Albert Einstein – “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

End of post.

Just kidding, but also not. Isn’t that somewhat of a “mic drop” by Mr. Einstein?

For the first couple years of my investing journey, I really didn’t fully comprehend what he was meaning when he said this. Of course I understood that the reason why investing can be so lucrative is because of compound interest, but what I didn’t fully get was that those that don’t understand compound interest “pay it”.

Before we get too far into the weeds, let me first explain what compound interest is. The concept is that when you earn interest in X amount of time, that next time period you’re going to earn interest on the principal AND the interest that you previously earned. Basically you’re double dipping on return on your investments.

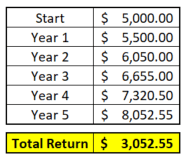

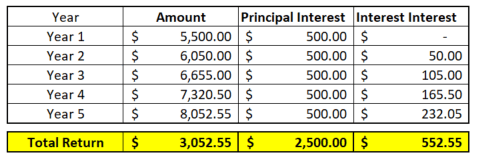

Let’s imagine this situation – you invest $5K and earn 10% each year for 5 years. 10% on $5K is $500, and since you’re investing for 5 years, you’d make $2500 ($5K*10%*5 Years), right?

WRONG!

You’re actually going to make much more. That first year you did make $500, or 10% on your $5K investment. But, in Year 2, you’re going to make 10% on your $5,500 invested rather than just the $5K that you initially put in.

In fact, at the end of it all, you would’ve made $3,052.55, a huge chunk of change!

And the thing is that the interest that you earn on your investments is just going to keep growing and growing over time. Check out the chart below that shows this over that 5-year period:

“Andy, this is great, but how can I really apply it from what Albert Einstein was saying?”

There’s really two parts – it’s the part about “earning” and the part about “paying”, but what does he exactly mean?

Earning

The earning aspect is very, very similar to the example that I just gave you above. That example might seem outlandish but it’s really not. Believe it or not, you can actually save $5K/year with just a few simple tweaks in your daily life.

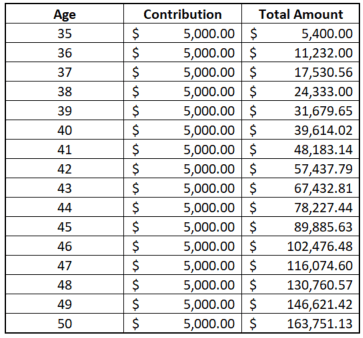

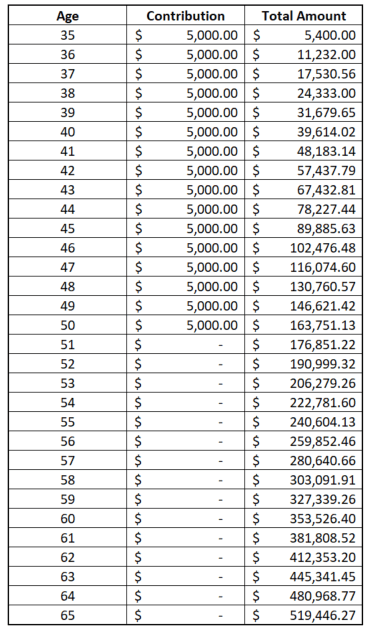

Imagine this scenario – you’re 35 and you start to implement this change where you’re going to save $5K/year until you’re 50. That means that you have a total of $75K! Nice chunk of change.

But what if you invested that in the stock market instead of letting it just sit in the bank account?

This can be done quite simply by opening a brokerage account, picking a S&P 500 ETF like SPY and then investing that money. It’s very simple – legit a 15 minute process.

Historically, the S&P 500 has returned about 10% on average, but just to be a little bit conservative, let’s go ahead and use an 8% return because I’d rather underpromise and over perform.

So, still thinking $75K is what you’re going to end up with? NOPE! Try nearly $164K!

And guess what – that’s just by only adding $75K and letting the rest ride. If you wanted to stop adding but let that money sit there in the market until age 65, how do you think that would turn out?

WOW – nearly $520K!

Are you starting to understand the importance of earning compound interest? But this is just one, simple example. Let me show you another!

One of my favorite compound interest examples that I like to use is the power of making small changes in your everyday life and then sitting back and watching the money compound like crazy. To me, the #1 easiest change to implement is simply to stop going out and buying lunch every single day at work.

