AT&T 10Q Summary First Quarter 2020

AT&T Inc announced its first-quarter earnings on April 20, 2020. What follows is a summary you can read to give you an understanding of the performance of AT&T during the first quarter of 2020.

Financial Metrics:

Current Market Price – $31.38

Current Market Cap – $223.58 B

Earnings per share – $0.63 per share

Revenue – $42.8 B

Net earnings – $4.6 B

Return on Equity – 10.12%

Return on Assets – 3.36%

Return on Invested Captial – 4.6%

Dividends Per Share – $0.52

Overview of Results

AT&T reported first-quarter net income to common stockholders of $4.6 billion, with diluted earnings per share of $0.63. Compared to $4.1 billion and diluted earnings per share of $0.56 in the first quarter of 2019.

First-quarter revenues were $42.8 billion in 2020, which was down 4.6 percent compared to the first quarter of 2019. AT&T attributed the decline in WarnerMedia. The declines were a result of strong theater carryovers, declines in video subscriptions, lower equipment sales as a result of store closing as a result of the Coronavirus pandemic. AT&T reported increases in wireless service revenues and business services, which offset the declines from WarnerMedia.

Operating expenses for the first quarter of $35.3 billion for the first quarter 2020 were down 6.1% primarily from a one-time gain from a spectrum of transactions, also lower cost of revenues in segments Entertainment Group and WarnerMedia. Additionally, there were lower expenses from the wireless equipment costs as a result of lower device sales and cost efficiencies.

First-quarter operating incomes were $7.5 billion, up from $7.2 billion in the same quarter of 2019. AT&T’s operating income margin was 17.5% for the first quarter of 2020, compared to 16.1 percent of the same quarter of 2019.

AT&T reported cash from operating activities of $8.9 billion, which was down $2.2 billion when compared to the same quarter of 2019. AT&T attributes the decline to investments in HBO Max, and a higher WarnerMedia spend in preparation for the release of HBO Max. There was also increasing pressure on business collections as a result of the pandemic.

Capital expenditures were $5 billion in the first quarter of 2020, which increases to $5.8 billion with the additions of $790 million cash paid for vendor financing, no significant FirstNet reimbursements.

AT&T reports its operations in four segments: Communications, Warner Media, Latin America, Xandr

Communications Segment

AT&T Communication segment is broken down into Mobility, Entertainment Group, and Business Wireline.

The first-quarter operating revenues for the segment were $34.2 billion, which was down 2.6% compared to the first quarter of 2019. The segment reported contributions of $8.2 billion, which was up 2.4 percent compared to the previous year’s quarter. The Communications segments operating income margin was 24 percent, which was up compared to 22.8 percent for the year-ago quarter.

Mobility

Mobility reported revenues of $17.4 billion for the first quarter of 2020, which was up 0.2 percent compared to the first quarter of 2019. The increases were driven by higher service revenues resulting from prepaid subscriber gains and postpaid phone average revenue per subscriber growth. Decreased equipment revenues offset the gains as a result of store closures stemming from the Covid19 responses.

Mobility operating expenses totaled $11.6 billion, which was a decrease of 3.7 percent versus the first quarter of 2019. AT&T attributes the decrease to lower postpaid upgrade rates, lower advertising costs, increased efficiencies, all of which were offset by higher bad debt.

Mobility reported an operating income margin of 33.3 percent, an increase from 30.6 percent versus the year-ago quarter.

In the AT&T Mobility business unit during the first quarter, they reported a gain of 3.3 million wireless subscribers. At the end of the quarter, March 31, 2020, AT&T reported a total of $169.2 million wireless subscribers, which was an increase from 154.7 million in subscribers in the first quarter of 2019.

During the first quarter of 2020, AT&T reported total phone adds of 120,000, with the total net, adds by the following subscriber categories:

- Postpaid subscriber net adds were 27,000

- Prepaid subscribers net adds were a loss of 43,000

- Reseller net losses were 190,000

- Connected device net adds they totaled 3.5 million, of which 2.5 million were a direct result of connected cars.

Postpaid churn for phones only was 0.86 percent, versus 0.92 percent in the first quarter of 2019. The total postpaid churn was 1.08 percent, versus 1.16 percent in the previous year-ago quarter.

Entertainment Group

Entertainment reported revenues of $10.5 billion for the first quarter of 2020, which was down 7.2 percent compared to the year-ago quarter. This reflected continued declines in video subscribers, all of which were offset by higher broadband revenues.

