When it comes to choosing a credit card and rewards program, there are a ton of different options to choose from. Keep reading to see all the Allegiant credit card pros and cons.

One of the most “millennial” things right now is collecting credit card rewards. And while young folks have really turned their attention to capitalizing on reward programs, this is something that all ages are collecting.

My father is 65 years old, and no one is more diligent with credit card spending than him. He pays the full balance each month but is constantly using one of three cards he has to collect different rewards. He understands that one card offers three times points on fuel, another on groceries, and the last on dining.

It’s a full-time job to understand each card, but if you like to travel or cashback programs, a credit card offers you a ton of perks. In the last week I covered the Target Red Card perks, which is a store-specific credit card, and today I want to cover the Allegiant credit card perks.

This card is different than a store card but can offer a lot of great perks, especially for frequent air travelers. The Allegiant Air credit card is a Mastercard that can be used at any location Mastercard is accepted.

Allegiant Credit Card Perks:

Sign-up Bonus: As with most credit card programs, to get you reeled in, they offer you a very nice sign-on bonus. This typically requires you to spend a certain amount in the first few months of having the card, but after you get the points, there really aren’t any catches.

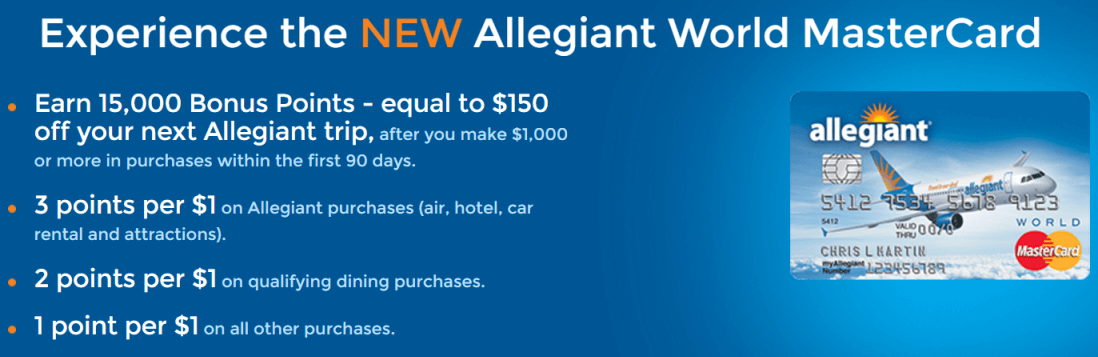

The Allegiant Mastercard works the same way. If you spend $1,000 in the first 90 days of having the card, you will receive 15,000 bonus points towards Allegiant flights. This particular program offer is comparable to $150 off a future airfare with the company.

The bonus is nice, but two things do stick out to me. For one, the spend amount is low which is a great Allegiant credit card perk. Typically, a card will require you to spend at least $2,500 before you get the bonus. I know I spend enough on a card each month to hit that, but it can sometimes cause unnecessary spending just to hit a bonus.

The second thing I noticed is the bonus offer isn’t as strong as some cards offer. That doesn’t mean this isn’t a good card and you shouldn’t consider it if it works for you, but I have seen other airlines that will offer 50,000 or even 100,000 points for signing up for their credit card. Full disclosure: I haven’t done the math on each program on how the points work.

For example, Allegiant points may be extremely valuable as currency. A flight may only cost you on average 10,000 points, whereas another airline costs you 30 or 40,000 points. This is just something that did catch my eye and would be worth double-checking if you are serious about the card.

Bonus Rewards: Another one of the Allegiant credit card perks is the bonus rewards that you can receive in certain categories. Not only are you receiving points for every dollar that you spend, but you can also receive multipliers in certain categories.

For the Allegiant credit card, you can earn three points for every $1 you spend at Allegiant. That includes flights, hotels, and rental cars that are booked through the company. It also includes any fees for luggage or purchases inside the aircraft which is a nice benefit.

Not only do you get a bonus on Allegiant spending (which makes sense), but this card also offers you the ability to earn double points on all money spent on dining. That means every time you go out to dinner or get takeout, you are earning two points per $1 you spend.

If you really want to justify vacation, I could make the argument that the more you travel and dine out, the more points you can earn for your next vacation. I mean that is simple math, right?

Last but not least, you will earn one point per $1 spent on all other purchases that you make. That means anything not spent at Allegiant or dining will be at that rate.

Additional Perks: When evaluating Allegiant credit card perks, you need to consider everything. There are three other small perks that should be considered in your evaluation.

The first consideration is zero foreign transaction fees on the card. There are a lot of credit cards that now offer this perk, but if you ever travel internationally, this is a great perk so you don’t incur additional fees or have to worry about exchanging currency. You should have at least one credit card in your arsenal with this perk.

The second small perk that can be big is priority boarding on flights. Sometimes getting on the plane early when you have assigned seating isn’t a huge advantage, but if you are trying to fly with just a carry-on piece of luggage, getting in the plane early means you will get the overhead storage and not have to gate-check your bag.

The last Allegiant credit card perk I want to discuss today is the free drink. You heard that right, you will receive one free drink on every flight when you show the card. This is a very small give for the company, but still, something nice of them to offer.

To this point, we have covered all the Allegiant credit card perks, but I would be remiss if I didn’t cover some of the negatives as well. When it comes to credit cards and travel partners, there are a lot of options that you must consider.

Allegiant Credit Card Cons:

Companion Fare Catch: A lot of airline credit cards have started the “companion pass”, which basically means you can fly on a buy one, get one free basis. Obviously, this sounds like a huge perk, but there is a major catch that you need to understand.

