Updated 4/1/2024

One of the most challenging steps to becoming financially independent is getting that little snowball moving downhill by creating a gap between your income and spending.

Once you’ve done that, it’s time to go on to the fun part – investing! And by far, the best way to keep up the momentum with your goals is to set up some auto-investments.

Click to jump to a section:

- What Do I Mean By Auto-Investments?

- Retirement Accounts

- Other Investment Accounts

- Savings Accounts

- Bills and Expenses

What Do I Mean By Auto-Investments?

Now, I don’t mean investing in your automobile because, let’s be honest – that might be one of the worst investments you can make. Sure, you obviously have to spend some money on basic upkeep like tires, oil changes, and brakes, but you can save for that with a sinking fund. And guess what? That can be an auto-investment as well!

As with anything in life, the word automatic means that you’re taking some sort of process that used to be manual or required some sort of attention and you’re utilizing systems to complete the task without any input from you.

Let’s continue with the car analogy—a manual car requires you to press the clutch and shift as you want to change gears, while an automatic car allows you to press the pedal to the metal!

An automatic car is better than a manual, right? Well, not always…

A manual is better if you’re racing because you have more control over getting your car to accelerate the way you want it to. Driving a manual is generally more fun when you’re going on a joy ride.

My first car was a Hyundai Tiburon that I saved up for and bought out of pocket. I thought I was the coolest high schooler ever driving my 6-speed, manual, yellow Tiburon.

I did truly love driving that car around just for fun, but things changed. Now I am old, have a wife and son, and when I’m driving, the last thing I want to do is something I don’t have to do. Sign me up for a boring ol’ white Nissan Sentra with an automatic transmission. The less that I have to do, the better. Now I get my fun by zoning out, and the family falls asleep while I sit in silence!

Times Change

“Andy, what the heck are you even talking about?”

I’m saying that things change, and people are different! You might want something now and not want it later, and guess what? That applies to auto-investments as well. But first, what am I even talking about when I say auto-investments?

What would you do if you wanted to invest $100 in your investments right now? You’d have to go to your brokerage firm, transfer the money into your account, and select your stocks, right?

An auto-investment is quite literally automating that money. For instance, you can set up a certain amount of funds to transfer into your account on a certain day of each month. It takes all the hassle out of it and also takes out the ability for you to forget to do it.

But do you know what else auto-investments help with? They remove 99% of the likelihood that you’re not going to invest that money. If you know that according to your budget, you have $500 left over at the end of every month, and you auto-invest that money, then it’ll just show up there on the date you specify.

But if you don’t auto-invest it, you might get to the end of the month, see that $500 sitting there, and decide it’s time to go on a quick trip for a long weekend. Sure, that trip would be great, but that’s instant gratification and does nothing but hurt your future.

And it hurts your future…a lot. Because compound interest relies so much on time the earlier you can start investing, no matter your income, the better off you are.

Long story short, auto-investing is an absolutely amazing way to force your hand into getting money into your investment accounts and saving for the future. But what are the best methods to do this?

Retirement Accounts

Retirement Accounts like a 401k and IRA are, by far, the best way to do this. First and foremost, the example I gave above about having pressure not to transfer funds will be even more prevalent in your retirement accounts. Would you rather spend that $500 now or save it for 30 years?

“I might not even be alive in 30 years! I’m going to spend it now and live life today how I want.” I hear this so many times and while I completely understand it, it also makes me extremely sad. So many people nowadays are all or nothing with this mindset of “live for today” or “save for tomorrow,” but guess what – money isn’t an either/or game! You can do both!

Obviously, I’d prefer you find a way to cut out some things you don’t care about, so maybe you have $700 at the end of the month, and you can put $500 in retirement and splurge with the other $200, but that’s not always possible.

So, save $350 and spend $150. You have to find the perfect balance that works for you, but the key is to find out exactly what that balance is BEFORE you are at the decision point because otherwise, you’re going to decide to spend it all. That’s precisely what I would do, so I auto-invest into my retirement accounts.

401k’s and 403b’s

The other main reason pertains specifically to your 401k or 403b.

A 401k can only be contributed to if it comes directly out of your paycheck from your employer. So, if you decided at the end of the year you wanted to add some extra money to your 401k, you wouldn’t have the option to do that out of pocket. Let me give you an example.

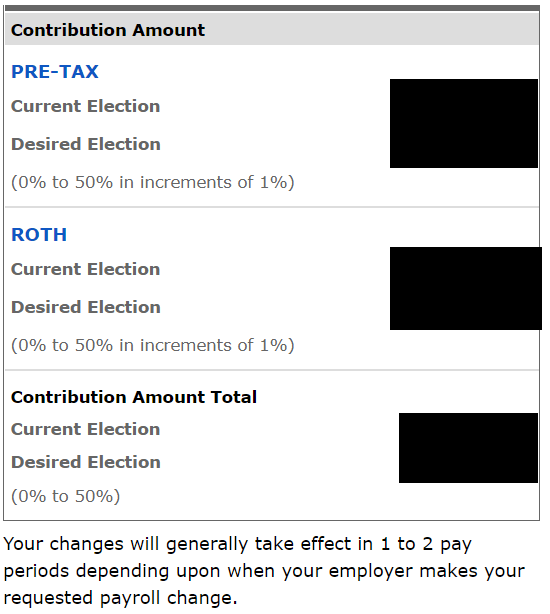

It’s December, and you realize that you will have an extra $2K that you want to put in your 401k – awesome! You can’t do this directly from your bank account, so instead, you change your 401k contributions so that you have two paychecks in December equates to putting $2K into your 401k just as you can see a screenshot from Fidelity below:

Great plan! Except for one thing…

Notice that little piece at the end that says it’ll take into account in “1 to 2 pay periods depending upon when your employer makes your requested payroll change.” That can very well mean your payroll change isn’t updated until January. Or, maybe in December but after your last paycheck. What does this mean?

