Estimating a valuation for a REIT is vastly different than a valuation for any other company because of the unique business model for REITs. That’s why investors need to use REIT-specific metrics such as FFO (Funds from Operations) and AFFO (adjusted Funds from Operations) to estimate Free Cash Flow and valuations.

Creating a rough estimate Free Cash Flow (for a DCF valuation) usually requires taking Cash From Operations and subtracting Capital Expenditures.

However, you can’t do this for a REIT because the real estate generally appreciates in value rather than depreciates.

And so because a large portion of the assets of a REIT involve land, which appreciates rather than depreciates, the depreciation charges which appear on a REIT’s financials do not accurately represent the true flows of cash in a REIT’s business.

That makes Net Income and EPS for a REIT subject to potentially wild inaccuracies (since Net Income is calculated after adding a Depreciation charge). Also, the impact of gains from selling real state can also artificially inflate Net Income and EPS, which doesn’t show the true operating results of the underlying business either.

That’s why the FFO (Funds from Operations) and later AFFO (adjusted FFO) were created.

These are non-GAAP metrics, but are created by NAREIT as the industry standard. NAREIT stands for the National Association of Real Estate Investment Trusts.

Definition of FFO (used to calculate AFFO)

The FFO formula, as defined by NAREIT, is:

“Funds From Operations (FFO)

The most commonly accepted and reported measure of REIT operating performance. Equal to a REIT’s net income, excluding gains or losses from sales of property and adding back real estate depreciation.

Following is the definition of Nareit FFO:

Net income (calculated in accordance with GAAP), excluding:

- Depreciation and amortization related to real estate.

- Gains and losses from the sale of certain real estate assets.

- Gains and losses from change in control.

- Impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity”

For our purposes, we can simplify it to:

FFO = GAAP Net Income + Depreciation & Amortization – Gains from Property Sales or Change in Control + Impairments from Real Estate Depreciation

Make sure you have the positive signs and negative signs correct when applying the formula.

Basically, because FFO is trying to uncover how the underlying operations of a business are performing, we have to intuitively exclude any potential distortions that can flow into Net Income.

This is a similar approach to a regular Cash From Operations (or Operating Income) calculations, where you exclude things that affect Net Income but not the underlying operations—like interest from investments or non-cash expenses like depreciation.

The Importance of Using AFFO

Next is AFFO.

It’s extremely important to understand that you can’t just use FFO as a substitute for Free Cash Flow to value a REIT.

Because just like with regular businesses, REITs need to make capital expenditures in order to maintain the earnings power of their assets.

In other words, depreciation is an eventual real expense for businesses because the values of Property, Plant, and Equipment (PPE) eventually decay and need improvements.

Free Cash Flow takes real depreciation into account by including capital expenditures, and so for REITS, real depreciation is taken into account by using AFFO after a FFO calculation.

Because although depreciation on land is not a true depreciation expense for REITS, depreciation on the buildings and other PPE is real, and needs to be accounted for as maintenance capex.

Going back to NAREIT’s website, AFFO (adjusted FFO) is defined as:

“Adjusted Funds From Operations (AFFO)

This term refers to a computation made by analysts and investors to measure a real estate company’s recurring/normalized FFO after deducting capital improvement funding. AFFO is usually calculated by subtracting from Funds from Operations (FFO) both (1) normalized recurring expenditures that are capitalized by the REIT and then amortized, but which are necessary to maintain a REIT’s properties and its revenue stream (e.g., new carpeting and drapes in apartment units, leasing expenses and tenant improvement allowances) and (2) the adjustment to GAAP revenue to “straight-line” rents. There is no standardized definition of AFFO; therefore, financial statement users should understand how the measure is defined by the company.”

Unfortunately, REITs can vary widely in how they present AFFO in their financial statements, which makes calculating AFFO (and thus equivalent FCF) for each REIT a truly unique process.

In theory, we could just take FFO minus capital expenditures to get to AFFO.

But there’s several problems with that theory:

- Not all REITs will create a “capital expenditures” line-time in the cash flow statement

- There’s a difference between growth capex (not in AFFO) and maintenance capex (include in AFFO)

- Because REITs are so unique, being vaguely right is a way to be precisely wrong

Because of these inherent problems, using many of the websites that I usually love to use as shortcuts to estimate FCF—like Finviz, quickfs, or Gurufocus—is a terrible way to go for getting quick estimates for AFFO.

