Updated: 6/7/22

Many of you know me as Doctor Budget, which I absolutely love, but I personally think one of the most important things for a doctor to do is understand that not everything in life is a one-size-fits-all approach. That being said, one of the approaches that I use in Doctor Budget is with activity based budgeting, and I think it’s a great method for everyone to use!

In the past, I have always been the type of person that has been adamant that there is one way to do things but I am quickly learning that this is simply not true. For instance, and not to get off on a tangent, but while I personally could never wrap my head around using the debt snowball method instead of debt avalanche, I do understand why people do it.

A long time ago I had a personal trainer and they told me that “the best diet is the one that you will do” and that’s exactly how personal finance is, so while debt avalanche might be more optimal, it might not be the best for your specific situation.

The same exact thought process applies to budgeting! The best budget is the one that you will stick to. And while I hate to associate a budget with a “diet”, it really is that. You’re going to learn to practice some self-control and stick to really the core essentials. All that mindless spending will need to stop so you can correct your financial life.

One of those great options is with activity based budgeting, but what exactly is it?

Well, activity based budgeting is something that you typically will see quite frequently in the business world and maybe a little less common in someone’s personal life. Corporate Finance Institute defines it by saying,

“Activity-based budgeting (ABB) is a budgeting method where activities are thoroughly analyzed to predict costs. ABB does not take historical costs into account when creating a budget.”

To me, all that this means is that you’re going to go back and look at previous expenses to try to identify some sorts of trends to allow you to better plan for where your money is going to be spent. This makes a ton of sense, right?

If all that you know is that you end the month with less money than you started but have no insight into where that money is going, how are you ever going to get better?

You’re not!

That’s why I am always a huge proponent of going back in time and post-auditing yourself to see where your spending is going. Not only is this good in personal finance, but you can do it with test grades in school, calorie intake, workouts, anything that you have access to see any sort of tracking.

And while you haven’t budgeted in the past, I guarantee that you have some sort of look into your spending from an online source, such as your bank account, credit card or even PayPal.

One of the first things that I recommend Doctor Budget users to do is to log into their bank/credit card/PayPal accounts and download the last few months of transactions. When you do this, you can then start to slice and dice that information into various buckets.

Then you will actually have some insight into where your money is going. “Oh, I spent $500 at Kroger two months ago” or “wow, did I really spend $150 at Starbucks alone last month?”

Those are the types of trends that will smack you right in the face!

Now, there is an obvious con with doing this – it can be very time consuming. I’m not even trying to hide it, it can be a very overwhelming thing to do for someone that historically isn’t huge on budgeting.

Not only am I going to tell you that you have to budget, but I am going to make you go back at least three months and dive through likely hundreds of expenses. It can be frustrating and hard, but it’s essential.

Have you ever tried to make a budget with literally zero baseline? I have. It sucked.

I made a budget for my wife and I when we were planning our wedding, and while that was great, it was completely fabricated. I put in an amount for what I thought everything would cost but I was missing items, had amounts completely wrong, and in general just had no idea what I was doing.

I won’t say it was a waste of time, but it wasn’t the most helpful thing that I have ever created. The issue, quite simply, was that I had no baseline or history so I couldn’t anticipate any spending.

Trying to just create a personal budget without understanding your current spending is absolutely insane. You have the tools available for you to actually create an effective budget, you just need to go in and do it!

For me, a large majority of the spending that myself and my wife do is with our Visa. We get 1.5% cash back on that card which is pretty strong and then we use our AmEx for gas and groceries as we get 2% and 3% back, respectively, on those categories.

And while credit cards can actually be used for good, if you don’t pay them off in full each month, you’re going to absolutely blow through any sort of rewards when you have to make interest payments with that 20%+ APR (among many other “uh oh’s”).

