If you’re familiar with personal finance then you likely understand compound interest, but do you actually know how to apply that knowledge into your FI journey? It’s hard to take book knowledge and turn it into street knowledge, so that’s why I am here to tell you the best compound interest investments!

Before we get going on all of the best options for you to put your money, I want to explain what compound interest is. Compound Interest is when you essentially earn income on top of interest (or returns) that you have earned the year before. Let me explain:

The total yield for the S&P 500 since 1928 has been about 10%. So, let’s pretend that you invested $1,000 in 1928. That means that in 1929, you would’ve earned 10% on your investment, so now you have $1,100. Then, you will make another 10% in 1930 meaning you now have $1,210. Not only did you make 10% on the $1,000 that you initially invested but you made anther 10% on the $100 that you earned in 1929.

So, in total, you earned $100 from investing in 1929 and then $110 in 1930. The beauty of compound interest is that the time is just as important, if not more important, than the amount that you’re investing.

Let me lay out two different situations and you tell me which you think ends up with more money:

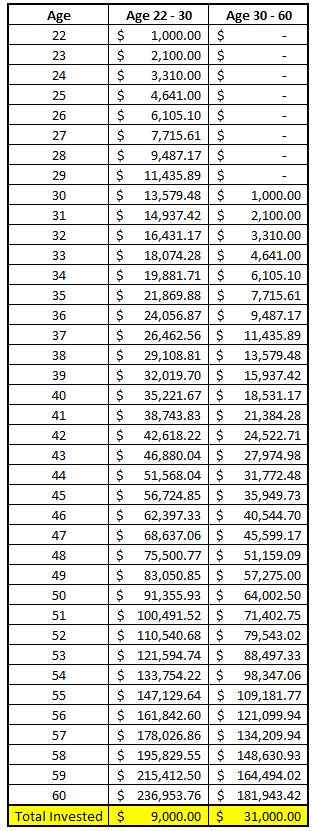

- Person A invests $1000/year from Age 22 – 30 and then never touches their money again or invests any more money

- Person B invests $1000/year from Age 30 – 60

Both people earn 10% each year on their money which as I mentioned is the average to invest in an ETF like SPY.

Who has more?

Person A – and it’s not even close!

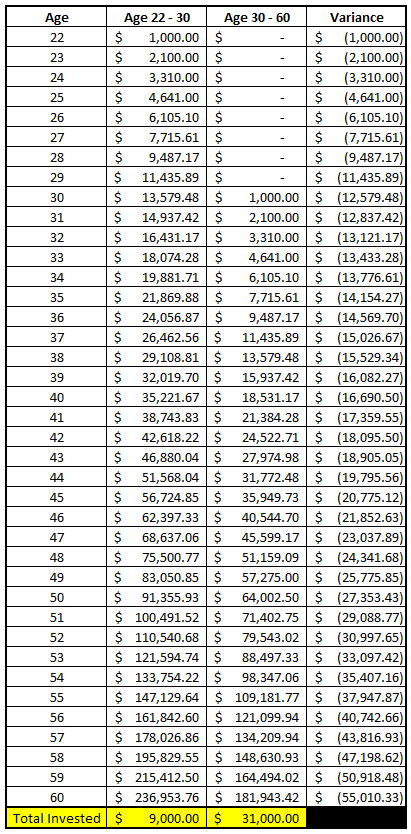

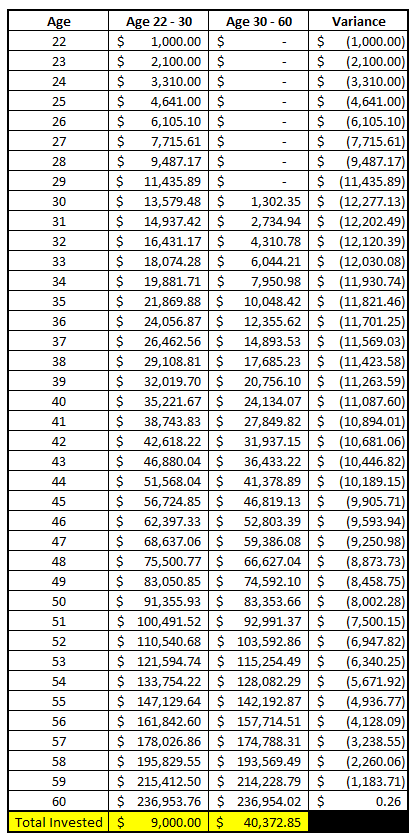

As you can see, Person A absolutely destroys person B by more than $55K. And do you know what else? The variance actually keeps increasing and Person B would literally never, ever catch Person A.

