A 401K is a fantastic retirement account and arguably the best investment account in general. However, what should you expect from this account, such as the average 401K return and what this means for retirement? The answer varies, but expect 6-10% on average. Read further to determine how to invest to maximize your gains based on your situation.

Click to jump to a section:

- What is a 401K?

- Types of 401Ks

- How to Set Up a 401K

- Where is my 401K Invested?

- Average 401K Return

- How To Get the Most Out of Your 401K

What is a 401K?

At its core, a 401K is a tax-advantaged retirement account. This tax advantage comes in the form of tax-free growth. Tax-free growth means that you won’t be taxed on any investment gains.

Tax-free growth is a powerful method of building wealth and saving for retirement. The funds you save from not paying taxes compound over the years and supercharge your growth. You will outperform everyone with a standard investment account just by this fact alone.

The one downside to a 401K is that withdrawals are restricted. With other investment accounts, you can withdraw whenever you want. With 401Ks, you can’t withdraw until age 59 ½. Any withdrawals before that will be more heavily taxed.

There are a few different versions of 401Ks and a few different methods of obtaining one.

Types of 401Ks

Employer-Sponsored 401K

The traditional form of a 401K is an employer-sponsored 401K. These accounts are restricted to employees whose employer offers a 401K through them.

These kinds of 401Ks are contributed to using pre-tax funds. There is no better way to build up a lot of money than to contribute without tax. You will only be taxed on contributions once you withdraw from your account at 59 ½.

This tax deferral functions to lower your taxable income by lowering your tax bracket. This allows you to pay less for taxes now and pay taxes closer to retirement when you likely have a lower income.

An employer-sponsored 401K offers one massive advantage over other investment accounts. This is the opportunity for a contribution match. This is when your employer provides up to a 100% match for any of your contributions up to a point.

A typical figure for an employer match is 6%. Thus, if you contribute 6% of your paycheck to your 401K, your employer will contribute up to 6% as well.

A traditional 401K has an annual contribution limit of $20,500.

Roth 401K

A Roth 401K functions very similarly to a traditional 401K. They are even set up through your employer, like a traditional 401K.

However, instead of deferring taxes until retirement, a Roth 401K is funded with post-tax funds. This spreads out your tax burden when paired with a traditional 401K. If you invest everything into a traditional 401K, you could pay higher taxes when you withdraw.

Roth 401Ks, sadly, don’t offer a contribution match. However, they still grow tax-free, making them incredibly powerful.

Self-Employed 401K

If you are among the hardworking few to become self-employed, a 401K isn’t out of the question.

Also known as a Solo 401K, a self-employed 401K is a 401K for small business owners with no employees. These kinds of 401Ks, of course, do not offer an employer match, but they do have one trick up their sleeve.

You can contribute up to $45,500 per year, compared to the $20,500 of a traditional 401K. This is done through contributing both as an employer and an employee. Both contributions are counted as business expenses and use pre-tax funds.

To learn more about how to set up a self-employed 401K, check out Fidelity’s post here.

How to Set Up a 401K

401Ks are set up differently than most investment accounts. With most accounts, you select a brokerage and open your desired account directly. However, the process is different because a 401K uses pre-tax funds.

Most 401Ks must be set up through your employer. This will restrict you to the brokerage selected by your employer. Contact your Human Resources department to find out how to set one up.

The one exception to this rule is a Self-Employed 401K. Since this account is set up independently, you can select your own brokerage. As long as they support self-employed 401Ks, you are good to go.

Once you set one up, make sure to immediately set up a contribution at least equal to your employer’s match. If you have a self-employed 401K, contributing at least 6% is a good benchmark. Setting up this automatic deposit upfront will ensure you don’t forget and regret it later.

Where is My 401K Invested?

401Ks are unusual when it comes to investment accounts. With most accounts, you deposit money which is left uninvested until you choose to buy an asset.

However, a 401K sets up a default fund for you to invest in based on your expected retirement age.This fund will attempt to balance your risk based on how far you are from retirement. This balancing process is completed without your input unless you decide to alter it.

If you are 25 years old, your expected retirement year will likely be set as 40 years from now, 2065 (the funds increment by five years). This will invest you in the brokerage’s 2065 target fund. Since your retirement is so far off, the portfolio will be balanced to include more risk. You have more time to recover from any downturns.

On the other hand, if you are 55, your target date will be 2035. This target fund will be balanced for far lower risk. You are opting to focus on wealth preservation instead of wealth growth. You wouldn’t want your portfolio to fall too much right when you need to withdraw from it.

