Updated 4/4/2024

One of the hottest scenes in the market today is fintech, with $266 billion in new investments in the first half of 2021 alone. The rise of fintech, such as PayPal, Square, Affirm, Adyen, Stripe, and many others, is driving many innovations in banking, leading to fantastic valuations and huge gains in the market.

Banking as a service, or BaaS, is part of this growing trend in finance, much of which was accelerated by the pandemic. The reliance on technology to do our banking accelerated during COVID-19, and that trend continues with more services popping up.

The big question remains: How much will fintech disrupt the way we have banked for centuries? Many, including myself, believe those changes are here today, and the reliability and service available from banking from your phone are here to stay.

In today’s post, we will learn:

- What is Banking as a Service (BaaS)?

- What is Banking as a Service Stack?

- Differences Between Open Banking, BaaS, and Platform Banking

- Leaders in the Baas Space

- What is the Future of Banking?

Okay, let’s dive in and learn more about banking as a service.

What is Banking as a Service (Baas)?

Banking as a Service (Baas) offers the complete banking services we are used to, such as payments and credit, all through their modern API-driven platforms.

With the rise in technology and internet capabilities, many businesses are beginning to offer banking services by embedding financial services in their products and services as a means to an end, offering a better experience for their customers.

Banking as a Service is accelerating the adoption of this embedding of banking services and a better customer experience in any digital business ecosystem. For example, when you upload your payment method on the Uber app, you enable Uber to process your payment and make your experience more personal and easier.

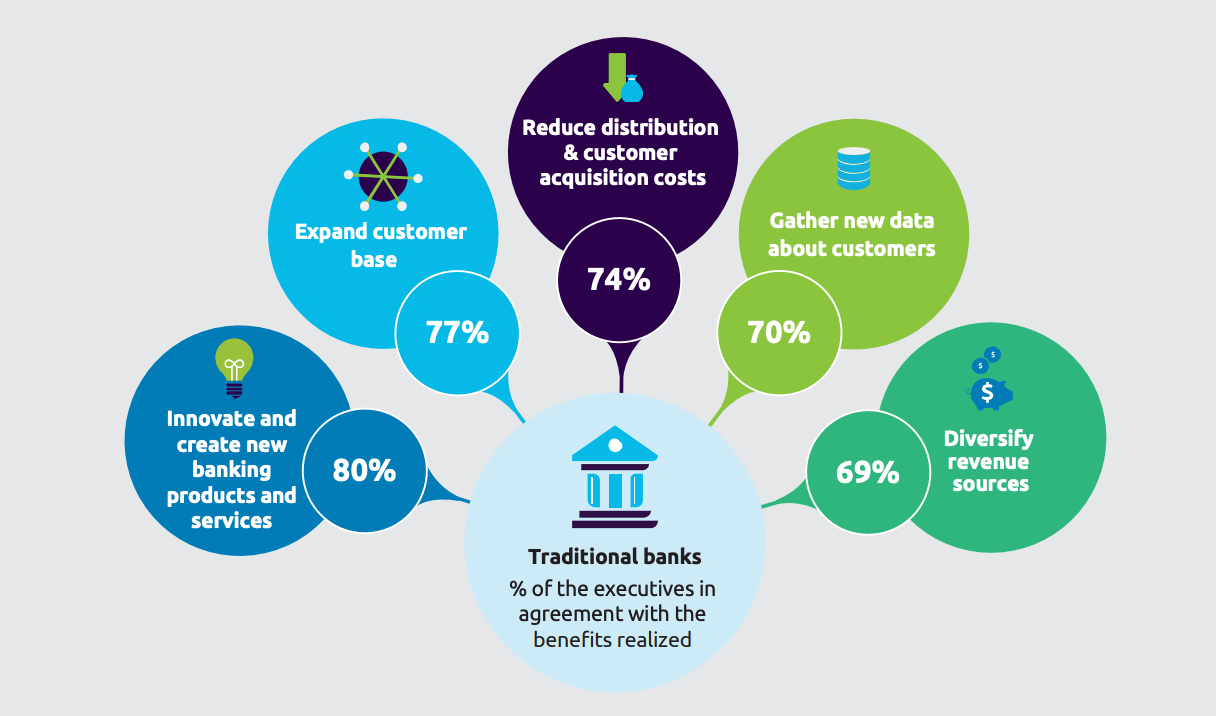

Why Are Banks Embracing the BaaS Model?

