free kind.

- Shelter – rent the cheapest apartment that you can find without sacrificing safety. Honestly, might even be worth trying to bum it with a friend or asking the parents if you can move back in!

I know these all sound extremely drastic, and they are, but let me show you some of the math behind why you need to max out your 401K match.

One thing that I always hear from people is that it’s a 100% ROI.

Wrong.

It’s way more than that!

When you’re paid and you invest that money in the market…history says you’ll make about 10% on average each year, using the total S&P 500 yield. So, you will make 10% in Year 1.

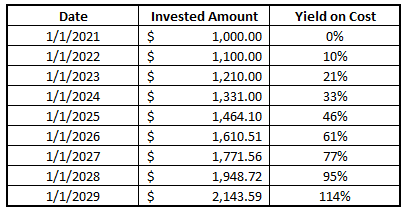

Then, you’ll make 10% on that entire amount in Year 2; another 10% in Year 3; so on and so forth. Let me give you an example – If you invested $1000 on 1/1/21 and you made 10% each year, the following scenario would play out:

As you can see, by 1/1/29, just 8 short years later, you would’ve more than doubled your money. But, your Yield on Cost, a term that I really like to use, is over 114%.

What that means is that your “cost” was $1000 as that was your initial investment. Because you now have $2143.59, your Yield on Cost is 114% because you have 114% more than you started with!

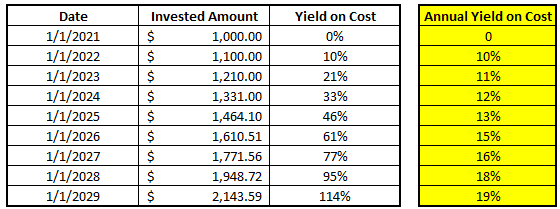

But do you notice how the yield on cost continues to get bigger each year? Take a look:

The reason that this number keeps growing is because every year you’re earning more and more on the interest, or gains, that you realized the year prior. And that, my friends, is compound interest.

And that’s exactly why you HAVE to max out your employer match. Sure, the immediate return is 100% as they’re giving you the same amount that you’re putting in, but the number actually grows to be much, much larger than that!

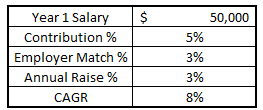

The beauty of this file is you can completely personalize it to your own situation to make sure that you’re pulling in the numbers relevant for you!

The only things that you need to know are:

- Salary

- Contribution % – this is the percentage that you plan to contribute yearly

- Employer Match % – this is the percentage that your employer will match you up to

- It’s important to note that your contribution percentage and employer match percentage might be different, for instance:

- Your employer matches 3% but you want to put in 5%, or

- Your employer matches 50% of your investment up to 6%, meaning you put in 6% and they put in 3%

- It’s important to note that your contribution percentage and employer match percentage might be different, for instance:

- Annual Raise % – this is going to be a guesstimate but you can look at previous years with your employer or even ask coworkers what a “normal” raise is. If anyone questions your motive, just say you’re doing some financial planning – and it’s true!

- Growth Rate – this is the amount that your 401K is going to grow each year. As I mentioned, the S&P 500 average is 10%, but after inflation you’re likely around 8%, so that’s what I use. Want to be aggressive? Go higher. Conservative (my preference, if anything)? Go lower and start at 5%. 100% up to you!

- Years left of working & investing – you need to know how many more years that you have left of working so you know how long you’re going to be adding to your 401K. And then you need to know how many years left of life that you think you’ll have because your money will continue to grow during that time.

- I know this is hard but again, just be conservative – put 110 or something!

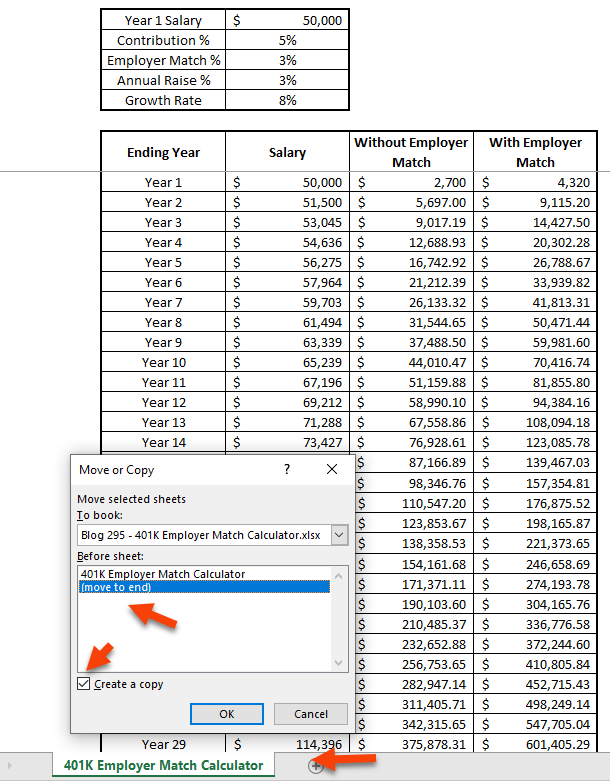

Once you know all of these pieces of information, you can begin to fill out the calculator as I have shown below:

You’ll see that the years are not included at this point – it’s something that you will adjust later on.

