Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

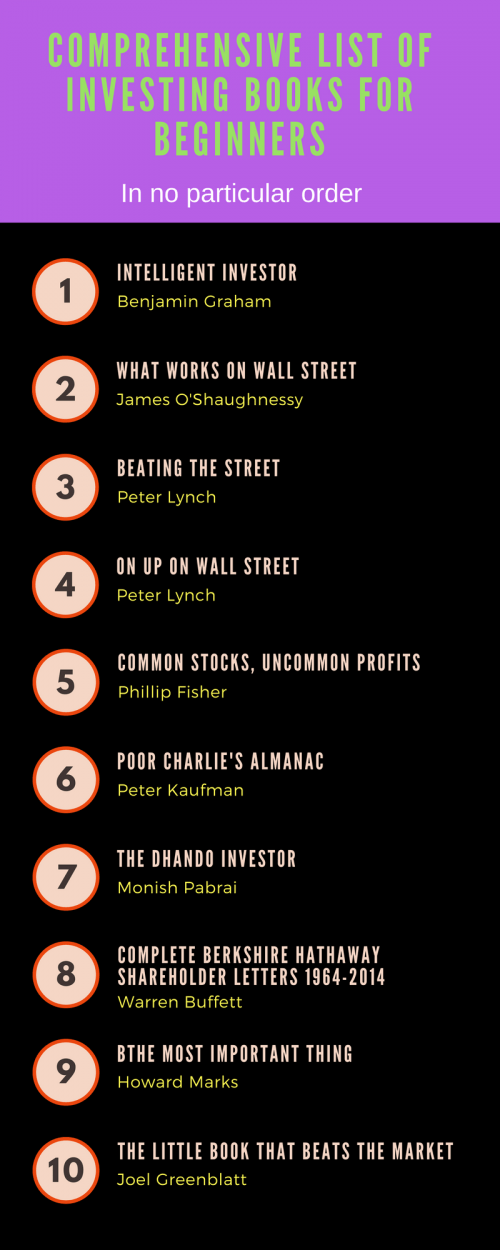

Welcome to Investing for Beginners podcast episode 57, Andrew and I are going to take a stab at talking about some of our favorite books.

Books are a fantastic way to learn and as Andrew and I are both self-taught investors we thought we would share some of the books that have helped shape our views and philosophies. So without any further ado, I’m going to turn it over to Andrew and he’s going to talk about his first book.

Andrew: yeah love to talk about them and it’s so crucial right if you want any chance at jumping into the stock market I think it’s important to instead of immersing yourself immediately in the media and in the charts and everything that’s going on the business world. You can build a base and a foundation and get some wisdom from people who’ve done this for decades.

Getting a huge head start on the rest of the investors who are going to they’ll go out and they’ll learn these expensive lessons where you can kind of shortcut all of that and you can really get your skill set get that at a much higher level in the beginning and the only compound from there.

I mean there’s some books while Dave and I don’t have like the whole financial educational background we do have a huge passion when it comes to reading these books. I’ve personally been reading these books voraciously and I’m just constantly reading new investing books so you start to get to a point where a lot of the books start to say the same things and that becomes a good point because then you understand which parts of these books are really crucial which ones have worked for a ton of investors and not just maybe one or two who sound really opinionated.

But has worked for the majority and then you start to get the collective wisdom of all these smart people and so I’ve always been just going through all these different books ever since I started out. So it gets hard for me to kind of pinpoint in and there’s so many different recommendations that I want to give out.

I’ll say this like what we’ll talk about the Intelligent Investor and that’s an obvious must read for everybody. It’s a book Buffett that highly praises it’s the foundation of any value mister you talk to they’re going to talk about the Intelligent Investor but I really think that books a little tough from a readability standpoint I think you need like a quick win you need to you need to get confidence you need to get excitement and you need a book that like starts to kind of it’s like baby food right.