Unfortunately we have to dig into the 10-k’s, which can be a time consuming process.

Let’s show two examples of calculating AFFO on real REITs, one where capital expenditures are not reported and one where they are.

Calculating AFFO Example: PLD (10-k)

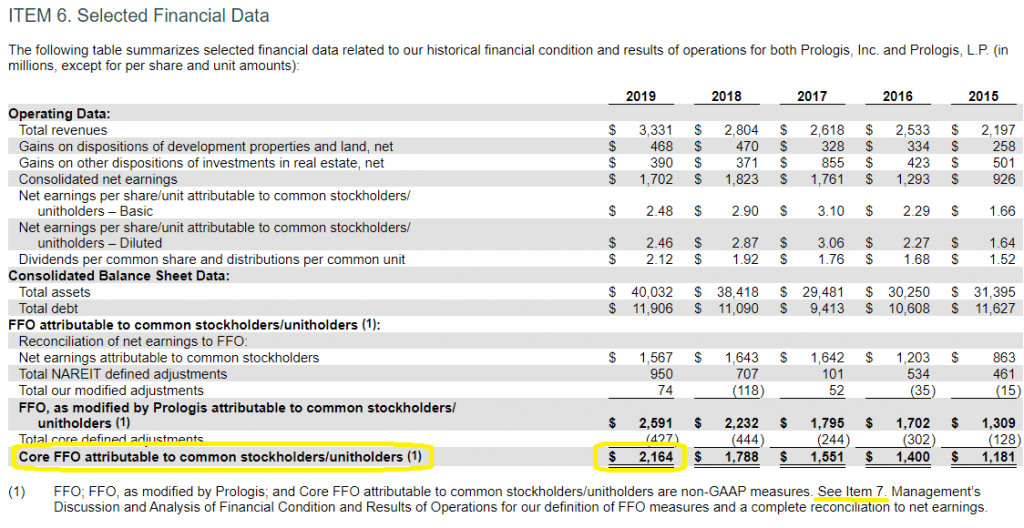

For the first example, I’ll take a look at Prologis (PLD), an industrial REIT which primarily invests in logistics warehouses. From their latest 10-k, we can search for the company’s FFO calculation:

If you compare the company’s FFO to their Net Income, you’ll notice a flat Net Income versus a steadily growing Funds From Operations. It’s a great example of a growing business whose growth is not accurately being represented by its EPS.

Keep in mind that the company disclosed where you can find more information on how management decided to estimate their FFO (Item 7: MD&A), which is an important part of understanding how and why the company reported FFO in that way.

And remember that the FFO definition can differ by company, since it’s not a GAAP metric, and so you’ll want to check that the company’s estimate is credible and that you’re comparing FFO across competitors on an apples-to-apples basis.

- PLD FFO (2019) = $2,164 million

- PLD FFO (2019) = $2,164,000 thousand

Now let’s adjust that FFO for our AFFO estimate.

