“Focus on return on equity, not earnings per share.”

One of my favorite Buffett quotes of all time. Focusing on the returns on equity, and not earnings, forces us to recognize the company’s performance in managing their capital versus strictly the earnings and nothing else.

Buffett likes to compare stock returns to the returns you would get from a 10-year T-bill. He says he would rather receive a 10% return for his investment in a company instead of the 5% return you would receive from the bond.

Another great quote from Buffett in regards to return on equity:

“If you earn high enough returns on equity and you can keep employing more of that equity at the same rate — that’s also difficult to do — you know, the world compounds very fast.”

If a company can re-invest its capital at great rates, that makes it a truly wonderful company, and those are difficult to find.

In today’s post, we are going to explore the return on equity:

- What is Return on Equity?

- How to calculate Return on Equity

- Pros and Cons of Return on Equity

- Sector comparisons of Return on Equity

What is Return on Equity?

According to Investopedia:

“Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders’ equity. Because shareholders’ equity is equal to a company’s assets minus its debt, ROE could be thought of as the return on net assets.”

Return on equity is considered one of the best ratios to measure how well management uses its company’s assets to create more profit.

We can only calculate return on equity on companies with positive numbers for both net income and shareholder equity. If a company loses money from the bottom line, like Snapchat, for example, then it will not have a return on equity.

We can use return on equity best when compared to companies in similar industries. However, it is not a stand-alone metric that can tell you good or bad; more on this in a little bit.

The key to finding great companies who can become great investments for the long term involves finding companies earning great returns on equity over many years. Of course, the next trick is to find it at a good price.

How to Calculate Return on Equity

We have spent some time learning what the return on equity ratio is all about; let’s look at the formula and learn how to calculate a return on equity.

The formula for return on equity is short but sweet. It is simple and easy to use.

Return on Equity = Net Sales / Average Common Shareholder Equity for the Period

Luckily, we have worked with these numbers before. They will be easier for us to find.

We will find the net sales on the income statement and the average common shareholder equity on the balance sheet.

Remember, shareholder equity equals total assets minus total liabilities. Shareholder equity is a combination of retained earnings from the income statement and capital paid in by the owners, usually at the business’s founding.

Let’s look at several companies to understand how this ratio works.

The first company I would like to analyze the financials for our return on equity formula is Microsoft (MSFT).

