In this post, you’re going to learn precisely how to use the Altman Z-score formula to avoid companies on the verge of bankruptcy.

This guide will include lots of:

- Real examples using real companies

- A complete breakdown of the Altman Z-score formula

- Where to find all the information required to calculate the formula

- An analysis of how to interpret the results

- And much more

If you are looking for a formula to help you avoid companies on the brink of bankruptcy, this guide is for you.

Let’s dive right in.

What is the Altman Z-Score?

According to Investopedia:

“The Altman Z-score is the output of a credit-strength test that gauges a publicly-traded manufacturing company’s likelihood of bankruptcy. The Altman Z-score is based on five financial ratios that can calculate from data found on a company’s annual 10-K report. It uses profitability, leverage, liquidity, solvency, and activity to predict whether a company has a high probability of becoming insolvent.”

It mentions that we use the Altman-Z score with manufacturing companies, but you can use it with other types of industries. Only financials are out of bounds as it doesn’t adapt to that industry well.

A little history about the Altman Z-score: it was developed in 1967 by Edward Altman, then an NYU Stern finance professor. His findings were later published in 1968.

Over the years, Altman has worked on tweaking his Z-score. During the years he has evaluated companies using the score:

- 1969 to 1975: 86 companies in distress

- 1976 to 1995: 110 companies in distress

- 1996 to 1999: 120 companies in distress

Altman found through his studies that the accuracy of his Z-score ranged between 82% to 94%.

In 2012, Altman released an updated version that we could use to evaluate public and private companies, all industries except financials.

We can use the Altman Z-score to evaluate corporate risk, and the formula has become a reliable way to measure the credit risk of businesses.

The focus of this model is to protect our downside, predicting bankruptcies is hard, but avoiding permanent loss of capital is rule number one.

As we will discover, a high Altman Z-score doesn’t indicate a strong buy, merely that the chance of bankruptcy is low. However, a low Altman Z-score raises questions about the financial strength of the said company and should be a red flag that we should investigate.

One of the main issues with the Z-score is it is not well suited for specific industries. Industries that operate with high leverage, such as airlines, I am looking at you Boeing, will naturally show a higher risk of bankruptcy.

Others that will have issues because of possible negative working capital, such as restaurants and retail, will exhibit higher levels of bankruptcy.

The efficiency of the score in predicting bankruptcies has fallen over the years. Still, for me, the reason why I like to use is the ability to determine a quality company. Not whether companies are going bankrupt or not, for that, I use Andrew Sather’s Value Trap Indicator.

The Altman Z-score can give us a good check on the credit of the business as well as the quality of the business. As we will see, the Altman Z-score lines up nicely with the bond ratings of a company, which tells us the overall financial strength of a business.

As with our study of bonds, the bond rating is an indicator of a financially secure business, but it is not necessarily a predictor of bankruptcy.

Most of those signs are fairly obvious:

- Overloaded debt

- Short term debt is higher than long-term debt

- Cash from financing operations greater than cash from operations

And many more, but that is for another time.

Ok, now that we have explored what the Altman Z-score and ways to utilize the formula, let’s dive in a discover the formula.

The Altman Z-Score Formula

Here is the formula; it may look complicated, but we will break down each individual part.

Z = 1.2*X1 + 1.4*X2 + 3.3*X3 + 0.6*X4 + 1*X5

Where:

- X1 = Working Capital / Total Assets

- X2 = Retained Earnings / Total Assets

- X3 = EBITDA / Total Assets

- X4 = Market Value of Equity / Total Liabilities

- X5 = Net Sales / Total Assets

To start to put this into practice, let’s look at each component and break them down a little bit, plus where to find the data we need.

Here is a list of the items we will need to locate to calculate the formula.

- Total Assets

- Total Current Assets

- Total Current Liabilities

- Retained Earnings

- Pre-Tax Income

- Interest Expense

- Revenue

- Market Cap

- Total Liabilities

Let’s dive into a look at some examples with real companies.

How to Calculate the Altman Z-Score with Examples

The company I would like to use for our example is Oshkosh Corp (OSK), a manufacturing company that, among other items, makes the Hummer.

Altman X1 = Working Capital / Total Assets

The above breaks down as:

Altman X1 = (Current Assets – Current Liabilities) / Total Assets

Nice, simple formula to understand, and lays out the short-term financial position of the company based on figures from the balance sheet.

Remember, the more working capital compared to the total assets, the better liquidity the company has available.

A few notes for you in regards to working capital, negative working capital isn’t always inadequate. Walmart (WMT), for example, has leverage over its supplies for favorable payment terms, which translates to higher current liabilities versus their current assets. Other examples of this are Verizon (VZ) and Southwest Airlines (LUV).

Also, higher working capital may not mean all good as well. It could indicate that the company has too much inventory, or they are not reinvesting their cash.