Person A invested only $9K while Person B invested $31K and they still have just dominated.

In fact, if you did want to end up with essentially the same amount that Person A had, you would need to invest $1,302.35 each year. So, all in, Person B invested a total of $40,373 by age 60 while Person A invested $9K and they ended up with the same exact (within 2 bucks) at age 60.

Do you see why starting early is so important?

If you’re still struggling with understanding compound interest, or even getting motivated, checkout these 5 simple and insanely motivating ways to get started. I highly recommend you understand the concept of compound interest before reading further on so they will help get you the rest of the way there!

But enough is enough, let’s get started with my list of the best compound interest investments! In reverse order, of course ?

7 – Normal Savings Accounts

Normal savings accounts would be anything that specifically doesn’t say a high-yield savings account. I don’t normally put companies “on blast”, but Fifth Third is one that I have done and continue to do so as my savings account would earn me .01% interest.

Yes, every year I earned a dime for every $1,000 I had in that account. What a reward!

Now, I do hate them for that but let’s be honest – it was my fault for having my money in that account in the first place. But as soon as I found out my interest rate and knew how compound interest worked, it was gone.

I still use them for my checking and I do have a savings account with only $1,000 if I need immediate cash, but that’s it. All the rest of my money that I have for an emergency fund, short-term savings, rainy day fund, etc., is tied up in the next best compound interest investment!

6 – High-Yield Savings Accounts

As I mentioned, I will put all the rest of my money in a high-yield savings account that I will potentially need in the next 1-3 years. I do this because it’s extremely liquid and I can remove it quickly, but I do sacrifice returns for the liquidity.

So, while I can get this money within a day or two at any point in time, I am only earning .5% interest as of September 2021. Now, that still is an astounding 50x over my Fifth Third account, but still pretty measly.

I do expect this rate to go up as federal rates do as well, as when I first opened my high-yield savings account with Ally in 2019, the interest rate was an extremely respectable 2.3%.

I know some people that will put their short-term savings into other investment options, but I really just want access to my money the second I need it, and for that reason I use the high-yield savings account.

If you’re riskier and more willing to go for a higher return, then maybe investing in a CD might be right for you!

5 – CDs

Some people will use a CD ladder where essentially, they open various CDs that all roll off one month apart from one another. This is a strategy that Dave has written about previously that makes a lot of sense but depending on the use, such as with an Emergency Fund, it can be a bit more risky just because you might not have the cash right when you need it.

That being said, it definitely will be a better compound interest tool than a savings account so it falls at third on the list.

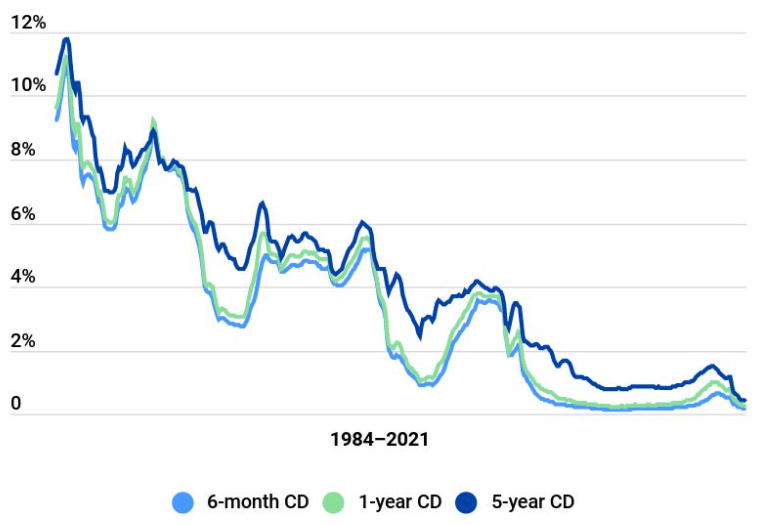

Below is a really nice graph from Bankrate that shows the typical CD rate over time since 1984:

While the average CD rate is likely very nice, you can clearly see that the rates have been going down significantly over time.