Risk is set primarily using stocks and bonds. Bonds provide a lower, stable, guaranteed rate of return. Meanwhile, stocks provide higher potential growth along with greater risk.

At the beginning of your career, this ratio may be as high as 90% stocks and 10% bonds. Later in your career, this ratio may shift to 60% stocks and 40% bonds. All of this happens automatically, behind the scenes.

Other Options

In a 401K, you are limited in what you can invest in compared to other accounts. However, there are still options other than the target fund.

The primary reason to choose options other than target funds is lower fees. Target funds charge around a 0.3% management fee. Though this number seems very low, it is 10x higher than other funds’ usual 0.03% management fee.

Your specific options will vary based on your brokerage. But most will offer some whole market fund instead of a target fund. Especially for younger people, this is the way to go.

A fund tracking the overall market will provide greater long-term gains than a target fund. This is because a target fund dilutes your profits with bonds to increase stability. But at a younger age, growth is more important than stability.

As a younger person, you shouldn’t be withdrawing from your 401K. First, you are charged hefty fees for early withdrawal. Second, you are interrupting tax-free compounding, a cardinal sin in investing. Treat the money as gone for now, and allow it to grow as much as possible.

The only thing to make sure of when you switch investment vehicles is that you meet the minimum investment threshold. Some funds require millions of dollars to enter. A glance at the details of your chosen fund will show you this requirement.

Average 401K Return

Ok, so you’ve set up your chosen 401K and set it up to invest as you see fit. Now comes the fun part – returns. What kind of returns should you expect from your 401K?

This answer will vary depending on what you have your 401K invested in. Let’s look at your expected return for each common option:

NOTE: Returns will fluctuate based on bond returns. As interest rates rise, so do bond returns. These figures are for early 2023.

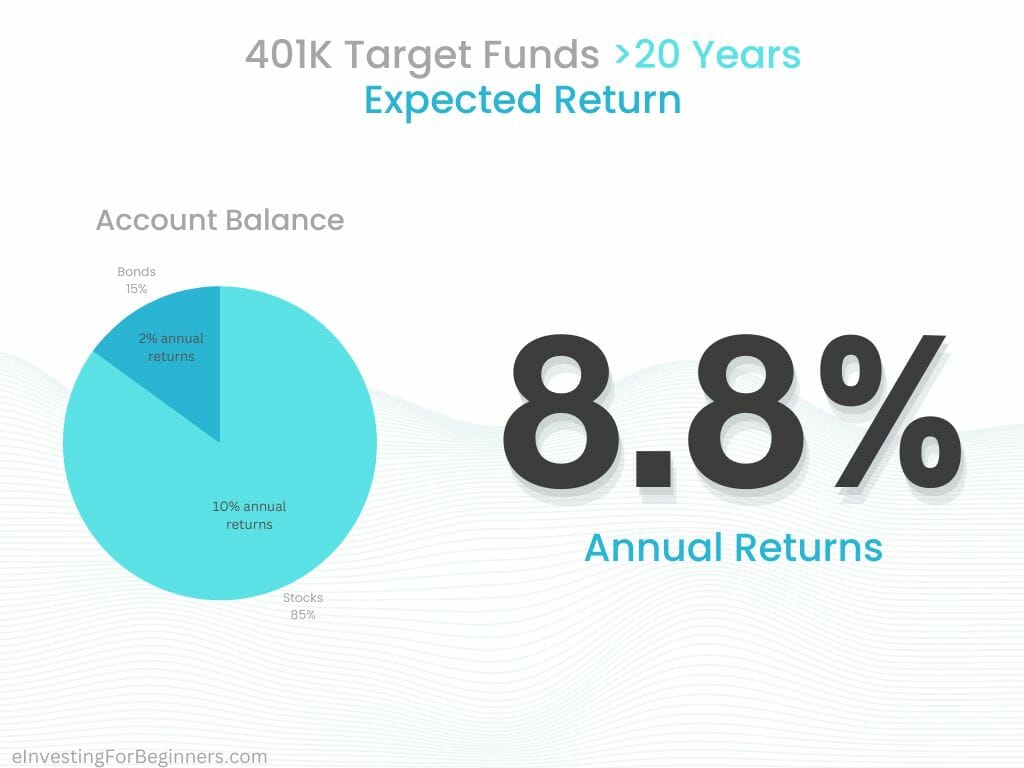

Target Funds Far Off (>20 Years)

With retirement still so far off, your target fund will still be heavily balanced toward stocks. This ratio will likely be between 80%/20% stocks/bonds and 90%/10% stocks/bonds.