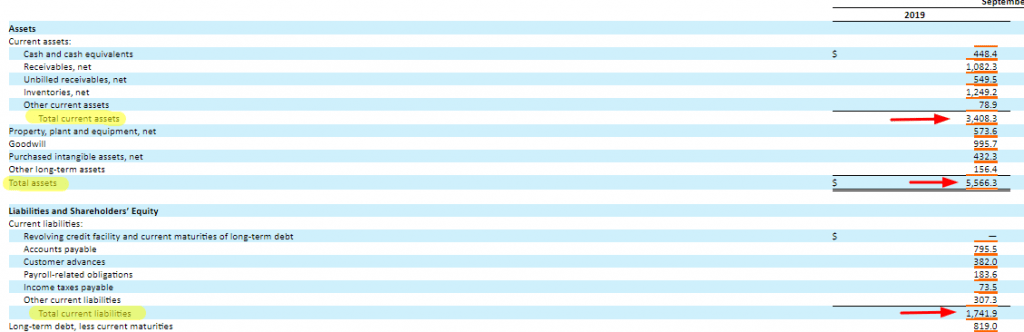

Back to the formula, we can find all three items from the balance sheet of Oshkosh Corp.

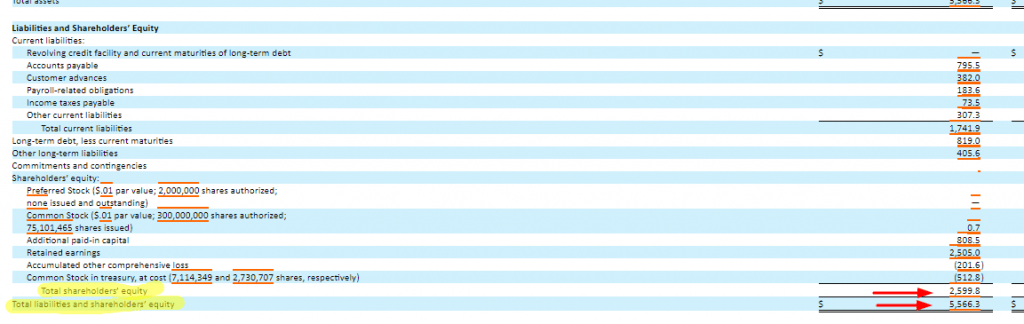

Pulling our numbers from the balance sheet:

- Current Assets – $3,408.3

- Current Liabilities – $1,741.9

- Total Assets – $5,566.3

Plugging all the numbers into our formula, we get:

X1 = ( $3,408.3 – $1,741.9 ) / $5,566.3

X1 = 0.29

We are moving on to the next portion of our formula.

Altman X2= Retained earnings / Total Assets

Remember that retained earnings are the percentage of net earnings that are not paid out for dividends or share repurchases. When we combine it with total assets, the purpose of the ratio is to relay to us how much the company relies on debt.

Logically, this makes sense when you think about it. Because if a company has little or no retained earnings, it will need to raise funds to operate the business from somewhere. The lower the ratio, the more a company is funding assets by debt, as opposed to retained earnings.

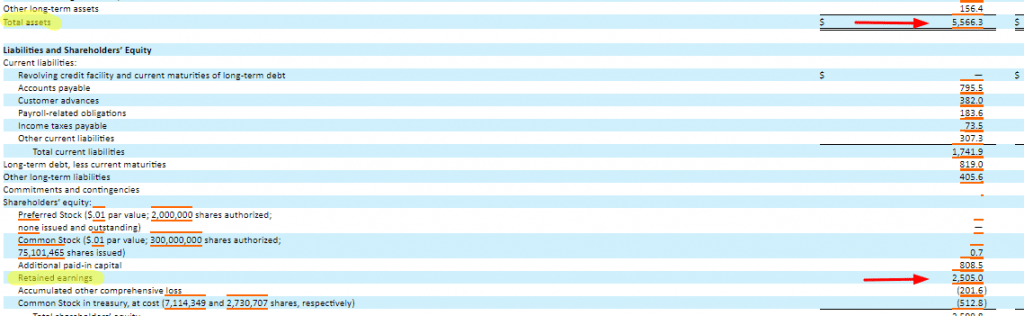

Pulling numbers from the above balance sheet:

- Total Assets – $5,566.3

- Retained Earnings – $2,505

Plugging everything into the formula:

X2= $2,505 / $5,566.3

X2 = 0.45

Altman X3 = EBIT / Total Assets

The above formula might look vaguely familiar, reminds me of Return on Assets, which is net income divided by total assets. The only difference is that earnings before interest and taxes are the numerator instead of net income.

It all amounts to the same result; the ratio looks at Oshkosh’s ability to generate profits from its assets.

