A bag holder is a stock market sucker. This is an investor who buys a stock, hoping it goes higher, but then gets caught “holding the bag” as the stock eventually crashes.

For some reason, we investors like to believe we’re never the bag holder of a stock, and never will be.

I’m ashamed to admit this– but today, I was the bag holder. I don’t even know how it happened… all I can blame is sudden greed. And Tesla (TSLA), with its parabolic rise, was the perfect stock to do it with.

Note: This is a special contribution from someone who wanted to remain anonymous for now. It’s a great example of what NOT to do.

If you’ve ever seen the movie with Mark Wahlberg called The Gambler… you see this greed in action. In fact, the biggest irony is, I just watched this movie for the first time over the weekend.

And I was disgusted with Wahlberg’s character, as we had to watch him win tens of thousands of dollars, only to continue gambling it, with bigger and bigger bets, until he inevitably loses it all (multiple times, I might add). I cringed during the movie.

It was hard to watch someone get so consumed by greed.

Wahlberg did a good job with the role– you could see the character absolutely go into a daze, a craze, a trance… consumed by something un-human. I’ve also witnessed this gambling trance consume my friend at a casino– like it sucked the money right out of him through the ether. Both of these men started a winner, and came out the ultimate bag holder.

I’d like to provide you with some context before I dive in to this embarrassing confession.

First off, Let’s be clear: I’m a Bag Holder with Prudent Investment Philosophies

I like to think I’ve had some humble beginnings. From a very young age I was taught the value of money, and worked hard to earn and save it. I would never imagine myself to become careless with money, let alone a foolish bag holder. Especially, ESPECIALLY, because I’m so careful with stocks in general.

My investment strategy has always been based on sound investment principles—principles that I was fortunate to stumble across and really internalize before I had serious capital to invest.

These are things you’ll read about on this website such as investing even small amounts of capital, until your investments bring compound interest. Other wise strategies that I follow include diversification, dollar cost averaging, and buy and hold.

Curiously, I threw that all to the wind for a day.

But if I’ve done one thing right in this whole debacle, it’s that I’ve successfully separated my “hard earned life savings money” from my “play money/ vacation / new car fund money”. But just because it was “play money”, doesn’t make the sting of bag holding any less painful.

To make matters worse, my bag holding occurred on a stock that I’ve always been bearish on, and have been completely wrong about for years. However, even though I was wrong that Tesla would continue to rise, doesn’t make buying TSLA right now is a good decision.

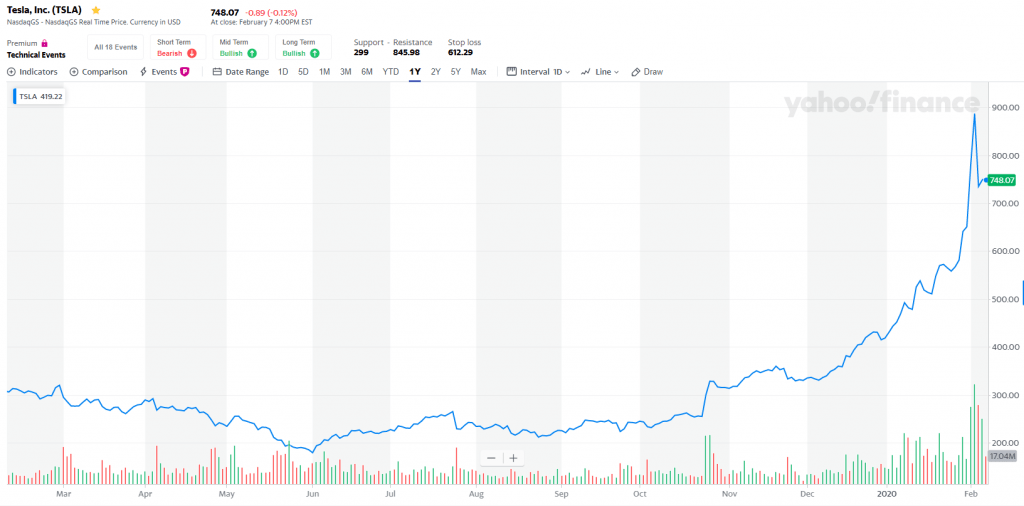

Any investor with an iota of experience can clearly see that this is a bubble stock. Just look at its 1 year chart from Yahoo Finance:

