An ADR, or American Depositary Receipt, is a simple type of share that allows U.S. investors to invest in companies headquartered outside the U.S. But the taxes for these are anything but simple. For example, the capital gains taxes for ADRs are different than the ADR dividend tax.

How these tax rates affect you will depend on:

- The particular company you buy and their corporate/legal structure

- The country the ADR is domiciled in, and their dividend tax rates

- The type of account you hold the ADR in (tax advantaged or taxable)

For starters, let’s look at the taxes for an ADR in a country with a favorable tax treaty with the U.S. Most ADRs in the developed world are like this.

In this post, we will cover the following [Click to Skip Ahead]:

- Tax Rules for ADRs with a Foreign Dividend Tax

- Capital Gains Taxes in ADRs

- Tax Rules for Retirement Accounts for ADRs

- Which Account is Better for Buying an ADR?

- The Bottom Line

Tax Rules for ADRs with a Foreign Dividend Tax

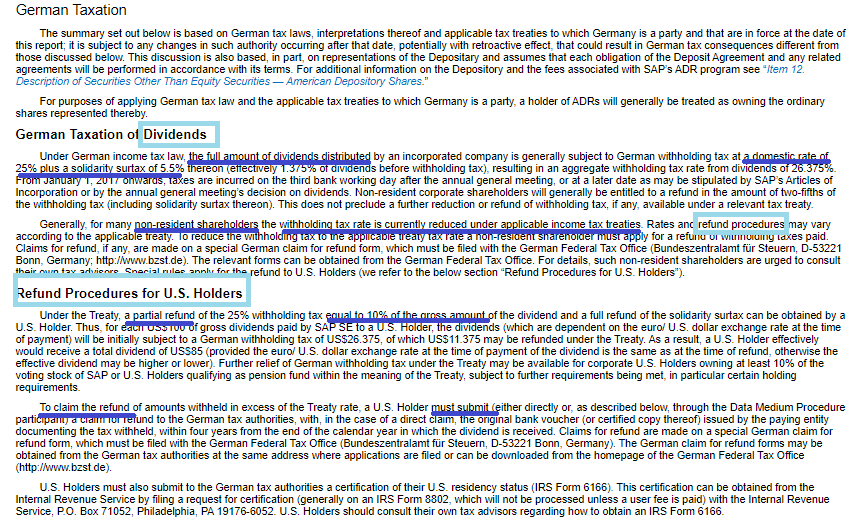

This one comes from a company called SAP SE and its 20-F. (The 20-F is the required annual report for non-U.S. companies to the SEC). By reading this document, we can see that SAP SE is headquartered (“Jurisdiction of Incorporation”) in Germany, and you can buy ADRs for it, traded on the NYSE.

Here’s the section in the 20-F about the various taxes:

To pull this up quickly, simply use CTRL+F in the 20-F and search for “capital gains” to find the section on ADR taxes.

For dividends, we can see that Germany will withhold 25% plus a surtax of 5.5%. We also see that a U.S. investor can apply for a refund of 10% of the dividend because of a tax treaty the country has with the U.S.

Now, just as you have to pay a tax on dividends in foreign countries, you also have to pay a dividend tax to the U.S.

If this sounds like double taxation, it sort of is…

EXCEPT for the fact that the U.S. offers its investors a tax credit when they pay a foreign country a dividend tax on an ADR.

So although dividend taxes are withheld by the foreign country in an ADR, the IRS has allowed for a foreign tax credit that offsets this tax. That way, the U.S. investor isn’t double taxed. The investor just pays taxes on their dividends from the U.S. side.

This means that if you are buying ADRs in a regular taxable account, you will be taxed by the IRS on the dividends as usual. But you can also apply for a foreign tax credit/deduction as specified by the IRS in the link I provided.

ADR Dividend Tax for a Roth

Unfortunately, this credit is not available to you if you use a tax-advantaged account like a Roth IRA.

In the case of something like a Roth IRA, you never have to pay taxes to the IRS for a dividend. But because you are buying this stock internationally as an ADR, you will have your taxes withheld by the foreign government regardless of your standing with the IRS in the U.S.

The total dividend tax rate for an ADR will depend on the particular country the ADR is based in; in this case, it was Germany.

So, because you don’t pay dividend tax to the IRS in the U.S., you are not eligible for the foreign tax credit since there are no taxes paid to the IRS to credit against.

At least you’re only taxed once—on the foreign side—and not twice.

By investing in an ADR you can’t avoid the dividend tax completely, but you can ensure that you don’t get double taxed by taking advantage of the tax credit in the United States.

