Most of the risk associated with investing in banks is tied up in the bank’s balance sheet. All banks go through a process of stress, testing the bank balance sheet to ensure the bank has enough liquidity to withstand multiple stressful situations.

Much of the risk banks face stem from the credit, operational, market, and liquidity risk. Since banks face exposure from many areas of risk, the banks have risk management departments set up to manage that risk from multiple different angles, and using the stress test information helps banks navigate that risk.

Banks are a great source of revenue for income investors though their dividend payments, but most investors shy away from banks because of the risks associated with banks.

During the Great Finacial Crisis, banks bore the brunt of the blame for the crisis, and rightfully so, as they had taken on far more risk than was prudent. In many cases, the banks created the bad assets in the first place as a way of making additional money.

Unfortunately, banks still carry that stigma from the Crisis, and with the ongoing crisis associated with the Covid-19 pandemic, banks are still going through some pain. Instead of risky assets, the pain is coming from loan reserves and ensuring they have enough liquidity to maintain solvency in the event of loan defaults.

In today’s post, we will learn:

- What is a Stress Test for Banks?

- Breaking Down a Bank Stress Test

- Why are Bank Stress Tests Important?

- The Types of Stress Tests and Effects on the Banks Balance Sheet

- CECL and Stress Tests

Ok, let’s dive in and learn more about the bank’s balance sheet and stress tests.

What is a Stress Test for Banks?

A stress test for banks as defined by Investopedia:

“A bank stress test is an analysis conducted under hypothetical scenarios designed to determine whether a bank has enough capital to withstand a negative economic shock. These scenarios include unfavorable situations, such as a deep recession or a financial market crash. In the United States, banks with $50 billion or more in assets are required to undergo internal stress tests conducted by their own risk management teams and the Federal Reserve.”

After the 2008 financial crisis, stress tests were put in place because it became apparent that many banks and financial institutions were left severally undercapitalized. For example, think of Lehman Brothers and Bear Stearns as the poster children for this situation.

As a result of the financial crisis, federal and financial authorities expanded regulatory reporting requirements greatly. The intention was to provide greater scrutiny on the adequacy of capital reserves and the internal management of capital.

Banks must now regularly determine their solvency and document it, via the Basel Accords and the use of Common Equity Tier 1 reporting.

Banks that fail their stress tests have to take additional steps to build up their reserves or preserve the reserves already in place. For example, Wells Fargo recently passed its stress tests with flying colors, but because of past transgressions, the bank now must allow for higher reserves to ensure the bank doesn’t fail.

Because of the additional reserves Wells Fargo must carry, the bank is limited in the capital outlays it is allowed to perform, such as increasing dividends or share buybacks.

Breaking Down a Bank Stress Test

In the US, banks with assets greater than $50 billion must undergo a stress test conducted by the Federal Reserve.

Simply, the stress test analyzes how the impacts on the bank balance sheet will impact the bank adversely in different economic situations.

Stress tests run by the Fed offer several different scenarios with multiple variables. Let’s look at several of those common scenarios with examples:

- Interest Rates

- How will a 5 percent change in interest rates affect the bank’s financial condition?

- Unemployment

- What happens if unemployment rises by 25 percent in 2021?

- GDP

- What happens if the GDP falls by 10 percent and unemployment rises by 25%

- Equity and Debt Markets

- What happens if the markets fall by 50 percent, and how will that impact the bank’s assets?

- Commodities

- What if the price of commodities such as oil/precious metals drops by 20 percent, how does the bank’s exposure affect its assets?

- Real Estate

- What happens if the housing markets crash 20 percent?

Stress tests help determine the financial health of a bank by running scenarios like the ones above, but running scenarios like above is a tedious job, as there are multiple variables involved.

All stress tests contain a standard set of scenarios that any bank might encounter. A hypothetical scenario, including events such as a hurricane hitting New Orleans or a war in the Middle East, is in the stress tests.

In addition to the above scenarios, banks run projections on the financials for the upcoming nine quarters as a basis of determining if they have enough capital to survive the scenarios.

The regulators also include historical scenarios such as:

- The tech bubble collapse of 2000

- The subprime meltdown in 2007

- The coronavirus pandemic of 2020

- The market crash of 1987

- Asian financial crisis of the late 1990s

- European sovereign debt crisis of 2010 and 2012

In 2011 the Fed instituted regulations that required a bank to do a CCAR or Comprehensive Capital Analysis and Review, which also includes running multiple stress-test scenarios, more on this in a moment.