It’s something that can start you out and until you get to some bigger more intense concepts that you can really chew on. so for me personally and I really lucked out like it’s kind of funny the way I got into it was I don’t know how I ended up at this bookstore I was out of Barnes and Noble. I don’t even know if those yeah they’re still around today right so I know there’s one down the street from where I work but I went into Barnes & Noble and I went over to the investing section and didn’t have really a clue right.

Outside of a couple of conversations, I have with the guy who really pushed me in the direction of investing kind of listening to him talk about some of the general principles of investing like dollar cost averaging was a big one that you really espouse in my head from the outset.

Outside of those like little discussions, I didn’t have much of a foundation when they came to educating myself in the stock market and investing as a whole. so I literally went to the investing section and I just had an open mind I had no idea which books I was going to pick out and just saw if anything really stuck out and I saw Beating the Street by Peter Lynch and literally like my thought process was what that named Lynch sounds really familiar like sounds like Merrill Lynch so this guy must know what he’s talking about.

All right I’ll pick up this book and I’ll buy it and then I was looking at the other books and then there was the Intelligent Investor and that one stood out is this red book and it kind of reminds you of the Bible and then you pick it up and then it’s kind of me meaty and thick like the Bible and then on the top it says something some quote about Buffett like singing this praises about the book.

And I’m like again like I don’t know hardly anything about the finance world stock market I wouldn’t even tell you what the hedge fund is or who the hedge fund managers are but I knew then I knew the names Buffett I knew Lynch is maybe somehow tied to Merrill Lynch. So I bought those two books I happen to pick up Beating the Street first and I started reading that one.

I really loved that book and it really got me excited and I was like hey this the way he was explaining the stock market the way he was explaining his basic strategy like he didn’t get too in-depth into it where you’re like when these are too many complicated terms but he’s just say gave me like the basics of the price to earnings ratio and so I had like I had an idea of like okay this is what a valuation is this is what metric I can use and this is what this is what is really going on with a business it’s not just a stock thing it’s not just prices going up and down that’s not just traders on the trading floor yelling buys and sell orders.

This is a business and this is this is what’s going on behind the scenes so that really kicked me off and I felt like I mean lucky for me that’s how I got into it and I think that really helped me so then when I picked up the Intelligent Investor I already knew what PE was cuz Graham talks about it in that book and then he also introduces a price to book ratio and I can’t remember if he talks about PS or not but then I was like okay and then I was like I was building on that previous knowledge.

I definitely recommend Beating the Street the other one I will say which I read probably last year 2017 I don’t know if I read this from your recommendation or not Dave but Joel Greenblatt’s The Little Book that Beats Market is that is that what it’s called?

Dave: yes that’s what it’s called.

Andrew: yeah so I love this book and especially because like as soon as he opens he like has an intro and he says like alright well if I had to leave my children with a piece of advice I’m like how can I get into the stock market. Like if I were to basically try to break it down so they can understand and he was saying how his kids are really young and all this stuff he’s like this that’s what this books going to try to do. Just going to try to explain it in simple terms how my kids can understand it.

And then he goes into a story about how he used to have this like entrepreneurial mindset when he was a kid in school I think he mentioned something about like selling gum and like finding profit margins on that and then he talks about how that relates to how businesses really work and how the stock market isn’t just some game.

But it’s really representative of these businesses again similar concepts right where you want to be an owner and you want to accumulate assets and you want to have these businesses create profits and so that books also super valuable and it also gets into some basics. I know he introduces the magic formula which is his value investing strategy.

Both of these guys you can argue Lynch as a value investor at heart you never like explicitly says it Greenblatt definitely is unabashedly a value investor and has been influenced by Graham and everything like that but you can take those lessons and I really use those two books whichever one you choose to really get a basic knowledge on a stock market how it’s like a business what valuation means and then maybe move on to something more complex like the Intelligent Investor.

And that can really form like a really solid foundation when it comes to understanding the basics and really giving yourself that edge because I think personally the biggest edge you can have if you’re going to be picking individual stocks is going to be being able to identify stocks that are trading at a discount to their intrinsic value. Like we always say on the show a margin of safety with the emphasis on the safety and if you have that basic strategy down whatever that looks like for you.