Like, down so low that investing in them seems like almost a waste of money and one that’s most likely not going to outpace inflation.

The nice thing about CDs is that they’re insured by the Federal government so you do know that this is a very safe investment, but it’s still one that just has a very, very low compounding effect.

4 – Bonds

Bonds are very similar to CDs in the sense that it’s a fairly stable return but are a little bit riskier as they’re not guaranteed by the Federal government, meaning the returns can typically be slightly better – aka a better compounding tool (assuming you don’t lose your money!)

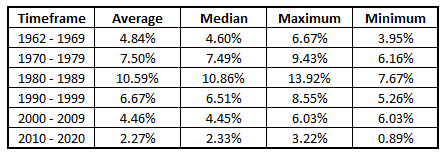

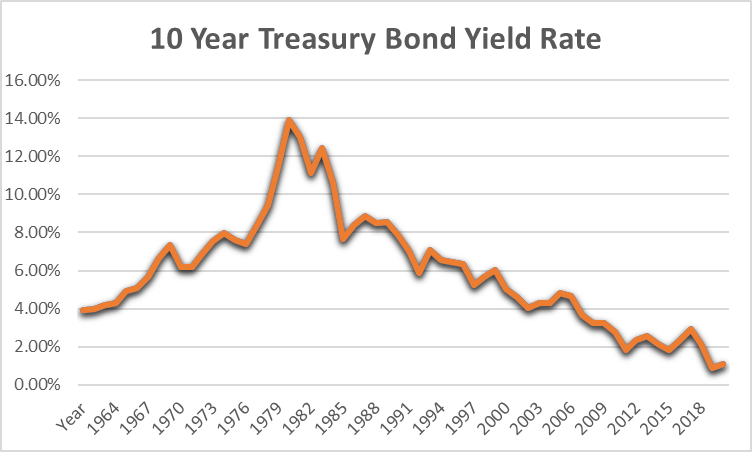

Macrotrends put out a nice chart of average 10-year treasury bond rates since 1962 which I put into a graph to help you visualize it a little bit better:

The chart looks pretty similar to the CD chart, doesn’t it? You can see the peak in the early 1980’s and then just a slow, steady decline to rates that are right around 0%.

This shouldn’t be too surprising as it is similar to all of the previous compound interest investments that I have talked about. Now, is this trend going to continue?

It’s hard to imagine that it will because there’s not much more room to go until we get negative yields, but believe it or not, some countries do have negative yielding bonds.

It’s a hard concept to wrap your mind around that you’d want to invest $1 today knowing that it will be less than that in 10 years, which is why I recommend you start with our Economics basics series that Andrew and Dave went into on the pod.

When looking at these rates on a decade(ish) basis, you can see that the trend is pretty obvious with the slow and steady decline:

So, while this might seem like a solid compound interest investment, I still think there are many better options, especially in today’s world where the rate is well below 1%.

3 – Paying Down Debt

Paying Down Debt comes in at #3 on my list of the 7 best compound interest investments, but truthfully, it can really be anywhere from 1-5, and it all depends on your interest rate.

Let me explain!

If your debt is on a credit card where you’re paying 20%+ interest rate and you’re constantly carrying a balance, I would pay that off ASAP.

Sure, you might beat 20% by investing in the market, but historically speaking, you won’t.

Instead, every time you pay just one extra dollar down on that debt, you’re going to be saving 20% interest on that dollar or in other words, getting a 20% return.

Now, don’t be one of those people that think credit cards are evil because you actually can use them in a way to achieve FI faster as long as you’re a responsible person with your finances.

But, most of us aren’t carrying some major balance. Most likely, we’re going to be talking about doing things like paying off a mortgage, student loans, car loans, etc., that are all generally somewhere in the 3-7% range, or let’s say 5% on average.

Similar to the credit card example, every time you pay extra on a loan you’re essentially “earning” that APR by not paying interest on it.