With such a heavy weight towards stocks, you can expect returns close to the overall market. Assuming market returns of 10% and bond returns of 2%, you can expect a return of 8.8%.

These returns are close enough to the market that you aren’t missing out on many gains due to the bonds.

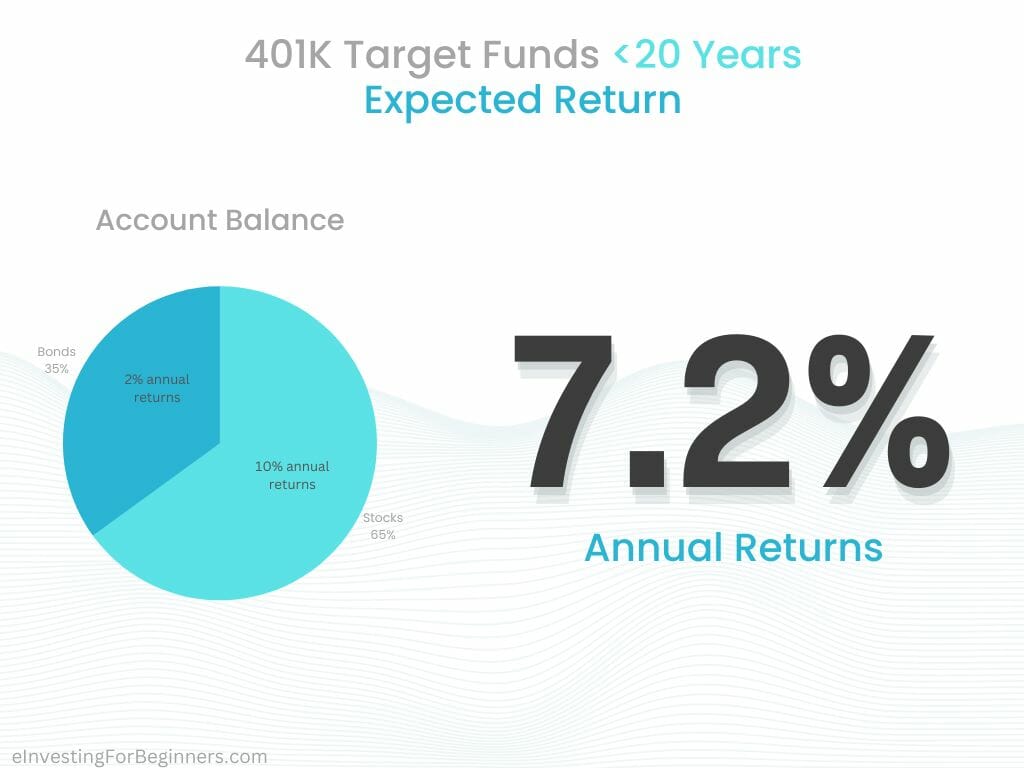

Target Fund Near Future (<20 Years)

Now that you are nearing retirement, your target fund will shift to lower your risk. Since you must access your funds relatively soon, your portfolio will prioritize wealth preservation. This will increase your reliance on bonds.

At this point, your portfolio ratio will be between 70%/30% stocks/bonds and 60%/40% stocks/bonds. Assuming the same returns of 10% in the market and 2% on bonds, you can expect a return of 7.2%.

This return may not seem significantly lower, but the difference compounds. A 1.6% difference over many years can become tens of thousands of dollars. Don’t miss out on these gains unless you need additional stability.

