More often than not, inflation is something that isn’t that pertinent to the everyday person, but that’s not the world that we currently live in. When inflation nearly reached 10% in any year, it’s completely valid to freak out a little bit and start looking for the best hedge against inflation.

Key Takeaways:

- Inflation is volatile and historically has ranged from 18% to -10%.

- Inflation is constant and there are tangible ways to account for it

- I-Bonds are the best inflation hedge but maybe not the best investment for you

In this post, I’m going to cover the following major topics:

What is Inflation and How Does It Impact Me?

Inflation is essentially the loss of your purchasing power over time. When someone says that “inflation is typically 2-3% every year”, that means that on average, the goods and services that you’re likely to purchase will cost 2-3% more next year than they do this year.

I won’t go in-depth on inflation like I did earlier in the pandemic but it’s something that I recommend people understand because it can have a major impact on your life.

To the common person, 2-3% is likely pretty unnoticeable in their everyday life, but when you zoom out over time, it becomes extremely evident just how brutal inflation can truly be. The most obvious impact of inflation is your day-to-day life.

Sure, it might not seem major if your can of green beans goes from $.50 to $.51, but if you zoom out just a little bit and pretend that your bills are all 2-3% higher, that can be detrimental.

If you were someone that was essentially living paycheck to paycheck and your costs just went up 2-3% but your income stayed the same, you’d be in major trouble! You would quickly find yourself in a scenario where your living standards are now unsustainable and find yourself needing to cut costs or find a way to increase your income.

This is by far the biggest impact that you’ll have with inflation but there are many other ways as well, such as with your income.

It might not seem like inflation would affect your income, but guess what – it does! I think that my employer should give me a raise every year that, worst case, will match inflation. If a company’s costs rise due to inflation, they should theoretically mean that they can charge a higher price. That means that their employees should also be compensated accordingly.

Inflation is 2-3% on average…I expect that to be my minimum raise and if not, I will bring it up to my employer!

Another way that inflation can impact your life drastically is your investment returns and retirement. Many people will look at the S&P 500 returns and think that if they get those returns each year, then they’re going to be able to retire at a specific time. Well, it turns out they’re not accounting for inflation.

So while the S&P 500 normally returns you 10% annually, that number after inflation would average out to be about 7.5%. Might seem minor, but it’s not.

