One of the things that I hated the most when I was first starting my financial freedom journey was that there was soooo much information, it made it overwhelming to actually get started. Fortunately for all of us, George Clason, author of ‘The Richest Man in Babylon,’ boils it down to a list of the 5 laws of gold.

We have already learned some great lessons from George Clason in ‘The Richest Man in Babylon’ such as learning how to grow your fix your lean purse and how the more ready you are to pounce on an opportunity, the ‘luckier’ that you will be, but this chapter just adds another great level to really keep hammering the point home of wealth creation.

But what am I waiting for? Let’s get started on the list!

1 – “Gold cometh gladly and in increasing quantity to any man who will put by not less than one-tenth of his earnings to create an estate for his future and that of his family.”

This is a lesson that was hit really hard in a previous chapter, ‘7 Cures for a Lean Purse,’ but I am happy that Clason is bringing it up again because this is step 1 in any financial freedom journey. If you’re not spending less than you’re making, then all of this talk about investing strategies, tax-advantaged accounts, and retiring early is a waste of time.

You HAVE to be spending less than you make so that you can do something with that money. If you don’t have extra money, then you will never get ahead. You will live paycheck to paycheck and likely end up with a ton of debt! That is not a good situation.

Are you currently spending less than you’re making? If not, that needs to change now and it can simply by following the best budget tool that’s out there – Doctor Budget!

While the book recommends that you save 10% of your income, I think you need to be in the 20% range at a minimum. Yes, 10% is a great start, especially for those that aren’t investing at all, but 20% is a number that’s really going to help boost you faster to financial autonomy.

I promise I didn’t just pull this number out of thin air! The 4% rule tells us that we need to save 25 times our annual spending habits to retire safely, so if you need $50,000/year to retire, you need to save $1.25 million.

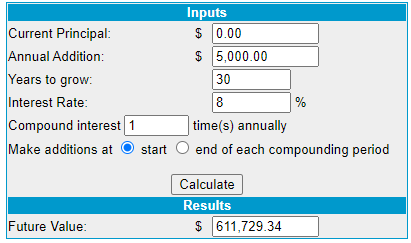

If you’re currently making $50,000 and saving 10%, you will fall well short of that goal:

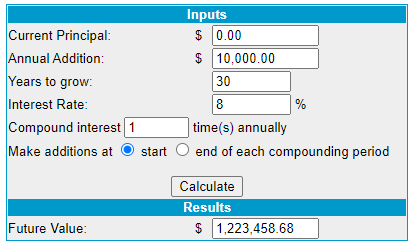

If you’re making $50,000 and saving 20%, you’re right there in the ballpark!

Of course, the annual return (interest rate) and the years to grow can vary based off your situation, but these are typical numbers that I like to use as the S&P 500 CAGR is 11% since 1950 so 8% seems conservative to me. And obviously, the years 100% varies only on your specific situation.

The more that you can save and invest is obviously better but sticking to 10% is a very conservative minimum per Clason – I say to up it even more!

2 – “Gold laboreth diligently and contentedly for the wise owner who finds for its profitable employment, multiplying even as the flocks of the field.”

This is all about letting your money work for you. Now that you have been able to set aside a certain amount of your paycheck and live on the rest, what do you do with the remaining amount? Hopefully you put it to use to make more money for you!

Before I started investing, I was a victim of this. I let my money sit in my Fifth Third bank account that earned me .01% interest.

Not only have I started to take that money and invest it, but I also have moved nearly all of my money that’s meant to stay in a savings account, like an emergency fund and near-term purchases, into my Ally savings account where I am currently earning 1.25% but was earning 2.3% about a year ago, all due to the fed decreasing interest rates.

As Buffett says, “If you don’t find a way to make money while you sleep, you will work until you die.” This is a perfect quote to sum up the second rule of gold. I think that the best, and most readily available, way for someone to make money while they sleep is to invest it in the market. Now of course, the market is only open during the day but this saying is a hyperbole!

The meat of this rule is to find a way to have your money make you more money without you having to break your back over and over. The stock market has historically produced annual returns of 11% since 1950, so if you simply had invested $1000 into the S&P 500 in 1950, you would now have over $1.5 MILLION!

Don’t believe me? See for yourself !

The point is that you need to find a way to put your money to use and create wealth for you and your family!

3 – “Gold clingeth to the protection of the cautious owner who invests it under the advice of men wise in its handling.”

Just like how Dave always ends the podcast by saying, “invest with a margin of safety…emphasis on the safety,” this quote is also urging you to be protective with your money.

To me, this is telling me that you simply need to trust those that you are letting handle your money.

Maybe it’s a financial advisor, and if so, have you properly vetted them and made sure that they’re a fiduciary?

Or, maybe it’s a tenant at your rental facility. Sure, you’re not directly giving them money, but you’re giving them a place to live in exchange for a monthly rent payment and if they don’t pay, you’re the one that’s going to have to figure that out and you’re the one that’s on the hook with the bank.