Why Are Bank Stress Tests Important?

The introduction of bank stress tests occurred after the global financial crisis of 2008. The crisis exposed the holes and weaknesses in the banking system worldwide. The crisis wiped out many large banks such as Lehman Brothers, Bear Sterns, Washington Mutual Bank, among many others.

Large banks such as Royal Bank of Scotland, Merrill Lynch, AIG, Freddie Mac, Fannie Mae, and many more came within a whisper of going bankrupt, and without substantial bailouts, most would have declared bankruptcy.

In fact, over 465 banks in the US alone declared bankruptcy between 2008 and 2012.

After 2008, regulators realized that many large financial institutions were instrumental to the smooth operation of the economy and deemed “too big to fail.” If the Fed had allowed these institutions to fail, the ramifications had the potential to cause widespread panic and lead to more pain and suffering.

One of the benefits of stress testing is the improvement in risk management in financial institutions. Adding the bank stress tests puts another layer of regulations on the banks, which forces the banks to improve its risk management frameworks and internal business policies.

In other words, it forces the bank to think through the possible scenarios in relation to adverse economic conditions before making any decisions.

Additionally, since all banks of a certain size are required to perform periodic stress tests and publish those results, now market participants have better access to the information regarding the financial condition of, for example, JP Morgan.

The increased transparency is helpful to investors looking at any bank that partakes in this system.

Regulations require that any bank that fails a stress test put on hold items such as dividend payments or share buybacks as a means of increasing or preserving capital. All of which can prevent undercapitalized banks from defaulting or avoiding any runs on that bank.

An adverse side effect of coming close to failing the stress test is the restrictions put upon banks such as a reduced dividend or the stopping of the dividend completely. Any such change has negative impacts on the share price of the bank as investors HATE dividend cuts, as it indicates weakness.

Types of Stress Tests, Effects on Balance Sheets

The Fed, along with officials at each bank, run the stress tests for banks to ensure there is enough liquidity coming from the bank’s balance sheets.

In 2020, the Fed released the results for the most recent round of stress tests, and they found that the 33 banks that were tested would experience substantial losses under the most severe scenario presented. But they concluded the banks would have the ability to continue lending to businesses and households, as a result of the significant buildup of reserves.

There are two types of stress tests; this encompasses most major banks, including larger regional banks. Credit unions, since they are not part of the Federal Reserve system, undergo their particular type of stress test.

How does a stress test work?

When a bank runs a stress test, it is a what-if scenario to determine if they have the financial strength and sufficient assets to survive during any of the scenarios presented. Stress tests assume the bank will lose money during the scenario and measure the impact of those losses on the ability to retain liquidity on the bank’s balance sheet.

In the US, the Federal Reserve uses three different sets of conditions to estimate the baseline for capital requirements:

- Baseline

- Adverse

- Severely adverse

The Federal Reserve outlines the details surrounding the stress testing each year by informing banks of which assumptions to use for the stress test.

Any bank or financial institution with more than $250 billion in must perform stress tests, and there are two different types, depending on the size of the bank.

Dodd-Frank Act Stress Testing (DFAST)

All banks above $250 billion must pass the DFAST by performing company-run tests either annually or biannually, depending on the type of institution. After the tests are run, the banks forward the results to the Fed.

The Fed releases the scenarios before running each test, and then after the banks perform the tests, the Fed releases the results to the public. All the information concerning the tests are available is on the Fed’s website, and there is more information there than you can possibly read through, and trust me, I have tried!

The banks run through all sorts of permutations regarding the financials of the banks, using projections of the next months as the basis for the stress tests.

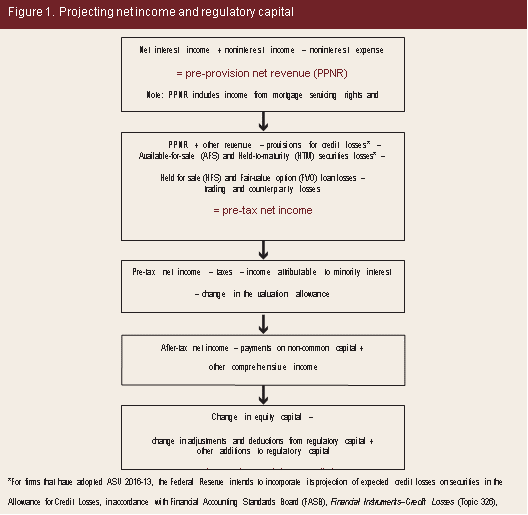

Chart courtesy of Federal Reserve

The above chart illustrates one of the tests of quantitative measures that are part of the stress test.