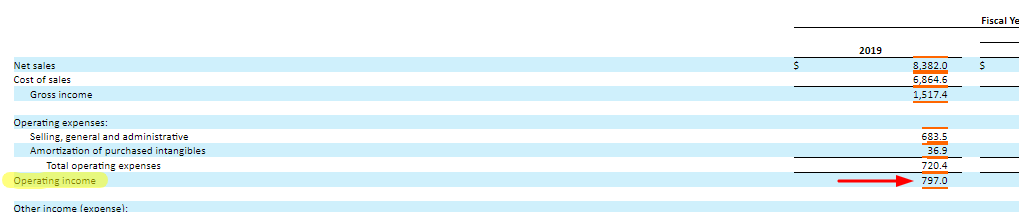

To calculate this formula, we are going to pull numbers from the income statement and balance sheet. We have already used the total assets twice, so I am not going to use that balance sheet again.

EBIT from Oshkosh’s income statement equals:

- $797

Plugging in our numbers for the formula:

X3 = $797 / $5,566.3

X3 = 0.143

On to the next section of the formula.

X4 = Market Value of Equity / Total Liabilties

One of the more controversial sections of the formula because as the price of the company increases so does the market value of the equity, and price does not always indicate the strength of financials.

Exhibit A would Tesla (TSLA); by all financial measures, Tesla is a train wreck, but currently, their market cap is astronomical because of the cult-like following of the company, not because they are making any money, which they are not.

Companies with a negative PE ratio can have a healthy number in this ratio, solely because of the popularity of the company and a high price point.

Let’s look at the current market cap for Oshkosh Corp, and the balance sheet for the total liabilities.

Source: SECPulling our numbers from the balance sheet:

- Market Cap – $4.33B

- Total Liabilities – will we need to calculate

the total liabilities by subtracting the total liabilities and shareholders’ equity

from the shareholders’ equity.

- Total Liabilities = ( $5,566.3 – $2,599.8)

- Total Liabilities = $2,966.5

Now we can plug all of our numbers into the formula.

X4 = $4,330 / $2,966.5

X4 = 1.46

On to the final component in our formula.

X5 = Net Sales / Total Assets

The above ratio indicates asset turnover, and it looks at the dollar of sales generated by the company for every dollar of assets.

The more money we can generate form assets, the more we like the company.

The ratio is also a great indicator of efficiency and the quality of the business and is best used comparing to the previous year.

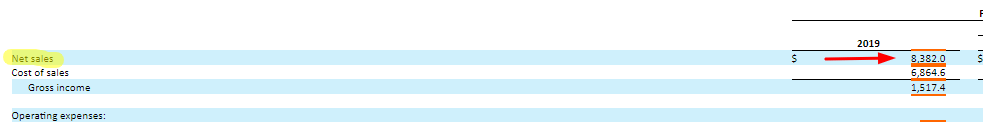

Pulling again from the income statement for net sales, also known as net revenue.

Our net sales from the income statement:

- $8,382

And we are using the total assets from the above balance sheet examples we have used for the other ratios we have calculated.

X5 = $8,382 / $5,566.3

X5 = 1.51

Ok, that wraps up our analysis of each component of the Altman Z-score, now let’s add all of our numbers to the formula, and we can find see our results for Oshkosh Corp.

First a refresher on the formula:

Z = 1.2*X1 + 1.4*X2 + 3.3*X3 + 0.6*X4 + 1*X5

Results from our calculations:

- X1 = 0.29

- X2 = 0.45

- X3 = 0.143

- X4 = 1.46

- X5 = 1.51

Ok, now let’s add our numbers to the formula and see what we get.

Z = 1.2*0.29 + 1.4*0.45 + 3.3*0.143 + 0.6*1.46 + 1*1.51

Z = 0.34 + 0.63 + 0.47 + 0.87 + 1.51

Z = 3.82

Ok, that wasn’t too hard, was it? It looks pretty daunting when you start, but once you break down each component of the formula, you see that it is straightforward and easy to complete.

Let’s take a look at a few more to help us solidify how to utilize the formula best.

The next company I would like to take a look at is Caterpillar (CAT), a manufacturing company as well.

For this example, I am going to use the trailing twelve-month numbers or TTM to get the most recent number.

Here is a list of numbers pulled from the financial reports before we put together the ratios.

- Total Assets – $78,453 Mil.

- Total Current Assets – $39,193 Mil.

- Total Current Liabilities – $26,621 Mil.

- Retained Earnings – $34,437 Mil.

- EBIT – $7,812 Mil.

- Revenue – $53,800 Mil.

- Market Cap – $62,946 Mil.

- Total Liabilities – $63,824 Mil.

