Asymmetric investing performance simply means that your gains are bigger than losses. For example, an investment that could gain 300% or more, but can only lose at most -100%, is an asymmetric opportunity.

The truth is, ALL investors in the stock market can receive asymmetric results over the long term because the potential upside of buying a stock is unlimited, while the downside is at most -100%.

But not all investors achieve asymmetric results.

And in fact, if you’re buying individual stocks, and your performance compared to the stock market average is not asymmetric, you are not succeeding as an active investor. The legendary Howard Marks of Oaktree Capital Management has some great thoughts we will unpack about that.

In this article, we will discuss [Click to Skip Ahead]:

- Asymmetric Investing and the Stock Market

- Stock Market Returns That Aren’t Asymmetric

- Asymmetric Risks in Investing

- Asymmetry and Stock Market Outperformance

- Lessons For Long Term Investors

Let’s start with some basics about asymmetry, the stock market, and investors.

Asymmetric Investing and the Stock Market

Look to the historical track record of the stock market to understand asymmetric performance.

We have to go back to the basics, and combine logic with this history.

A share of stock represents part ownership of a business. As a part ownership stake, a share of stock entitles the holder to a part of a business’s cash flows, now or in the future.

The worst case scenario of part ownership of a business is the business going bankrupt. At that point, the share of stock is worth nothing.

But the other possible scenarios of owning a share of stock is that a business flourishes and continues to grow. In that case, the value of the ownership stake is increasing, because the value of the business itself is increasing. So, the price of the share of stock is also increasing.

Where the stock market can deviate from these basics is in its volatility.

Because these shares of stock can be traded publicly 5 days a week, its prices can move up or down, independently of the actual value of the business.

However, over the long term, the price of the share of stock follows the value of the business.

And that’s where history kicks in. Over the last 10+ decades, the stock market has averaged a 10% return per year. In about 7 years, that return compounds to a +100% gain (double in value). So after 7 years, the average return to a long term investor becomes asymmetric.

This is the key.

Any investor can receive asymmetric returns by just buying and holding the stock market over the long term (through an index fund such as an S&P 500 ETF).

This is because the stock market represents part ownership of many of the businesses in the economy. The economy continues to grow over time. Stock prices follow that growth over the long term.

Stock Market Returns That Aren’t Asymmetric

That’s the theory. In practice, investors can shoot themselves in the foot many ways and fail to achieve asymmetric investing performance.

One easy example of this is buying and selling too frequently.

While a stock price follows the value of a business over the long term, it deviates greatly in the short term. In fact, I saw a shocking statistic recently…

Data suggests that something like 70% of a stock’s one year performance is due to changes in its multiple.

Translating that simply: how a stock trades in the short term is based on emotion. It has little to do with the value of the business.

But when you look at multi-year periods, the impact of emotion on a stock’s price lessens.

If you graph the long term results of a company’s EPS (earnings per share) and its stock price, you will see almost perfect correlations much of the time. In general, the farther you zoom out (10 years or more), the greater this correlation.

The emotions around a stock price can be independent from the value of the business in many ways:

- Prices can move based on expectations of the economy

- Prices can move based on expectations of inflation

- Prices can move based on expectations of its industry

- Prices can move based on the movements of interest rates

- Recent price trends can be reinforcing, on both the up and down side

- Prices can move based on popularity, media coverage, or public perception

- Prices can move because of a whale (big investor)

We could go on and on, but this reality of stock prices in the short term is what can trip up lots of investors seeking asymmetric return.

If you are trading in the short term, you do not have the same, natural asymmetry that long term investors have.

Because there are so many factors in the short term (see above), versus one for the long term (business growth).

Asymmetric Risks in Investing

There are many ways to flip asymmetry in the stock market, and investors have tried all of them.

In the pursuit of higher return, there can be many ways to take higher risk.

An obvious one would be the use of options. While many investors will simply buy and hold stocks, you can also take the reverse bet by short selling. And options allow this, and magnify it.

Options are another way to use leverage in your stock market trading.

Leverage is the use of debt, which can amplify return because it allows you to put more money at stake than you have. It can also amplify risk, for that same reason.

And using leverage to go long (buy and hold) stocks does not amplify the asymmetric returns, but in-fact creates asymmetric risks.

When you use leverage (“margin”), you must do two things:

- Pay interest on the borrowed money

- Put up collateral on the borrowed money

Collateral helps reduce risk for the broker who is lending you the money. If a stock moves against you, you must put in more collateral (“margin call”). A margin call could continue happening, with no limit to its requirements compared to your initial investment.

When you are able to lose more than your initial investment, you have asymmetric risk.

And by using margin, or selling options, you are exposing yourself to the risk of losing more than your initial investment.

So while you have a theoretical unlimited gain potential, you also have a theoretical unlimited loss potential.

That’s not the same as the asymmetric return potential of simply buying and holding stocks for the long term.

Which is a simple explanation for why simply buying and holding stocks is the best decision an investor can make.

Asymmetry and Stock Market Outperformance

Many investors are tempted to attain stock market results which are better than the average.

This is known as active management.

An active manager who is skilled at what they do is able to “alpha,” which is the difference between his/her returns and the average stock market return.

Howard Marks has been a successful active investor for over 40 years.