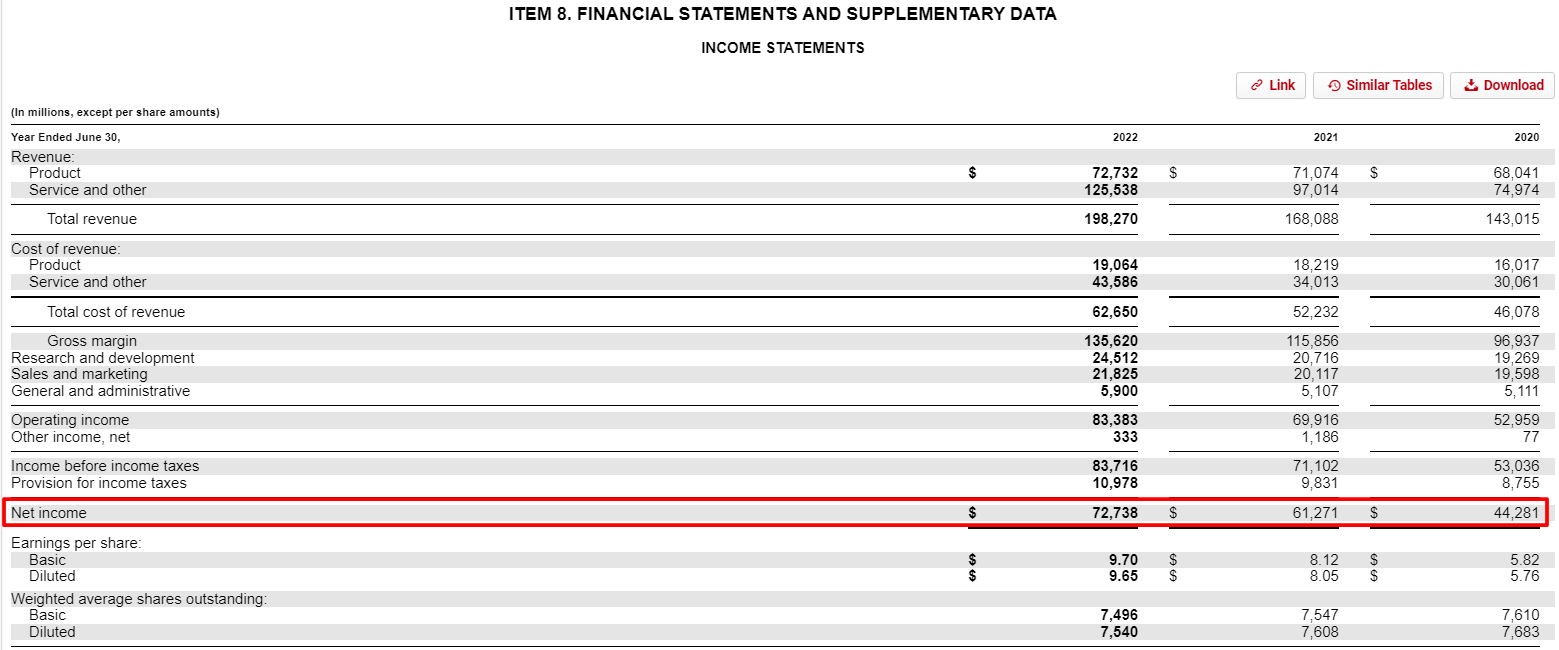

First, I will look up their latest 10-K from June 30, 2022. As always, all numbers will be in millions unless otherwise stated.

As you can see from the highlighted section, Microsoft had a net income of $72,738 million.

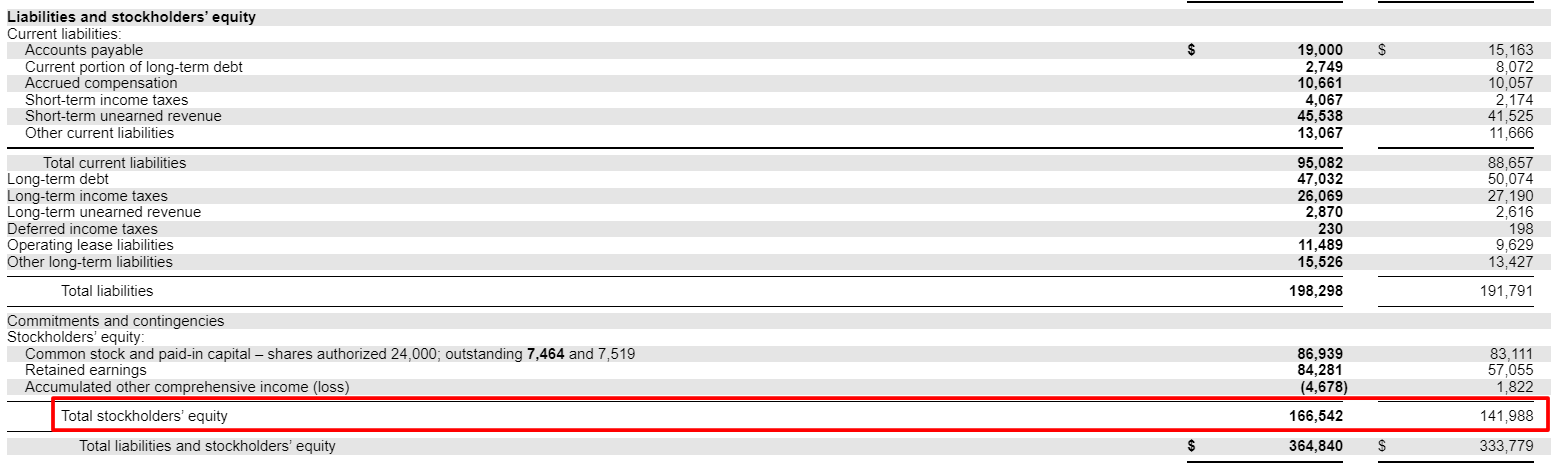

Now, we will look at the balance sheet for Microsoft.

We can see from the above chart that Microsoft had Total Shareholder Equity of:

- 2022 – $166,542 million

- 2021 – $141,988 million

Ok, now let’s plug the numbers into our formula.