I have coworkers and friends that will go out to eat every single day for lunch. Some days they’ll spend $7, others it’s $20, but on average I would say it’s likely right around $12, especially if you’re sitting down somewhere. Nowadays it’s somewhat hard to go out to eat for under $10, and then you can tack on a 20% tip and end up at $12 pretty quickly.

But how much would you save if you simply just packed your lunch instead? It might not seem like you would save a ton of money, but you can pretty easily pack a very hearty lunch for $3, and then your savings for just that one lunch is $9.

I mean, I literally will eat a salad with a half pound of chicken on it, cucumbers and hummus, and an apple and I am spending about $3 total on that meal. It’s a complete steal when you think about the amount of food, the quality of that food, and the price that I am paying.

Now, I am able to do this because I take the time to prepare meals and create a budget for my grocery items, along with all the common themes like buying in bulk and having a meal plan, but it really isn’t that much work.

By doing these things and getting $3 lunches, I would save a total of $45/week over the person that ate out every single day – isn’t that nuts?

I can already hear you whiners in the back going, “Andy, I am not going to just pack my lunch everyday and eat by myself like a loser.”

I 100% get that, and I have multiple suggestions for you:

- You can pack your lunch and still eat with others. Let your friends get takeout and eat outside with them or even bring it back to the office.

- You don’t have to pack every single day. I typically will pack 4 times/week and then go out with friends later in the week, typically on a Friday.

- If you’re going to lose your friends because you’re packing your lunch, then they were never your friends anyway.

- Try eating by yourself someday. Personally, I actually enjoy it a lot. I’ll listen to a podcast, clear my head, maybe work on a side hustle, or even just work through lunch and actually leave on-time for once rather than staying late. It’s definitely not an everyday thing, but something you most definitely can do from time-to-time.

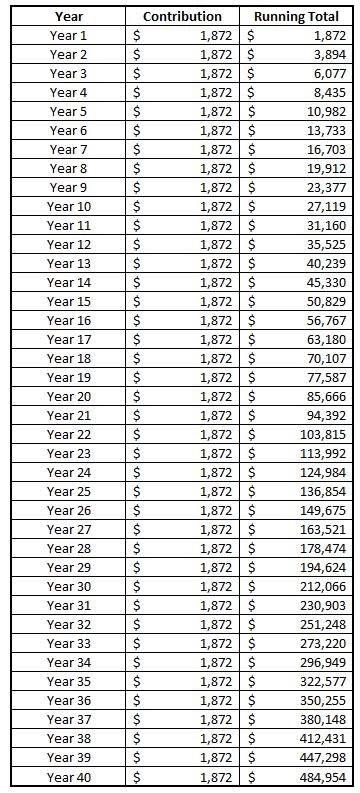

So let’s go with the scenario that I proposed about my life – I will typically pack 4 times/week meaning that on those 4 days, I am saving about $9/day for a grand total of $36/week, or a total of $1872/year! That’s a lot.

But what if I did that for my 40-year career and I invested it the entire time at an 8% return? How would that look?

I know…i couldn’t believe it either. simply by packing your lunch 4 days/week, you can save nearly $500K in 40-years. Do you know how insane that is?

Using the 4% rule, that $500K would be able to provide you $20K/year for the rest of your life! All because you were able to make the “sacrifice” of packing your lunch.

Sure, I know there can be a hassle to doing this if you’re not that experienced in meal prepping, but just grill up a bunch of chicken, throw it in some tupperware with lettuce and other veggies on a Sunday afternoon, while you’re watching football or listening to a podcast, and just reap the rewards.

It really is a no-brainer.

But just as these examples make it so obvious why we need to be taking advantage of compound interest, the banks are taking advantage of us when we PAY it!

Paying

When we use the term “compound interest” in the investing world, we’re not really even usually talking about interest but rather the gains/returns that we might receive from our investments. On the other hand, compound interest really does apply to when we’re paying it because it’s usually because we’re working to pay off some massive debt.

Let me explain – if you go out and max out a credit card, as I have personally done back when my spending was out of control, you’re going to find yourself with a very high balance and likely paying the bank back at an interest rate that is 20% or more.