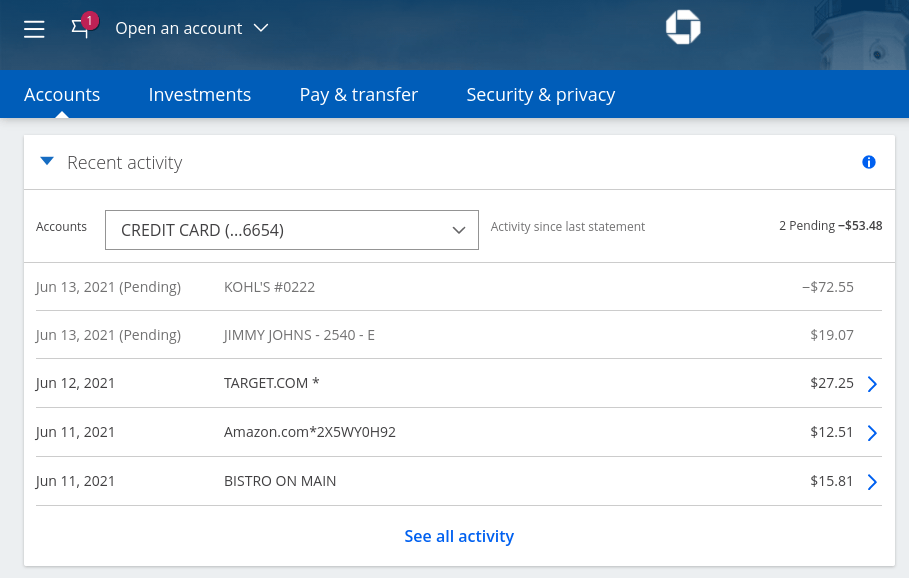

After I login to the Chase account, I select the credit card and land on the screen below:

When I am on this screen, I simply will click on the “See all activity” button and then it takes me to a new screen.

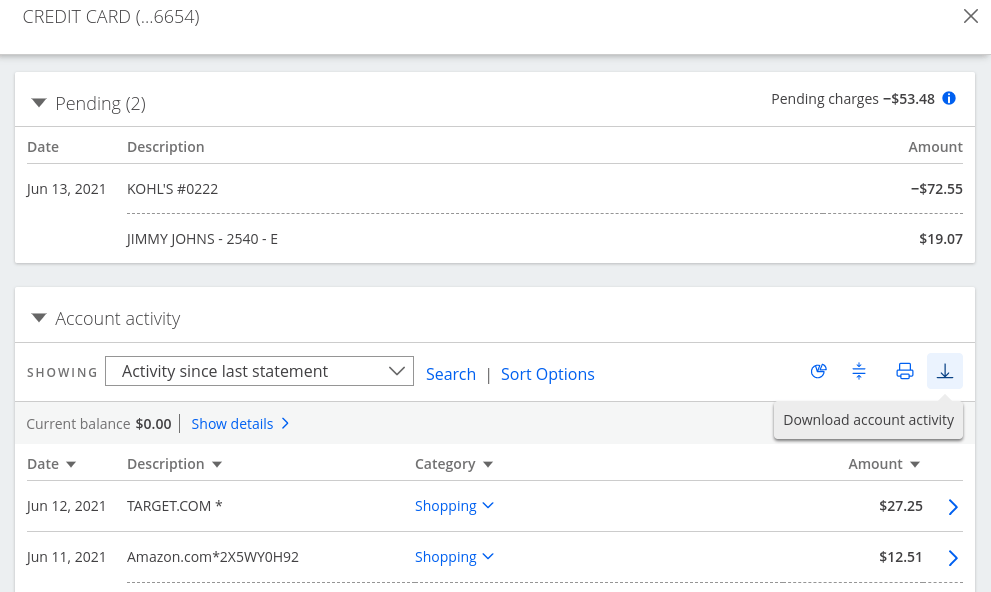

On the new screen, which you can see below, I will click on the little button with the down arrow in the middle of the page on the far right of the screen.