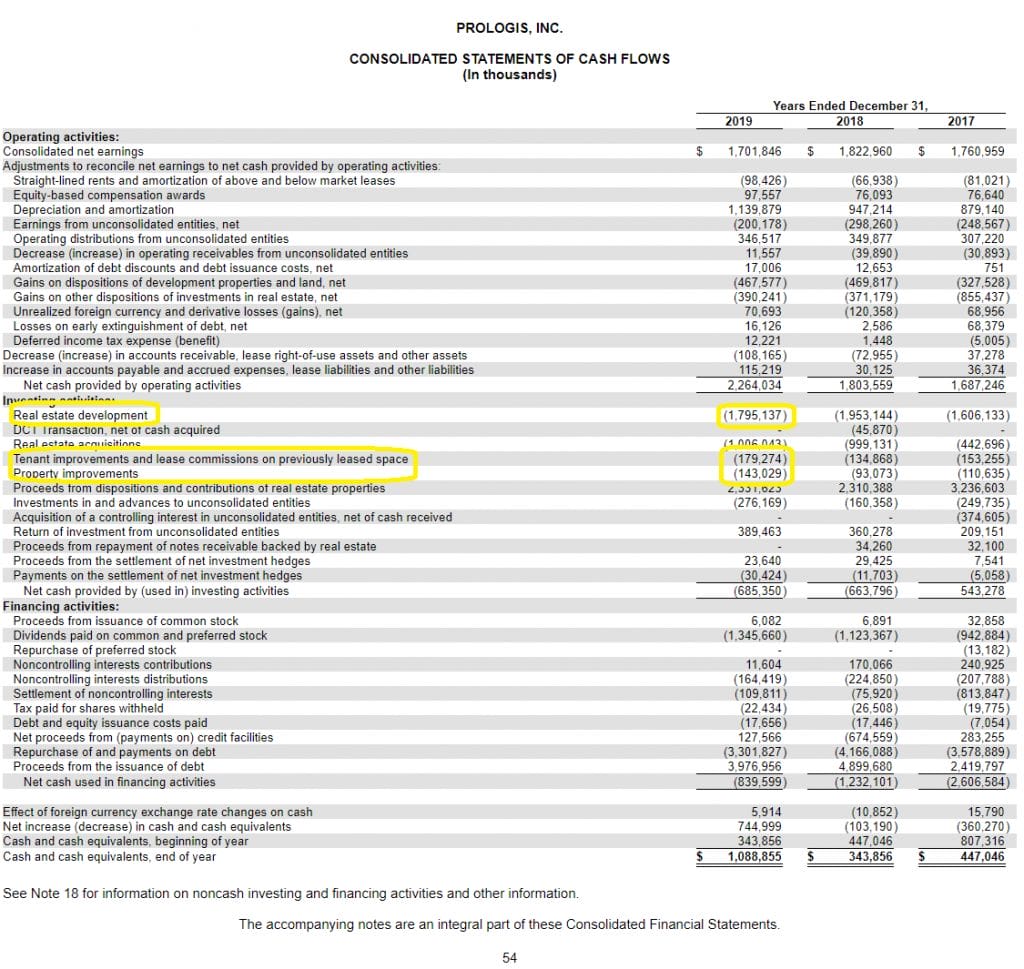

Going to the company’s Cash Flow Statement, we see the following line items:

As taken from the statements (in thousands):

- Real estate development = $1,795,137

- Tenant improvements and lease commissions (previous space) = $179,274

- Property improvements = $143,029

All 3 of these line items really represent capital expenditures, but the real estate development represents growth capex, while the improvements represent maintenance capex which is the sole requirement to allow current operations to continue.

Since we don’t care about growth capex (similar to the way that Warren Buffett excludes growth capex in his owner earnings formula for FCF), we only subtract the maintenance capex from FFO to get AFFO.

Thus,

AFFO = FFO – maintenance capex

AFFO (PLD) = FFO – tenant improvements – property improvements and lease commissions (previous space)

AFFO (PLD) = 2,164,000 – 179,274 – 143,029

AFFO (PLD) = $1,841,697 (thousand)

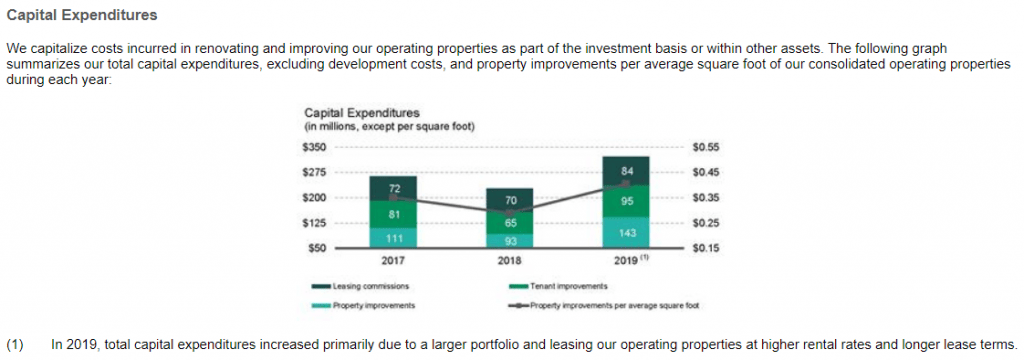

We can double check our work by parsing the 10-k for the company’s further capital expenditures breakdown, which we can see in this section:

We can see that PLD further broke down their tenant improvements into 2 figures in the table, $95 thousand for “Tenant improvements” and $84 thousand for “Leasing commissions”, which equals the $179,274 million used in our AFFO calculation above.

We can make a few more calculations to come up with some REIT valuation estimates from AFFO.