I mentioned that I did this before and while I purposefully opened a card with 0% interest to enjoy my last year of college, I was so stupid in my thought process that I could pay it off before the 0% interest promo expired. Fortunately, I had gotten the $12K balance down to about $8K before the interest came into play, and I continued to pay it off aggressively after that, but many people don’t do that.

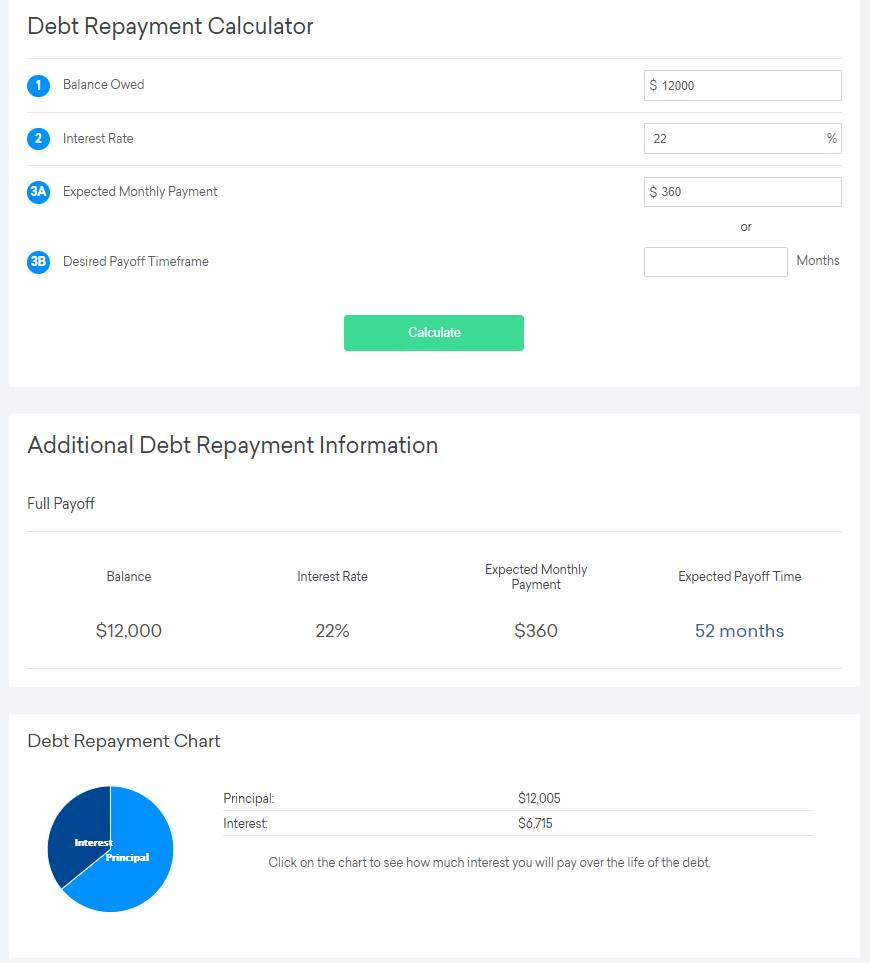

Many people will go out and max out that $12K limit that I mentioned and simply just make minimum payments on that card which are typically 3% or so. So let’s pretend that’s exactly what I did rather than correcting my actions.

3% of my $12K balance is $360/month. When I go to Credit Karma and type in $12K balance, 22% interest and $360 monthly payments, I can see that it’s going to take me 52 months to pay off this loan and I’m going to pay over $6700 in interest!

Yes, I literally am going to have to pay over 50% interest on the total amount that was outstanding, and that doesn’t account for any interest payments that I was making along the way as I was racking up this balance. This is just soul crushing.

