Have you ever heard the saying that “anyone can be a genius in a bull market?” Well, it’s true, if you’re not benchmarking performance of your portfolio. Not benchmarking your portfolio can really cause some major issues if you’re not careful and will have some major, long-term negative effects on your portfolio.

So, what even is benchmarking your performance? Well, it’s pretty simple in all honesty – all that you’re doing is you’re taking the performance of your portfolio and then comparing it to the stock market average. For instance, you would take your portfolio performance, let’s say it’s 8%, and then compare it to the stock market average over the same time period that you’ve been investing, and let’s say that’s 6%.

Did you actually make 8% on your money? Heck yeah you did! But is that a fair representation of how your portfolio performed? Nope! What you should say is that your portfolio outperformed the stock market by 2% (which is very good by the way).

But why would you actually want to do this? Well, it’s to keep you rational, honestly, but let me really focus in on two main points:

The Background

An example to show the importance of benchmarking that I can think of is with golf. Typically, a golf course will be Par 72. “Par” means that is what the professionals would theoretically shoot, so if the course is Par 72, that means that they should take about 72 strokes to play all 18 holes. If you’re a “bogey golfer”, meaning that you shoot 1 over par on every hole, then you’d shoot 18 strokes over par as there’s 18 holes, right?

So, that means you’d shoot 90 on a Par 72. Well, what if the course was actually a Par 70, or even a Par 66 (like a really crappy course I played in college because it was close to campus)? If it was Par 66, and I played Bogey golf and was 18 over par, then I shot 84!

Wow, that sounds like a really good round, right? Well, I actually played no better or worse than my normal score, it’s just that the Par, or the benchmark, of the course was a lot lower than normal.

A personal finance example of benchmarking is when you’re looking at your budget, either in the Doctor Budget spreadsheet or with your own system. If you spend $3000 is that good or bad? What if you spend $2000? I mean, $2000 is definitely better than $3000, right?

Well, what if your target budget, or your benchmark, was to spend $1800 and you spent $2000? That wouldn’t be good! But if your target budget/benchmark was $3300 and you spent $3000, then you did a great job that month!

The point that I’m making is that simply stating numbers to indicate performance mean absolutely nothing unless there is some sort of context behind them. You have to provide a benchmark to compare it!

The best baseball players in the history of the game only get a base hit about 30% of the time. If I told you that I was successful 30% of the time, you’d think that I was a massive failure, but in baseball you’d be a Hall of Famer!

I know that I’ve likely given a few too many examples just now, but I really just want to drive home the importance of a benchmark and that it’s really just providing context.

Anyone can get $100 and go put it into an index fund that is meant to mimic the stock market, like SPY, and get nearly identical returns to the S&P 500 without doing any analysis or strategic thinking, and that’s perfectly fine! But if SPY resulted in a 19% gain like it did in 2019 and your portfolio returned 15%, how would you feel?

Would you be happy because you assumed a return of 8%? Of course! But would you feel like you were a genius? I sure wouldn’t. I would feel like I underperformed the average by 4%. So, while I was happy, I’d also feel like I left a lot of money on the table…4% of my investments to be exact.

The Mindset

The mindset of having a benchmark is so incredibly important and can keep you from experiencing very high highs and very low lows, therefore smoothing out your confidence (or lack thereof) for investing in the market. Essentially the thought process is that if you consider the benchmark being the average, and that anyone can get the average, then you should only see how you perform above or below that.

In the example that I gave previously, if you’re going to get a 15% return but the market got a 19% return, then it’s imperative to view that as just that – you underperformed the market by 4%.

Just as if the market dropped 19% and your portfolio dropped only 15% – then you outperformed the market by 4%.

The key is to view the market as something that isn’t controllable, because it really isn’t. I always am talking about “Opportunity Cost” so the Opportunity Cost, or the alternative, is simply investing in SPY. So, I literally view the returns of the market as a lost cause and just try to beat the market whenever I can because that’s all that I can control.

If you have the mindset of comparing it against a benchmark at all times, then it’s going to keep you from looking at these crazy swings in volatility that we’re seeing nowadays. Last week we tied the record of 6 straight days with a market move of at least 4%, either positive or negative. If you can instead compare your portfolio against the market, which means that maybe your portfolio was within a percent or two, then you’re going to be a lot more rational in your decision making.

So how can this actually help you as an investor?

Typically this strategy is going to help you in times of great market success and also in times of major downturns, and I can’t think of a better example than 2019 – current.

In 2019, the market was up 19% as I mentioned, but my portfolio was only up 17%. 17% is an incredible return if I’m only looking at the number, but since I was benchmarking it, I underperformed Joe Schmo by 2%. Instead of thinking that I was a genius and that I was the best investor ever since I had 17% returns, I was able to stay rational and see that I still had areas to grow and areas to perform better. I took this as an opportunity for me to dive deeper into my stock picks and learn where I had made mistakes and where I had flourished.

In general, I had made some great investments and some bad ones. My great ones were the ones that I had stuck to my value-investing strategy, utilized the VTI, and invested in great companies with growing dividends. My bad investments were some of my “flyers” that I occasionally will invest in, like Lyft.

