I find that backlog accounting is best explained by the home builder industry. A backlog represents work that needs to be performed but has not been recognized as revenue yet.

As an example, a customer who is approved for a mortgage on a new home goes into a home builder’s backlog. Once that transaction closes, the customer’s purchase is added to revenue and removed from the backlog.

Keep in mind that this is in contrast to deferred revenue, where revenue is recognized but not yet delivered.

Because backlog is not recognized as revenue, it is not an official GAAP metric and not required to be disclosed in company annual reports (10-k).

Here’s an example of a computer company, Dell ($DELL), and their 10-k disclosing the significance of a backlog to their business:

“Product backlog represents the value of unfulfilled manufacturing orders. Our business model generally gives us the ability to optimize product backlog at any point in time, for example, expediting shipping or prioritizing customer orders toward products that have shorter lead times. Because product backlog at any point in time may not result in the generation of any predictable amount of net revenue in any subsequent period, we do not believe product backlog to be a meaningful indicator of future net revenue. Product backlog is included as a component of remaining performance obligation to the extent we determine that the manufacturing orders are non-cancelable.”

You’ll find that most businesses report backlog in their 10-k in this way.

However, some businesses do typically report backlog as it can be a great indication of forward demand, with some predictive power to short term future revenues.

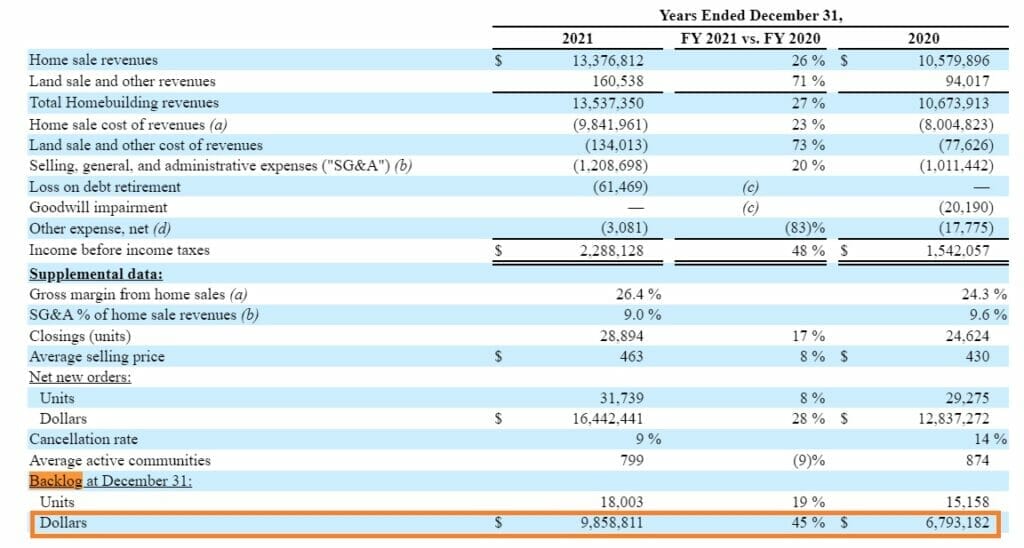

Let’s go back to home builders, a great example of disclosed backlog accounting in a 10-k. I’m going to share disclosures from PulteGroup’s ($PHM) latest 10-k.

Under the “Sales and marketing” section of the Homebuilding Operating segment overview, Pulte talks about how their contracts with customer include provisions.

Such provisions can include the requirement of the buyer to sell their home, or be approved for financing in a time window or desired interest rate. In the case that such a provision is broken, the contract typically can be cancelled with no penalty to either the home builder or home buyer. In that case, backlog doesn’t convert to revenue and instead gets removed with no other impact to the financials.

You can see that the reporting of a backlog is a natural byproduct of the longer sales process of buying and financing a home.

Now let’s look at PHM’s backlog chart. From the 10-k:

You can see how backlog is accelerating substantially through 2021. The company explains some of the factors which contributed to these results, both on the supply and demand side. As quoted:

“Backlog, which represents orders for homes that have not yet closed, was $9.9 billion (18,003 units) at December 31, 2021 and $6.8 billion (15,158 units) at December 31, 2020. This increase in 2021 backlog compared to 2020 is primarily the result of overall robust demand for new housing coupled with elongated cycle times due to supply chain delays for certain materials and labor and obtaining necessary approvals, permits, and inspections from local municipalities.”

Management’s additional comments, to show how the backlog situation is expected to play out in the near future (to eventually be converted to revenue, or not):

“For orders in backlog, we have received a signed customer contract and customer deposit, which is refundable in certain instances. Of the orders in backlog at December 31, 2021, substantially all are scheduled to be closed during 2022, though all orders are subject to potential cancellation by or final negotiations with the customer. In the event of contract cancellation, the majority of our sales contracts stipulate that we have the right to retain the customer’s deposit, though we may choose to refund the deposit in certain instances.“

The company also reported additional details on the backlog, with dollar values and units as the following over the last 3 years:

- 2021

- Units: 18,003

- Value: $9,858,811

- 2020

- Units: 15,158

- Value: $6,793,182

- 2019

- Units: 10,507

- Value: $4,535,805

Knowing the basics of the backlog’s relationship with revenue and (future) demand can help analysts understand a company and its financial results better.

It’s not an end-all, be-all figure, and doesn’t always perfectly represent or forecast demand accurately.

But, it can be an important proxy, especially in industries like home builders and other manufacturing companies with longer delivery times.

Understand the key difference between a contract that gets put on the backlog and a contract in which revenue is recognized. Then, you’ll know whether to focus on a company’s backlog or deferred revenue.

After you’ve mastered backlog accounting, what’s next?

Taking this question in the context of the home builders industry, I’d say that understanding the industry is the next logical step.

That starts, as it does with every company, with the 10-k: reading the business description and Management’s Discussion and Analysis (MD&A).

Those sections have valuable insights straight from the mouth of leadership, who could have decades of experience in the industries and companies you are looking to invest in.

Once that picture is absorbed, and you’ve created an industry map, it’s time to dig into the financials with key metrics and formulas. A few other ideas to get you started:

There are a lot of resources that I’ve just linked for you here, but that’s because there are lots of parts of a business that make the gears spin.

Like with the backlog, each can give you an insight into the company’s future demand and growth potential based on what the company has done so far.

Updated: 8/05/22

Related posts:

- Deferred Revenue: Debit or Credit and its Flow Through the Financials Basic accounting for public companies can get confusing with different terms that mean the same thing (like deferred and unearned revenue), vs opaque definitions (such...

- How to Read the 10-k (Annual Report) If you want to learn more about a company or invest in a company, you can find a plethora of information on the company’s annual...

- How Purchase Obligations (in the 10-k) Affect Inventories and Capex Purchase obligations can be a key part of understanding future cash flow. In 2002, the SEC made the disclosure of purchase obligations (POs) a requirement...

- Simple Income Statement Structure Breakdown (by Each Component) Updated 8/7/2023 The income statement is the first of the big three financial documents that all public companies must file. But what do we know...