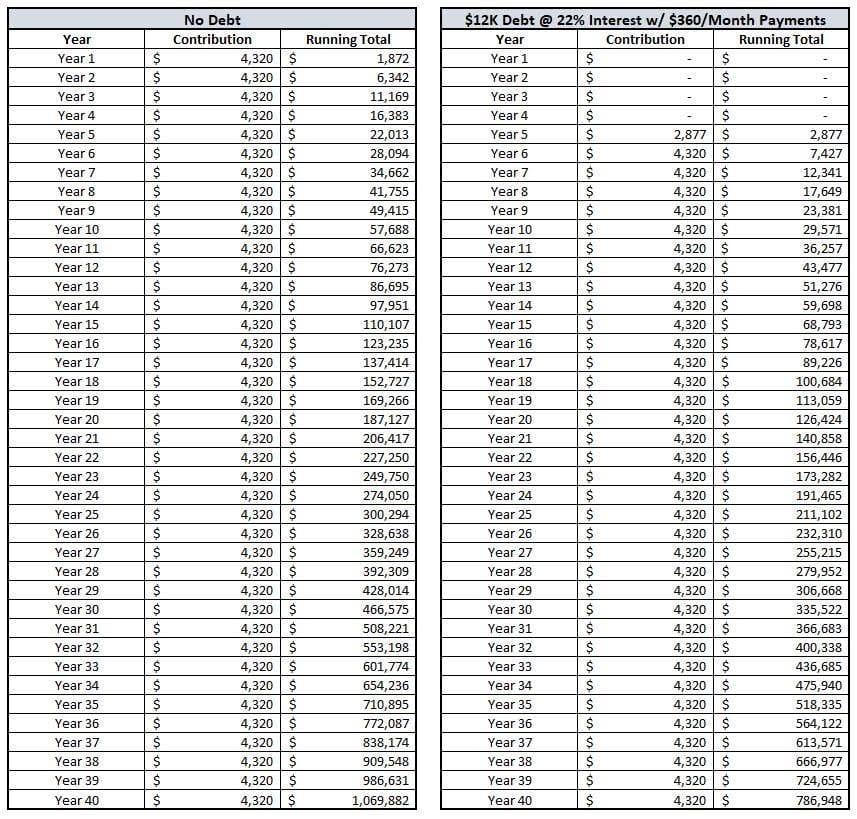

In addition, you’re going to have a MASSIVE opportunity cost. On average, the stock market goes up 10% each year as I have mentioned but I like to use that 8% number just to be safe. Well, while you’re paying off this debt you’re missing out on extremely valuable time investing in the market.

You might be thinking, “Ok, it’s $360/month*52 months so a grand total of $18,720. Sure, that’s a lot but it’s not going to kill me.”

I would agree. But your math is soooo wrong.

You see, you’re investing this money, and equally important (if not more important) than the amount you’re investing is the time that you have. By taking that extra 52 months, or 4.33 years, you’re missing out on a lot…like a lot, a lot!

Do you see what I am saying? Without debt, you’re nearly at $1.07 million while the debt scenario isn’t even at $800K. In total, you’re not only paying interest but your opportunity cost is $283K worse than if you didn’t have any debt at all.

Not only are you paying it to the bank, but you’re paying it to your employer because now you’re going to have to work even longer to be able to fund your retirement.

And you’re paying it to your family because you’re stealing valuable years away from them where you could be traveling to see grandkids, going on great vacations, or maybe even you simply just missed the ability to fund their college education because you had to focus on your retirement – all because you maxed out a $12K credit card and made low payments on it.

Summary

My takeaways are this – compound interest can be your best friend or your worst enemy – it simply just comes down to your comprehension of it and how you can use it in your favor or against yourself. If you want to go out and buy something fancy on a credit card, that’s fine – but pay that thing off.

Don’t do something as boneheaded as what I did where I was treating myself to something that I really shouldn’t have ever done. Even though I paid off the loan, I was lucky to do so. Who knew if something crazy could’ve happened and my job offer was revoked or maybe I had major unforeseen expenses come up that prohibited me from paying my loan off quickly.

At the end of the day, compound interest is always going to make a lot of money for someone – just do your best to make sure you’re the someone that it’s making money for.

Related posts:

- 5 Insane Compound Interest Examples to Keep You Motivated Compound Interest is one of the most amazing things in this world and is the reason that I got behind investing in the first place. ...

- Comparing Compound Interest from Paying Student Loans vs Investing If you listened to the most recent episode of the Investing for Beginners Podcast with Andrew and Dave, then you heard them both GO IN...

- This 401k Match Calculator Shows How Powerful Compound Interest Can Be There’s various compound interest calculators out there, but not many specific 401k match calculators that are easily manipulable to show how different contributions and employers...

- The Continuous Compound Interest Formula Excel Function for (Us) Nerds Ever wanted to illustrate exactly how powerful compound interest can be? Wanted to have an Excel function to do it for you? This post reveals...