Capital Gains Taxes in ADRs

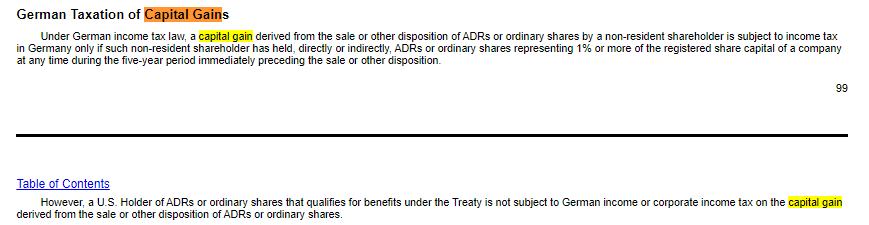

Going back to our SAP SE example, here’s what the company disclosed about German taxation on capital gains:

You can see that there’s no capital gains for a “non-resident shareholder”, as long as the shareholder doesn’t own more than 1% of the company.

For the average investor, that probably won’t be a problem.

But, there could be capital gains taxes on the U.S. side depending on the account you have. In that case, the rules should be the same—if you’re in a taxable account, you’ll owe capital gains taxes on your ADR; if in something like a Roth, there’s no capital gains tax.

Like with dividend tax rules, double-check that the ADR you are looking at has the same capital gains policy as one like this.

If the country does expect capital gains taxes to be paid to them, then you might want to re-consider buying the stock. Think about if the extra costs of your time, paperwork, and reduced after-tax gains you might incur are worth the hassle. You may find it better sticking to countries with more favorable tax treaties with the U.S.

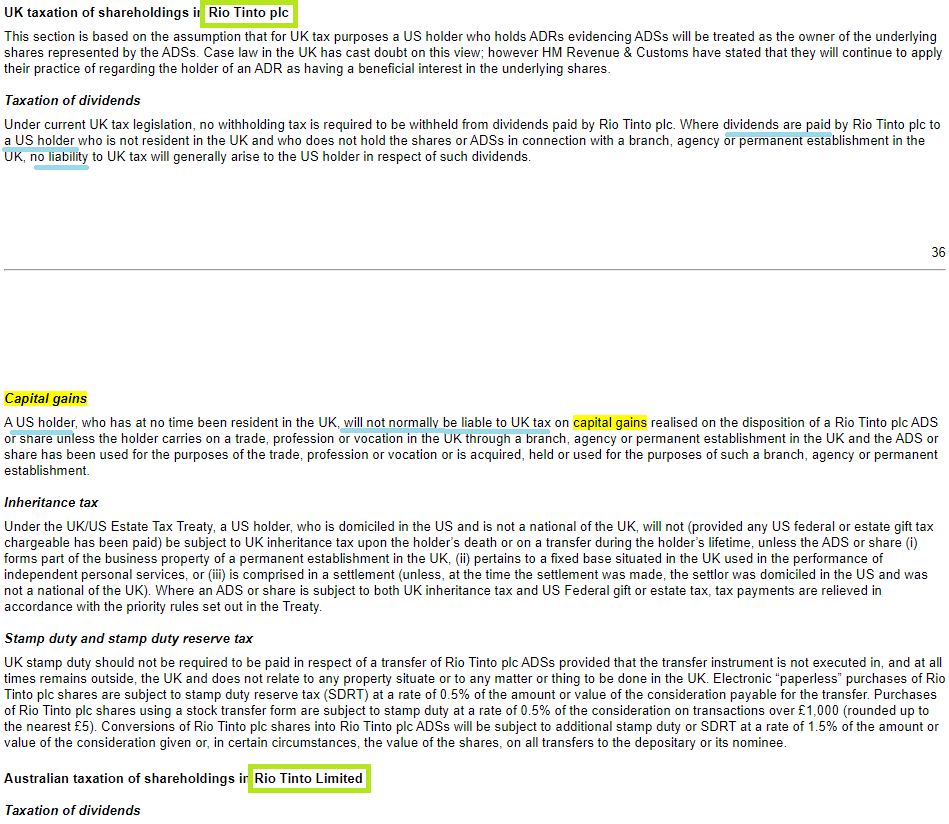

Example of No Dividend Tax for U.S. ADRs

Some countries will not charge any dividend tax on U.S. holders of their ADRs, such as the United Kingdom (as of writing this article).

I’d recommend reading a company’s most current 20-F thoroughly in order to determine whether this is the case or not.

Here’s one example of no ADR dividend tax for a company, this one called Rio Tinto. By reading their 20-F, we can see that Rio Tinto is split into Rio Tinto plc in England and Wales (which you can buy ADRs for, traded on the NYSE) and Rio Tinto Limited (shares can be bought in Australia).

Here’s the section in the 20-F about the various taxes:

To pull this up quickly, simply use CTRL+F in the 20-F and search for “capital gains” to find the section on ADR taxes.

We can observe two things about investing in this company:

- Capital gains taxes will be paid in the U.S., not England and Wales

- England and Wales will not withhold dividend taxes, but these might be taxed in the U.S.

I say “might”, because if you are investing in a tax-advantaged account like a Roth IRA then there is no ADR dividend tax charged by the U.S. IRS.

However, if you buy an ADR like this in a regular taxable account, then you will owe dividend taxes to the IRS in the same way you would owe dividend taxes on a U.S. stock.

Tax Rules for Retirement Accounts for ADRs

To review, the ADR dividend tax rules will differ depending on whether you are buying them in a retirement account or a regular (taxable) brokerage account.