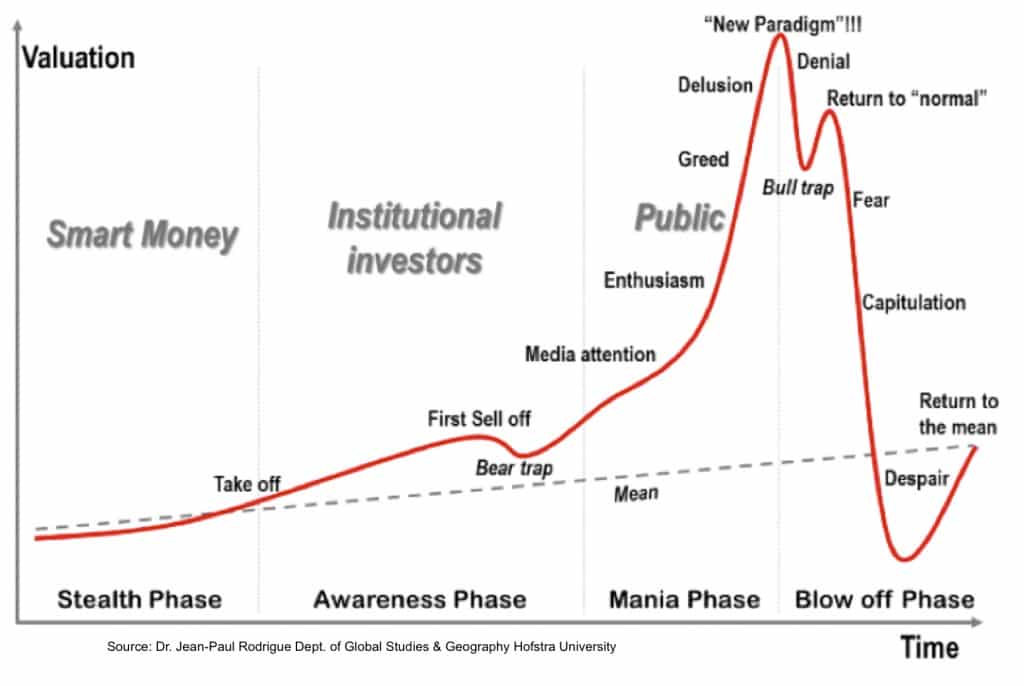

Compare it to the classic bubble chart.

Source: (Dr. Jean-Paul Rodrigue) And the bitcoin chart from 2012-2015:

Source: TradingViewLike the news media has said, Tesla has become completely parabolic.

I watched Tesla hit the infamous $420 mark. Then it went up 4.7%. I watched it go up 8.5% at the open in January, only to hit +15.5% a few days later! And finally, after hitting a peak of $908 in premarket trading and rising 15%+ in the first 5 minutes of trading… I decided today (02/04/20) was the right day to be a bag holder.

I was tired of not being part of the party, for the last time.

If my retirement fund wasn’t going to get a piece of this pie, well at least my next vacation could be a little more extravagant… right???

I want to take you through my experience and the emotions I felt during this bag holding experience.

This will read like a journal, as I started jotting some notes as I went through it.

Just watch at how fast bag holders like me got caught up, and witness and learn from my example of what it’s like to experience this so you don’t have to go through it yourself.

The Emotional Phases of Becoming a Bag Holder

Now, you might be wondering how I managed to pick an “investment” that could lose over 50% of their value in a mere matter of minutes. Well my friends, that’s the joy (and terror) of the options market, and really don’t recommend except as a fun type of hobby, and importantly with money you really can afford to lose all of.

