If you have been investing for some time then you have likely heard of annuities, and even more likely is that you have likely heard someone else’s opinion about them, either good or bad. Well, my friends – I am here to take a deeper dive into annuity rates to try to determine if they’re worth of the investment or not.

To start, let me first talk about what an annuity even is. Essentially, it’s a retirement tool that allows you to get a steady source of income throughout your retirement. The best analogy that I’ve heard is to think of it as a pension that you pay for.

The reason that I like that analogy over a simple loan where you get interest is because ideally you are only getting your pension at retirement age, and that’s really the only time that an annuity should be a tool in your portfolio.

There are various types of annuities, as I have shown a screenshot below from Investor.gov:

The three different types of annuities all really depend on the risk tolerance that you are willing to accept but again, this really only should be considered for those that are in retirement.

Note that I said ‘in retirement’ rather than ‘getting close to retirement’ because getting close to retirement might mean you’re what, 55 or 60? Maybe 65 if you’re going to work longer?

Great.

If you start taking too conservative of investments at age 55-65 and then you live until 100, then likely half of your investing adult life is going to be off too conservative of investments. You need to keep your money in the market as long as you can do it because people live longer and longer lives nowadays – and that’s a great thing – but you need to make sure your money strategy is in sync with your life.

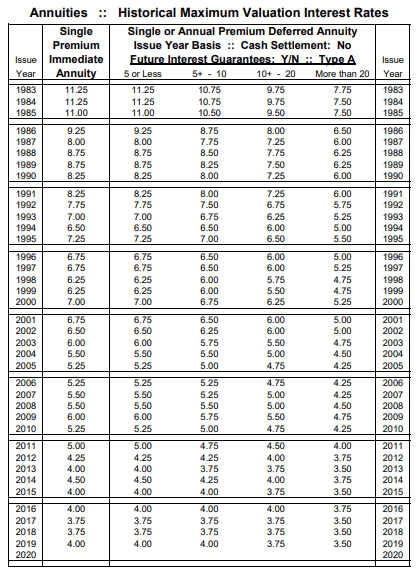

So, what is the average rate for an annuity? Well, annuity rates will change by the company that you get them from, but I found a pretty straightforward chart from Hause Actuarial online to show what the rates look like and included it below:

If you’re pretty young, then you might be shocked about how high some of these rates seem back in the pre-2000 days and I’d agree with you. Those seem like some pretty hefty returns for a “conservative” investment like an annuity, but are they actually?

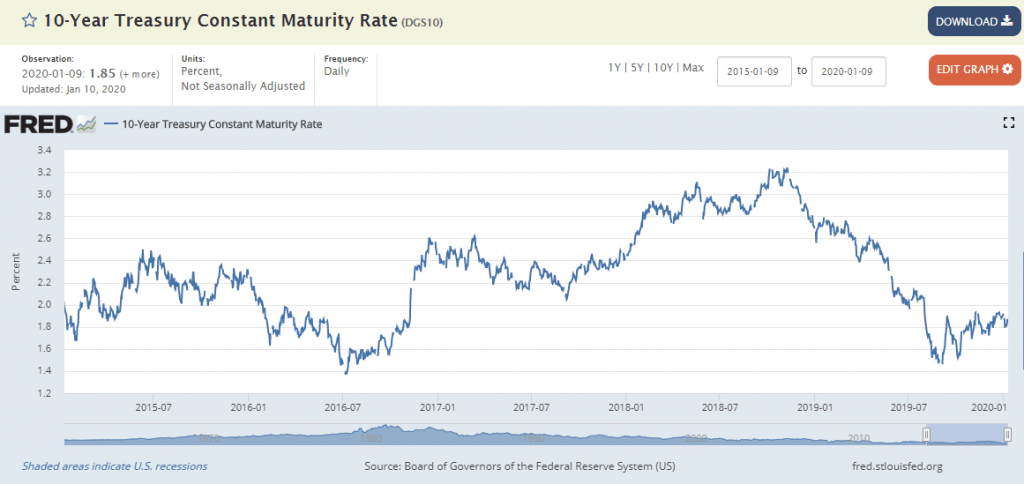

I wanted to take a deeper dive into the numbers and compare these annuity rates vs. the 10-year Treasury Yield to see how they truly compared. To do so, I took a look at FRED, which stands for the Federal Reserve Economic Data, to pull in what the 10-Year Treasury Data has been over time .