Then I think you’re going to have a major advantage over any other investor that’s out there trying to pick and choose and follow different storylines or follow their gut on how they feel like the futures going to play out.

I mean you’ll definitely have an advantage over those type of guys so while you definitely want to have the meaty the real value investing type pillars down you also want to have books that kind of help lead late lead into that and maybe warm you up to it and I think Beating the Street by Peter Lynch and a Little Book that Beats the Market by Joel Greenblatt are excellent places to start.

Dave: I totally agree those are fantastic books. I’ve read both of them and loved them a lot and they’ve taught me so much and the Joel Greenblatt book to me was the thing I enjoyed about it was the way he writes he tells stories and so instead of it just being a technical book about talking about this formula and that formula and that kind of thing which don’t get me wrong but they have a place for them.

But for me as a beginner it was so easy to read and I think I read in a couple days and I just couldn’t put it down because he just he tells stories in it made it relatable it made it enjoyable you liked him and you liked the stories he was telling and it just helped get his point across so much better and I really enjoyed that.

A couple books that I wanted to throw out there while we’re talking about these was the first one was the Dhando Investor by Monish Pabrai and I’ve talked about this off and on through our podcasting history here. and that was one of the first books that I read and like Andrew was saying it’s an easy book to read he has all kinds of great information and wisdom that he drops in the book and it’s not overly technical and it’s not one of those boring kind of textbook kind of books and it’s very relatable and he talks a lot about margin of safety.

And he talks a lot about his phrase in a book is heads I win tails I don’t lose that much because when he’s talking about investments that he gets into he looks for such a large margin of safety in his eyes that even if he does make a bad choice.

He’s not going to lose everything and I really kind of related to that and he has different points that he talks about throughout the book that are very relatable and he uses a lot of common sense very much like Charlie Munger and Warren Buffett and those are two of his idols especially Charlie Munger and excuse me he talks a lot about using common sense and being logical and being rational about things and again he tells stories as well which help illustrate all the points that he’s trying to make and it’s such an easy book to read and I really enjoyed it.

I got so much out of it and it really kind of helped form a basis for me as I was starting to try to read more textbook kind of things like an Intelligent Investor or Security Analysis which is so heavy and the theory and the formulas and the technical part of investing which can be really hard to get through especially when you’re a beginner.

But I slogged my way through them because I was told I had to read the books and I learned a lot from them don’t get me wrong but like Andrew is saying when you’re looking for beginning trying to get quick wins things that you can really kind of wrap your arms around something like the Dhando Investor to me it was something that I could definitely embrace.

Another book that I really enjoyed that we’ve not talked about enough is called The Most Important thing and it’s written by a gentleman named Howard Marks and I thought if Warren Buffett Joel Greenblatt and Seth Klarmann where I might recommend a book this needs to be on my to-do list for reading.

I read it was awesome Howard Marks is a co-founder of the chairman of Oak Creek capital and it’s he’s not a big name he’s not flashy he’s very much about the margin of safety and frankly when you read his letters he can kind of come across a little bit cranky yeah and a little bit doom and gloom he’s always talking about bear markets.

The book is not it’s not a how-to invest book it’s rather it’s kind of a look into insights of a man who struggles with his own daily investment choices. He doesn’t offer any shortcuts he doesn’t have any easy formulas he’s not out how to wisdom thing but he talks a lot about second level thinking which is his way of telling us that there are no real mechanical ways to invest.

But rather than investing could get kind of messy by this he means that people in their emotions drive a make drive markets and trying to filter all that down to a mathematical formula is kind of impossible. so he talks a lot about emotion seeing talks a lot about psychology and he gets a lot of his wisdom from Charlie Munger and that’s one of Charlie Munger’s big focuses is on the psychological aspects of investing and we’ve talked a little bit about that in the past.

but this book really delves into how Howard thinks and where he’s going with his ideas in how he decides he wants to do things and he’s very much a value investor and if you look at his portfolio it’s he’s got all the classic value investing stock picks and he’s not a flashy guy and he’s not out there promoting himself and it’s a fantastic book.

