Updated 5/4/2023

Investors target high ROIC stocks for their portfolio because highly efficient companies can sustain higher long-term growth.

Companies with a high ROIC tend to be better investments than companies with a low ROIC, but not always.

The price you pay matters, and ROIC can be manipulated to an extent.

In this post, I will explain how ROIC works on a most basic level and what a good ROIC tends to be. Then we’ll discuss whether high ROIC stocks outperform the market or not, and finally, I’ll show you how to find high ROIC companies with a stock screener.

Think of this as your top-to-bottom guide on ROIC, hopefully answering most of your questions on it; these will be the topics we cover [Click to skip to below]:

- Explain ROIC Like I’m 5 Years Old

- Do High ROIC Stocks Outperform?

- What is a Good ROIC Value?

- How to Use a Stock Screener to Find High ROIC Stocks

- Additional Resources on ROIC

Let’s begin with an introduction to the ROIC formula from a 30,000 ft view.

Explain ROIC Like I’m 5 Years Old

ROIC stands for Return on Invested Capital, and it generally tells you how much profit a company can make by reinvesting in its business. It’s a “return on capital” formula, you can think of it as the investment returns a business gets on its capital.

Said in the most simple way—ROIC measures how much money a company can make on its money.

To make things simple, we can think of “Return” as profits. You simply divide this by “Invested Capital” to get ROIC.

For example, if I had $100 and was able to turn that $100 into $2 in profits, I’d have an ROIC of 2% (2 divided by 100 = 0.02 = 2%). If next year I took those $2 in profits and reinvested them fully in the biz, and earned a 2% ROIC again, I’d have $2.04 in profits the next year ($102 times 2% = $2.04).

Notice how that’s a 2% growth rate (increasing profits from $2 to $2.04 is a 2% increase).

As we apply the “Invested Capital” metric to real-life businesses, we have to understand how businesses tend to define it. Invested Capital is most commonly made up of either:

- Long Term Assets

- Working Capital

Companies grow their long-term assets by investing in capex (“capital expenditures”), and reinvest in working capital through the cash flow statement (working capital is the short-term net assets needed to run the business).

Let’s use some easy examples of this, starting with capex.

High ROIC from Capex

Take a company like Amazon. Say Amazon were to invest $100 million into long-term assets through capex, like a fleet of trucks and a distribution center.

If Amazon can save on UPS shipping costs by owning its own fleet of trucks and save in warehouse costs by building its own warehouses, or “distribution centers”, then that’s more profits to Amazon over the long term from its capital investments (“capital expenditures”).

So if Amazon increases its profits by $4 million next year because they saved $4 million in costs from these investments, its ROIC would be 4%, and it would have grown profits from that action by 4% in that year.

Some companies are masterful at using capex to generate high ROIC.

One example that may surprise you is the high-tech company Microsoft. Over the last 3 years, Microsoft has spent a little over 25% of its Cash From Operations on Capital Expenditures.

From the company’s 10-k:

“Additions to property and equipment will continue, including new facilities, datacenters, and computer systems for research and development, sales and marketing, support, and administrative staff. We expect capital expenditures to increase in coming years to support growth in our cloud offerings.”

As Microsoft builds or purchases data centers to generate cloud revenues, it is able to earn a high return on those investments because they are able to use data centers to serve a wide range of customers, with revenues and profits generally increasing the more their customers use the data centers.

This low-cost scalability leads to high-profit margins— with Net Margin above 30% in the last 3 years—so it doesn’t take much revenue from its capex investments to earn an immediate high return.

With a high ROIC over 20% in the last 3 years, Microsoft is an example of a company with a great business model that’s able to generate high returns, and thus high growth, as it reinvests in long-term assets (or “Property, Plant, and Equipment”).

High ROIC from Working Capital

For other businesses, they don’t reinvest their capital through large long-term assets but rather in short-term assets such as inventory. Distributors are a classic example of an industry that reinvests through inventory rather than long-term assets.

Industries that have high ROIC despite low profit margins are usually companies that reinvest heavily in working capital, and turn it over very fast.

For example, take a technology distributor like CDW Corp.

Despite having an average Net Profit Margin of only 3% over the last 10 years, CDW has had a median ROIC of 11% over the same time period. This is possible because as they reinvest through working capital, the company is able to grow faster through heavier volumes.

Say that CDW invested $100 million into inventory for a year. At only a 3% profit margin, they would only earn $3 million on that invested capital.

But, if the company sells that $100 million quickly and is able to invest another $100 million in inventory, sell that and then invest another $100 million before the year ends, they can earn 9% for the year on a 3% profit margin because they sold through their inventory 3 times in the year.

You see lower margin retailers like Costco or Target perform similarly, and it’s through investments in working capital that industries with low profit margins are able to still earn high ROICs.

Getting Granular with ROIC

The reality of ROIC is that it’s not solely about returns and investments; the components actually include many more line items than what I described.

For example, the actual formula for ROIC is the following:

ROIC = NOPAT / Invested Capital

This takes more meticulous calculations and can really start to distort the simpler concepts of ROIC, like reinvestment and profit.