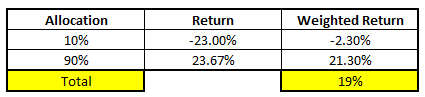

I took a flyer on Lyft and bought it near the IPO price and sold it right in the range of $60, locking in a loss of about 23%. If someone were to do this on 10% of their portfolio (which I did not) then they’d have to have the reaming 90% of their portfolio earn a return of 23.67% for their portfolio average to be the 19% that the SPY earned.

In short, a “flyer” can also be a “crasher” pretty stinking quick. It’s fine if you want to take flyers but understand the risk. If I hadn’t looked more in depth at my portfolio by comparing it to a benchmark, I likely would’ve thought that I was a “genius” and continued to take these flyers, further damaging my portfolio now and in the future.

This can work the exact same way in a downturn. If the market is down a bajillion percent, like we’re seeing with this COVID-19 pandemic, then it’s easy to look at your portfolio and see that it’s down 30% and panic sell out of all of your positions.

Well, this is absolutely not what you want to do. If you liked your portfolio 30% ago, why would you like it less now, unless something materially different has occurred? If it hasn’t, then why would you sell your positions?

It would be like if you bought a shirt for $10 for a trip in the summer, never wore the shirt, and then you went back to the store the next week and saw the shirt was there for $7. Would you go try to sell the shirt back to the store for $7?

No!

The shirt hasn’t changed – it still hasn’t been worn and is in great shape for your future plans, the summer trip that you’re eagerly anticipating. If anything, you should go buy more, right? That shirt is the exact same but now you can get them at a better price – time to stock up! (pun not intended)

Investing should be the same exact way, but the best way to keep this mindset is to compare it to the market! Let me show you what I mean.

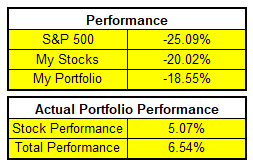

I track my investments in Excel (like a nerd, I know). In March, my portfolio is down….a lot. As a whole, I am down 18.55% but my actual stocks are down about 20% (I keep some cash in there for opportunities ?).

If I was only looking at this performance, I guarantee I would’ve panic sold by now. Instead, I’m continuously comparing it against the alternative, or my benchmark of the S&P 500. When I do that, my performance actually looks pretty good!

I look at this and don’t see a Portfolio down 18.55% – I see a portfolio that has outperformed the market by 6.54%! This sort of mindset really keeps me rational in these extremely scary times and keeps me focused on my strategy.

I trust that the market will rebound, just as it always has, and that it will maintain the average CAGR of 10%. I don’t care if my outperformance comes from when the market is down 20% or up 20% – as long as I stay focused on beating the market then I am going to stay a rational investor.

I mentioned that this mindset has allowed me to stay rational, any by staying rational, I have bought all the way down. If anything, I have likely bought a little bit too early, but I have been putting my money into the market.

By staying rational I have allowed myself the peace of mind to keep adding to my portfolio and dropping my average cost a significant amount, therefore reducing my breakeven point to where I can see major gains.

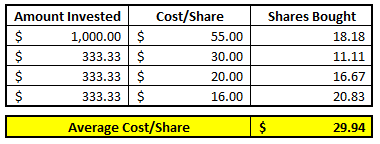

Let me show you a perfect example – pre-COVID-19, I had invested $1000 into a company at $55/share. As that stock has continued to get pounded, I’ve invested the entire way down along with it, trying to pick three good spots that I thought were a value.

As I bought, my average cost/share dropped too. I initially had just over 18 shares with my first $1000 but now that I’ve bought at lower prices, my next $1000 has purchased me over 48 shares. I liked the company enough at $55, and I don’t think that the COVID-19 pandemic has changed that company’s course for the long-term, so I continued to buy down to try to reap the rewards in the future years.

When I see an industry like the airlines getting absolutely punished, I don’t sit there and avoid them like the plague – I look at it as a buying opportunity. Not necessarily that I need to buy them, but that I should investigate them. I mean, are airlines going to completely disappear as an industry? No, absolutely not.

They’re getting crushed for short-term concerns. Or maybe even long-term. But I’m investing for the long-term, and you should, too.

If I never used a benchmark, I never would’ve even thought this way. I would’ve sold a long time ago, and likely made money from doing so…in the short-term. But I also would’ve definitely missed the rebound, likely began investing again in 2025 when the S&P 500 is probably like $4500 or something outrageous, and then gotten really comfortable just in time to see another downturn.

Rinse and Repeat.

Don’t stick to the cycle – break the cycle.

Related posts:

- How to Use Jensen’s Alpha to Measure True Investor Performance Updated 1/5/2024 Measuring investment returns continues to be something everyone looks to do when investing in the markets. The search for “alpha,” or market-beating investment...

- How to Use Return Attribution to Compare Portfolio Return Being able to attribute the sources of portfolio return is an important aspect in the decision making process surrounding portfolio management. The process of return...

- Are you Market Timing? If so, I Bet You’re Losing Money… Updated 4/17/2024 Have you ever been a victim of marketing timing and inevitably lost a lot of your money? So many new investors fall victim...

- The Information Ratio – CFA Level 2 An investor’s Information Ratio is a measure of the Active Return that is being achieved per unit of Active Risk. The Information Ratio is important...