In the most recent episode of the Investing for Beginners Podcast with Andrew and Dave, they talked about some of the companies that have recently been added to the Dividend Aristocrats. One that really stood out to me was a company called A.O. Smith (AOS) and the AOS dividend.

If you have listened to any of the podcast episodes before, you likely know that Andrew and Dave really focus on investing of a margin of safety, with an emphasis on the safety. One part of accomplishing this is finding companies that offer a dividend.

Companies that offer dividends are typically perceived as a more conservative investment as they’re giving you some “cash back” every quarter when they report their earnings.

Some people will use this as in income stream while some will reinvest that money back into the market, either in that same company using the Dividend Reinvestment Plan or into a different company.

But you know what’s even more of a “sure thing” than a dividend paying stock? A Dividend Aristocrat.

To be a Dividend Aristocrat you have to be a part of the royal family…kidding! There’s two different criteria to make this list:

- Be in the S&P 500

- Have at least 25 years of consecutive increasing annual dividends

Sounds pretty easy, right? WRONG! As of 2019, there’s only 57 companies that make up the Dividend Aristocrats. While a lot of companies do pay dividends, they might be excluded from this list because they’ve cut their dividend when times get tough, or maybe they have a strong dividend, but they’ve only been increasing it for 15 years.

Or, maybe they’re not even in the S&P 500! I mean, there are only 500 companies that make up that criteria after all…

But alas, let’s talk about A.O. Smith. AOS was recently added to the Dividend Aristocrats list in 2018 and they have had an extremely strong period of increasing dividend growth.

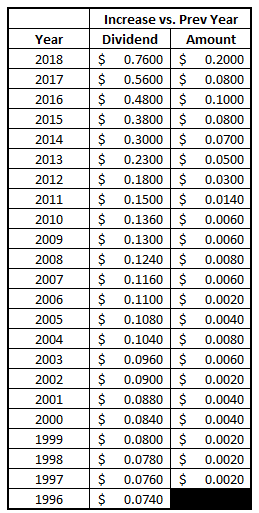

I’ve laid out their annual dividend payments by year below:

Not too shabby, right? As you can see in the last column, they have raised their dividend every single year since they started paying a dividend in 1996.

That is an extremely strong track record. But, this doesn’t really tell the whole story if you really think about it. Take a look:

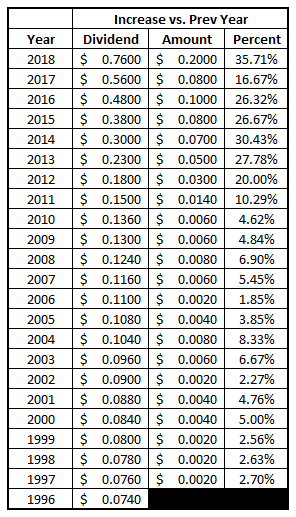

When I add in a new column at the end, you can see the percentage jump in dividend payment each year. It’s rapid!

You can see that the dividends are at a slow creep of an increase and then they get out of control as we start to get to the recent years. You can see that the dividend increases all start in the mid 2% ish range and then start to increase into the 5% range or so and then they really start to increase after that.

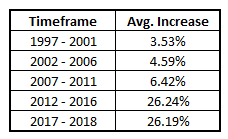

I’ve broken it down into 5-year periods below that will show you the average annual dividend increase during that 5-year period, below:

Note that the last period is only for 2 years but the most recent dividend jump in from 2017 to 2018 was an increase of nearly 36%, so if that type of jump continues, I really like my odds that the dividend is going to keep growing at an extremely high rate into the future as well.

While the Smith dividend is growing at an extremely rapid pace, their payout ratio is still fairly low. I wrote about Payout Ratio in depth in a previous article but the Payout Ratio is essentially telling you what percentage of earnings are being paid out to investors via a dividend payment.

This is a ratio that is very important to know, but it’s also important to know that it can be skewed by things such as stock buybacks.

In my article, I talk about how I think that a very strong payout ratio is in the range of 30-50%. While a payout ratio that’s up around 75% or even higher might seem very desirable, this is very short-term thinking.

If a company’s payout ratio is at 75% and bad things happen, the company now only has 25% of those profits to survive these tough times. For that reason, I think that 30-50% is a perfect range because it gives the company a good range of cash for rough times and to fund growth as well as paying out a strong dividend to their investors.

Buy why am I even bringing this up? Well, because the AOS dividend is at 33.73%, or right there in the low-end of what I think is a really strong payout. History shows that they’ve stayed right in the 25-30% range so if their dividends paid are picking up, there earnings have to be picking up as well.

I oftentimes have talked about dividends and how they shouldn’t be used as the end all, be all to purchase a stock, and I still 100% feel that way. A dividend can be a prerequisite, or maybe a tiebreaker, or whatever term you think is appropriate when deciding to buy that stock, but it should simply be one of many factors and not just the only one.

Andrew has talked in the past about a really cool calculator that can show you how if you invested X amount at a certain time, and DRIP’ed your investments, how that investment would look now… I decided to do this with AOS just for the heck of it.

If you invested $2500 on 1/1/1996, your $2500 investment would now be worth $528,267 for an average annual return of 25.28%. WOW! I wish I had done that.

Andrew and Dave really try to hit home that this is the type of company that they’re trying to look for when they’re investing in a company. You can listen to the entire episode about Dividend Aristocrats below.

They particularly said in that podcast episode that maybe you won’t find the next dividend aristocrat from day one, but you can find them when they’re in year 10 of this 25+ years of growing dividends.

But I challenge you on this – is AOS simply the next Dividend King, where as they have 50+ years of growing dividends and they’re only in year 27? Maybe you’re 27 years late, or…

Maybe you’re 23 years early.

Related posts:

- CSCO Dividend – Will its Rising Dividend Make it a Future Aristocrat? Cisco (CSCO) implemented their first dividend back in April of 2011, which really isn’t that long ago if you really think about it. Back then,...

- Realty Income (O) Dividend History: Monthly Income, Long Track Record Realty Income Co (O) is a company that has a really strong focus on providing dividend value to their shareholders, and honestly, I see the...

- A Look Through Johnson & Johnson (JNJ) Dividend History Johnson & Johnson (JNJ) has been increasing their dividend for many, many years! In fact, that have increased it for 57 consecutive years, and as...

- A Look Through 3M (MMM) Dividend History If you’ve been following my posts at all, you probably see that I cover a lot of different topics, so it should be of absolutely...