Entertainment operating expenses totaled $9.2 billion, which was down 6.8 percent versus the previous year-ago quarter. Entertainment operating income margin was 12.7 percent in the first quarter of 2020, which compared to 13 percent in the first quarter of 2019.

At quarter-end of March 31, 2020, Entertainment revenue connections included:

- Approximately 19.4 million video connections at quarters end, which included 788,000 AT&T TV Now subscribers, which compared to 23.9 total subscribers from the previous year’s quarter. During the first quarter of 2020, Entertainment saw net losses of premium TV subscribers of 897,000, and AT&T TV NOW saw losses of 138,000

- Broadband connections for the first quarter of 2020 were approximately 14 million compared to 14.5 million of the year-ago year. During the first quarter, net losses for IP broadband subscribers were 44,000, with 13.6 billion subscribers at quarters end.

Business Wireline

The Business Wireline reported revenues of $6.3 billion for the first quarter of 2020. A decline of 2.3 percent compared to the year-ago quarter. The declines continue in legacy services, which was partially offset by growth in strategic and managed services.

Business operating expenses totaled $5.3 billion, which was flat when compared to the first quarter of 2019. Operating income margin for Business was 17.1 percent, which was down from 18.9 percent versus the previous year-ago quarter.

At quarter-end of March 31, 2020, AT&T totaled switch access lines ( Entertainment and Business ) was 8.2 billion, which was down compared to 9.6 billion at quarter-end March 2019. The number of U-verse voice connections saw a decrease of 156,000 in the quarter, which included 4.2 million at quarter-end, compared to 4.9 million in the previous year-ago quarter.

Warner Media

AT&Ts WarnerMedia segment consists of Turner, HBO, and Warner Bros. The segment reported first-quarter operating revenues of $7.4 billion, which were down 12.2 percent compared to the first quarter of 2019. The segment operating contribution of $1.7 billion, comparatively down 25.8 percent versus the previous year’s quarter. The WarnerMedia segment reported operating income margins of 23.1 percent versus 26.8 percent from the year-ago quarter.

Turner

Turner reported revenues of $3.2 billion in the first quarter of 2020, which down 8.2 percent versus the previous year-ago quarter. The declines were attributed to the decline in advertising revenues from the cancelations of the NCAA Tournament Basketball Tournament. Turner reported increases in subscription revenues, which helped offset the decline in ad revenues.

Turner’s operating expenses were $1.8 billion for the quarter, down 19 percent compared to the previous year-ago quarter. The decline was attributed to lower programming and marketing expenses.

The segment reported an operating income margin of 43.7 percent versus 36.2 percent from the previous quarter.

HBO

HBO reported revenues for the first-qaurter of 2020 of $1.5 billion, which was down 0.9 percent compared to the previous year-ago. The decline was attributed to a decrease in content and other revenues from lower content licensing. HBO reported flat subscription revenues for the quarter.

Operating expenses were up 13.9 percent for a total of $1.1 billion, versus the year-ago quarter. HBO reported an operating income margin of 28.3 percent, compared to 37.5 percent from the previous year’s quarter.

Warner Bros.

Warner Bros reported revenues of $3.2 billion, which were down 7.9 percent compared with the first quarter of 2019. Unfavorable comparisons drove the decline to the previous quarter, which included carryover revenues from Aquaman and a more favorable mix of home entertainment releases.

Warner Bros’ operating expenses were up 0.7 percent to total $3 billion compared to the first quarter of 2019. This was due in large part to higher bad debt reserves. The segment reported operating income margins of 7.7 percent versus 15.5 percent from the previous year’s quarter.

Latin America

AT&T’s Latin American segments consists of the Mexico and Vrio units. The first-quarter 2020 operating revenues were $1.6 billion, which was down 7.5 percent from the previous year’s quarter. The segment contributed ($184) million, compared to ($173) million in the previous quarter. Both operating revenues and contributions were driven down by currency exchange pressures. The operating income margin was (11.8) percent for the quarter, down from the previous year’s quarter of (10.1) percent.

Mexico

The Mexico wireless revenues were $703 million, which was an increase of 8 percent when compared to the year-ago quarter. Operating expenses were down 0.9 percent for a total of $848 million, and the operating income margin was (20.6) percent, versus (31.5) percent from the year-ago quarter.

The segment reported approximately 19.2 million subscribers at quarters end, which was up from the previous total of 17.7 at quarters end 2019. The segment also had prepaid net adds of 108,000 with postpaid net losses of 141,000.