Other aspects tested:

- Loan losses and provisions

- Losses on Loans on a Fair-value Basis

- Loan securities in the available-for-sale

- Many more

Comprehensive Captial Analysis and Review (CCAR)

Banks with more than $100 million in assets must perform the more rigorous CCAR stress testing. For the biggest banks, over $250 billion in assets, the CCAR test can include a qualitative aspect, in addition to the quantitative elements of testing.

The qualitative aspects of the testing include reviews of internal bank policies and procedures for dealing with issues, and any proposed corporate actions, and much more.

The CCAR is done in conjunction with the DFAST stress test, and as mentioned above, is far more qualitative than the DFAST, which includes more quantitative measures.

CECL and Stress Tests

One of the main factors in the stress testing is the accounting standard, CECL, which stands for Current Expected Credit Losses. The CECL replaces the ALLL (Allowance for Loan and Lease Losses), which was in effect during the financial crisis in 2008.

The focus of the CECL is the loan reserves that banks set aside to maintain liquidity for the banks in the event of a crisis.

The big difference between the two standards is CECL focuses on an estimation of loan losses, where the ALLL focuses on incurred losses.

The financial crisis highlighted the weakness in the ALLL standard in the fact that it did not allow for timely adjustments of reserver levels and relied on losses incurred but not realized. During the crisis, the negative impacts on loan losses was not taken into account. As a result, the reserves were not set aside to account for the ongoing economic slowdown.

The CECL accounting allows for larger reserves to occur and allows for the immediate recognition of the losses. The CECL accounts for the losses associated with loans over the life of the loan.

The impact of the new accounting has helped grow the bank’s reserves since the financial crisis, as well as allowing for increases in reserves as the Covid-19 pandemic started to impact the economy.

One of the impacts on banks is the decrease in earnings, as the reserves are from earnings or raised from debt to help cover any loan losses the bank might incur.

As those reserves increase, the pressure on earnings for the bank increases, which impacts the share price of many banks; as the earnings decline, investors sell their shares in the fear that the bank’s operations are struggling.

The impact of loan losses is one of the focuses of the stress tests as the banks struggle to set aside enough loan reserves to anticipate loan defaults in the event of any economic disruption, such as the Covid-19 pandemic.

The Fed recently released the results of its most recent stress tests, with all 34 banks passing. The tests showed that banks would lose between $560 billion to $700 billion in loan losses, which would drive down the capital ratios from 12 percent to between 9.5 percent to 7.7 percent.

In light of the ongoing pandemic and its impact on the economy, the Fed required that all banks resubmit their capital plans and put on hold all share repurchases and capping dividend payments at current levels.

Final Thoughts

Banks have born the brunt of impacts from the financial crisis, and in some ways, have never recovered from the crisis. With the recent economic downturn, the stress tests that arose as a result of the failures of banks during the crisis have helped reduce the pressure on the banking system.

Many are skeptical of banks and the banking system, but the fact remains that banks help the economy function at its smoothest. The stress tests that are in place currently allow for much more clarity of the financial strength of each bank.

The stress tests combined with the Tier 1 Equity ratios allow for investors to assess the strength of a bank’s balance sheet. Based on the tests and the methods of calculating the Tier 1 equity, allow us to determine the bank’s strength.

The bonus for us, as investors, is the bank does all the heavy lifting for us, and a bank that both passes the stress tests and achieves its level of Tier 1 equity is one that owns great liquidity and strong assets.

That is going to wrap up our discussion today.

As always, thank you for taking the time to read this post, and I hope you find something of value on your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Tier 1 Capital – The Easy Way to See the Strength of a Bank’s Balance Sheet Banks take the lead in earnings season every session, and analysts make a lot out of the bank’s ability to withstand losses if the economy...

- How Fractional Reserve Banking Works and How Banks Create Money With It Updated 8/7/2023 The banking system, with all of its checks and balances, is confusing to many, including yours truly. However, depositing our money in our...

- More than Just Shark Tank Investors Can Partake in an Equity Raise! For any business, the art of raising capital is an extremely important aspect task to stay afloat, at many different times of the business. One...

- Be Aware of Liquidity Risk as an Investor Liquidity Risk is an important concept that continuously pops its ugly head up from time to time. It occurs when a party has urgency or...