The growth stocks vs value stocks debate has raged on over many market cycles. Some expert investors, like billionaire Warren Buffett, has said there’s no such thing as growth vs value—but rather that they are adjoined at the hip.

Peter Lynch, former fund manager at Fidelity of one of the most popular funds of all time, is long known as a growth at a reasonable price (GARP) type of investor.

One of his primary valuation techniques had been to compare P/E with the growth rate, in a ratio called the PEG (or P/E to growth) ratio. Basically, Lynch is happy to pay a higher P/E ratio as long as a company’s growth can match it.

The reasoning behind this idea is what I’ve found most fascinating.

Lynch has popularized the following idea:

“Because of compounding, a 20 percent grower with a P/E of 20x is a better investment than a 10 percent grower selling at a P/E of 10x.”

Empower Your Investing, by Scott A. Chapman, CFA

See, buying on low price-based ratios has always made sense to me. But, the power of compounding has also always made sense to me.

So I decided to put this theory to the test, using some handy Excel calculations and some mildly reasonable assumptions. I found these revelations also fascinating, so I’d like to share them with the world.

Maybe it will help bridge the divide between the most adamant growth and value investors.

But first, some background…

Background of the Growth vs Value Debate

Value stocks, defined as low price to earnings (or assets), have seen periods of outperformance and underperformance through the decades. As have growth stocks, defined (by most) as high price to earnings or assets (assumedly with a high growth rate).

Since the 1920’s, value and growth stocks have had alternating periods of outperformance against each other. These periods usually occur in a time range of anywhere between 5-20 years.

Suffice to say, you can make the argument for the long term superiority for value stocks (such as a study from Merrill Lynch looking at 1926-2016), or you can make a similar case for growth over value (especially over the 15-year period ending 2021).

It all depends on what starting point or ending point you look at.

Bottom line—value and growth stocks go through bear and bull markets in relation to each other. This is cyclical just as the stock market goes through its bear and bull markets over time.

Is Growth Better Than Value Due to Compounding?

Now we’ll get to the heart of this discussion, which was admittedly eye opening to me as a long time value investor.

First, I had to see the P/E example for myself.

The question becomes: how much better is 20% growth at a 20 P/E vs 10% growth at a 10 P/E?

A few assumptions before I reveal the titillating answer:

- Most seasoned investors know that over the very long term, the average P/E for the stock market has been close to around 15- 17.

- And so one reason that value investing works is that if you buy at a P/E of 10, for example, eventually the stock should trade near the long term historical average of the stock market (say 15). Price gains occur just from the P/E rising all by itself (this is also called mean reversion).

- So in my opinion, we not only have to take into consideration growing earnings, but the likelihood that a stock at a P/E of 20 will eventually settle to the long term average of around 15 (“mean reversion”). This should cause downward pressure on the price (over the long term).

The calculations at this point are simple.

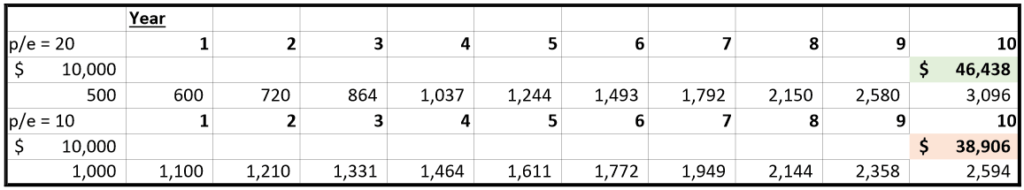

Taking two examples of a stock priced at $10,000: one is trading at a P/E of 20 (earnings = $500) and one at a P/E of 10 (earnings = $1,000).

Now we’ll grow stock A’s earnings at 20% per year and stock B’s earnings at 10%. Then, after 10 years, we’ll take year 10’s earnings value for both stocks and multiply both by 15 to account for mean reversion.

Which stock does better?

The stock with a starting P/E of 20 is eventually worth $46,438, while the stock with a starting P/E of 10 is worth $38,906, after both “revert to the mean” with an ending P/E of 15. Though the P/E of 20 stock started behind the P/E of 10 stock, through the power of compounding, it grew its earnings above the slower growing stock, to have a higher ending value even after seeing its P/E fall over time.

I was very surprised to see that the higher grower did much better than the lower grower even though the lower grower got the mean reversion boost.

That’s the power of compounding at work.

To further emphasize this, I want to highlight another thing Peter Lynch has talked about over and over again in his conversations and writings.

From a fantastic book profiling great investors like Buffett and Lynch called Empower Your Investing was this quote by Lynch:

“I can’t say enough about the fact that earnings are the key to success in investing in stocks. No matter what happens to the market, the earnings will determine the results.

In thirty years, Johnson & Johnson’s earnings are up seventy-fold, and the stock is up seventy-fold. Bethlehem Steel earns less today than it did thirty years ago, and, guess what? The stocks sells for less than it did thirty years ago”

Peter Lynch

And that’s really the crux of it.

Because a stock’s price will eventually follow its earnings, a higher grower could eventually grow into its valuation even if that valuation is rich today, because of the compounding effect of growth on its earnings.

But, investors should be careful about applying that example blindly.

Stocks with 10% average annual growth are common; stocks with 20% average annual growth over 10 years are not.

Investor Takeaway

Remember that there can be multiple growth drivers for a stock and its Earnings Per Share, so we don’t have to be a Debbie downer on our growth estimates even if we are a value investor. Growth drivers for EPS can include:

- Market share growth

- Growth of the industry

- Inflation

- Buybacks

- Acquisitions

But, I think that blindly applying historical growth rates is also not a great idea. If the industry is matured, or maturing, watch out! If the competitive advantage is eroding, watch out!

When it comes to growth vs value, it really comes down to the growth rate, growth rate, growth rate.

I think the takeaway is this.

Spend almost all of your time on projecting what you think is a reasonable growth rate moving forward, based on expert knowledge on the industry—competitors, drivers for the market as a whole, etc. Then apply a margin of safety.

And then finally, double check your work for sanity.

Does it make sense? Would someone say, yeah that’s using common sense…

This is what I’m thinking about today for my approach moving forward, and I hope it’s been helpful for you today too.

Related posts:

- 6 (Hidden Gem) Investment Quotes by Peter Lynch During His Retirement Peter Lynch has one of the best track records on Wall Street of all-time. You may have heard quotes from his best selling books, but...

- “Beating the Street” With Peter Lynch’s Investment Strategy – 25 Rules Few investors have performed as well as Fidelity’s Peter Lynch. If you’re looking for key insights into the Peter Lynch investment strategy, look to his...

- The Growth/Value Barbell Portfolio Explained: Pros and Cons As the growth stocks vs value stocks debate rages on, and value investing undergoes an almost two decade run of underperformance to growth, a new...

- What the Value Trap Indicator Is and What It Is Not. “But I’m just a soul whose intentions are good, Oh Lord, please don’t let me be misunderstood” –Nina Simone If you’re reading this, you’ve either...