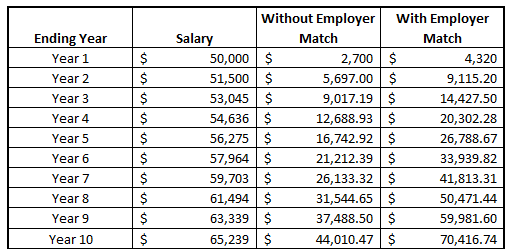

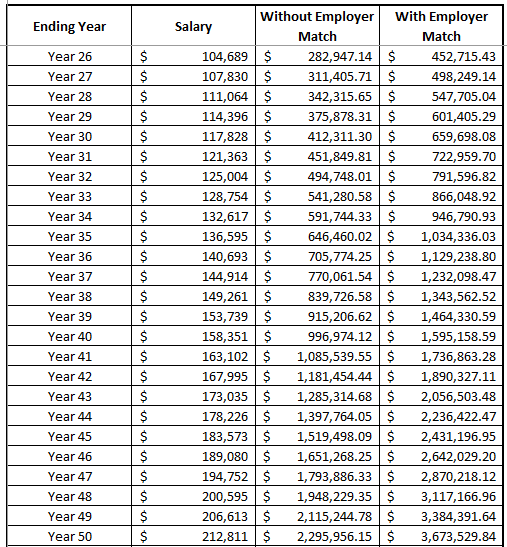

Once you input this information, you can see how the data then populates into the table below. I have shown the first 10 years to give you a frame of reference:

You can see that the salary is growing by that 3% that you had inputted each year and then you have two columns – one showing if you invested 5% with the 3% employer match while the other shows your 5% contribution with NO employer match.

Now, I know that you said your employer match is 3%, but I think it’s important to show both for comparison purposes.

I have this chart typed up to go through 110 years, which means if you start working at 18 then you’re covered until 128….

So, you’re probably safe, to say the least. But the next step is to decide what year you think you’re going to stop working and then also pick a date that you likely will have passed away (sad, I know).

Let’s say you’re currently 30, want to work to 60, and want to plan to 100. That means that I will take the following steps:

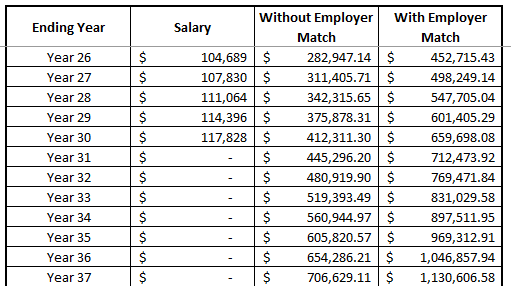

Since I am 30 and working to 60, I will go to Year 30 (Age 60 retired – Age 30 Now = 30 working/investing years) and put $0 in the salary for the remainder of the time.

Current

New

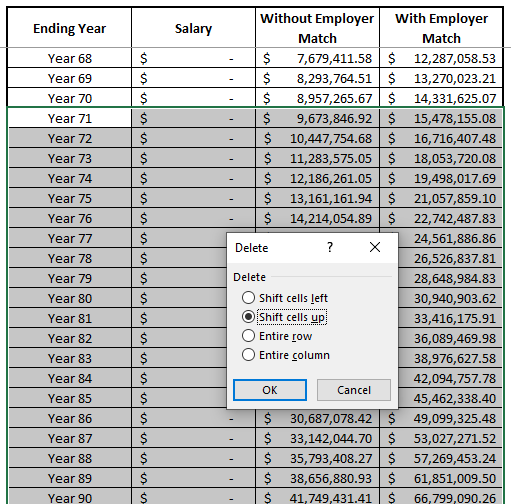

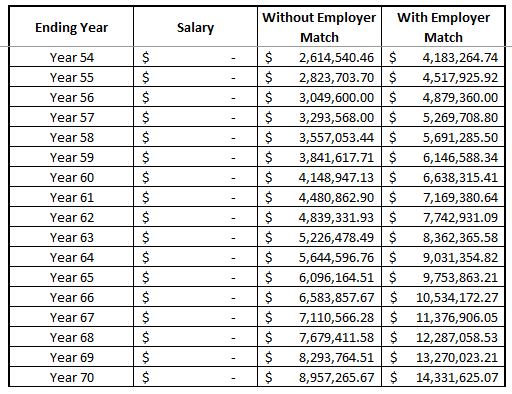

Now, like I mentioned, this only addresses when you’re going to stop working. The next step that you want to do is to delete everything after Year 70 (Croak Age of 100 – Current Age 30 = 70 Investing Years). So, you’ll do the following:

