I don’t normally spend an entire blog post just talking about a certain company or ETF, but I am making an exception to the rule to talk about this specific ETF. I have heard A TON of news about it lately and you all know me – I’m not one to just buy-in without doing some research myself, so let’s take a deep dive into the ARKK stock holdings!

ARKK is the ticker symbol for the ARK Innovation ETF that is headed up by Cathie Wood. She has been getting a lot of hype lately as the CEO and CIO of ARK Investment Management LLC and was even named the best stock picker of 2020 by Bloomberg – some pretty high praise if you ask me.

Cathie Wood has quite an extensive career in the investing world at various different companies and even played a pretty major role in convincing Elon Musk to keep Tesla private, after his infamous tweet debating whether the company should go back private.

In December 2020, ARKK became the largest actively managed ETF, and it’s really just the beginning. Just one month later, ARK Investment Management created a Space ETF under the ticker of ARKX.

Long story short – Cathie Wood has a very extensive background and is a person that likes to take risks on new, up and coming companies. I 100% understand why this ETF grew to be the largest actively traded ETF, because the companies that she invests in are the same ones that retail investors tend to fall in love with.

ARKK was described by an analyst as:

“The recently launched ARKK follows an active “all of the above” approach. The fund combines the strategies of the three other thematic funds issued by ARK: genomic revolution, industrial innovation and Web x.0. ARKK is full of cutting-edge—maybe bleeding-edge—firms ripped from the headlines, like Tesla Motors, Intuitive Surgical and Alibaba. However, the fund’s mandate seems to be so broad as to include nearly any company that might benefit from new technologies, even Disney and Charles Schwab. ARKK can’t be called cheap but is on par with some other niche ETFs.”

It’s the companies that are always talked about on CNBC, trending on Twitter and heard about on various podcasts, so people view buying into ARKK as a way to potentially hedge their bets among various companies and also get a small piece of a ton of companies.

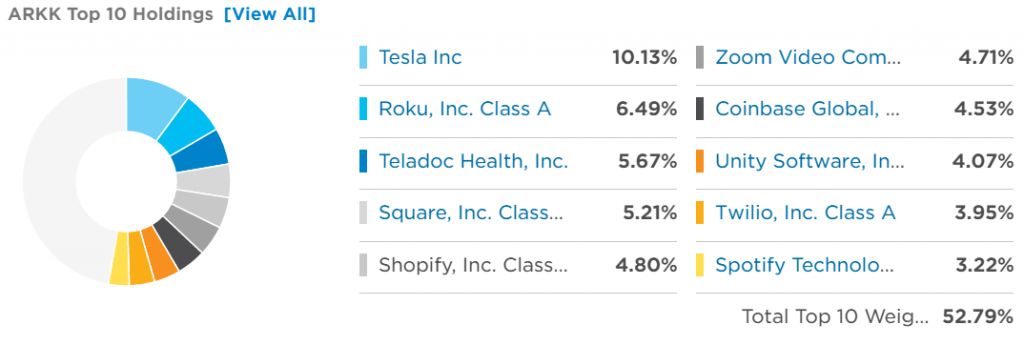

For instance, below are their top 10 holdings as of 8/4/2021:

A lot of these names are all of those super trendy companies that people love to talk about so honestly, I am not surprised at all that it has such a large following of money and is the largest actively traded ETF.

That screenshot above is from ETF.com, and you have the ability to actually view every single holding that the ETF has which I think is super cool.

One day I was listening to Fast Money on CNBC and I heard them talk about how amazing the ETF did in 2020 as it returned 170% to their shareholders. I mean, yeah – that is absolutely insane, but skeptical Andy wasn’t just taking it for face value.

You know me – I had to dive in a bit deeper.

The first thing that I instantly noticed at that time was that Tesla was the largest stock holding at like 12%. Well, Tesla was up over 700% at that time so sure, that certainly is going to help out quite a bit in making the total ETF look like a homerun.

But just because ARKK crushed it with their Tesla pick doesn’t mean that it’s been a successful company forever, so I dug into some of their annual returns a little bit more.

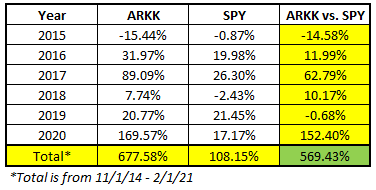

The ETF started in November of 2014 and in it’s first full calendar year in 2015, the ETF was down 15.44% while SPY, an ETF that mimics the S&P 500, was only down -0.87%. Personally, I would’ve likely bowed out at that point in time with pure terror of how bad the underperformance was.

That would’ve been a massive mistake!

Since then, ARKK has absolutely crushed SPY in all but 2019 where it was essentially flat for all intents and purposes.