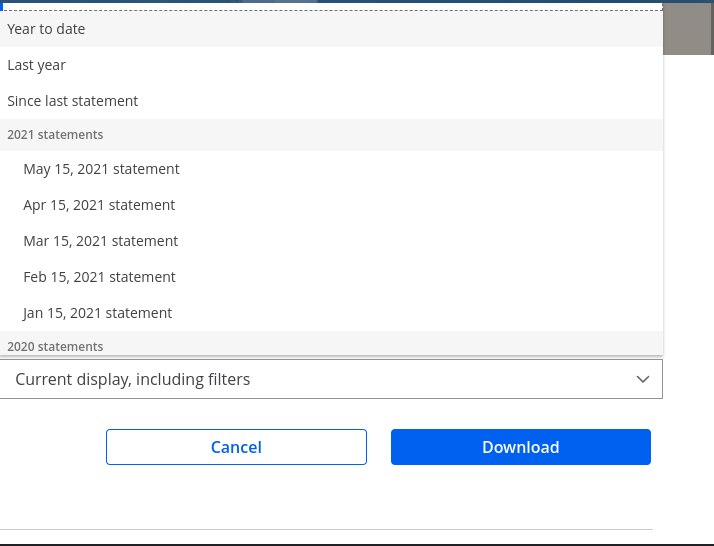

Once I click on this screen, I have the ability to set the time frame of my transactions and then simply download the data:

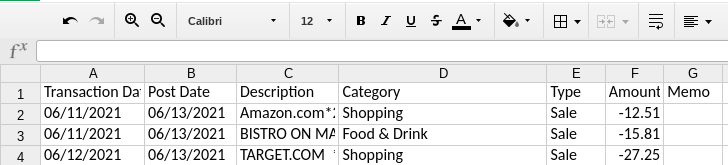

And then wa la, the data is downloaded in a very simple Microsoft Excel template:

At this point, you have the ability to simply go in and slice and dice your data to find out where your money is going.

Personally, I like to immediately drop these transactions into Doctor Budget because all that I have to do is decipher what category each expense will fall into and then it automatically sorts it in the summary section. For instance, I would know that Amazon was for new light bulbs which was “Home Maintenance”, Bistro was for Eating Out which I call “Food” and Target is for some new clothes for my son which is “Clothing”.

Code those things in and wham, it tracks it automatically! There are definitely ways that are easier and require less time for you to do this activity based budgeting approach, but I really don’t think you’ll get the full benefit from it.

Some apps like Mint do give you the ability to go in and manually edit each transaction but I actually think that can be even more time-consuming depending on the accuracy for Mint. While this method that I outlined might make you think it’ll take a ton of time, it really doesn’t.

I will typically sort the expenses by their names and then I can just crank through them. For instance, I know everything that is Kroger is Food. Everything that is Speedway is gas. Everything that is Starbucks is food. So on and so forth.

The only one that can take a lot of time is Amazon, and then I will sort by just those expenses and open up my Amazon account and just quickly go line-by-line and key in the appropriate category for each expense. All in all, you’re talking maybe 15 minutes to do a month of spending so I would think you could do a 3-month look back in under 45 minutes, especially if you’re efficient and do all Amazon expenses at the same time, along with other recurring charges.

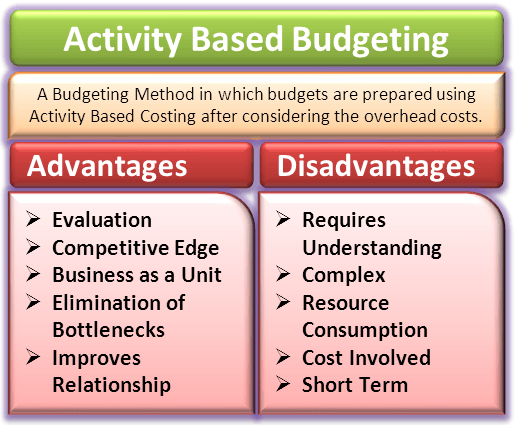

This might seem like a roundabout way to get the information that you need, but it’s really not. In fact, I think that Finance Management outlines the pros and cons fantastically, and I think that the pros far outweigh the cons:

Now, the thing that I will say is that this pros & cons list was really focused on use for the business rather than an individuals’ personal finances, but the lessons translate the same.