Especially if you’re looking at trying to start to delve a little bit more into the psychological aspects of investing and you don’t want to go the full followed nine yards and go with a very heavy psychology book like something from Daniel Kahneman or Amos Tversky those are much heavier and that end and Howard does a great job of kind of easing everybody into it I just I really enjoyed it.

Andrew: yeah I loved that book too I remember getting into it kind of later on so I learned some of the concepts that he was already talking about. I just remember I like to listen to a lot of books on Audible in addition to reading certain books and I just remember like always nodding my head every time I would hear these words come out about the book because yeah everything in the books like yep it’s what you got to do it’s what you got to do yeah it’s a good luck that overview it’s almost like a guide in a way.

Dave: yeah exactly.

Andrew: I would put Dhando Investor or my reading list cuz that really sounds good and you talk about him a lot.

Dave: yeah I really I really like him if you ever get a chance look listen to some of his talks on YouTube fantastic.

Andrew: and we’ve been plugging YouTube lately haven’t we?

Dave: yes we have.

Andrew: all right so I’m going to pivot a little bit most definitely there are so many different books that you can get that are going to give you the real meat of value investing I think David I will 100% with our hands up and say without a doubt that the Intelligent Investors the book to go for that.

And if you want more of like one say like a summary but like good discussion on some of the most important parts of that book we did a couple episodes way back in the archives if you go to episode 20 and episode 21 we covered what we thought were the two best chapters of the Intelligent Investor could be good supplements to reading I don’t think it would replace your reading but definitely check those out and then if if you really feel brave move on the Security Analysis that’s so much nitty-gritty and so much good stuff about valuing the company.

I have some other books too I want to recommend but before I do that I think it’s also important to get general knowledge and not be so not narrow-minded but it’s so singularly focused on one’s particular strategy I think it’s important especially when you’re first starting out to get exposure to all the different strategies that are out there and then form your opinion on whether you personally agree with the values about investing or not because it’s not going to be for everybody and every strategy.

I’m not going to say every but most strategies have their pros and cons and some of them there are some that can also be successful as long as you stick it out you just have to figure out okay what’s important to me whether my values one of the things that I relate to. if being a day trader and putting tons of hours in really speaks out to you but you found strategies you found systems you found people have done it successfully before and if it really engages you in the way that you like to do it well then sure go do it.

If you like to be more of the person who likes to be able to sleep at night and likes to be able to know that you’re in safe investments understanding that you’re not going to get quick wins all the time but over the long term you’re going to get businesses that will compound your wealth.

Well that may be a strategy of value must seem like Dave and I preach is more you’re more your level right. so I think a great book that gives introductions to a lot of the different things that are out there I don’t agree with all of it because he in end says that value investing is impossible and we did an episode 8 kind of talking about our rebuttal to that and that drew a lot of heat so that was fun.

But a Random Walk Down Wall Street by Burton Malkiel basically he concludes a book saying that investors should be passive investors and the markets completely efficient and that there’s no way you can beat the market things of that nature. but he also talks about a lot of the importance of buy-and-hold I mean you can get that in a lot of the other books too but he also talks about like the downsides of growth investing some of the other strategies that were out there I remember dogs of the Dow was talked about nifty 50 I believe was talked about and just a ton he talks about momentum and trend all these different technical analysis fundamental analysis all these different strategies he kind of breaks it down in a really nice way.

And there are some good things he says about indexing which are true and which can apply to investors so there’s just a lot of if there was one book that kind of encompasses everything that goes on in Wall Street I would say that would be the one. I don’t I don’t feel that there’s anything in there that’s like super actionable where you can make great gains from it. But I think it’s just from an overall knowledge perspective it’s a great book.