Because you probably will—eventually. Trust me.

My Bag Holder Journal: Tuesday 2/4/20

9:30am: I start with my normal day trading options routine, trying to pick up quick wins and then calling it a day.

9:33am: I pick up a Visa call option for $198, looking for a quick flip.

9:34am: Got my flip, sold the Visa call for $220 for a 1-minute 11% gain. Happy and almost ready to call it quits.

9:35am-9:41am: Screen for any more quick options plays but don’t find any.

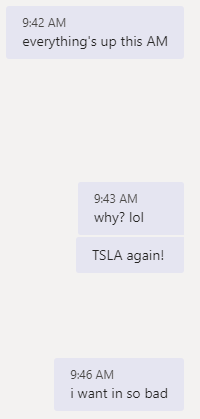

9:42am: Then I check out how the market is doing. Here’s where the trouble starts…

You can see a chat I had with a friend:

Tesla was up 14.74% in the pre-market and had gapped up at the open. It continued to climb…

9:50am: I’m looking at the call options for this stock. Their prices have gone absolutely nuts. One call option (the most out of the money call expiring in 3 days) is up 3,000% since yesterday. I’m looking at it.

9:51am: The stock is up 20% now. It’s gained somewhere between 5-10% just in the 10 minutes since I first told my friend about it…

9:52am: My mind starts racing. “It’s ridiculous what this stock has done. It’s worse than Bitcoin. I laughed at the idea that it could ever hit $420, and now I legitimately think it will hit $1,000.” Bit sized comments that I’ve read over the past week start popping into my head: “shorts are getting killed, the institutions are buying this up, we have some rouge big players who are flooding this stock with liquidity…”

9:53am: Here’s where the adrenaline kicks in. And my greed takes over. My mind, I’m sure, succumbs to the evil demon of greed– no thoughts, just “click” enter my limit order. I check the stock, it’s falling. I go in to lower my limit order. Too late. I’M HOLDING THE BAG…

My trade is EXECUTED for $6.80 (comes out to -$680 out of my account). The option? 1500 CALL expiry 2/7.

Not kidding, you can’t get any dumber than that. I’ll explain why in a minute, but back to the story…

9:54am: As always seems to happen when I’m trading options, the trade immediately goes against me. The stock starts a consistent downtrend for at least the next 30 minutes…

10:09am: My option is down to $4.00. I’ve lost $280 in 15 minutes. It felt like two. I “double down” here, the classic gambler move. I buy my second 1500 CALL expiry 2/7 for $400.

10:20am: I “brag” to my friend about my move. He was just joking that he should buy to lock-in the top. Too late, I already did. I report to him my shame…

10:21am: Assessing the situation. Check on the prices for my 2 call options and I’m down $600 in total. What a bag holding achievement: -55% in 28 minutes. Here’s where I just start to realize just how STUPID a move this was. My saving grace? I decide to hold…

10:25am: I look at my retirement portfolio to feel better. At least every stock in there is up for the day, on this crazy up day in the market.

10:38am: I decide to stop checking on TSLA here. I set a stock price alert and focus on other things.

11:47am: Strolling into the gym, thinking about my trade from this morning. I start to reflect on my knowledge of options, and how the value of these things aggressively disintegrate as the day goes on, especially when they are so far out of the money (strike price of 1500 vs a stock price of around $900) like my call option was.

I’ve very aware about the insidious effect of time decay on the price of options, yet I still acted against that knowledge. Why?

11:50am: Shame starts to set-in. How could I let myself get consumed by the greed that I’ve so successfully avoided for 7+ years as an investor? Why did I ever start trading options in the first place?

It hasn’t been a successful endeavor yet I keep doing it. It’s as if all of the small, mostly responsible options trades in my recent past have acted like a gateway drug that enabled this “wild passion” to overcome me.

