If you could only choose one, would you choose active or passive income? I mean, they’re both good because you’re making money, but I’m here to preview this incredible battle of Active vs. Passive Income!

The last time that I did a heavyweight matchup like this I was comparing short vs. long-term investing and boy, that sure was a battle! I won’t spoil who won that battle but let’s just say that it was a long battle! ?

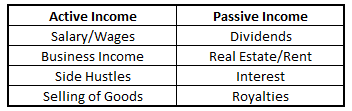

First off, what are the differences between active and passive income? The best way that I can describe it is active income is when you receive income for hard work and effort that you have put in recently, while passive income is when you receive income for hard work and effort that you put in a long time ago.

Both of which are you being paid for things that you have done and effort that you have put in. Some people might confuse passive income as simply just doing nothing and then making money later but let me tell you – that is absolutely not the case!

Sometimes for me the easiest way to think about the definition for something is with examples, and income is no different:

As you can see with that Active Income – all of those activities involve work you’re currently doing! I work a job form 8-5 Monday-Friday and get paid every two weeks for that. If I quit, I don’t get paid, so that’s definitely active.

Same with the business income – if my company was to just liquidate, that’s right – no income because the company isn’t around.

Side hustles are more of the same as the previous two items and then we get to selling goods. I think of selling goods as maybe having a garage sale. You take the time to grab the items you want to sell, setup in your garage, advertise and then actually run the garage sale. You make money but the second your garage sale is done, so is your income. It’s 100% active.

You’re not selling that old baseball card set to someone on a payment plan for $1/month for eternity. You’re listing it for $25, they’re low balling you at $5, then you’re inevitably settling at $8 because you realize if they don’t buy it, you’re just going to throw them away.

And then we get to Passive Income! Passive is something that continues to pay you for years and years. So, dividends, this seems like an obvious one and one that is constantly talked about on The Investing for Beginners Podcast.

You bust your butt now to make $100 – that’s passive. Then you buy $100 worth of a dividend stock and hold it forever, that entire time you’re being paid a dividend and you’re never investing another dollar into it.

Doesn’t that sound appealing? I know it does to me, and it’s one reason that I love dividend stocks. Most dividend stocks pay you quarterly but some dividend stocks like Realty Income Co. will pay monthly!

Not like it matters because I’m never touching it, but it is motivating to get that payment.

Other examples are real estate, interest and royalties. These are things that, just like dividends, allow you to keep earnings for years and years. Now, you could make the argument that royalties are not passive income because you’re likely still working on growing a business and I would agree, but at some point, you will stop…but the royalties likely will not as long as they’re in perpetuity.

Real estate is similar in the sense that it can be very active if you manage the property but also can be very passive if you outsource that out to a property manager – all depends on your preference, but it 100% can be 100% passive if you want it to be.

Chances are, you know of people that might swear by certain types of income stating that it’s how they became rich, and while that is great, I am here to tell you that there are many different ways that you can become rich, or as we call it in the Personal Finance world, Financially Independent… lol.

Feeling like you have a good grasp on the differences between the two types of incomes? Good – I am too! Now let me tell you which one I think is better…

Passive.

Hands down.

Are you surprised that I didn’t take you down a wild trail and drag out what I thought was the best? Yeah, me too – I just felt like being nice today. But let me tell you why I think passive is the best.

At this point in my life, I really am only partaking in one aspect of passive income, and that is with dividends. But the thing is, it’s not really even passive income – it’s all just dividends that are continuing to work and grow.

The thing that made me get crazy about dividends started with understanding compound interest and then it turned into me realizing that dividends are really compound interest on steroids.

I created a Dividend Reinvestment Calculator that you can download for free to help paint the picture for you with your own scenario, but let me describe my thoughts to you:

I am 30 years old and I am hoping that I live to, I don’t know, 90? So, let’s say I have 60 more years that I need money. I am going to bust my butt in 2021 and max out a Traditional IRA at $6,000 and invest it into a dividend stock. Let’s assume that stock is similar to SPY, which is an ETF for the S&P 500, and it does the following:

- Stock grows at 8% annually

- Current Dividend Yield is 2%

- Dividend grows at 3% annually

If you’re familiar with investing then you know that none of these things are unreasonable, or even considered a stretch – in fact, I would say that they’re all pretty conservative!