Banking as a Service offers a much quicker payment process, collaboration with other services, and business specialization. All of this innovation allows businesses to offer better propositions to customers at a much quicker pace than previously.

Many of the traditional services that we could only get from a bank are now offered at retail stores. Imagine walking into a furniture store and being able to buy that dream bed for $2,000, and instead of paying cash, you get a loan at zero interest with four or six payments. In the past, you had to go to the bank or use your credit card, which carries higher interest rates, making the purchase more expensive, and applying for a card or loan can take days, an eternity. But with services such as BNPL (buy now, pay later), the furniture business can process your “loan” in minutes.

These services make the process quicker, drive up the business’s check average, and close more retailers’ deals.

A great example of how this might work for a business is to imagine you are a restaurant facing some serious competition and want to increase your loyalty. If you offer a customer a debit card, you award them loyalty points whenever they use the card. Each time they use the card, they interact with your brand, and you could analyze their spending behavior with the data you collect from their card usage and customize dishes or food to increase their loyalty.

Starbucks embraced this idea with its app and loaded it with money to make purchases at the store. This is an example of Banking as a Service.

There are many different ways businesses could improve their customer service and boost their revenue by offering banking services. However, offering any banking services requires capital, regulation, and a banking license. That is where a Banking as a Service steps in, allowing non-banks to integrate digital banking services directly into their products and services.

The Bank’s system communicates with the restaurant via an API and webhook, allowing customers to access banking services directly through the Starbucks website. Starbucks doesn’t touch the money directly; it acts as an intermediary, which allows it to avoid any regulatory services a bank needs to perform.

What is a Banking As A Service Stack?

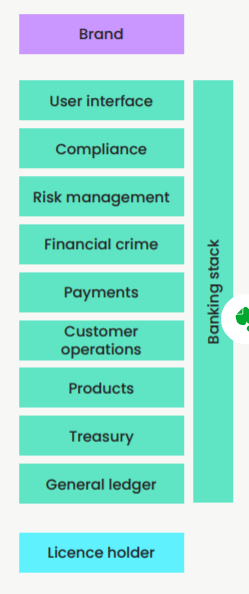

The Baas model layers in three levels:

- Brands

- Providers

- License Holders

Okay, let’s unpack each layer a little.

Brands

A brand is any company that wishes to embed financial services into its customer offerings and enhance customer service.

The brand manages the customer’s experience by embedding financial services in its user interface that the customer interacts with and enhances their experience. For example, Shopify helps merchants finance their inventory, warehouse the inventory, ship the product, and accept customer payments all on one platform.

Other examples of this are:

- Uber

- Amazon

- Apple

- Many others

Brands are the first layer of the BaaS stack and the first and only direct connection to the customer.

BaaS Providers

BaaS providers are companies that offer brands different financial services that they can embed into their customer experience.

These providers offer multiple solutions to brands through their API-driven platforms. Brands can then choose from multiple providers to fulfill their needs and build the customer experience they wish. These providers allow the brands to “mix and match” their customer experience, adding or subtracting as they see fit.

The product offerings are limitless, from:

- Debit cards

- Products

- BNPL (buy now, pay later)

- Fraud

- Collections

- Risk management

There are dozens of different offerings, and many providers specialize in one or two. Some offer multiple offerings, allowing the brands to house all of their offerings on one platform.