I feel like I’ve betrayed myself. I scoff at the irony that I’ve heard this story before, online, many times… of traders who start small and then get sucked into doing “YOLOs”– essentially extremely high risk, low odd trades fueled by greed.

10:57am: At this point I’m starting to feel a pit in my stomach. The reality of my situation is starting to really set-in. My January W/L track record of 28-15 and the small resulting profits have been erased, and then some, from a single keystroke and one impulsive idea over the span of a few minutes.

All this time following a strict system, with a $200 position size each trade, and then out of nowhere I take on $1,000 of risk, with no real reason why it should work. FOMO (the Fear Of Missing Out) is real, and sinister, if you allow it…

11:59am: Now I’m PISSED at myself. I take it out on my set of deadlifts. Then I start to think of all of the fun things I could’ve done with $600, or $1,000. Was those seconds of thrill worth that money?

I don’t care how wealthy you are, $600 can buy a ton of fun– maybe even a weekend of fun. How long do most people work to earn that kind of money? It’s not insignificant… My anger at myself grows…

I start to think about just setting a sell order to cut my losses here. I check the ticker, luckily it’s on an uptrend and has recovered a little, so I decide to hold.

12:03pm: My mind is so preoccupied, that I accidentally confuse the weights on a workout machine and lift the wrong weight: 140lbs instead of 80lbs. At least that’s one piece of a silver lining here…

12:05pm: I remember the time decay effect on my call option, and how unlikely the stock is to jump significantly like it did earlier in the day. And that if the stock drops like a rock, it will absolutely destroy my call option. I decide I need to cut losses sooner than later.

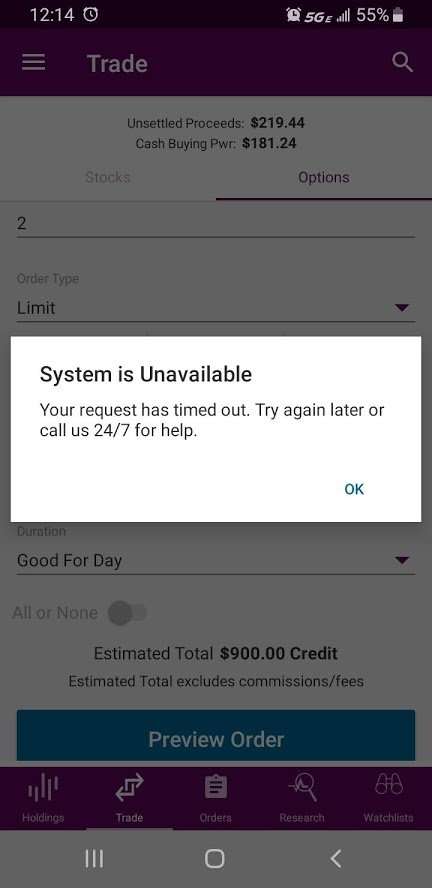

12:07pm: I’m thinking about how my greed before put me into this bag holder situation, and that I’m getting greedy by waiting on this uptrend again and just holding. I try logging in to my Ally app to plan out a sell point. The app crashes.