Ever heard the saying, “a dollar saved is a dollar earned?” That applies to paying interest. If you can save on spending money for no reason on interest, that’s basically you earning that same amount.

The main benefit of paying off debt first is that it’s a 100% guaranteed return.

All of these other investment options are variable and can have changing returns. When you pay extra on a loan, you are 100% locking-in that return. That can be good or it can be bad – purely lock, honestly.

Personally, I use 6% as my trigger point. Anything over 6% APR gets paid off prior to investing in a brokerage account. Anything under 6% gets the minimum monthly payment and then I use the rest to invest.

“But Andy, what do you invest in?”

Well, I don’t want to spoil – but let’s just say it’s one of my last two best compound interest investments!

2 – Rental Income

I’ll be 100% honest and upfront with this one – I don’t invest in real estate outside of Real Estate Investment Trusts (REITs) because I just haven’t had the financial runway to do so, yet…

Now, I do love REITs because they allow me to get some action on the real estate market through my investment accounts, but I don’t do a ton of investing in them.

According to the Real Wealth Network, a good return on a real estate property is in the 7% range while a great investment is in the 10-12% range.

Sound like any other asset classes? ?

The thing that really intrigues me about real estate is that on top of the monthly income that you might receive from the rent, you also are going to have the opportunity to sell that property at a higher value if the value appreciates, which is fairly common.

So, you can basically get a monthly check to cover the mortgage and then also sell that house for a much higher value later on in life.

Sounds like a no-brainer, right?

Well, the one concern I have is that when you own a house, bad things seem to happen non-stop lol.

We have owned a house for about two years and have had to put in nearly $10K in random things – new AC, driveway repair, landscaping, etc.

It’s really, really annoying.

But, it’s part of owning a home, so you need to make sure that you’re banking on these things happening when you buy the house.

I do listen to a lot of real estate podcasts because we’re toying with the idea of buying a new house and keeping this house as a rental, and one general rule of thumb I always hear about is the 1% rule.

That rule basically means that you should be able to charge 1% of the home value as a monthly rent to a tenant.

So, a $200K house means you can theoretically charge $2K every month. That sounds like an obvious reason to invest in real estate, but there are other major things that you need to remember prior to doing so.

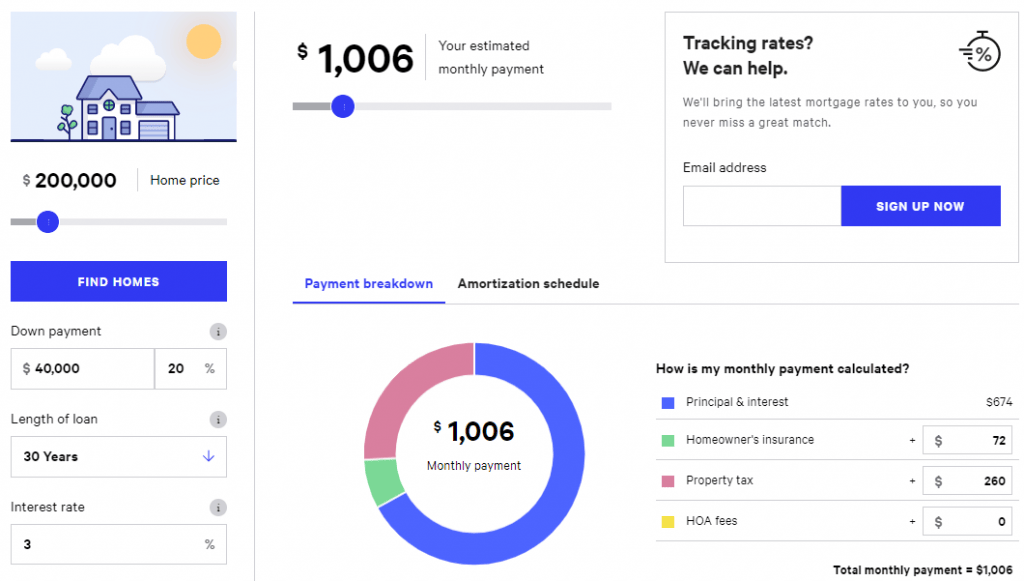

Using bankrate.com, a very simple analysis shows that on a $200K house at 3% APR, you’re going to be paying about $1K each month – not bad!