Marks wrote a fantastic memo called What Really Matters? which covered the short term volatility of the stock market, and asymmetry. It’s a great read and I encourage aspiring active investors to check it out.

In this piece, Marks argued that an active manager should be evaluated based on whether they achieve asymmetric alpha or not, and that they should be judged based on their investing style, and how asymmetric their results in both “good” and “bad” times (bull and bear markets) are.

To define a “style” means evaluating whether a strategy is biased towards aggressiveness or defensiveness.

In Mark’s view, an investor with an aggressive style should be able to easily outperform the stock market when there is a strong bull market. And on the flip side, a defensive investor should easily outperform the market during a bear market.

Where the asymmetry, and true alpha, comes in… is actually how the manager does in the opposite setting.

In other words, how much the aggressive investor underperforms during a bear market, and how much the defensive investor underperforms during a bull.

He sums it up nicely:

“In sum, asymmetry shows up in a manager’s ability to do very well when things go his way and not too bad when they don’t.”

Basically, evaluating an active manager requires measuring if their results are asymmetric. If you take the average between the performance in good times and bad, it should be better than the market.

The problem is that many active managers are praised without thinking of this asymmetry.

They are praised based on shorter term, rather than longer term, performance.

It is the active managers who were the most aggressive during a bull market which are most revered. And since bull markets can last for 10, 15 years or longer, the aggressive managers with great 5, 10, or 15 year track records can have their actual skill evaluated poorly.

Marks explains it in this way,

“A great adage says, ‘Never confuse brains and a bull market.’ Managers with the skill needed to produce asymmetry are special because they’re able to fashion good gains from sources other than market advances.”

It may seem to a beginner investor that aggressiveness is the way to go if the market seems to always be in a bull market.

But I’d caution investors who don’t understand the history of the stock market to reconsider.

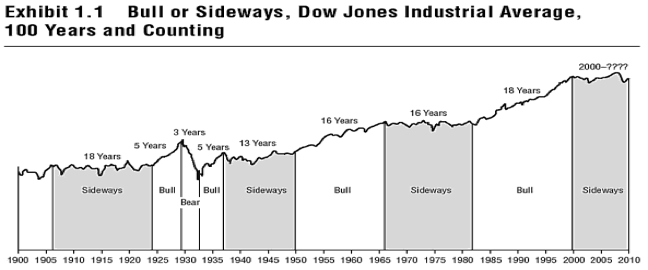

Another value investing thought leader, Vitaliy Katsenelson, had an excellent chart of the stock market spanning back to 1900.

While we think of the stock market as long bull markets and short bear markets, Vitaliy showed in his book that the market actually fluctuates between long bull markets and long sideways markets.

See this chart:

It’s clear when presented in that way that the stock market has had 13-18 year periods of sideways markets. And it’s in those sideways markets that defensive investors should outperform the market.

So if we see defensive investors applauded after 10 years of a sideways market, we should treat those accolades with the same reservation as we do for aggressive investors during a bull market.

This makes the game of investing hard.

Lessons For Long Term Investors

Marks concluded with the following,

“When you think about it, the active investment business is, at its heart, completely about asymmetry. If a manager’s performance doesn’t exceed what can be explained by market returns and his relative risk posture – which stems from his choice of market sector, tactics, and level of aggressiveness – he simply hasn’t earned his fees.”

Investing is really such an expansive game.

The amount of money that goes into investing, and the fees generated from the moving around of this money, is truly staggering when you learn about it.

And how many of these fee-based active managers are evaluated completely ignores this asymmetric aspect. Or chooses to ignore it.

Learn from the past

Another great historical lesson from this memo was the popularity of hedge funds immediately following the 2000 – 2002 dot com bust in the market.

Hedge funds were simply more defensive, and so many managers had performance that looked excellent over that time period because of that one feature. Hedge funds then went on to underperform the market over the next 15+ year time period.

And now, as I write this at the end of 2022, hedge funds are having their time in the sun again. The market has been brutal YTD, and hedge funds with their defensive positioning have easily outperformed in the same time period.

You wonder if investors really ever learn from real examples like these.

The reality is that we are all naturally impatient. We easily fall to envy, fear, and greed—and this makes our emotions easily suspect to short-term thinking.

Those emotions cloud our perceptions and create biases.

But maybe the silver lining is that these natural biases create opportunities. For the investors who can successfully thwart these short-term tendencies, they can create more and more asymmetric opportunities.

By taking a long term mindset and ignoring the short term noise, an investor can participate in much of what the stock market and economy has to offer.

Isn’t that what it’s all about at the end of the day?

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- The Information Ratio – CFA Level 2 An investor’s Information Ratio is a measure of the Active Return that is being achieved per unit of Active Risk. The Information Ratio is important...

- How to Use Return Attribution to Compare Portfolio Return Being able to attribute the sources of portfolio return is an important aspect in the decision making process surrounding portfolio management. The process of return...

- Beginner’s Guide to Value Investing and Intrinsic Value, From the Top Investors Updated – 12/6/23 Value investing is all about finding stocks trading at a discount to their intrinsic value. Investors have used this strategy for decades...

- How to Use Jensen’s Alpha to Measure True Investor Performance Updated 1/5/2024 Measuring investment returns continues to be something everyone looks to do when investing in the markets. The search for “alpha,” or market-beating investment...