There’s various compound interest calculators out there, but not many specific 401k match calculators that are easily manipulable to show how different contributions and employers matches can compound. We present an Excel version, or you can simply place your own inputs on the page (scroll to the bottom)!

Earlier this week, I made a Compound Interest post in the Investing Facebook group and had a follower of the group, Joshua Glenn, ask me if there was a 401K Compound Interest calculator… I was somewhat dumbfounded.

Out of all of the compound interest calculators that I had seen, I hadn’t seen one that allowed you the ability to put a certain percentage of your income to determine your contribution amount, as well as include an employer match, and even give you the ability to adjust for potential future raises as well, and for some reason I never even questioned it.

In the investing community, we often almost glance over 401Ks.

It’s like, max out your company match, but then go invest in companies with dividends, max out your Roth IRA, etc., etc. And yes, I agree with those things, but the first thing I said was MAX OUT YOUR COMPANY MATCH!

We never focus on that – so I wanted to, thanks to the great question on the Facebook page.

The Importance of Calculating the Compound Interest from a 401k

For most people, I think that investing in their 401K is the most common form of a retirement plan that they might have, and I think that’s because it’s easier and also because their company might have a company match.

It seems easier because the company is likely pushing it and explaining the program to new employees, along with touting their 401K match to their employees to try to get them in the door and get them saving for retirement, as well as using it as a major selling point in interviews to try to sell potential employees on the position.

I mean, if I was going to ask a potential new employer what their benefits look like, the main two things I would care about were the vacation time and the company match… everything else is all gravy.

Now, a 401K contribution is determined by taking a percentage of your income rather than an amount of the income.

In other words, if you want to contribute $100/month and your salary is $40,000, you don’t say that you will contribute $100 – you have to contribute 3% of your income ($40,000 annual salary/12 months = $3,333.33. $100/$3,333.33 = 3%).

Of course, as you get raises, the amount that you contribute will increase if you keep your percentage at 3%.

401k Employer Match Example

Imagine you work at a company that gives you a 5% raise every year and they give you a 4% match on 5% personal contributions (I frequently see this as a match for companies.

For instance, they match 100% of your contributions up to 3%, then half of your fourth and fifth percentages).

You can probably easily calculate how much you might invest this year, or maybe even next year, but I wanted to create a tool to help you to do this automatically. Below is a screenshot to show you the format, and here’s the link to the actual Excel file: 401k Match Calculator

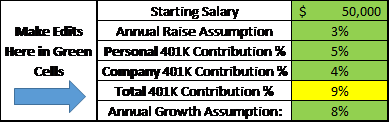

First, you will need to input a few different sections, which are highlighted in green below:

- Starting Salary – Input your starting salary here

- Annual Raise Assumption – Assume what you will get as a raise on an annual basis; it could be 0% if you want to be extra conservative or if you usually receive 3-5%, maybe put 3% to still be conservative

- If you don’t want to just use a blanket annual raise percentage, you can click on the tab titled ‘Salary & Contribution Details’ and change the salary. For instance, this could come in handy if you normally get a certain percentage raise, but you know that around age 40 you’re going to stop trying to climb the corporate ladder and spend more time with your family, so you could just drop the salary down a bit manually.

- Personal 401K Contribution Percentage – Simply enter this percentage

- Company Match 401K contribution percentage – Simply enter this percentage

- Total 401K contribution percentage – You do not need to change anything here. It’s a simple function to add together the two previous cells

- Annual Growth Assumption – Put in your assumed 401K return. Average S&P return since 1950 is 11%. I used 8% to be safe, but you can use whatever you feel comfortable with.

- Look at your returns!

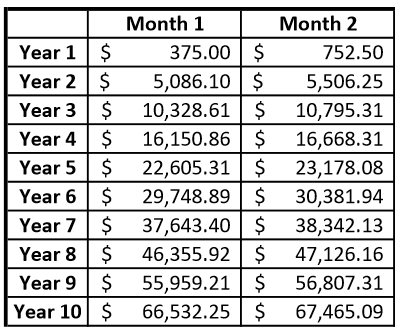

As you can see, your first month you would have $375 (9% total match*$50,000 salary/12 months = $375). Month two, you are adding another $375 plus you’re earning .67% (8% interest/12 months = .67% interest monthly) interest on your $375 from month one, so on and so forth.

Starting in year two, your new monthly contribution is $386.25/month, since you assumed a raise of 3%. ($50,000*1.03% = $51,500 annual salary. $51,500*9%/12 months = $386.25).

Now, let’s imagine this exact scenario plays out for 35 years…you will end that last year with $1,187,336.48. Not a small chunk of change by any means. Now, some people might want to work long after this, so I’ve included the file to go out to 50 years, which would give you a total of $3,383,001.21….I have a feeling you want to work for 50 years now, right ?

We’ve also included an ability to customize your own inputs right here on this page:

See what happens when you change the return from 8% to 10%, or the time period from 47 years to 50 years.

Or try your own 401k contribution numbers, and see just how much compounding you can earn over time!

A couple months ago I wrote an article explaining what to do with a money windfall and I listed the #1 thing as maxing out the company match on your 401K – I still believe this and believe it even more so once you put some numbers behind it.

With vs. Without a Company 401k Match

For example, I mentioned that in the above scenario, which assumes a 5% employee contribution and a 4% company match, you would have $1,187,336.48 in 35 years… but if you only invested 3% and your company match was then dropped down to 3%, how would that look?

Your new total in 35 years would be $791,557.66, or $395,778.83 less!!

So, in other words, you would have “saved” $60,462.08 of your paycheck by not putting that in the 401K throughout the 35 years but and it would’ve cost you almost $400K at retirement. Not exactly optimizing your finances.

Not to mention, your 401K contributions go in pre-tax, and that $60K would need to be taxed, so your “savings” is probably closer to ~ $47K after taxes.

Ouch. Please, please, please – do me a favor and max out your company match – your 65-year old self will thank you for it.

Please take a look, play with the 401k Compound Interest Calculator (click to download the Excel version), and let me know if you have questions, comments, or requests for other tools similar to this.

At the end of the day, we’re here to help educate and allow us to all learn from each other to get to our own personal finance goals.

Updated 11/9/20 — Andy Shuler, Dave Ahern, and Andrew Sather

Related posts:

- Take Control of Your Own Destiny with This 401K Employer Match Calculator! Every now and then I will have someone tell me that they’re choosing to forego their 401K employer match because of something else like paying...

- Curious What the Average 401k Match Is? I Bet You’ll Be Surprised! One of the biggest mistakes that I oftentimes will see people make is that they will not take full advantage of their 401k match. Honestly,...

- The Continuous Compound Interest Formula Excel Function for (Us) Nerds Ever wanted to illustrate exactly how powerful compound interest can be? Wanted to have an Excel function to do it for you? This post reveals...

- Comparing Compound Interest from Paying Student Loans vs Investing If you listened to the most recent episode of the Investing for Beginners Podcast with Andrew and Dave, then you heard them both GO IN...