Take a look below at those annual returns:

DANG! Isn’t that just absolutely freaking nuts? Of course, it’s extremely easy to sit there and look at the total return and just have your mind absolutely blown, but I like to get a little bit more in the weeds and think a few steps past that.

The first thing that I want I always like to focus on is the outliers. Warren Buffett has famously said that the first rule of investing is to not lose money – well, that’s exactly what happened in 2015 with this ETF.

I can’t exactly just write that off being the first year, but losing 15% in a year is a pretty significant amount when the S&P 500 was essentially flat.

On the other hand, I also like to key in on the massive outperformance. In 2020 you see that they just went bonkers with their returns. Now as I mentioned, Tesla was up 700% in 2020 and Roku certainly held their own being up 225%, going from $120/share to $389 by the end of the year.

So, if 20% of your ETF is up that much, of course you’re going to see some incredible returns. It’s not fair for me to just discount that because the ETF obviously had the foresight to grow massive positions in both of those companies and reward their shareholders, but is it repeatable? Maybe, maybe not. Too early to tell.

But the reassuring thing is that they also have had a 90% year in 2017 when the S&P was up 26%, an outperformance of 63%.

Along with that, they’ve had two other periods where they outperformed the S&P 500 by over 10%. Not going to lie – that’s incredible. I could only dream about having that sort of outperformance vs. the benchmark.

While it’s great that ARKK is clearly outperforming against the S&P 500, I am a little bit skeptical of the repeatability of doing something like this. One word that I think is really important for people to have is perspective.

Perspective is taking a larger look at the overarching themes or what is going on in the world.

It’s very important for people to remember is that we have been in a decade+ long bull market. So, when you have an ETF that is solely focused on getting these mega-growth companies like Tesla, ROKU, Teladoc, Invitae, etc. – you should see some massive outperformance.

It seems pretty common sense to think that if growth is doing extremely well vs. value, and that’s definitely not always the case, then an ETF that focuses heavily on the top growth performers is likely going to do extremely well.

On the other hand, what if things start to turn?

What if this long bull market peaks and we see a flat or down market over a couple years? It seems like a logical scenario that these growth names that have run up are going to probably pull back a little bit harder and faster than some of the value companies, right?

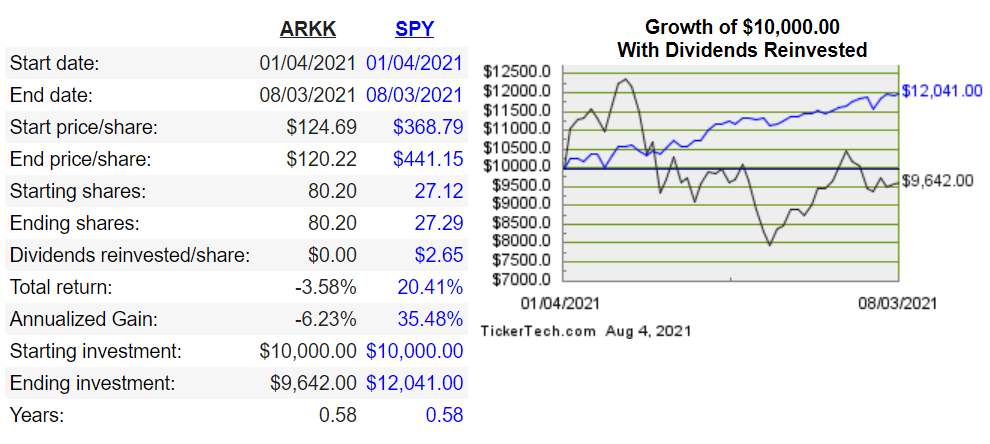

In fact, this very scenario is one that we’re seeing play out in 2021. Take a look at ARKK vs. SPY:

Pretty intereting right? ARKK has actually lost money thru 8/3/21 while SPY is up over 20%! Now, there are still five months in the year and regardless, it’s important to look at stocks and ETFs on a longer timeperiod than just a year, but it’s important to see how this ETF performs in a period of scary growth.

But, let’s keep on going with our analysis and take a look at the dividends of ARKK and then an S&P 500 ETF like SPY.

After all, the total yield is price share return + dividend yield, so it’s imperative that you get a well-rounded picture when comparing the two.

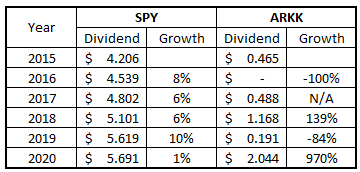

Take a look at the annual dividend performance since 2015 for SPY and ARKK:

This is the normal type of simplistic analysis that I perform when I am comparing two different dividends, but you’ll notice that there’s a pretty major error – ARKK didn’t have a dividend in 2016! So that really kills some of the comparative pieces that I like to use when I am simply just measuring dividends.