X1 = ( Current Assets – Current Liabilities ) / Total Assets

X1 = $39,193 – $26,621 / $78,453

X1 = 0.16

X2 = Retained Earnings / Total Assets

X2 = $34,437 / $78,453

X2 = 0.44

X3 = EBIT / Total Assets

X3 = $7,812 / $78,453

X3 = 0.10

X4 = Market Value of Equity / Total Liabilities

X4 = $62,496 / $63,824

X4 = 0.98

X5 = Revenue / Total Assets

X5 = $53,800 / $78,453

X5 = 0.68

Now, let’s take all the ratios and add them to our formula.

Z = 1.2*0.16 + 1.4*0.44 + 3.3*0.10 + 0.6*0.98 + 1*0.68

Z = 0.19 + 0.62 + 0.33 + 0.58 + 0.68

Z = 2.37

Ok, that was interesting, one more for giggles.

Let’s try Boeing (BA), which has been in the news a ton lately because of the trouble they are in and the aggressive share repurchases they had initiated before the financial crisis.

Here are the numbers from the financials, again I am going to use the TTM or trailing twelve-month numbers. This time I will just show the results of the ratio calculation as I know you can all do the math.

Boeing TTM numbers:

- Total Assets – $133,625 Mil.

- Total Current Assets – $102,229 Mil.

- Total Current Liabilities – $97,312 Mil.

- Retained Earnings – $50,644 Mil.

- EBIT – -$2,259 Mil.

- Revenue – $76,559 Mil.

- Market Cap – $83,415 Mil.

- Total Liabilities – $141,925 Mil.

Ok, now for the calculations for our Altman Z-score.

Z = 1.2*0.036 + 1.4*0.379 + 3.3*-0.01 + 0.6*0.59 + 1*0.57

Z = 0.04 + 0.53 + -0.03 + 0.35 + 0.57

Z = 1.46

Ok, that is interesting, and that wraps up our calculation section of the Altman Z-score.

Let’s move on and discuss what the results tell us about the companies we just analyzed.

What is a good Altman Z-Score?

Before we get into the results of our calculations, let’s review our scores for each company.

- Oshkosh Corp – 3.82

- Caterpillar – 2.37

- Boeing – 1.46

There are rules for interpreting the Altman Z-score:

- When Z is equal or greater than 3.0 the company is safe

- When Z is between 1.81 and 2.99, it is in the Grey Zone

- When Z is less than 1.81, it is in the Distressed Zone

Looking at our above three companies, we could assign the following to each:

- Oshkosh Corp is in the safe zone

- Caterpillar is in the grey zone

- Boeing is in the distressed zone

Which coincides with what is the perception of the market of the strength of all three of these companies.

To put this in the perspective of bond ratings and the Altman Z-score, we can get a correlation of the creditworthiness of companies.

Here is the reference to bond ratings and the Z-score:

- AAA/AA 4.13

- A 4.00

- BBB 3.01

- BB 2.69

- B 1.66

- CCC/CC 0.23

- D 0.01

According to the numbers above, Oshkosh would have a credit rating between BBB and A, Caterpillar would have a credit rating between B and BB, and Boeing would be between B and CCC.

Using this score to give us a quick reference to the credit ratings of the companies is very useful to asses the financial strength of any company.

For reference, any company below BBB is considered high-risk bonds or otherwise known as junk bonds, above BBB is corporate bond strength.

Final Thoughts

The Altman Z-score is a little under the radar as far as formulas go, it is not a familiar one and has dwindled in use over the years. It still has value as an easy way to asses the credit quality of a company, plus it gives you an overall picture by calculating each ratio of the financial strength of each company.

As you work through the calculations, you are going to see which companies have greater balance sheet strength and utilize their assets to create revenue, than the companies that are struggling in those areas.

The formula looks daunting, but as we have seen once you break down the parts, it is easy to perform. The biggest trick is knowing where to find each piece of data, once you know that it is a breeze.

That is going to wrap up our discussion of the Altman Z-score today.

As always, thank you for taking the time to read this post, and I hope you find something of value on your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out, I am here to help.

Until next time.

Take care and be safe out there,

Dave

Related posts:

- How the Beneish M-Score Keeps You Cognizant of Earnings Manipulation Earnings manipulations are one of the more sinister aspects of financial accounting. While it isn’t prevalent, it is an aspect of investing to be aware...

- Enterprise Value Formula and Definition – CFA Level I & II Fundamentals A company’s enterprise value (EV) is an important point of understanding for investors and is a fundamental learning point in many business schools, as well...

- Short-Term Debt: Evaluating Financial Strength and Cash-Generating Growth Updated 2/7/2024 Short-term debt and current liabilities are often combined into the same bucket. When calculating a company’s debt-to-equity ratio, most investors use the total...

- Levered Free Cash Flow Formula (FCFE) Explained Free cash flow and a DCF go hand-in-hand in estimating valuation. But should levered free cash flow (also called FCFE) be used in a DCF?...