Great. I’ve heard about things like this losing people money before…

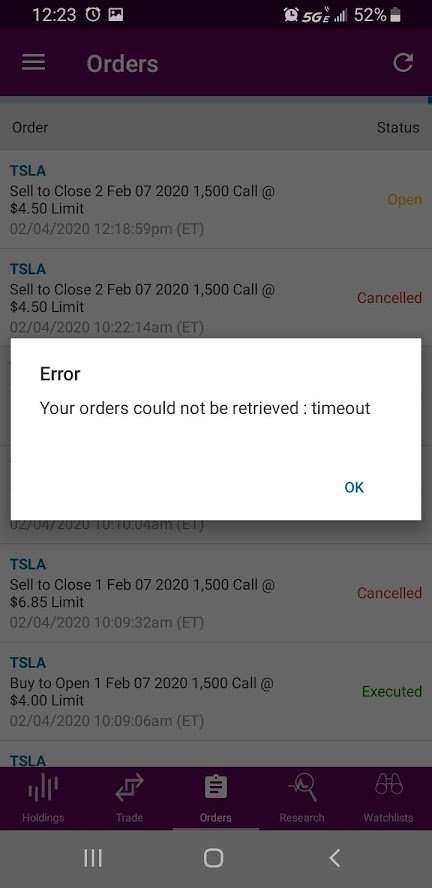

12:14pm: Now I’m frantically trying to get logged in to my account so I can set a sell order. I’m okay with losing money because of my mistake, I’m very NOT OKAY with losing money because of a technical difficulty. More error messages:

Great news from the Ally Mobile App12:18pm: Finally get a sell order in. Sell to close both contracts at $4.50 each. Now to see if it gets filled…

12:23pm: I think about how high that TSLA rose in the premarket trading, and how the stock isn’t back at that point yet. I try raising my sell limit order, only to get timed out again. “Whatever. I’m giving up and leaving it at $4.50.”

The Ally App again...12:33pm: 10 minutes later and my order hasn’t been filled, and I realize I’m being greedy again. I (smartly) lower my sell limit to $4.25, and get filled for 1 contract pretty quickly.

Combining my 2 buy orders from the morning puts me at about a $5.43 cost basis per contract. Selling 1 contract at $4.25 and I’ve locked-in a $123 (-21.7%) loss, a much better picture than how most of the morning looked.

12:34pm: I see that the stock is on an uptrend again, and my second contract sell order is setting the Ask price. I decide to up this last sell order to $4.40, since it’s not a far cry from where the bid-ask spread currently is. I’m going to monitor this though, and set my limit back down if the stock turns again…

12:45pm: My last sell order is EXECUTED and I feel a wave of relief. I’m done with this mess. Selling the second contract at $4.40 locks in a second $103 (-19%) loss, and at least I’ve limited my total loss to less than $300.

It could’ve been worse, and certainly looked to be that way. I realize I’ve had my taste of a bubble stock, a chance at profits in one of the craziest stocks ever in Tesla… finally I’ve tried it, and I really didn’t like it. It’s easy to think other people will be the bag holder, but in reality it’s pretty easy to become one.

Back to my normal day (a calmer, and generally happier one…)

My Reflections: I Wasn’t the Only TSLA Bag Holder

Some quick post trade analysis, before continuing (the story resumes at 3:08pm):

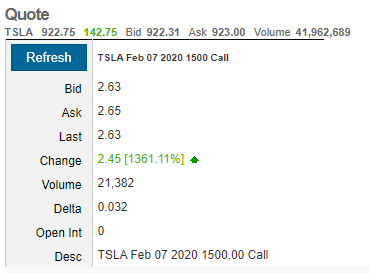

Carefully following the timeline and the path of Tesla’s stock price that day reveals that time decay really did take its toll on my call options. The stock price even rose as the day went on, and yet the call options lost value!

Take for example, the price of those same options at 1:42pm, with TSLA back up at $922.75 (above its price at 9:53am when I first bought):

Source: Ally InvestTime decay really does kill the bag holders of options even more than the bag holder of a stock.

I’m lucky it wasn’t way worse.

But the story’s not quite over yet…

3:08pm: Traders alike all say not to do this, but I’m sure most of them do it anyway. I check up on Tesla, and the greed/ FOMO cycle in my head resets. The stock is up 21% for the day now, and the contracts I sold at $4.25 and $4.40 are now worth $5.00. Of course…