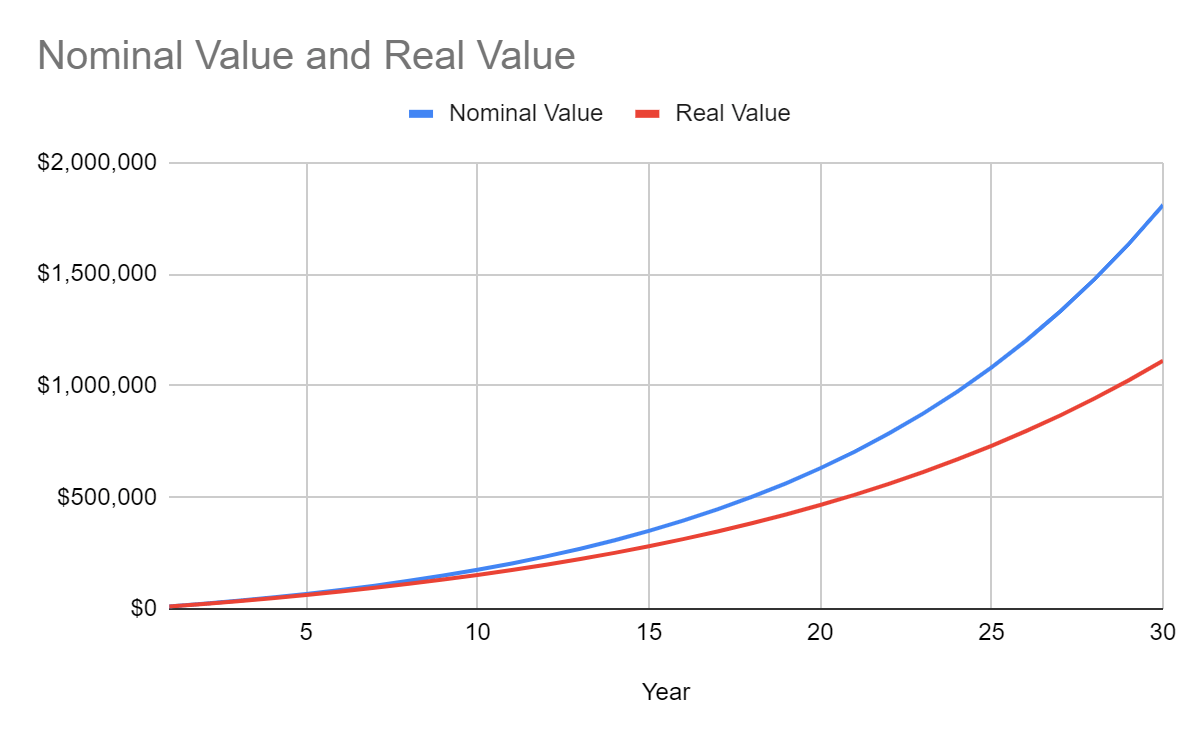

If you were to invest $10K each year for the next 30 years and earn 10% on your money, you’d end up with over $1.8 million! That would mean that using the 4% rule, you’d be able to withdraw $72K each year and likely never run out of money.

Below shows the “nominal value”, which is the actual dollar amount, and the “real value”, which is the amount adjusted for inflation. You have $1.8 million, but your expenses have also increased drastically!

As you can see, inflation can kill you! If you were sitting here thinking that you currently have expenses of $72K/year and wanted to retire in 30 years, you’re going to need way more than that in retirement because of inflation.

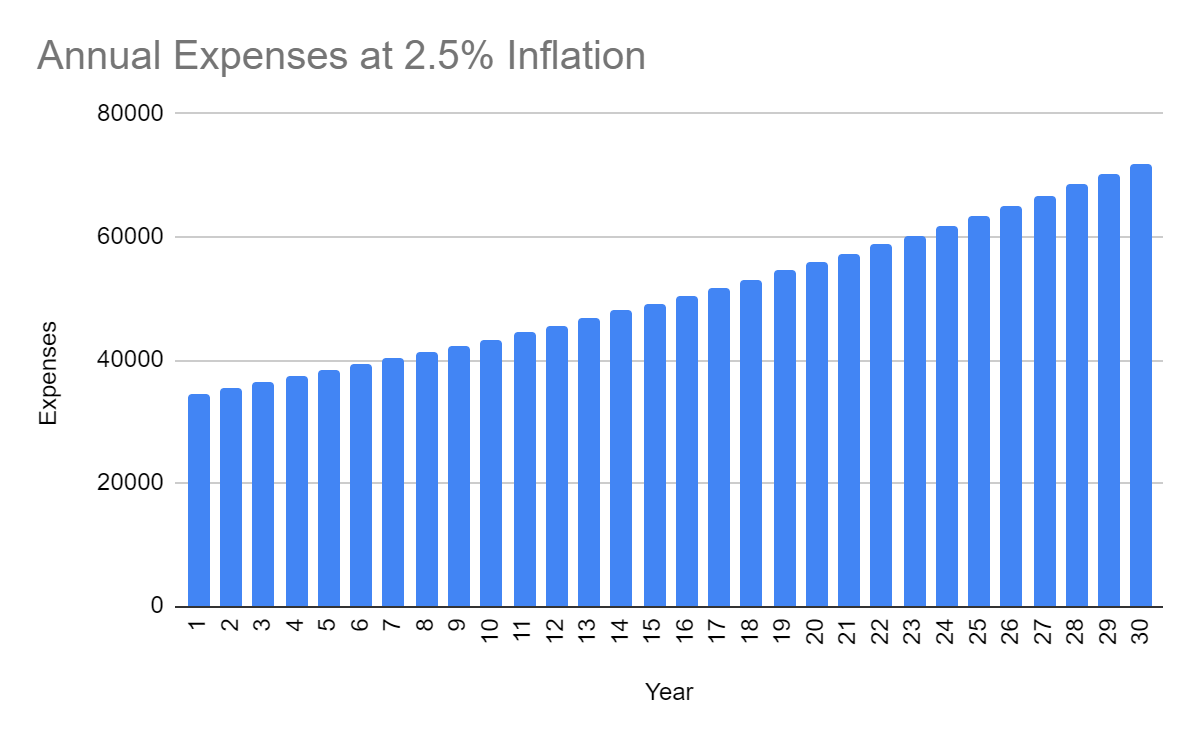

Expenses of $72K in 30 years are the same spending power as $34.5K currently. Check out the chart below showing how expenses of $34.5K would change over time at a 2.5% inflation rate:

Pretty terrifying. For this exact reason, you need to account for inflation when doing your retirement planning or you’re simply not going to save enough. When you’re doing your planning, simply make sure to adjust for inflation. I always use 3% as a safe guide at a minimum. But as Dave and Andrew say, invest with a margin of safety, emphasis on the safety!

History of Inflation

Chances are, you’ve heard people say that you should plan on about 2-3% inflation each year. Doing so will allow you to not only plan your daily expenses appropriately but also the amount that you need to save for retirement.

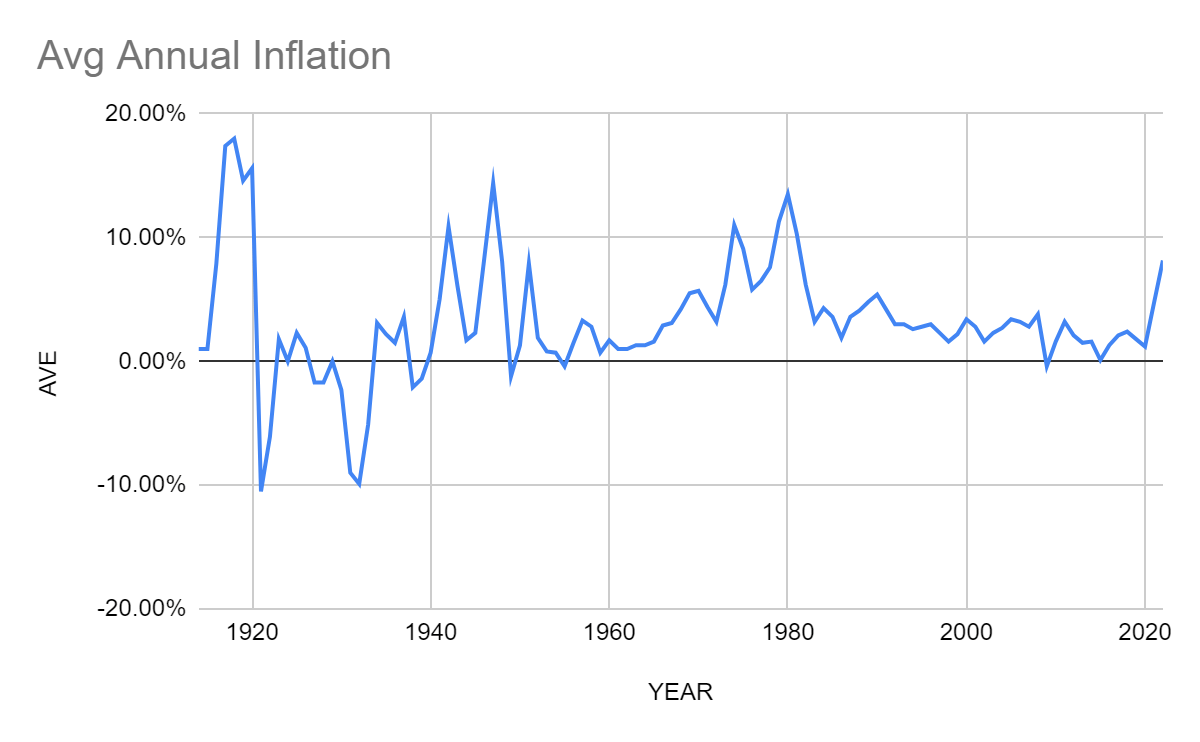

Well, 2-3% is somewhat accurate, but that’s merely just an average, and we can see some major swings in that average on a year-to-year basis:

Since 1914, inflation has averaged 3.55%. That’s not extremely off base, but it’s higher than the 2-3% that people tell you to plan for. During these 100+ years, we’ve seen max inflation of 18% and deflation of 10.5%…a 28.5% swing between the two!