But, as I mentioned, you have many other costs that you need to consider:

- You likely will need a property manager which can be $100 – $200/month

- You’re going to want to save for those unplanned expenses like I mentioned. We’ve had $10K in 2 years, or $417/month

- You might not have 100% occupancy. If you assume 10 months of the year are occupied, you have $22K in total income for the year

- So, all-in, you’re at $22K – $5K ($10K over 2 years) – $12K (mortgage) – $2400 (Property Manager) = $2,600.

- If you put down 20%, or $40K, then you earned 6.5% that year.

Not awful, and this is super rough math, but it does give you a general idea of how the returns work. Now, like I mentioned, the home value could go up but if you don’t sell then it’s an unrealized gain meaning it’s basically worthless.

The home could go up to $250K and then a year later go to $150K. Not likely but could definitely happen. So, you can NEVER bank on that.

I think the safe thing to do is just assume that you’re going to be in the 7% range and then anything above and beyond that is just gravy!

7% is pretty dang good, but it can’t touch the #1 best compound interest investment!

1 – Stock Market

The stock market is the king of kings!

It sounds ridiculous and maybe a bit obvious based on the website that I am writing for, but it’s true – investing in the stock market is the best compound interest investment that you can have, even if you’re not someone that likes to read all the financial reports and get into the nitty gritty.

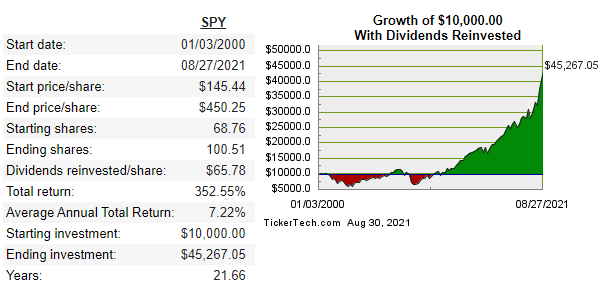

If you simply just put some money into an investing account, such as a tax-advantaged account like an IRA, or even into a brokerage account, then you can simply just invest in the stock ticker of SPY and let that money sit.

That’s it.

You’re going to pay an expense ratio of .09%, which is essentially nothing, and just reap the amazing rewards. How amazing, you ask?

Well, using that handy dandy dividend channel website that I referenced above, if you had put in $10K on 1/1/2000 and just let it sit, you would now have $38,688.94 if you reinvested those dividends:

And guess what – while those are actual numbers, that is actually extremely low!

You can see that the average annual return is 6.62% but let me tell you this – that is SO much lower than we have seen if you look at time periods that go back even further to 1975, 1950 or 1928.

Can you make the argument that looking at a more recent time period is going to be more accurate? Sure.

But that’s why I like to look at many different time periods to get a well-rounded perspective!

Summary

At the end of the day, any investment is good as long as you’re outpacing inflation and getting some return. Personally, I think you should stick to the top 3 options that I’ve laid out unless you’re investing for the short-term or holding onto your money for an emergency fund.

If you’re looking for the most bang for your buck, the obvious answer is to put it into the stock market, even if it’s an ETF like SPY that encompasses the entire stock market.

But if you’re more of a stock picker like I am, then you need to check out the Value Trap Indicator and the Sather Research eLetter – both of which are going to set you up for a foundation of success – and even give you some great buys for RIGHT NOW since you’re a little late to the party!

Related posts:

- Want to Retire Early? You Better Understand the Importance of Investments! If you’re even thinking about retiring early, or really even retiring at all, then the importance of investments absolutely cannot be understated. If you’re struggling...

- Struggling to Save? Start with These 4 Simple Auto-Investments Updated 4/1/2024 One of the most challenging steps to becoming financially independent is getting that little snowball moving downhill by creating a gap between your...

- Start Investing Now, Because Even Small Investments Add Up! One of the most common excuses that I hear for why people don’t invest is because they don’t have enough money to do it. Well,...

- How Investing Early Changes Lives: Compelling Data Everyone knows that investing early can dramatically change your future. But how much can it actually change? The answer is a lot. Click to jump to...