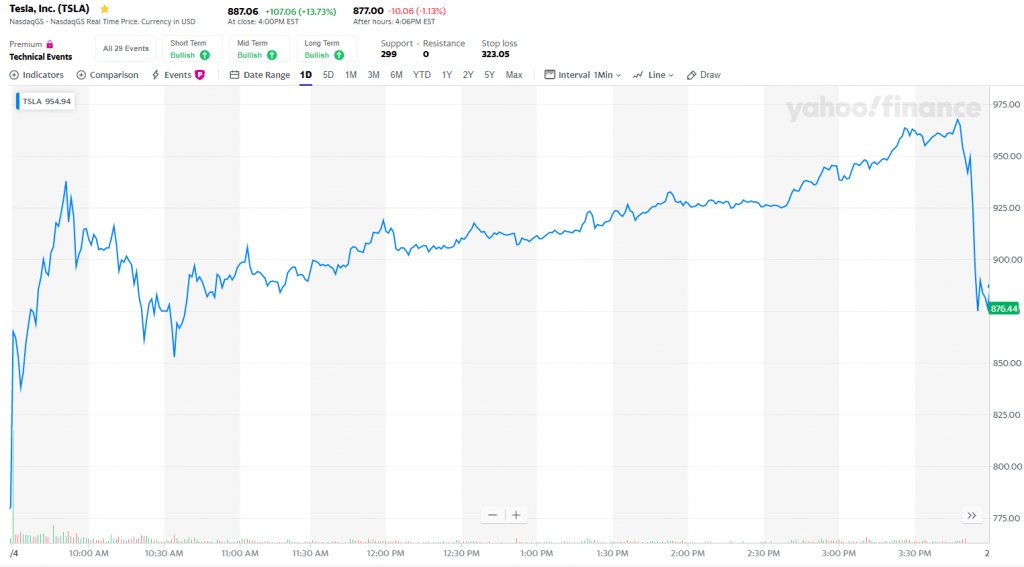

3:48pm: I’m collecting my thoughts about today for the journal. Tesla races up to $965 and looks primed to break $1,000 by the end of today, in fact it seems that everyone is expecting it…

I check on the 2 call options I sold earlier… Ouch, up to $600 each. I hate options…

3:56pm: Pop. Oh, this is nasty. The stock just CRATERED to $885-ish, putting it up ~12% for the day after being up 24% minutes ago. These call options have lost 50% in value again…

More (wise) thoughts fill my head: Though I felt like a bag holder, there were some real bag holders in there at the end right here. But I’m guessing the joke will be on all of us, knowing how this stock has gone. There’s no rhyme or reason behind it. Thank God I sold.

4:00pm: Another crazy day with Tesla’s stock comes to an end. It finishes at $887.06 for a 13.73% gain, well below what I originally bought it at. What a time to be alive.

The day ends, and this final snapshot of the chart of Tesla exposes the entire wild and crazy ride:

The Final TSLA 2/4 ChartAll in less than an 8 hour day you saw the wide array of emotions that can take place for any bag holder, or really, any investor who’s debating on a stock sell.

I wish I had the answer for you to avoid emotions like these, but sometimes that’s the nature of stocks.

However, I do know that you DON’T have to subject yourself to this kind of cruelty if you’re going to be a prudent long term investor. It’s extremely rare to find a stock that will drop 50% in a single day, even in a bear market– but with options that’s obviously a different story.

Tonight I’m counting my blessings for dodging a bullet.

I hope you’ll never put yourself in a position to have to move out of the way like that.

Stay smart, and follow the great tagline from The Investing for Beginners Podcast: always invest with a margin of safety, EMPHASIS on the safety.

Related posts:

- What is High IV in Options and How Does it Affect Returns? As you have learned from previous posts, trading options is buying the ability to buy or sell a stock at a certain strike price. A...

- Taking Worst Case Scenarios of Selling Covered Calls – It’s Not That Bad! While I am new to the options game myself, I have learned quickly that options are like stocks, but on steroids. In this article I’m...

- Pyramiding Your Protective Calls and Puts When Trading in a Trend As I mentioned in my Trading Options for Beginners post, I’ve been dabbling with quick day trades with options, and using a protective call or...

- Stocks Vs Options: What Beginners Need to Know If you haven’t already, you’ll quickly discover the sexy, fast moving counterpart to stocks — options. It’s hard not to stumble upon these shiny derivatives....