Some great examples of providers are:

- Marqeta – debit cards

- Affirm – Buy Now Pay Later (BNPL)

- Green Dot – debit cards/gift cards

- Stripe – payments

Not all of these companies are public yet, with Stripe still a private entity, but many expect they will go public soon.

License Holders

These are the banks that provide financial licenses for the Baas providers.

These banks enable their partner brands, such as Uber, to offer financial services to their customers through a fee arranged between the two. The Bank maintains the financial component and ensures that the agreement is satisfactory for regulators.

Here are a few examples of banks currently offering these services:

- Cross River

- Green Dot

- Starling Bank

- Evolve Bank

Banking license opportunities will grow as more and more BaaS services come online and continue to offer more solutions and products to consumers. The big boys such as JP Morgan, Bank of America, and others are not part of this system, but who knows what the future will be?

Recapping: brands such as Uber, Square, and Starbucks offer different services through their platforms, such as debit cards, payments, and loans. They partner with banks to license the financial component and meet regulatory standards.

When we break up the stack, we can see that different players can participate in different portions of the stack, which allows for greater flexibility for the brands, providers, and licensed banks.

For example:

Mercury – Brand

- User Interface

Evolve Bank – license holder

- Compliance

Synapse – BaaS provider

- Risk management

- Financial crime

- Payments

- Customer operations

- Products

Evolve

- Treasury

- General Ledger

We can see how the three companies interact with the stack and the different products, systems, and services they offer to enhance the customer’s experience. Most of this happens in the background without the customer’s knowledge.

Differences Between Open Banking, BaaS, and Platform Banking

Okay, now that we understand Banking as a Service, let’s discuss the differences between BaaS, Open banking, and platform banking.

There can be some confusion because open banking and Banking as a Service providers connect to brands via an API. However, they are different providers and offer different services.

For example, BaaS models integrate non-bank brands into their banking products. Open banking differs because the brands or non-banks solely use the Bank’s data for their products. In the fintech world, these non-bank businesses are known as third-party service providers or TTP.

A great example of TTP is the Intuit app Mint, which uses the bank’s data to manage its customer offerings. Financial apps such as Mint, Spendee, Goodbudget, and many others illustrate TTP using open banking.

These financial apps aggregate all of your financial data from your different accounts in one place, making it easier to manage your money. These can help you improve your credit, manage your cash flow, or save more money. The financial app uses open banking APIs from your financial institutions to aggregate the data and enable this process.

The API integration often comes from another provider, an API banking platform, which acts as the middleman between the bank and Mint. These API providers create and manage the API that sits on top of the banking system, allowing data flow.

The key idea is that TTP can’t offer banking services such as deposits or loans because they don’t hold banking licenses. Open banking differs from BaaS services in enabling data flow from one source to another but doesn’t provide banking services such as BNPL that BaaS providers offer.

Now, platform banking is kind of the reverse of Banking as a Service in that they own the customer, but they offer fintech services to their customers by embedding the fintech solutions on their platform. For example, if a bank wants to offer Robo advisors to their customers, they can embed a fintech offering.

In the coming disruption to banking, as we know it, we will start to see more traditional banks offering services by enabling those services on their platforms. The banks will use the tech and relationships with fintechs to enhance product offerings to their customers, encouraging customer growth and a defensive measure to prevent customer churn.

Leaders in the Banking As A Service Space

Much of the initial focus of fintechs has been payments, and many companies such as Square, Robinhood, Paypal, Chime, and others turn to BaaS companies to help them create a seamless payment service for their customers.

These providers create clean, modern APIs with ease and simplicity in mind. However, the options and solutions fintechs offer are growing exponentially, with technology growing by leaps and bounds.

Three leading BaaS providers in the US offer a complete suite of solutions along the tech stack.

Galileo: is now part of the student loan provider SoFi and offers debit, prepaid, and investment opportunities through SoFi’s platform.