- Highlight everything that is Year 71 and down, all the way to Year 110

- Right click on your mouse and hit delete. Then select “shift cells up”:

You’ll end up with the following:

The reason that this is important is twofold:

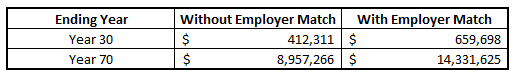

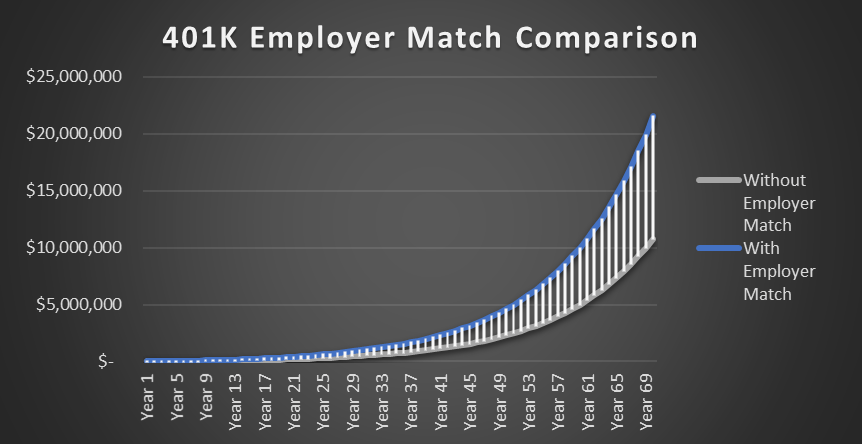

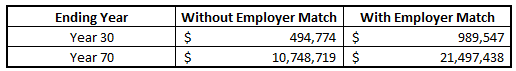

1 – you can see the monster difference in the two numbers at the end of your investing timeline. For a quick summary, when you do this, you’re going to have quite a nice chunk of money:

This shows me that not only is the employer match extremely important, but it also says the value of letting your money sit from the market. I mean, the employer match becomes nearly 22X what it was from Age 60 to Age 100, or Year 30 to Year 70, by literally just sitting there. Insane!

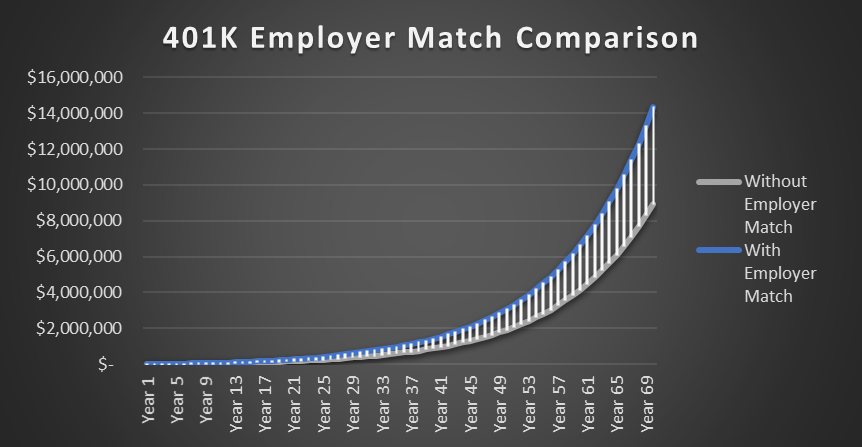

2 – you can see the monster difference in a nice graph format!

The graph below shows how your portfolio would look over that 70-year period:

And now we finally get into the part that I just absolutely love talking about – the Yield on Cost!

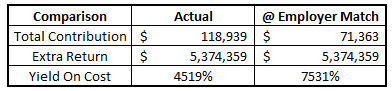

The table below shows the total amount that you would’ve contributed if based on the actual scenario (you invest 5%; employer matches 3%) and then if you only invested at the employer match level which in this case is 3%:

Obviously, your total contribution is higher in the actual scenario because you’re investing that 2% extra, but the Extra Return is the same because the employer match is the same.

I refer to it as the “Yield on Cost” because in the actual scenario, you are investing 5% total and receiving 3% for free, but truthfully, the real yield on cost is if you invested only at the employer match amount, aka 3% in this example.