Now, one way to overlook that is to just compare the total dividend growth by the two ETFs and in that case, ARKK absolutely dominates.

The total dividend growth for ARKK from 2015 to 2020 was 340% while SPY was just 35%. Now, 35% isn’t like some pitiful amount of growth for SPY to produce, but 340% is absolutely insane.

But again, we can’t just make a decision of where to invest off of past dividend performance – this is again where we need the entire picture!

Now, I could go through Excel and track all of the different prices and dividends and then make them reinvest in each other to see which would perform better, or…I could just go to the Dividend Channel where I can simply enter two different tickers and compare them to one another throughout history.

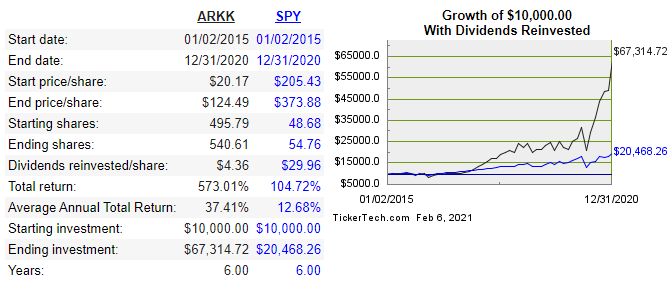

I chose to work smart, not hard, and now you can see the results of comparing $10K invested in SPY and ARKK below:

ARKK jumped out to an early lead, but then the two ETFs were somewhat flat until the past year or so. You can see that there has been a ton of volatility in ARKK which makes a ton of sense if you’re investing in a super risky growth ETF. You’re basically going for knockout punches so I’d expect to get some knockout punches right back.

Now, again, this is all great but it’s been during a period where growth has really outperformed. I am extremely curious what ARKK is going to do when the market turns and things inevitably pullback and go lower.

One thing that I found extremely cool is that ARK Investment Management LLC is very transparent with their trades. You can sign up to see the trades that ARK makes during the day by simply inputting your name and email in at their website.

Not going to lie – it’s a bit overwhelming. Like, they do probably 50+ trades each day among their actively managed ETFs. But I think it’s interesting at a quick glance to see what moves they’re making.

Now, hopefully you’re not going to go out and do anything crazy with this information when you see that ARK is making a trade for one of their actively managed ETFs, but it might give you a bit of a peak behind the curtain to see what sort of moves they are making with their investments.

Again, it’s just one piece of information but I really like the transparency that they’re providing.

If you want to see all of the ARKK holdings, or even all of the holdings for all of the ARK ETFs as a whole, you can easily find this information by going to Cathie’s Ark.

You’re likely not going to be able to draw any major conclusions from looking at the total list of companies other than saying, “Dang, these are some high risk, high reward stocks!”

I do love that this ETF is extremely speculative and seems very risky, which fits very well into my investing strategy because I am a young investor that looks for a lot of risk.

I also realize that the money that I put into ARKK certainly could drop in a downturn, and likely way more than the market itself as we saw in 2015, so it’s making me be a little bit hesitant.

Truthfully, I might think a little bit more on ARKK before investing in it because I personally think the market is a little bit frothy. I wouldn’t be shocked at all if the market dipped, so I have been decreasing some of my speculative positions in hopes to avoid a major drop if the market does dip.

Not that I am timing the market but merely just trying to be aware of the situation that we are in. Investing in ARKK could be a great way for me to keep some upside with various growth companies and still staying somewhat safe by having it in an ETF.

The one thing that I am fearful of, though, is how ARKK is going to do in a major downturn. That really does scare me a lot because we haven’t seen it yet. The closest we saw was when the S&P was down 1% and ARKK was down 15%…. ouch.

For that reason, my #1 ETF is still MTUM. Not only has it historically outperformed in the good years but also in the bad years. As an investor, what else could you want beyond total domination?

Related posts:

- Using Motif Investing to Build a Great Dividend Portfolio Motif Investing isn’t just a great tool for saving money investing but it can also help you find the best stocks for your needs. This...

- Succeed with Dividend Growth Investing by Analyzing a Stock’s Growth In a recent episode of the Investing for Beginners Podcast, Andrew and Dave broke down how to analyze a stock’s potential by using dividend growth...

- 3x ETF = 3x Gains? Evaluating the UPRO Stock Price History I’ve found myself going down a bit of a rabbit hole lately with some of these leveraged ETFs and it’s really been taking up a...

- Does Tesla Pay Dividends? Updated – 10/16/23 One question that I think is imperative that any investor knows the answer to is whether or not the company that they’re...