I highly recommend checking out some of the more in-depth articles we’ve written about ROIC on the site, starting with these two:

- Everything to Know about ROIC, with Average ROIC by Industry Data

- How an ROIC Tree Shows a Company’s Growth Drivers and Capital Efficiency

Do High ROIC Stocks Outperform?

There has been research suggesting that companies with high ROICs tend to have higher valuations in the stock market over time.

This is because the stock market recognizes these companies’ superior ability to grow with less capital, which makes it easier for the company to grow in the long term. High ROIC stocks are usually compounding machines; they compound their own capital and that of their investors very well.

This paper from Michael Mauboussin is a great example of some of the research behind that idea.

However, that said, outperforming the stock market isn’t always about finding the best companies but rather paying a fair price for good companies that can grow their value over time.

If you pay 100x a company’s earnings that has a high ROIC of 20% and grows at 20% per year, but the next year the earnings multiple of the stock careens down to 20x (from 100x), you’ve lost big on your investment even if the company still grew 20%.

What actually tends to happen in the real world is that most companies aren’t able to sustain high growth rates for more than a few years, even if they have a high historical ROIC, and so the price of these stocks tend to fall especially the more expensive their valuation was in the market. (This was something Professor Damodaran has stressed in his classes on valuation, as has Michael Mauboussin in his Base Rates book).

If you can find a stock that keeps the same valuation multiple over the decades (say a consistent 20x earnings), then you will earn the “ROIC” or rate of return that the company compounds its capital.

But in the real world, valuations (and earnings multiples) fluctuate, and so if you’re paying a historically high premium for a high ROIC stock, don’t be surprised if that multiple comes down, which could cause you to earn less on your investment than the “ROIC” or rate of return the company earned itself.

Two Reasons Companies Don’t Grow As Fast as Their ROIC

1—I mentioned at the beginning that ROIC can be manipulated; maybe that’s a harsh word, but high ROIC doesn’t always mean a high growth rate because of the way the formula is calculated.

Companies have many options with their profits.

They can certainly reinvest all of it back in the business, which is when you might see growth rates follow ROIC closely. But many businesses will hold off on reinvesting some of their profits, maybe to keep as cash or even to pay a dividend.

In this case, cash kept in the business or paid out as a dividend isn’t included in the ROIC formula. It’s not counted as Invested Capital.

So, a company could reinvest only a fraction of its profits into capex or working capital—so it wouldn’t be hard for that company to earn a high rate of return especially if the business is growing organically (without reinvestment from the company).

That’s how you could see a high ROIC and yet much lower growth rates, because the company is only reinvesting a fraction of its profits and relying on organic growth instead.

2—Past performance doesn’t guarantee future results

Because of the way that ROIC is calculated, it looks at past results only. You have to input NOPAT and Invested Capital metrics that the company has already produced, which may or may not line up with how the company performs in the future.

Like I mentioned above, the growth of high growth companies tends to saturate much faster than investors think, which is why you’ll tend to see huge drawdowns with these stocks as their growth outlooks moderate.

How a Company Can Grow Faster Than Their ROIC?

This one also can happen a lot, especially with growth stocks.

You might see a low ROIC stock that’s actually a great opportunity because the company is reinvesting all of their profits (or revenues) back into the business, and though there isn’t an immediate return on that capital, the future return can be outsized and make for super high ROIC in the future.

This one is much harder to project, so I’d highly suggest caution if you’re using this logic in evaluating a company’s ROIC and whether you’d like to invest in it.

One example in my own portfolio is aggregates miner Martin Marietta Materials.

The company has expanded aggressively through acquisitions and capital expenditures in order to secure the valuable zoning and permitting rights on open pit quarries.

These mines tend to be longer term investments—for example, the company’s average aggregates reserves (think of it as “useful life”) in 2021 was 78 years!

That means these acquisitions and capital investments are expected to pay off for many decades, and just because they don’t show an immediate profit today, doesn’t mean that these are bad capital investments especially if the demand (and prices) for aggregates continues to grow into the future.

What is a Good ROIC Value?

How you determine a high or good ROIC is really subjective, but most textbooks on finance will agree that a good ROIC should at least exceed a company’s cost of capital.

That’s a whole other deep dive into the minutiae of finance that might be overwhelming for beginners; if that’s you I’d highly recommend approaching it slowly and just trying to learn as much as you can over time.

If you do want to dive deep into the rabbit hole on cost of capital vs ROIC, I highly recommend Dave’s fantastic post on the topic.

To keep it simple, I’ll tell you that any ROIC above 10% is a good starting point for a “good ROIC”.

With my own investments, I’m targeting an 11% annual return—a company with an ROIC of 11% might not get there on its own, but paying for a stock like this at a great price could make my investment returns hit 11% per year even if the company doesn’t necessarily grow at that rate.

It’s all relative though, and I’d generally say that the cheaper the market is, the higher growth/ROIC companies you should be trying to invest in, and vice versa.