For P/AFFO, which would the REIT equivalent to P/FCF:

P/AFFO = $73,450,000 / $1,841,697

P/AFFO = 39.9

A dcf valuation using AFFO as FCF, with the following other (roughly estimated) inputs:

WACC = 4.75%

AFFO/share growth rate = 10%

AFFO/ share = $2.81

Terminal growth rate = 5%

Fair Value for PLD (based on AFFO)

= $83.57

Based on these 2019 numbers, PLD looks slightly overvalued compared to today’s price. However, with the 2020 fiscal year wrapping up, a better model would include 2020 quarterly information because of the wild changes in fundamentals that 2020 has brought.

Calculating AFFO Example: SPG (10-k)

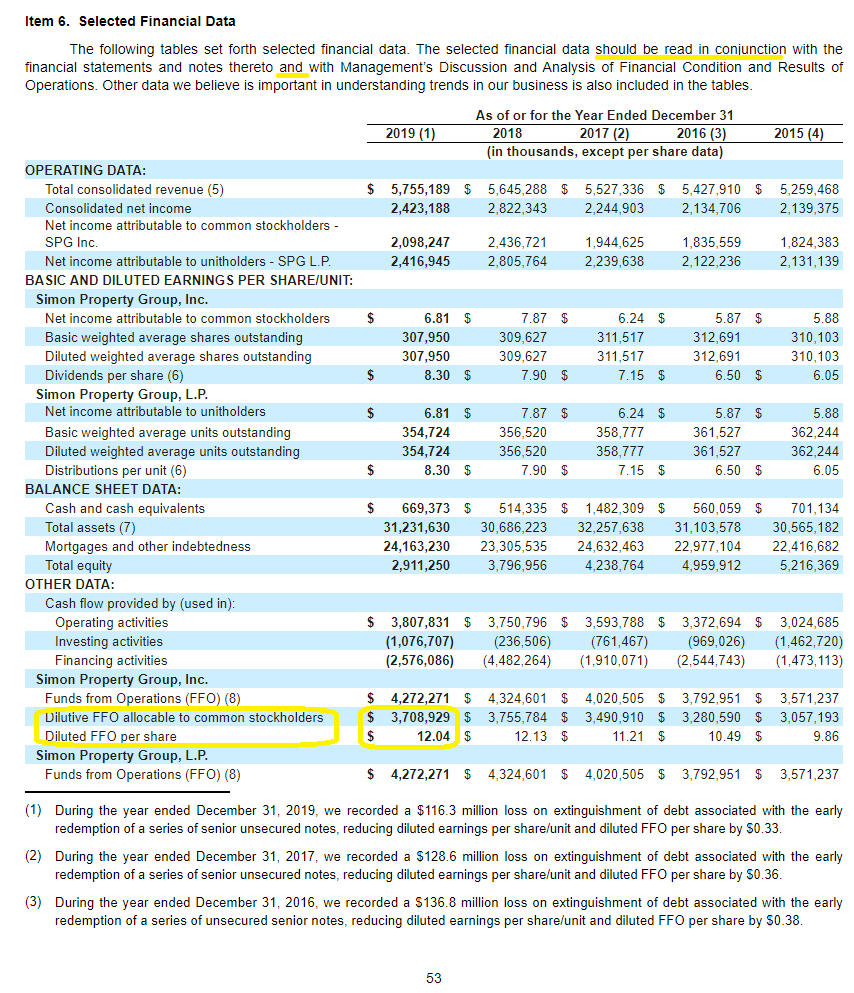

Now let’s do one more. In this case we are going to pull up the latest 10-k for Simon Property Group (SPG). Searching up for management’s estimate for FFO, we see the following:

- SPG FFO (2019) = $3,708,929 thousand

- SPG FFO (2019) = $3,708.9 million

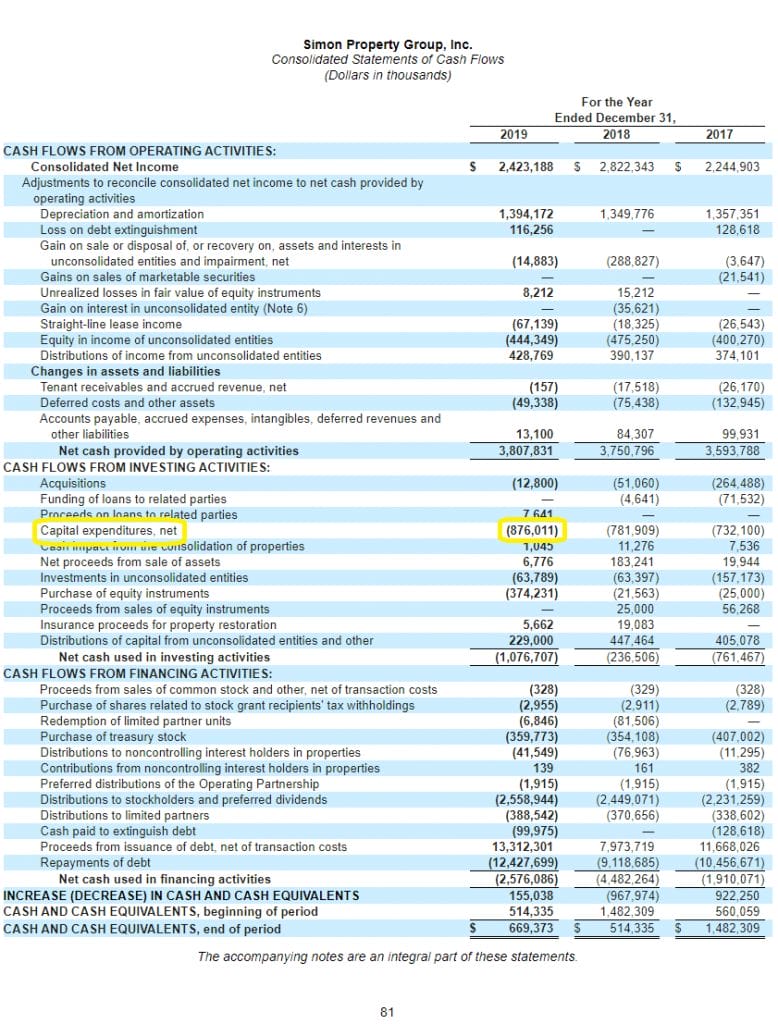

If we go the SPG’s cash flow statement, we see that the company doesn’t break out their capital expenditures between growth and maintenance for AFFO calculations, but rather groups them into one line item:

Since we now know that you can’t just group all REIT capex as the same thing, we know that we have to look deeper into the 10-k to find what the real breakdown of the capex is, in order to understand the company’s best estimate for FCF, using AFFO.

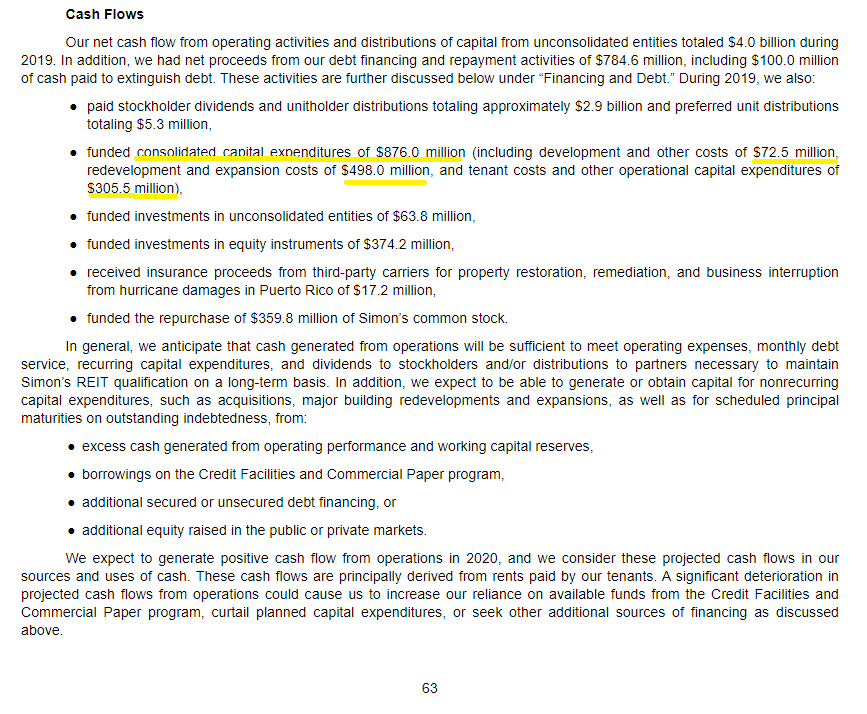

Searching for capital expenditures in the 10-k, we see the following section:

Adding the relevant figures below:

- Development and other costs = $72.5 million

- Redevelopment and expansion costs = $498 million

- Tenant costs and other operational capital expenditures = $305.5 million

- Funded consolidated capital expenditures (total) = $876 million

Here there is a little more ambiguity, because you really could argue that “redevelopment and expansion costs” could be tabulated either as maintenance or growth capex.