Return on Equity = 72,738 / ( (166,542 + 141,988 ) / 2 )

Return on Equity = 72,738 / 154,265

Return on Equity = 47.15%

Pretty easy, huh? You’re probably asking, “is this a good ROE?” We will get to the answer in good time. For now, realize for every dollar Microsoft earns, they return 47.15 cents to the shareholders.

A note about ROE: a ratio between 15% to 20% is right where you want to be; of course, higher is better.

The next company I would like to look at is Hormel (HRL). One of my favorite dividend aristocrats and long on my wish list as a company I would like to own, but alas, I wait for the price to fall to my margin of safety.

We will look at the latest 10-K for Hormel, dated October 31, 2022.

First, we will pull up the income statement for Hormel.

We can see from the above income statement the net income is $908,839. Also, notice Hormel refers to net income as net earnings. As you work with more financials, you will notice many companies use similar terminology for the same term. In this case, net income equals net earnings.

On another note, Hormel lists the income statement as consolidated statements of operations and the balance sheet as consolidated statements of financial position. Please don’t let that throw you off; if you are unsure, pick the one that is most logical to you or click on the link and look at what each statement contains and you can find the one you are looking for that way.

Now, let’s look at the balance sheet for Hormel.

Ok, the shareholders’ equity for Hormel for:

- 2022 – $6,927,883

- 2021 – $6,425,548

Now that we have our numbers, let’s plug them into our formula

Return on Equity = 908,839 / (( 6,927,883 + 6,425,548 ) / 2)

Return on Equity = 908,839 / 6,676,715

Return on Equity = 13.61%

Again, easy to calculate, and it tells us that Hormel was able to generate 13.61 cents per dollar of shareholder equity.

We have looked at two established, more mature retail and consumer goods companies. I want to look at a more conservative industry, like banking.

Let’s look at a relatively unknown bank that is extremely well run and has a fantastic reputation for customer service, on par with Disney.

First Republic (FRC) is a regional bank that operates out of the Pacific Northwest with a market cap of $17.66B, peanuts compared to the big boys, Wells Fargo and JP Morgan.

Ok, I will pull the numbers from the latest 10-K, dated December 31, 2021.

- Net income – $1,478 million

- 2021 Total Shareholder Equity – $15,898 million

- 2020 Total Shareholder Equity – $11,751 million

Now that we have our numbers, let’s calculate the return on equity for First Republic.

Return on Equity = 1,478 (( 15,898 + 11,751 ) / 2)

Return on Equity = 1,478 / 13,825

Return on Equity = 10.69%

So, First Republic had a return on equity of 10.69% for the year ending 2021, so they earned 10.69 cents per $1 per dollar of shareholder equity.

Not as good as the other companies we analyzed, but banks operate under different conditions and have to use their capital differently than other companies because of regulations.

Using return on equity is an easy way to find a profitable company and a great way to screen for wonderful companies. If you run a quick search on some of the more popular companies:

- Tesla (TSLA) 20.4%

- Netflix (NFLX) 38%

- Facebook (META) 31.1%

- Uber (UBER) (3.9%)

- Amazon (AMZN) 28.8%

Interesting little chart, isn’t it? In the case of Uber, they continue carrying a negative return on equity because, currently, they have negative net income; they IPO’d a few years ago and have struggled out of the gate.

One of the cool uses of this ratio is the ability to screen out companies that are not profitable quickly or not generating returns for us, the shareholders.

Pros and Cons of Return on Equity

Now that we have discussed return on equity let’s look at some of the advantages and disadvantages of the ratio.

First up, the advantages:

- Management – return on equity allows investors to analyze management because the components that go into the ratio include asset management, leverage, and pricing. Great asset management causes ROE to improve using fewer assets and a great profit margin, which we see in the earnings. Leverage, the ability to take on debt, raises ROE when used judiciously; more on this in a moment.

- Comparison – ROE focuses on returning money to shareholders and is best used to compare other companies. Earnings and profits can vary across sectors, sometimes wildly, and can be difficult to compare. But, ROE takes those earnings and makes it easy to compare across sectors.

Now we will look at the cons of using a return on equity ratio:

- Leverage – companies have two options when considering raising capital to improve their profits. It can take on debt, or it can take on new equity owners. Whichever route they choose, the company must choose wisely. Return on equity only focuses on the shareholders’ equity, not the debt. The extra debt means the company could lever up a ton of risky debt, which could juice the return on equity by providing more profits. A better option is to utilize other ratios, such as return on invested capital and ROE, to get a complete picture of the company’s financials.