How to Use a Stock Screener to Find High ROIC Stocks

The first thing to know about ROIC is that it is calculated in so many various ways online. The formula has become really subjective (since there are so many different line items in company financials), so you have to be careful about blindly following what a website says that a company’s ROIC is.

No tool is perfect, so I’d recommend using at least 2 to check your work.

My favorite for finding high ROIC stocks quickly are both free:

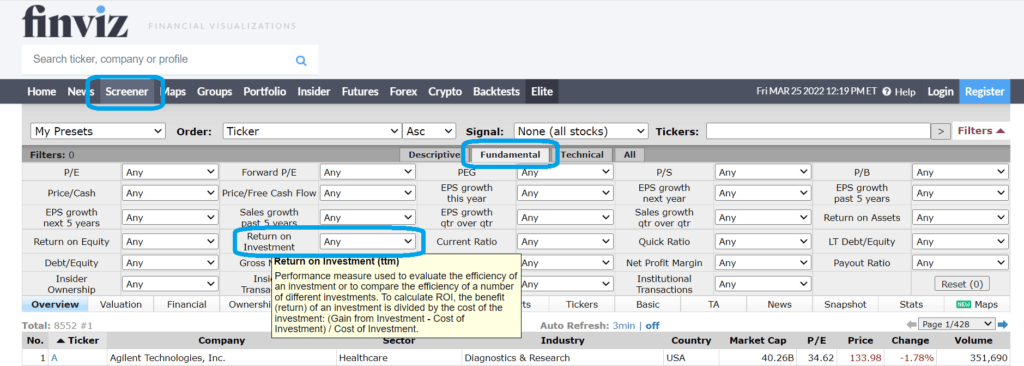

On finviz, land on the homepage and click Screener in the upper left tabs. You will see a myriad of fundamental and technical indicators you can sort for on over 8,000 publicly traded stocks.

Click the Fundamental tab near the center of your window, and then look for Return on Investment. It’s not a perfect measure and the website isn’t clear on how they calculate this one exactly, but I’ve found it to generally be consistent with my other source for ROIC (quickfs).

From here, you can either sort by ROI, or set minimum or maximum ROIs to be displayed in the screener. You can also combine this metric with many others to your heart’s desire—for example if you only want to display dividend paying stocks or stocks with positive earnings.

As an example, today these companies in the S&P 500 all have a very high ROIC according to finviz:

- Apple ($AAPL)

- APA Corporation ($APA)

- AutoZone ($AZO)

- CF Industries ($CF)

- Domino’s Pizza ($DPZ)

- Fortinet ($FTNT)

- Mastercard ($MA)

- O’Reilly Automotive ($ORLY)

- Otis Worldwide Corporation ($OTIS)

- Starbucks Corporation ($SBUX)

- Ulta Beauty ($ULTA)

- VeriSign ($VRSN)

- Yum! Brands ($YUM)

Each of these companies have an ROIC greater than 50%.

Once you’ve found a stock or list of stocks you’re interested in, check to see if another source also reports the company as having a high ROIC with a website like quickfs.net.

Right on the homepage you can enter a company’s ticker, and immediately get a visual on the company’s current and historical ROIC. Here’s an example with one of my favorite businesses, Microsoft:

This high-tech behemoth has historically had very high returns on its reinvested capital, which has in no small part helped the company grow from $13.7B in Free Cash Flow in 2002 to the $56B it recorded in 2021.

Additional Resources on ROIC

Learning about ROIC is really like opening a can of worms, it can seem more complex the more and more you learn about it.

That said, if you’re looking to become a great long term investor, it helps to at least know the basic concepts and how to identify companies that obviously have a good ROIC, and those that don’t. Once you have that basic foundation, the next step is evaluating why a company has a low or high ROIC—whether because of its business model, competitive pressures, or something else.

Knowing more about a business will help you continue to hold that business for the long term, which is a fundamental key to finding success in the stock market.

If you’re looking for additional resources to continue down the ROIC rabbit hole, we’ve got quite a few more that you can check out:

- Everything to Know about ROIC, with Average ROIC by Industry Data

- How an ROIC Tree Shows a Company’s Growth Drivers and Capital Efficiency

- Using Return on Invested Capital (ROIC) to Evaluate Stocks

- How to Calculate NOPLAT for Operating ROIC

- How to Calculate Invested Capital for ROIC (the right way)

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- Assessing The Capital Allocation Skills of Management Updated 9/15/2023 Capital allocation is job number one for any management team. The problem is that most CEOs lack this skill, intending to build long-term...

- The 7 Types of Capital Allocation and What They Mean for Shareholders Updated 9/3/2023 “Capital allocation is a senior management team’s most fundamental responsibility. The problem is that many CEOs don’t know how to allocate capital effectively....

- Beginner’s Guide: 7 Steps to Understanding the Stock Market Updated: 4/06/23 This easy-to-follow beginner’s guide will help you learn how to invest in the stock market. We’ll be leaving out all the confusing Wall...

- What are Quality Stocks? Do They Outperform? What are the Pitfalls? Updated – 11/3/23 Quality stocks are a popular type of stock market factor. Quality stocks are generally defined as businesses with above average growth and...