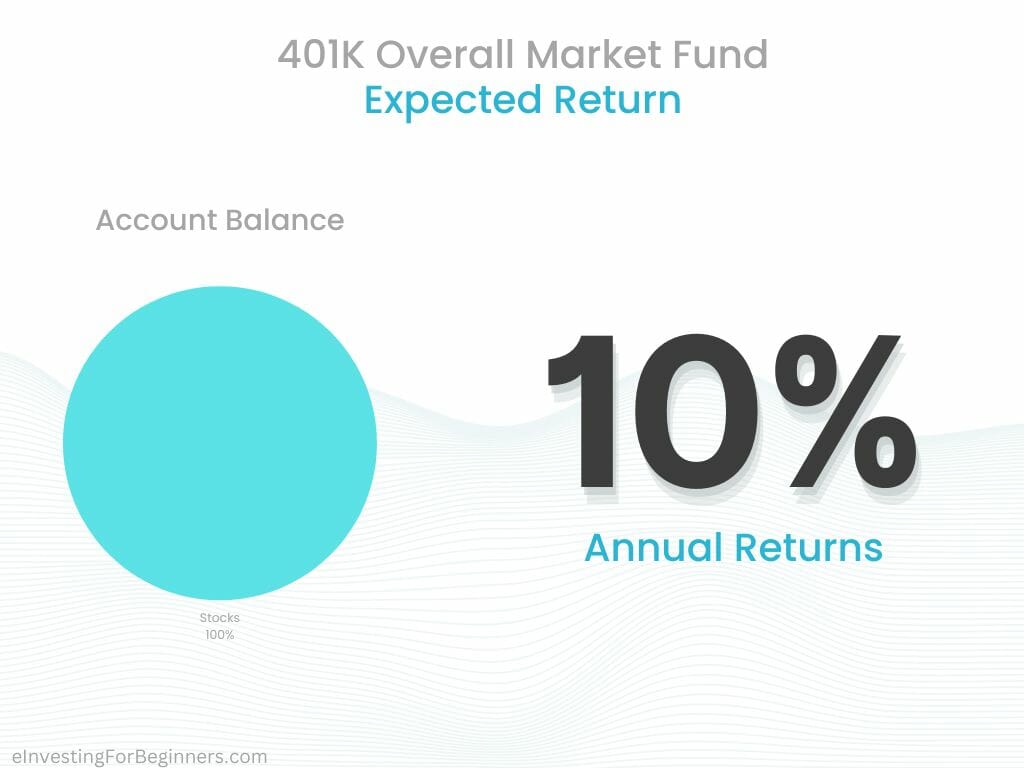

Overall Market Funds

This option invests you entirely into the stock market. Generally, this will be through an index fund that tracks the overall market. This means you can expect the same return as the overall market.

Over the 150+ years of its life, the stock market has returned an average of 10% annually.

This is the best return possible for your 401K, only sacrificing the stability of bonds.

However, you don’t need that stability if you have a while until retirement. Go all the way into the market.

How To Get the Most Out of Your 401K

Setting up your 401K is a personal matter based on your current situation. However, we can still follow a few guidelines to maximize it as much as possible.

Get That Match

If you are opening a traditional 401K with an employer and they offer a match, GET. THAT. MATCH. Nothing you do in investing will beat that immediate 100% return. The more free money you can get, the more you will have to compound in the long run.

Some employers offer a different system that matches 50% of your contributions up to a point. Again, if possible, contribute enough to make them contribute as much as possible.

Even if it means missing out on other investments in the short term, getting the 401K match is worth it.

Over Long Run, Risk = Gains

If you have a long time until retirement, take on the risk. Over its 150+ year life, the market has always more than recovered. That’s from depressions, recessions, diseases, war, and many other events.

You can feel confident that you are taking on the risk of fluctuations — not risk that you will lose all your money. You can always tone down the risk a couple of decades from now.

This risk in a 401K is in the form of its overall market indexes. If the one offered to you has a low-enough minimum investment, set future investments to be directed there.

Set Up Incrementing Investments

Over time, employees get raises. Many employees absorb these raises into their expenses, never to be seen by their savings. Setting your 401K to increment annually can solve this.

This is where your 401K contribution will be upped by 1% annually. That way, you can account for any pay increases in your 401K.

The best part is that this process is automated, which you know I love. It takes the responsibility off of you to remember to up it.

With this method, you’ll be amazed where your 401K gets to a few years later.

Closing Thoughts

The 401K is a fantastic investment account and offers many advantages over other accounts. The average 401K return depends entirely on how you invest it.

You can balance your risk vs. stability by looking at how far you are from retirement. This balance will ultimately determine your expected gains.

I hope you learned something here. I look forward to seeing you next time.

Evan Raidt

Evan is a personal finance blogger passionate about bringing beginner investors into the stock market world.

Related posts:

- Curious What the Average 401k Match Is? I Bet You’ll Be Surprised! One of the biggest mistakes that I oftentimes will see people make is that they will not take full advantage of their 401k match. Honestly,...

- Take Control of Your Own Destiny with This 401K Employer Match Calculator! Every now and then I will have someone tell me that they’re choosing to forego their 401K employer match because of something else like paying...

- I’m Getting a New Job – Will I Lose My 401K from my Previous Employer? Changing jobs can be a scary thing. It’s hard to leave what you know for the potential opportunity, and downside, of the unknown of changing...

- IRA vs 401k, Roth vs Traditional – Retirement Accounts Made Simple You decided to open a 401k. Finally! A smart decision today. But now they want to stump you with some investing jargon. Do you want traditional?...