I mean, look at 1920. We see inflation go from double digits to a double-digit deflation in back-to-back years. OUCH!

Deflation might sound like a good thing, but it’s really not, and debatably might be even worse than inflation!

Since 1980, inflation has been relatively steady until 2021 when we started to see prices skyrocket and gas hit well over $5/gallon in many parts of the country.

Inflation recently hit 9.1%, a 41-year high. That might not necessarily seem like an “emergency”, but if you have multiple years of 9% inflation and you’re only getting a 3% raise, you could very quickly find yourself in serious trouble.

For that exact reason, I think it’s extremely important that we put our money in some sort of hedge against inflation, especially if you’re living paycheck-to-paycheck and you need some extra protection in case things come crashing down.

Best Hedges Against Inflation

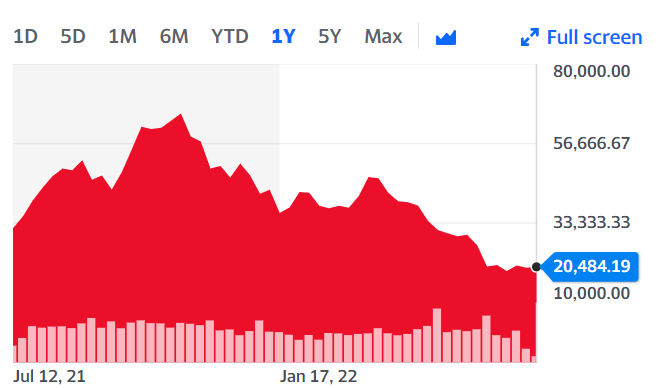

Before anyone even thinks it, let’s just start by saying that Bitcoin is not an inflation hedge, despite what anyone says. There’s an extremely obvious reason, which is the fact that bitcoin is down 35% in the last year while inflation is up 9%, meaning there is a 44% discrepancy in performance.

But there’s also just the simple fact that bitcoin is just way too volatile. Anything that has a chart like you can see above where it can double and also be cut in third in the same year is just way too volatile to be an inflation hedge.

We’re freaking out about inflation right now and it’s only maybe 6-7% higher than your normal year. Bitcoin makes a move that size every other day it feels like. Something changing value this frequently cannot be an inflation hedge, pure and simple.

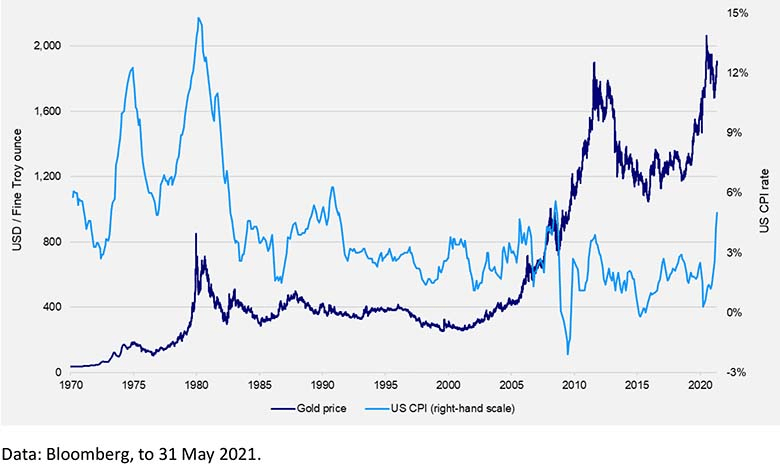

Another hedge that is common to hear about is precious metals such as gold. Gold is a much better inflation hedge than bitcoin and while it does perform pretty closely to inflation, that might not make it the best for you. Below shows the history of gold pricing overlaid with inflation:

As an investor, you’re likely happy to see that gold does follow the same general trend of inflation and does continue to rise in value, both of which are win-wins for you, but it’s not a perfect correlation.

The general thought here is that if your money can buy less, gold should be worth more as it holds its value, similar to other precious metals.

I get the concept of this, but for me, I’d personally be skeptical to invest in gold because I know nothing about it. If you wanted to buy a gold ETF, that certainly could be an option, but it’s important to understand that it’s still a publicly traded ETF that can come with a lot of volatility, similar to stocks. This takes me to my next point…stocks!