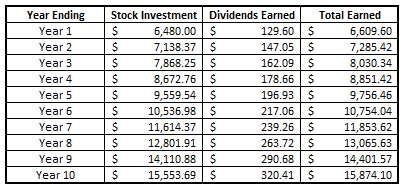

Your first year with this $6,000 investment is going to earn you $129.60 in dividends. Nothing earth-shattering by any means, but that’s only in year 1! Now, you’re going to reinvest that $129.60 into that same stock and your total investment is going to be starting $6,609.60 in year 2.

You get to the $6,609.60 because you earned 8% on your $6K, making it $6,480 and then the $129.60 in dividends.

But the key here is that since you’re reinvesting those dividends, you’re going to be earning more and more dividends every year!

As you can see, by the end of these 10 years, you’re earning over $320 each year in dividend payments! The pure number in itself is not staggering but think about how it has nearly tripled and you have done literally nothing since your initial investment of $6,000.

“But Andy – you’re saying that I have to reinvest my dividends – that sounds like work, right?”

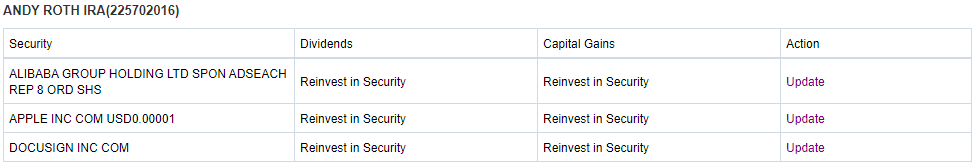

Nope! Reinvesting dividends takes next to zero effort on your part. All that you need to do is setup your brokerage account to automatically reinvest these dividends into the equity position. Take a look below at how this looks for me on Fidelity:

Yes, I know, you got a couple of my stocks in there too – consider yourself lucky ?

But then when I get my dividends, they’re just automatically put back in to keep compounding.

But that example is just for 10 years…I talked about needing to invest for many, many years after that!

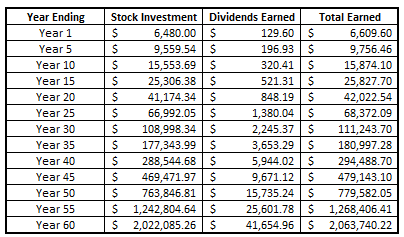

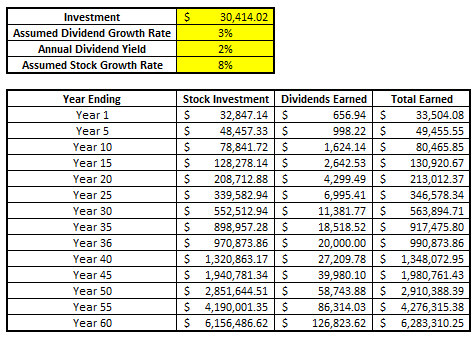

Take a look at just how much this passive income strategy would be worth in the future:

Can you imagine getting $41,656.96 in dividends every single year off of just a $6K investment? Now that is some serious gains!

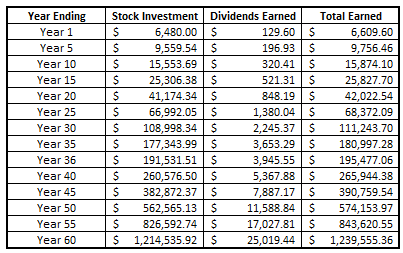

But let’s do a little bit more of realistic scenario…let’s imagine that instead of letting this money ride for forever, I want to retire at age 65 and take out these dividends to live on – how would that look?