So, when you look at the right column, you can see that in this scenario you would’ve invested a grand total of $71,363 over your 30-year career. As I showed above, your $71,363 will turn into $659,698 after 30 years, meaning an ROI of 924%!

That is absolutely amazing for simply doing nothing more than taking a little bit extra out of each paycheck.

Let me say this again to hammer it home – $71K turned into $660K in 30 years by simply doing nothing more than if you are spending 3% less money and then investing into a total stock market fund like SPY or an equal-weighted S&P 500 ETF like RSP!

Does it get easier than that? I don’t think so.

I recommend that you take this tool and play around with it a little bit just to see what kind of results that you can have.

For instance, if your employer matches 8% (sounds insane but I know some companies do), and you can only afford 6%, try inputting in both of those scenarios into the 401K Employer Match Calculator.

You can simply right click on the tab labeled “401K Employer Match Calculator, select “Move to End” and check the “Create a Copy”:

I just change the tab labels for one to say 6% and one to say 8% and then you would change the inputs just as I mentioned in the example above.

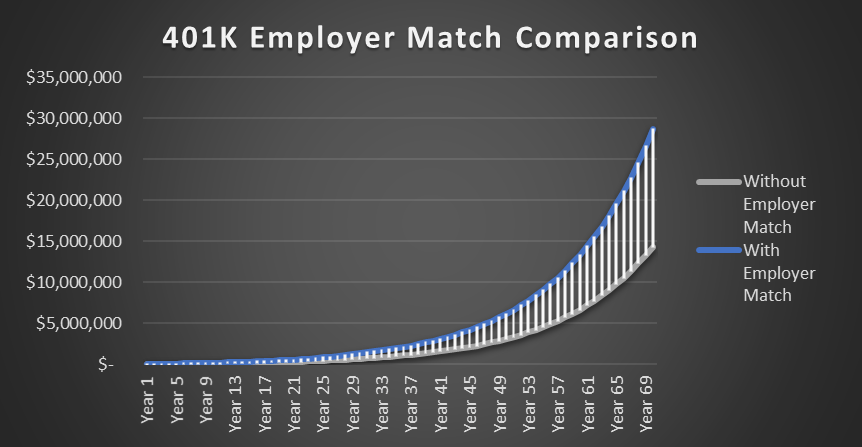

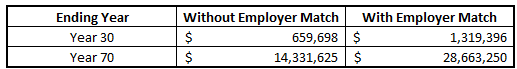

You’re likely thinking that it seems obvious you’ll be better off with the 8% investment, and that is for sure true, but take a guess how much better off you’ll be!

Seriously – do it. Guess!

The 6% investment is pretty impressive! I mean, $21 million is a pretty solid chunk of change, right?!

While this might be super motivating to getting you to invest as much as you possibly can, or at least maxing out that 401K employer match, the really motivating part comes from if you’re leaving anything on the table.

If you were able to just save and invest that extra 2% that the company is offering you, your new amount would blow this number out of the water!

I’m not sure about you, but that extra $7 million sure is a pretty dang nice chunk of change! To me, that certainly would motivate me to find a way to save and invest that extra 2%.

I mean, 2% on a $50K salary is only $1000/year or $38.46 for a biweekly paycheck. And that’s pretax dollars! So, realistically it’s like a $30 impact to you for a 2-week period.

$2 a day – can you find a way to save $2/day? I know that I certainly can! $2/day = $7 million.

If that doesn’t motivate you then I don’t know what will, because that math is just mind blowing to me.

Do yourself a favor and download the 401K Employer Match Calculator and play around with it for a little bit. It’s 100% free and I don’t get anything by you downloading, other than the satisfaction that I know I’m helping someone get a little bit closer to their financial independence goals.

Then you can finally do the math and make sure that you’re not making the biggest 401K mistake, but the question is – are you making any other mistakes?

Related posts:

- This 401k Match Calculator Shows How Powerful Compound Interest Can Be There’s various compound interest calculators out there, but not many specific 401k match calculators that are easily manipulable to show how different contributions and employers...

- Curious What the Average 401k Match Is? I Bet You’ll Be Surprised! One of the biggest mistakes that I oftentimes will see people make is that they will not take full advantage of their 401k match. Honestly,...

- I’m Getting a New Job – Will I Lose My 401K from my Previous Employer? Changing jobs can be a scary thing. It’s hard to leave what you know for the potential opportunity, and downside, of the unknown of changing...

- Optimize Your Retirement With This Roth vs. Traditional 401k Calculator! To many people, the terms “Roth” and “Traditional” only apply to their IRA, but I am here to tell you that this is not the...