Many people will say that stocks are a great inflation hedge because as the cost of goods goes up, so does the revenue for the company, thus generating a larger net income to distribute to shareholders. This is all good and dandy as long as the consumer can afford these price increases that they’re getting from inflation.

The issue is that sometimes inflation can run so hot that people will stop buying certain things. If your groceries are 10% higher, are you going to stop going to the grocery store? Of course not. If the iPhone that you want is 10% higher, are you still going to get it? Maybe, but I know that I certainly wouldn’t.

I am in the market for a new car right now and I am refusing to get one simply because the prices are so high. I am waiting for prices to come back down to a realistic level where they’re not being sold over the MSRP value and then I will purchase. But this in turn will hurt companies like Carvana that might be getting better revenue and profit on their sales, but fewer sales overall. It’s a bit of a give and take.

I wouldn’t invest in the stock market purely as an inflation hedge. That being said, it is a great inflation hedge in the long run. Having your money in something that historically produces double-digit returns every year is never going to do you wrong. The key is all about the timing of when you’re going to need this money.

If you’re talking about investing in an emergency fund or something you might need in a couple of years, anything with volatility is NEVER the right answer. That means no to stocks, no to ETFs, no to gold, and no to bitcoin. It needs to be an extremely safe investment and one that is very liquid.

But liquidity doesn’t make it the best inflation hedge. So what the heck is truly the best inflation hedge?

Well, that’s simple – it’s I-Bonds! Admittedly, I-Bonds are something that I was completely unfamiliar with until inflation started to rage out of control. Now I am extremely familiar with them thanks to all the podcasts that I listen to regularly!

I-Bonds earn interest based on what is happening with the Consumer Price Index (CPI) for Urban Customers. Things included in this are common items such as food, energy, car prices, and many others that the typical consumer would be subject to if prices were to increase.

The goal of CPI-U is to track the price changes in very common goods and services that impact the everyday consumer, or said more simply – inflation.

By investing in something that is going to give you a return identical to inflation, you’re going to perfectly match inflation. Seems simple, right?

Now, there are some downsides for I-Bonds to be considered:

- Annual Limit

- $10K/Person

- Additional $5K if it comes from your federal tax refund

- When you buy them, you have to hold them for at least 1 year no matter what

- If you sell the bonds after holding for < 5 years, you have to pay back the most recent three months of interest

- You have to buy the bonds from the treasurydirect.gov website directly rather than on your brokerage like most bonds

One cool thing about I-Bonds is that the interest rate changes twice/year – in March & September. So, you can track the CPI throughout the year and have a general idea of how the interest rates are going to affect your investment in these I-Bonds.

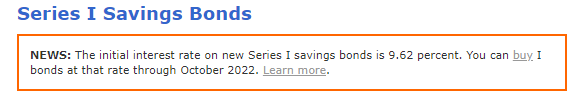

I bought some I-Bonds in April as an inflation hedge and I’m earning 8% interest on those. If you were to go out and purchase them right now, you’d get locked into a 9.62% interest rate for 6 months, as long as you purchase before November 2022.

Pretty incredible right? I think it’s pretty clear that I-Bonds are the perfect inflation hedge. Now, that doesn’t necessarily make them the perfect investment though because of the annual limits and the requirement to hold them for a certain amount of time.

If you’re looking for the perfect investment as a whole, well that’s simple – you have to start with the Sather Research eLetter!

Related posts:

- How to Create an All-Weather Portfolio Like Billionaire Ray Dalio Updated 6/7/2023 Investing in uncertain times is a scary proposition, and any investor should wonder: is there a way to avoid the ups and downs...

- Hedge Your Portfolio Like a Billionaire Did you know that you can hedge your portfolio just like a billionaire? In this post I’ll lay out a simple strategy used by large...

- How To Best Reduce Investment Risk – A Comprehensive Framework Updated 4/21/2023 After much effort, you have finally mastered value investing. You now know how to identify good companies and value them. You also only...

- How Impact Investing Can Reach the Mainstream Impact investing was introduced to the financial services industry almost a decade ago. The practice is used to generate environmental and social benefits alongside financial...