You’re SOL!

There’s nothing you can do. Instead, consistent auto-investment will allow you to continue contributing to your 401k and avoid this scenario. By planning with a budget calendar, you can try to identify if you’ll have any extra cash in December earlier in the Fall, allowing you to up your contributions a bit sooner rather than later!

Additionally, many employers offer a 401k match that you can take advantage of, but this is typically paid out per paycheck. So, if you get a 5% match, that’s 5% of every paycheck rather than 5% of the entire year. In other words, you need to ensure you’re contributing at least 5% every paycheck to max out the match.

Trying to make up for lost time by contributing 10% in other months won’t do it—the employer will still only put in 5%. And never, ever, ever decide not to take the match at least. It’s even more important than paying off extra on any debt that you might have!

Don’t believe me? Check the math yourself!

Other Investment Accounts

This section can include accounts like an HSA, brokerage account, and even a 529 that you might be using to save money for higher education for yourself or a loved one.

To me, saving money in an HSA is the #2 best retirement move behind maxing out your 401k because it’s so incredibly versatile as a tool and can have a tax advantage going in and coming out – something no other retirement account has. Therefore, I max it out yearly ahead of anything else in my savings plan.

Now, that doesn’t mean I’ll deposit the full $7300 (as of 2022) into the account. Instead, I’ll divide up exactly what I need to put in each paycheck and do it piece by piece throughout the year. Straight out of my check, it goes straight into my investments, and I never think about it.

529 is the exact same thing – take how much I want to save that year, divide it by how many paychecks I have, and then put that amount into an auto-investment and move on with my life. Literally 5 minutes of time in early January and I’m done with it for the year.

My brokerage account is a bit more in-depth just because I will have to invest my money after it’s in the account. Remember how I said that I would spend money if it’s in my account? Well, to eliminate that, I don’t let it hit my account.

For every single paycheck, I have $150 automatically pulled from my paycheck and put into the brokerage account. Then I log in to my brokerage and purchase shares of the month’s stock.

What is the stock of the month, you ask? Well, that’s based on what Andrew identifies in his eLetter, but again, that’s the most auto-investment method that you can have!

Savings Accounts

It’s the same for my savings account. Take the money straight out and put it straight into the savings account. All you do, again, is send your savings account info to your HR/Payroll and that money pulls out of every single paycheck when it’s time to get paid. I use this for various things such as my emergency fund, rainy day fund, and of course all of my sinking funds.

I like using Ally because I can bucket my money however I want. So if I put in $200, I can then go divvy that cash into each fund so I know exactly what purpose that money has.

Bills and Expenses

This is the fourth and debatably the most important auto-investment you can have. Set up any fixed expense to have that amount paid off every single month, on the same day, for the same amount, and track it using a budget calendar so you know exactly what’s coming out and you can plan around it.

“Andy, paying off debt isn’t an investment”.

Yes, it 100% is. It’s an investment in your finances, financial freedom, and ability to do better things in the future because you’re not weighed down by debt. Not to mention, every time you pay off any sort of debt, you’re gaining some return by not having to pay that interest anymore.

Having your fixed expenses set to autopay is a fantastic way to ensure that you’re moving towards financial freedom without thinking about it.

What about variable expenses? I HATE having them set up automatically. Repaying a $500 credit card is an awful decision, in my opinion. You might not have the money in your account and get hit with a charge from your bank, or even worse, you might pay $500 but have a $1000 balance and then get back in debt and start paying those interest charges again.

Anything that changes month to month shouldn’t be set up automatically. It will do more harm than good.

Hopefully, you can see the value in having auto-investments set to pull from your account and get you closer to FI. The beauty is that they take a minimal time investment in the beginning, and then you can just let it coast. Once you are already auto-investing $100/month, the jump to $125, $150, $250, and so on will seem very easy, especially if you prioritize it when you get raises.

That is the key to Financial Independence – let your savings rate compound to increase the compounding of your investments tenfold!

Related posts:

- Sure I Save Taxes, but is the 401k Worth It? Updated 3/28/2024 The 401k is one of the most popular tools for investing for retirement because so many employers offer it. But, believe it or...

- There are Several 401k Alternatives Available to You Are you stressed about your company not offering a 401K retirement plan? Don’t worry, there are tons of 401k alternatives for you to choose from....

- How Much Should I Have Saved by 30? It’s Less Than You Think! Updated 3/27/2024 If you’re wondering, “How much should I have saved by 30?” then let me tell you this—you’re not alone. It’s scary how little...

- What Cashing out a 401K can cost you Need money now? Cashing out a 401K is an option, but not the first option you should consider when liquidating assets. All of us, at...