- Negative return on equity with startups – in all likelihood, companies that are just starting will have a negative net income. Negative ROE could lead to missing out on companies with huge shareholder investments. There is potential that we might miss a tremendous opportunity because the ROE is negative from the start up. Analysts must decipher the shareholders’ capital and determine how long it has been in place. Newer capital can take time to produce, which will increase the ROE.

- Subjectivity – return on equity focuses on net income rather than revenue. Net income is the revenue minus expenses or costs of goods sold. Most investors understand revenues or the top line. Costs of goods sold can contain many manipulations by the company accounting policies, intentional or unintentional. For example, a company with many assets will have a large depreciation expense. The depreciation expense lowers the ROE compared to a company with fewer assets. Companies can also decide when or how they want to write down their assets, impacting the return on equity. The bottom line: we need to remain aware of the possibility of manipulating the costs of goods sold, which can make ROE unreliable.

Please remember that we never use one metric to analyze a company, all of the ratios and formulas we use are tools to help us find a wonderful company. As you become more comfortable with these ratios and deciphering financial reports, you will find the ratios and formulas that work best for you.

Sector Comparisons of Return on Equity

When calculating return on equity for a company, one of the best ways to use the ratio is as a comparison to other companies, either in the same industry or across industries.

Professor Aswath Damodaran takes the time to calculate the return on equity across all industries; you can find the webpage here. I will create a chart of the more popular industries that you can use for reference when using the ROE for comparison purposes.

|

Industry |

ROE |

|

Banks |

12.53% |

|

Business & Consumer Services |

13.67% |

|

Computer Services |

14.61% |

|

Biotech |

-0.76% |

|

Pharma |

14.55% |

|

Electronics |

14.72% |

|

Financial Services – Non-banks |

0.28% |

|

Household Products |

35.95% |

|

Investments & Asset Management |

23.77% |

|

Machinery |

21.13% |

|

Oil/Gas – Production |

3.30% |

|

REIT |

7.81% |

|

Online Retail |

44.11% |

|

Software |

30.47% |

|

Telecom |

5.93% |

Across all sectors of the market, Professor Damodaran found that the average return on equity (which he updates annually) remains 12.25%. He continues to be my go-to resource for any market data I need; his website is a must if you want to learn more about finance.

As an aside, his class at NYU Stern on corporate finance and valuation offers fantastic information, and they are free! You can elect to watch his lectures via YouTube videos, and I have cut my teeth listening to his lectures many times.

The above chart will help you analyze companies with an ROE because you can use the numbers to see whether your company remains effective at creating more profits with its equity.

Not only will the chart help you to compare to others in their industry, but across industries as well. We must go beyond comparing Apple to Microsoft or Walmart to Amazon. We must also look at how the company competes in its industry.

Final Thoughts

Return on equity is a powerful ratio that can help us screen for shareholder-friendly companies that are fantastic at creating value from their assets.

Return on Equity is a simple, easy-to-use ratio. All the information to calculate the ratio is easy to find on the financials, coming from both the income statement and balance sheet.

Return on equity has some downfalls to the ratio. We discussed what you must be aware of, and as I have pointed out today as well as in the past, we must use all of our tools to find a great company.

It is not enough to find a company with a great ROE and buy; we must thoroughly analyze all the tools to find the best investment whether you focus on financials like I enjoy doing or if you are more comfortable with retail or technology.

Return on equity is a quick way to find a great company to start your research.

As always, thank you for taking the time to read today’s post, and I hope you find something of value you can use on your investment journey.

Take care,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- ROE is a Valuable Metric but it Ignores The Debt Effect in its Calculation A return on any investment refers to the return of capital achieved over a certain period of time. In financial statement analysis, we are using...

- What is Return on Equity and How Do I Calculate it? Updated 1/5/2024 “Focus on return on equity, not earnings per share.” Warren Buffett In the investing world, there always seems to be a big divide...

- Everything to Know on ROA, with Average ROA by Industry Data Post updated: 5/5/2023 The return on assets remains a useful measure for investors to understand. The formula offers a great way to measure the performance...

- Beginner’s Guide: What is the P/B Ratio in the Stock Market? The P/B, or Price to Book Value Ratio, compares a company’s book value with its price in the stock market. Book Value, also called Shareholders’...