Marqeta: focuses on debit cards and payments and recently went public. It partners with small banks such as Lincoln Savings Bank, Sutton Bank, and Bancorp. Marqeta’s main focus is on card-control features for its debit card offerings.

Synapse focuses on customer operations and provides payments, deposits, lending, and investment products. Synapse is easier to embed than Marqeta and is more of an out-of-the-box solution for brands.

In Europe, which is embracing the fintech revolution in a bigger way than the US, there are a few providers to mention:

Railsbank: This company works with payment processors, banks, and fintechs to quickly adopt debit cards and payments through one API. Despite the name, it is not a bank.

SolarisBank: powers many of Germany’s largest fintech players with its banking license and its suite of API solutions.

GPS: is the payment processor behind the early fintech success in England, Revolut, Monzo, and Curve.

These are just a sampling of the BaaS offerings out there; not all are public companies quite yet, but likely in the future. Here are a few other resources for analysis to find other investment opportunities.

Buyers Guide to Banking as a Service

Banking-As-A-Service (BaaS): Navigating The Maze

Banking as a Service – List of 171 BaaS companies

What is the Future of Banking?

Fun fact: Only 15% of Americans have confidence in the banking system, which is an all-time low.

How can banks rebuild that trust?

First, they need to start working to build solutions and products that enable customers to manage their finances quickly and easily.

For example, creating budgeting solutions that allow customers to track their spending, manage their cash flow, and help anticipate spending habits would help people manage their money better and save more money.

Not all of these solutions need to come from inside the bank; as Jim Marous, a leading fintech analyst, says, banks can work with BaaS providers to create and enable the services customers want the most.

These are products that make the loan process more seamless, create budgeting services, enable better debit card transactions, or offer bonuses for their spending. These are all services that many fintechs already offer, and they are stealing customers from banks with these options.

Many banks are still the main source of bank accounts. Still, countless people have their direct deposit immediately routed from their bank account to another institution, such as PayPal or Square, for daily payments.

Recently, there has been a movement from fees; for example, Ally Bank announced they were doing away with overdraft fees, and many banks started following Ally’s lead. These kinds of actions will help slow the tide, but until banks embrace the technology and rapid pace of adoption that fintechs are embracing, I fear banks will start to lose relevance.

Banks losing relevance won’t happen in my lifetime. Still, as our children start banking via fintechs, banks will lose their relevance unless they partner with fintech providers such as BaaS to enhance and improve customer service and products.

Investor Takeaway

The fintech space offers boundless opportunities for investors once you understand the different types of businesses out there and what they offer. As technology improves, making how we spend and save money easier, the disruption will continue until banks open their eyes.

A handful of banks have started to pay attention to and embrace the idea of Banking as a Service and are offering these products and services to their customers.

A few big banks, such as JP Morgan, have noticed and are starting to step into the fray. However, there will continue to be new and exciting opportunities in the fintech space for years.

As with any investment, we need to do our due diligence, understand what we are buying, and find companies at a fair price for our returns. I hope this post can help you better understand this growing space.

Thank you for reading today’s post, and I hope it helps you on your investing journey. If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Fintech 101: Intro to Financial Technology Updated 12/19/2023 Fintech or financial technology describes new tech that seeks to enable and improve financial services. Despite the uptick in fintech and how we...

- Pin Debit Networks: A Guide to This Unknown World Updated 9/25/2023 In a survey recently released by the Federal Reserve Bank of Atlanta, U.S. consumers use their debit cards to make payments 68% of...

- The Future of Debit Card Processing, What It Is and How It Works Updated 10/27/2023 In 2020, the Federal Reserve Bank of Atlanta conducted a Survey of Consumer Choice, which reported that: Evidence also shows that increasing debit...

- Embedded Finance: The Services Revolutionizing the Financial Industry Updated 9/27/2023 The coronavirus pandemic accelerated businesses’ decisions about payments and how they would accept payments easily for both consumers and the business. These decisions...