Vrio

Vrio video service revenues for the quarter were $887 million, which was down 16.9 percent from the previous year. Operating expenses reported as $930 billion, down 10.1 percent. Both Vrio’s operating revenue and expense declines were a result of currency exchange pressures. The operating income margin for Vrio was (4.8) percent, versus 3 percent from the year-ago quarter.

Vrio had approximately 13.2 million Latin American video connections, down from the 13.5 million connections from the quarter end of 2019. The unit also experienced video net losses of 114,000 for the quarter.

Xandr

The Xandr segment provides advertising services from data insights to develop more targeted advertising. There is a crossover of revenues reported by the Communication segment, and those data have been removed.

The segment reported revenues of $489 million, which was an increase of 14.8 versus the previous year-ago quarter. Operating expenses were up 9.8 percent for a total of $190 million. The segment’s contribution was $299 million for the quarters end, up 18.2 versus the previous year-ago quarter. Xandr’s operating income margin was 61.1 percent for the quarter, compared to 59.4 percent from the previous year’s quarter.

Other Matters

AT&T maintained its quarterly dividend from the previous quarter of 2019 at $0.52 with no indications of a stoppage or reduction in the upcoming quarters.

The company announced the cancelation for the time being of the share repurchase program in light of the Covid-19 pandemic. AT&T did complete share repurchases of 141 million shares for $5.3 billion in the first quarter of 2020.

The company has also withdrawn any financial guidance for the rest of the year due to the fluidity caused by the Covid-19 pandemic.

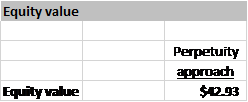

Valuation

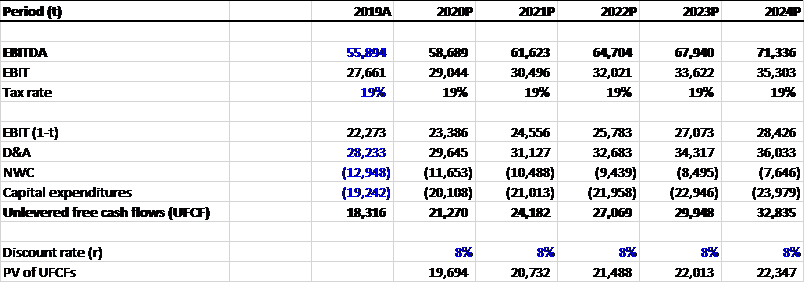

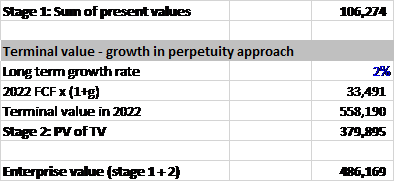

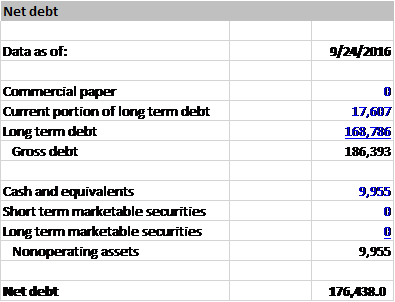

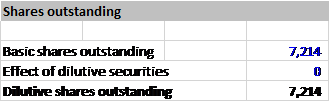

Based on the end of the quarter data and TTM (trailing twelve months) data, I will provide everyone with a valuation based on a discounted cash flow model.

The valuation is not meant as a buy target but rather as a price point compared to the current market conditions as they exist today.

Final Thoughts

That wraps up our summary of the first quarter 10Q for AT&T. The summary is not meant as a recommendation to buy or sell shares of AT&T and is meant as an educational resource.

As with any company, please do your due diligence when deciding to buy or sell any shares of AT&T.

Thanks for reading, and have a great day.

Related posts:

- Berkshire Hathaway 10Q Summary First Quarter 2020 Berkshire Hathaway reported its first-quarter earnings on May 2, 2020. This report is a summary of those first-quarter results and will not attempt any analysis...

- Prudential (PRU) 1st Quarter 2020 10Q Summary Prudential (PRU) 1st Quarter 2020 10Q Summary Prudential Financial Inc announced its first-quarter 2020 results on May 5, 2020. The quarter was as expected, given...

- Verizon (VZ) 10Q Summary First Quarter 2020 Verizon released its first-quarter earnings on April 24, 2020. In this post, we will discuss a summary of those results. Financial Metrics: Market Cap –...

- Wells Fargo (WFC) 10Q Summary First Quarter 2020 Wells Fargo 1Q20 Summary Wells Fargo reported its first-quarter earnings on April 14, 2020. What follows is a summary of the bank’s results for the...