The thorough evaluation allows you to identify bottlenecks of your spending and improve the relationship you have with money. If you can quickly find out where that “leak” is and remove that from your spending, you likely might be able to save literally hundreds of dollars each month.

During COVID, a “leak” of mine was buying really expensive beer. I wrote previously about how I didn’t mind treating myself but I would frequently treat myself to a $20 4-pack of beer. Well, while that’s great to find cool, new things like that and try them, I’d probably go through 1 every week (along with maybe a couple cheaper beers) and easily be spending over $100/month without even trying or being reckless.

All said and done, I was at a run rate of ⅕ of a Roth IRA contribution in alcohol! Yes, I enjoyed it, but it was becoming habitual and not a treat that it had initially started out as. I told myself that it was ok because “it was one of the few things I looked forward to during COVID” and while that was true, I should’ve been using that time to really focus on saving even more money so I could have more flexibility once restrictions were lifted.

Similarly, my wife treats herself with clothing. Now, she is an extremely conscious spender so I know when she’s buying things, she likely really needs them. She will buy a ton of items online, try them on and then return 80% of those things.

I personally don’t care as long as the unused stuff gets returned but at one point I asked my wife how much she thought she spent and her guess was $100 but it was actually around $250. She had no idea, and did truly bargain shop and only bought items that were truly needed, but it was simply that lack of transparency that she was missing.

Activity based budgeting is just that – transparency. It can really open your eyes and allow you to narrow in on the details.

Now, I also think that can be the biggest con to a somewhat seasoned budgeter. I used to be someone that had literally 50+ line items in my budget to get as specific as I could, but have recently transitioned into grouping things together a bit more. For instance, I used to have groceries and eating out completely separate, but have grouped them together because they really do directly impact one another as the more groceries I buy, hopefully I am eating out less, and vice versa.

Activity based budgeting wants you to break these items down into very small, specific categories every month so you literally know exactly where every dollar is going. That means if you go to Kroger and buy $100 of food, $15 in alcohol, $10 in cat food, and $20 in medicine – those theoretically should all be broken out.

That can be very time consuming, frustrating, and quite frankly just make you skip this process altogether.

Instead, why not just call the category “Kroger” and then you know exactly what the spending was? Or, come up with a creative acronym, such as GACH that I used to use for Groceries, Animals, Cleaning House to track those expenses that would all occur at the same store.

Remember when I said that the best budget is the one you’ll stick to? This is exactly what I mean.

I think that activity based budgeting is fantastic for laying the groundwork for someone and allowing them to make that very first budget and then start to refine their budgeting process. It’ll help you build up that groundwork and then you can eventually graduate into things like your net worth statement and a budget calendar to help along the way.

In the meantime, I recommend looking at your previous transactions as a starting point, and if you’re really ambitious, maybe check out Doctor Budget. It quite possibly could be the best $29 you ever spent!

It took me 5 years to develop and refine Doctor Budget – I wish I could’ve just paid $29 and been 5 years ahead of where I am now!

Related posts:

- How to Use the Doctor Budget Tool to Set Your Finances Straight Recently, I was fortunate to be invited on the Investing for Beginners Podcast and talk about my personal finance experiences and introduce Doctor Budget to...

- Apps? Excel? NO – I need a PRINTABLE Budget Planner! Let’s be real – Mint is a great app for budgeting but does it actually help you budget? Personally, I got way more from being...

- 7 Ways to Prioritize Saving with a Budget Calendar Have you ever heard of a budget calendar? Personally, I use one nearly every single day of the week and it saves me a ton...

- Yes, Acorns Found Money for My Friend, But I Have a Better Solution! I recently had a friend tell me that Acorns found money for them and it really made me think about if it makes sense to...