Not too shabby, right? That first year in Year 36, you’re going to get just under $4K in dividends! You can see how that amount will still continue to grow pretty rapidly though as your investments continue to grow 8% yearly.

But what if $4K isn’t enough for you? Maybe you want to target $20K in dividends in Year 36 – how much do you need to have saved?

Obviously, that’s a huge jump in the amount of money that you need to have, but it’s all about awareness and planning. If you have this goal but don’t actually know how much you need saved, then you’re just flying blind, and that’s why I recommend constantly checking on how your savings is tracking vs your goals.

But like I mentioned, dividends are just one part of passive income that I love. Real estate is another way that people will similarly get to their FI goals.

If you own rental properties, then you’re receiving rent checks each month that oftentimes will entirely cover the mortgage and give a little bit extra cash, too. So, you’re basically getting a little bit of cash and paying off a house that is just further value that you can eventually sell if you desire to do so.

The thing with passive income is that it never is going to just start out as passive. You’re going to have to bust your butt at first. Maybe you are working a side hustle to increase your savings rate to reach your goals. I can tell you that’s exactly what I do.

I have a side hustle where I work about 5-6 hours/week and generate some extra cash that is 100% used for savings/investments for retirement. If you can find something where you can generate just $115/week then you’re going to be able to max out an IRA.

Maybe you can double that and then you can max out an IRA for both yourself and your spouse!

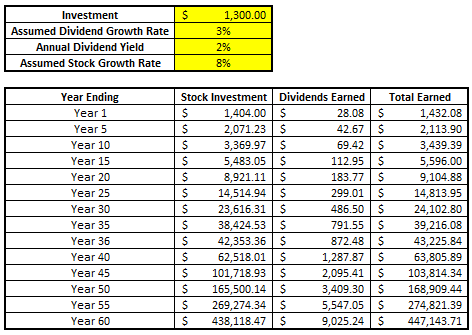

Or, maybe you can only drive Uber for a few hours each week but that gets you $25/week. Do you realize what even $25/week can do for you?

Again, this isn’t lifechanging, but $25/week, or $1300 for ONLY 1 year, can conservatively generate $38K for you when you’re ready to retire.

You have to put in that hard work right now, in anything that you do – and you have to grind. Work 60 hours/week so you can work 0 hours/week when you’re 55 and you can live off of everything that you have earned.

I love active income because it’s super motivating but passive income is the best because it means that you’ve made it. Passive income is like enjoying the fruits of your labor. When you put in the time, then you can sit there and enjoy the passive income later in life, and that’s exactly why I think that passive income is the best.

If I could summarize this post in just a few bullets, I would do so with the following:

- Passive Income is the end goal – active income is where it all starts. Passive incomes means you made it!

- Do anything you can to squeeze out that extra $10, $25, $50, $100, anything each week, because small investments can really add up

- Constantly monitor yourself to make sure that you’re on track with YOUR goals. The worst thing that you can do is get to age 60 and realize you never were doing what you needed to do from the get-go.

If you can do those three things then you’re going to be golden. Now of course, there are other ways to increase your dividend income too and a great option is to use a dividend ETF.

Many people used to use VHDYX for that, but now that VHDYX is closed to new investors, what’s the next best option? I got you covered!

Related posts:

- Comparing Online Investment Planning Services Robo-advisors can make investment planning quite intriguing. By using algorithmic calculations to determine the optimum asset allocation for your portfolio, robo-advisors offer you computerized investment...

- This 401k Match Calculator Shows How Powerful Compound Interest Can Be There’s various compound interest calculators out there, but not many specific 401k match calculators that are easily manipulable to show how different contributions and employers...

- Taxable Brokerage Account: Full Implications “Hey Andrew, I read your recent article on why people should consider Roth IRAs for investments. Regarding taxes, when would an independent brokerage account (taxable...

- The Continuous Compound Interest Formula Excel Function for (Us) Nerds Ever wanted to illustrate exactly how powerful compound interest can be? Wanted to have an Excel function to do it for you? This post reveals...