Or maybe it’s you! Maybe you want to buy a rental home but you don’t trust yourself to know the business. Or, you really want to invest in the market but you don’t trust yourself to be able to stomach the hard times and not sell at the bottom of the market when things seem to be in complete turmoil.

No matter if it’s you or someone else, you have to have 100% trust in the world in that person that not only will they do things to the best of their ability, but they will do the right thing. You need to trust that person’s expertise. And if it’s you, you need to trust that you will learn from any mistakes that you might make and ensure that you don’t make them again at a future time.

If you have 100% trust in people that are always going to look out for you, and do what’s best for you, then your money is in great hands, and you’re going to reap the rewards for years to come!

4 – “Gold slippeth away from the man who invests it in businesses or purposes with which he is not familiar or which are not approved by those skilled in its keep.”

This one seems really obvious, right? I often talk about how in the stock market you have investors and then you have speculators. Speculators are just gamblers that are buying a stock because maybe they’ve heard good things about the company or they like the product.

There is so much more that goes into it than that!

How is the balance sheet? How about the income statement? Have you run the traps with the Value Trap Indicator? Does the company look poised for long-term success? Have you read their 10-k? All of these things absolutely need to be taken into consideration before you buy a company.

Analysis is needed for you to properly be prepared to buy shares and take ownership of a company. If you skip the analysis stage then you’re speculating, and there’s really nothing more to it than that.

If you’re looking for a place to start, start with reading some blogs about balance sheet, or the income statement, and then maybe even using the Value Trap Indicator which I mentioned above. And of course, read the 10-k on SEC.gov.

It’s very important for you to avoid “paralysis by analysis” but you need to get a little bit more involved than simply just speculating.

This was hard for me at first and I really did just speculate when I was buying stocks. Sometimes I still do this and almost always I will regret it. It’s 100% the thing that I struggle with the most in my investing journey but I am actively working to be more of a pure data, both qualitative and quantitative, type of investor rather than a gambler.

There’s a wealth of information out there, whether on podcasts, blogs, YouTube, and even Instagram – it’s just up to you to find it, consume it, and use it!

5 – “Gold flees the man who would force it to impossible earnings or who followeth the alluring advice of tricksters and schemers or who trusts it to his own inexperience and romantic desires in investment.”

Similar to the advice above, you need to make sure you’re doing your due diligence on your investments. If someone comes along with a “once in the lifetime” investment opportunity, ask yourself, “why me?” Why are you the one that’s chosen?

Chances are, it’s because the think you’re gullible – and a sucker!

Personally, I don’t face a lot of situations where I am being susceptible to fraud, but I do think that this really can be a threat the more that you start trying to have your money work for you.

Two of the most common ways that I see people try to have their money work for you is in the stock market and in the real estate market. You can easily be tricked into buying a home that might not exactly what you think it is. Maybe there’s unseen damage, or it’s in a flood zone, or it’s in a small town where the biggest company is leaving town and now the values of the homes will all drop!

Any of these can drastically impact the value of the home and might be something that you were simply unaware of, but the buyer knew, when the home was sold.

You must do your due diligence on the property and the surrounding areas where you’re purchasing the property, and even the owners if you can. The more that you know, the more prepared that you will be to make sure that you’re not making a crippling mistake!

In the market, I instantly think of Luckin Coffee. Luckin coffee was just delisted in the US due to some massive accounting fraud within the company.

Could you have seen this coming?

No, most likely not. Many people were tricked by this and you shouldn’t feel bad, but it simply just stresses the importance even more that you must have when evaluating the company and doing your analysis. On top of knowing the numbers and performance of the company, you need to know the management of the company and trust them as well!

I love to use ROIC as a metric to measure the effectiveness of a company’s management, but if they’re lying about the numbers like Luckin was, then using a metric does absolutely nothing!

You have to trust the company’s management!

These 5 laws of gold are really great laws that everyone should manage their money by. I mean, it’s really pretty straightforward:

- Save at least 10% of your money

- Put your money to work so it makes money for you

- Only let people touch your money that you 100% trust

- Do your homework and know what you’re investing in

- Don’t get scammed

If you can implement these five tips into your life then you’re really going to be setup for a successful future with a very high earnings potential. But don’t take it just from me, take it from the 4 million people that have bought ‘The Richest Man in Babylon.’

If I am fooled by this book, at least there are 3,999,999 others! But I have a really good feeling that I’m not…

Good luck!

Related posts:

- The History and Secrets of Babylon and its Money If you’re finding yourself struggling with getting your mindset right and can’t seem to get motivated and focused on personal finance, you have come to...

- 5 Frugal Living Tips that Only Take Seconds to Implement Who says you can’t have fun AND save money? Here are some great frugal living tips that keep money in your wallet without killing your...

- 6 Must-Follow Wealth Creation Steps to so You Can Retire Early Do you find yourself in a situation where you’re having no issues living within your means, but you’re really not just getting close to financial...

- Retiring at 55? 9 Tangible Steps to Turn that Goal Into a Reality! Are you pumped for this blog post? I hope so! I know that I am extremely pumped to write it and show you all about...