Below is a screenshot to see what the data looks like over the last 5 years:

I love this view because you can pretty easily track the trends of how things have been going over whatever time period you wish to evaluate. As you can see, I have selected the 5-year look and the rates topped just over 3.2% around late 2018.

The beauty of this graph is that not only is it very easy to get the data that you want in a visually appealing way, but you can hover over any part of the graph to see the exact rate as it changes over that time period as well. In addition to that, if you’re that “next level nerd” like I like to think I am, you can download the data into an excel spreadsheet by clicking the ‘download’ button in the top right of my screenshot and then you can manipulate the data however you want.

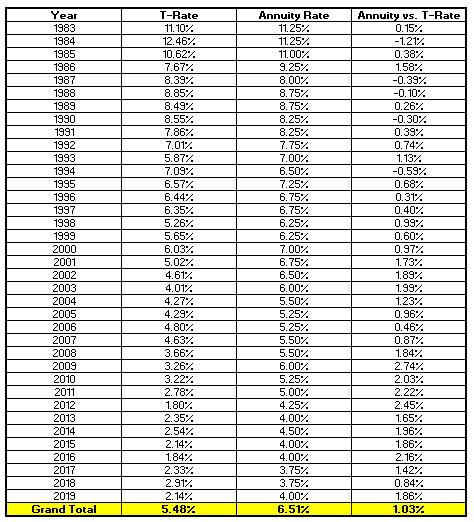

I took this data, downloaded it, and then compared it to the previous annuity chart to show the performance of one vs. another since 1983 (as far back as the annuity chart goes), shown below:

As you can see, the Annuity has pretty consistently outperformed the T-Rate since 1983, and it should! Do you know why it should? Because an annuity also charges you fees!

Dun dun dun…

Maybe you were expecting that, maybe not. Not all annuities have fees but some of them definitely do. According to Annuity.Org, the fees can really be anywhere from 1-3% depending on the type of annuity, the length, the company offering the annuity, etc.

If you’re looking at the chart that I have provided above, the breakeven since 1983 is 1.03% as that’s the amount that the Annuity Rate has outperformed the T-Rate over that time period.

As of more recently, the annuity rate has been a lot stronger as it’s outperformed the T-Rate by 1.66% since 2000, 1.85% since 2010 and 1.63% since 2015.

So, should you invest in annuities? As with many of my recommendations – it really comes to the specific situation that you are in.

First and foremost, you need to be in retirement already – if you are at this stage in your life then you can go ahead and check that box and that box is by far the most important to check.

Second – how do the annuity rates compare to the T-Rates in the past? I understand that there’s no way that you can tell how annuity rates are going to perform in the future but that’s just the same as any investment. I would recommend that you ask the annuity company for past annuity rates so you can go back and do a simple comparison like I have shown above.

Of course, the history is no guarantee for future returns, but they can be a great indicator to help you understand how competitive of an annuity you’re likely going to be receiving.

If I had to guess, the annuity rates are going to end up NOT being worth the time and risk that you’re going to have to accept.

If I was in this situation, I would make sure to do tons of research and make the best, most well-informed decision that I could, but chances are that I would likely just put my money into a high-yield savings account and then take the money as I earned interest.

Not only does that provide me income going forward, but it allows me the opportunity to pounce on things as I see value created before my eyes, say as the market takes a “dip” like it did in 2008.

Yes, you might give up a little bit of interest on the front end, but the potential reward might make you feel like a genius…and you can tell your friends “oh, the market crashed? I knew it…ty”…like annuity…

And that, my friends, is how you finish a blog post with a bang!

Related posts:

- Comparing Compound Interest from Paying Student Loans vs Investing If you listened to the most recent episode of the Investing for Beginners Podcast with Andrew and Dave, then you heard them both GO IN...

- Comparing Online Investment Planning Services Robo-advisors can make investment planning quite intriguing. By using algorithmic calculations to determine the optimum asset allocation for your portfolio, robo-advisors offer you computerized investment...

- The Continuous Compound Interest Formula Excel Function for (Us) Nerds Ever wanted to illustrate exactly how powerful compound interest can be? Wanted to have an Excel function to do it for you? This post reveals...

- This 401k Match Calculator Shows How Powerful Compound Interest Can Be There’s various compound interest calculators out there, but not many specific 401k match calculators that are easily manipulable to show how different contributions and employers...