With most airline credit cards that I have seen, the companion pass is obtained with a very large amount of spending. Typically, you must spend nearly $10,000 or more per month in order to qualify. So, it sounds great but really isn’t attainable by most. Someone with a small business is really the only one who is able to qualify.

The Allegiant card is similar. In order to qualify for their companion fare, there are a ton of strings attached. First, you are required to book a full vacation through Allegiant. And the vacation either must be four nights in a hotel or seven days of a car rental.

This doesn’t mean that their vacation package won’t be attractive and isn’t something that won’t work for you, but it certainly limits your options. If you are only planning on going somewhere for a few nights or not renting a car, it likely won’t make sense for a free flight to adjust your entire trip.

As mentioned before, Allegiant isn’t the only airline credit card that offers a companion pass that is next to impossible to utilize.

Limited Travel Footprint: Again, this con is something that can be big or small depending on the type of travel you enjoy. Another issue with signing up for the Allegiant credit card is you are limited in the airports that they have available flights.

At this time, Allegiant doesn’t offer any international flights, and they only fly to certain airports throughout the U.S. Now, maybe they fly to three places that you absolutely love to travel to, and the flight schedule is perfect. You may not even care about places they don’t travel to.

Allegiant has a slight reputation for being a cheap airline, meaning you can get places for a good price, but there is absolutely no luxury in the process, and has a bad reputation for delays. I’ll be honest, I’ve never had a bad experience, but where there is smoke, there is usually fire in these types of observations.

I know in my previous job I traveled to New Orleans at least five times a year for meetings. Allegiant had a great flight schedule out of my home airport, and they were direct. My boss always wanted me to fly another airline, but the convenience was just that good. If you have a situation like that, the travel footprint may not even be a consideration for you.

Annual Fee: Compared to some, the $59 annual fee isn’t horrendous, but when you look at what you get, it really isn’t anything to write home about. There is a one-time bonus point giveaway for signing up for the card, but after that there is nothing.

Most credit cards I have seen give you some sort of “annual” reward as well to help offset the annual fee. I know with two different hotel cards I have looked at the fee is almost $100 a year, but at least I get one free night a year, plus more.

When looking at the Allegiant credit card perks, they really do lack a lot of upside after the initial bonus. Another missing item that is bizarre to me is that you don’t even get a free checked bag with the credit card. It feels like the additional costs of traveling are insane, and that is such an easy give. I don’t understand why a free checked bag, or two, is not included in their package.

It’s almost not even necessary to add this in, but I feel like it’s worth noting. The interest rate on the card is anywhere from 16 percent to 24 percent. This is not a knock on the card at all, as nearly all credit cards are at this type of rate, but it must be noted that this card is not meant for carrying a balance or transferring debt.

Final Review:

After reviewing all the Allegiant credit card perks and cons, I’m not sold that this is a great card to continue investigating (for me at least). As I mentioned above, a credit card can be extremely specific to who it works for. Just because I don’t love it, doesn’t mean it won’t work well for you. As always, just make sure you fully understand the card and the benefits that it offers.

For me, there just isn’t enough upside to utilize the program and make it worth a commitment to traveling Allegiant airlines. The bonus points on spending aren’t great, there is no annual gift and yet there is still a fee, and the airport footprint is still limited. Another item to think about – with the recent Spirit and Frontier merger, the discount flying market could drastically change.

Because I’m not in love with the Allegiant card, I did want to provide a few other credit card options that may make more sense.

United Explorer Visa: This card does have a $95 per year fee, but the perks are far better than what Allegiant offers.

- 70,000 bonus miles after spending $3,000 in the first three months.

- Double points on United purchases, dining, and hotel stays. One point per one dollar on other purchases.

- One free checked bag for cardmember and one companion along with priority boarding.

- $100 credit towards TSA PreCheck every four years.

- Up to 1,000-anniversary points every year.

- No expiration on miles.

Chase Sapphire Preferred Visa: Another card with a $95 per year fee, but the Sapphire preferred will allow you to transfer points to many of your favorite travel partners.

- 80,000 bonus points after spending $4,000 in the first three months.

- $50 annual hotel credit when booked through Ultimate Rewards.

- Three times points on dining, online groceries, and one point per dollar on all other purchases.

- 10 percent prior year spending (up to $25,000) anniversary points each year.

- One-to-one-point transfers with the following rewards programs.

- Southwest Rapid Rewards

- United MileagePlus

- IHG Rewards Club

- Marriott Bonvoy

- And many others

There are also cards that offer a cashback percentage on every single purchase that you make, it just all depends on your needs and desires. The Allegiant credit card perks may make sense for some, but I’m not sold that it is one of the premier cards out there.

Related posts:

- Understanding all the Visa Perks on Different Credit Card Options With so many different credit card options available, it’s important to weigh all the possibilities. Check out the Visa perks on these different cards and...

- Understanding the Target Red Card Perks and How They can Benefit You Consumers have a ton of options when looking for new payment options. As with any financial decision, it’s best to weigh all options. Keep reading...

- A Deeper Look at all of the Credit Card Pros and Cons that Exist We now live in a world where most people solely use credit cards, cash is a blast from the past. Check out these credit card...

- Credit Cards? Pshh. Let’s Break Down the Debit Card Advantages and Disadvantages In the personal finance community, there are many varying opinions on all topics imaginable. And as you might anticipate, some of them can get pretty...