If it were me, I’d like to see a breakout between redevelopment (which I’d consider maintenance capex) and expansion costs (which I’d consider growth capex and would exclude from AFFO).

But because management didn’t make that distinction, and I’d rather err on the side of caution, I’m going to include redevelopment and expansion costs as a maintenance capex for AFFO.

AFFO = FFO – maintenance capex

AFFO (SPG) = FFO – development and other costs – tenant costs and other operational capital expenditures

AFFO (SPG) = 3,708.9 – 498 – 305.5

AFFO (SPG) = $2,905.4 million

Taking similar REIT valuation estimates on this AFFO like we did for PLD:

P/AFFO = $30,300 / $2,905.4

P/AFFO = 10.4

A dcf valuation using AFFO as FCF, with the following other (roughly estimated) inputs:

WACC = 7.09%

AFFO/share growth rate = 5%

AFFO/ share = $9.43

Terminal growth rate = 5%

Fair Value for SPG (based on AFFO)

= $154.34

Hopefully these two examples have helped give you clarity on the ways to estimate AFFO, and the impact this calculation can have on a good REIT valuation.

NOTE: These valuations were done using Fiscal Year 2019 numbers, which don’t include the massive effects of 2020 and thus probably don’t represent the true fair values of these companies today. They are more for demonstration and teaching purposes rather than estimates of current value.

Recap on the Importance of AFFO and FFO

Please remember when valuing REITs that FFO is important for all of the reasons discussed above, but perhaps its greatest importance is as part of the process in calculating AFFO.

You can’t simply use FFO as a proxy for FCF in a DCF for a REIT, as it will artificially inflate your DCF model.

Instead, make sure you are using AFFO, as those capital expenditures are real drags on a REIT’s true flows of cash, and represents cash that can’t be used to create shareholder return through dividends or acquisitions.

Also, AFFO and a DCF valuation are just a tool in valuing a REIT—it’s not an all-encompassing formula. There are other great valuation tools to use on REITs as well, such as a NAV Asset Value Model or a Dividend Discount Model (keeping in mind that using the Dividend as a measurement of value becomes less valuable the lower the FFO payout ratio is for the stock).

There are weaknesses involved with any REIT valuation tool you try to use, just as there are weaknesses and wild discrepancies possible with any valuation model and its assumptions.

For more excellent reading on how to value a REIT, be sure to parse these posts by Dave Ahern:

- REIT Valuation: Methods, Metrics, and Analysis (Simplified)

- Net Asset Value Model: A Valuable Tool for Finding the Intrinsic Value of a REIT

- The High Yield Potential from REIT Dividends: Considering Taxes and Safety

I hope this post wasn’t discouraging, but rather inspiring.

There’s so much to learn about valuation, which is difficult all on its own. And then you add all of the varieties that REITs bring, and it can truly be overwhelming.

Remember that just like you would eat a pizza, it’s not something you’re going to do all at once. It’s going to take multiple bites, probably multiple sessions…

And so look at understanding the intricacies of REITs, accounting, and valuation in the same way.

Over time the pieces will come together, as long as you keep at it.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- REIT Cap Rate Formula with Real-Life Examples [STOR, ADC, NNN] The REIT Cap Rate formula, along with Funds From Operations (FFO), are two critical REIT ratios to understand and implement when analyzing REIT (Real Estate...

- How to Estimate Future Free Cash Flow Growth for a Mature Cash Cow Post updated: 9/07/2023 When it comes to projecting or estimating future free cash flow growth, there isn’t a strict science behind it. Some common methods...

- MLP Valuation – Taxes and Metrics for this High Yielding Investment Master Limited Partnerships, also known as MLPs, are a great vehicle for income investors, similar to REITs, in that they distribute the majority of their...

- Building a DCF Using the Unlevered Free Cash Flow Formula (FCFF) Updated 12/12/2023 “Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during...