Tax-advantaged accounts like a Roth IRA (or regular IRA, or 401k) have a different ADR dividend tax situation than non-tax advantaged.

Because you are in a tax-advantaged account, you will not be qualified to take advantage of the foreign tax credit/deduction.

Although the U.S. will not tax you on dividends and capital gains on their side, the foreign government still will, and you won’t be able to get compensated for that tax by the IRS because you did not pay taxes to the IRS to offset the credit.

So you’ll have to pay a dividend tax on an ADR even if you buy it in a tax-advantaged account, though the foreign government will automatically withhold it for you—you won’t need to file paperwork or send money to pay the tax.

Trust me, that’s a nice perk.

Because of the relatively hassle-free characteristic of the way foreign dividends are taxed in an ADR, this could play into your decision on whether to invest in the ADR in the first place. For example, if your yield after (foreign) tax is still decent, it may be worthwhile.

Contrast that to an investment vehicle like an MLP (or Master Limited Partnership), where the paperwork you receive and must file each year can become a massive headache come tax time. In my mind, that’s often not worth the potential gains from buying most MLPs. That deterrent could also keep other potential investors out of the stock in the future, which could reduce the upside.

Which Account is Better for Buying an ADR?

This is where the personal situation of an investor comes into play.

Obviously, if you make too much money to qualify for a Roth IRA or Traditional IRA, then you have no choice but to buy ADRs in a taxable account. In that case, you’ll pay foreign dividend taxes, U.S. capital gains taxes (federal and state), and U.S. dividend taxes. But you’ll be able to also apply the foreign tax credit/deduction to lower your final tax liability.

Keep in mind that even if you make too much money to qualify for a Roth IRA, you may still be able to contribute to a Roth IRA through what’s called a backdoor Roth. This has its own set of strict conditions and might not be an option in the future if tax laws change, so it’s always worth doing updated research.

What if you have the option to buy an ADR either in a taxable account or Roth?

Well, in my mind that depends on:

- The ADR and their dividend amount being paid

- How much the foreign country is withholding for the ADR dividend tax

- Your current tax situation

- Current U.S. tax rates

- How long you plan to hold the stock

There could be many different types of scenarios which makes one account option better than the other.

One example might be an ADR in a country with a very low dividend tax rate for U.S. investors. In that case, it’s a no brainer to use a Roth or Traditional IRA to buy the ADR, since the actual ADR dividend tax paid will probably be minimal.

But say that you’re buying an ADR in a country with a much higher dividend tax rate than the U.S.

In that case, it might make sense to buy the ADR in a taxable account and then apply the U.S. foreign tax credit to try and offset that liability. I’d recommend learning the exact credit or deductions you’d be able to apply, based on your specific tax situation, or talking to a professional.

This could all vary based on your goals too.

If you don’t plan on selling the ADR for a while, in effect delaying capital gains, then that could tip the scales towards whether you want it in a taxable or tax-advantaged account.

Keep in mind there’s also “qualified vs unqualified dividend taxes” for U.S. investors to adhere to, which would need to be paid on ADRs in a taxable account but not a tax-advantaged account.

At the end of the day, weigh all of these options with even the option of buying a potentially better stock in the United States, which may or may not have similar tax implications.

The Bottom Line

Like Cameron Smith wrote about, you should always weigh your investment options on an after-tax basis as you make decisions to buy, sell, or hold various stocks (and ADRs, etc).

The right answer for you might not be the right answer for someone else, which could have nothing to do with the prospects of the company or stock and everything to do with your personal financial and tax situation.

One last word—ADRs might have different regulatory requirements depending on what “level” they are (refer to this document by the SEC on that). They could be required to file only an F-6, the more detailed 20-F, or even a 10-k (if more than 50% of the company’s voting power is in the US).

This could create additional risk factors beyond just the dividend tax implications that investing in an ADR might bring, as documents which are not regulated/audited as strictly as a 10-k could result in less favorable results to some investors.

Please note that I’m not a tax professional, just a passionate investor who has done some due diligence on this topic. I also recommend doing your own due diligence to confirm anything I’ve claimed here, as well as to see if any policies have been changed and/or the specific tax scenario to a particular ADR.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- How Do Dividends in a Roth IRA Work? What about REITs, MLPs, or ADRs? When I first learned about Roth IRAs, I thought the whole point of them was to eliminate taxes. Well, in essence, pay the taxes first...

- Capital Gains Tax Calculator for Relative Value Investing Turnover of investment holdings is a natural occurrence in any portfolio that triggers realized capital gains and taxes, which can eat into a portfolio’s return....

- Investment Terms Everyone Should Know Updated 9/3/2023 If you are new to investing, all the terms and jargon might seem overwhelming. But today’s post will help you learn some of...

- Qualified Dividends are Your Way to Minimize Tax on Reinvested Dividends! Long story, short, the answer is yes – you are going to have to pay taxes on reinvested dividends. While there are a ton of...