And then I really enjoyed Market Wizards blanking on the author right now. but it’s I wouldn’t say it was like necessarily practically useful for me in any practical way because there were all traders all talking about how they made money being becoming full-time traders and how they have their different strategies.

But it gave me some insight into the whole trading world the whole technical analysis world and there were a lot of things in there that like it was cool to see the differences in priorities when they came to these traders who are very active versus a value investor who is very passive. And it was it was funny to see the parallels and the similarities and they would just call it different things.

Like for example one huge thing that value investors always preach and pretty much any investor you talk to they’ll preach diversification right. So in the value investing world, we always talk about 15 to 20 stocks tends to be the ideal amount may be up to 25 stocks that’s what we always use terms like diversification.

But then when you talk to these traders they’re all saying the same thing but they’re saying a different language they call it position sizing. So the way they were there is they say well anything between three to five to seven percent position sizing there’s really that sweet spot where you want to be. They’re both saying the exact same thing but they’re just calling it different things and so I thought that was really interesting.

I thought it was cool too while basically, the book is a collection of interviews that whoever the author was doing with all these traders who were very successful it’s obviously talking to all the outliers and all the best performers that they’re where. but there’s a lot of cool stuff in there a lot of fun kind of strategy stuff and you see some of the quirkiness of some of these guys that went through and made money from their trading.

I thought that was really cool and I think it’s important to not be too overly zealous over one thing like if you look at the eLetter strategy I have where I break things down from normal portfolio to dividend fortress portfolio.

I like to use a trailing stop which is very characteristic of traders and not so much value investors and I have all my justifications behind that as well. so I think it’s just important to kind of its kind of like a broadening of your education just like Random Walk Down Wall Street is it’s a way to branch out and feel more confident if what people around you are doing and you understand the pros and cons between what you’re doing what they’re doing you can really give you like a secure feeling so I think if this really becomes a rabbit hole that you really barrel down and you’re looking for fresh material you’re really hungry for expanding your horizons I think those are two great books.

One last one I’ll mention is Common Stocks and Uncommon Profits by Philip Fisher. He’s more of a growth guy and he talks about like scuttlebutt which is something that’s not going to be possible for like 99% of us because we don’t have access to CEOs and stuff. But he was talking about calling these CEOs and sitting down and interviewing them and using that spur of his investment process.

Obviously that’s not something most of us can replicate but he also has a lot of cool stuff in there and I felt like it was when we talked about kind of the science versus the art of investing if you go back to episode I’m looking at the list right now I don’t know why ah 52.

We talked about like the art side versus the science side the science side is obviously looking at the numbers looking at the business and the financials and the art can be something kind of above that in addition to that I felt like Common Stocks and an Uncommon Profits was a cool kind of glimpse that can help you go beyond the numbers in the sense is. Also, one of those just classic books that have been around for a long time that a lot of people look up to and felt like was valuable from a lesson standpoint.

I would say those three books are good to broaden your horizons and I still have a couple more Dave if you have the time that I think are really meaty, but I’ll let you throw in a couple books too.

Dave: that’s a great list of books a couple ones that I’d like to throw out logs on the fire are Berkshire Hathaway Letters to Shareholders 1965 to 2014. so this is a compilation of all of his letters from those for about 50 years and where else can you learn better than from the Oracle of Omaha or in his feet reading his words and taking his wisdom and fantastic book and you can just see the evolution of his thoughts and how he invests in his wisdom from the early days to current times.

And it’s just a fascinating evolution of reading and just the history of seeing all that and it’s just I just was blown away by how smart the guy was just it’s just kind of ridiculous and he’s such a good reader or I’m sorry good such a good writer and he again uses stories and humor to kind of illustrate his points and it makes it so much more interesting for us the reader than just having somebody just kind of preach at us.

I just loved every year his letter comes out it’s one of the first things I do when it’s released as I read his letters and I’ve been doing it ever since I really got into investing and so going back and looking at all of his older letters as well. It’s just there are so many nuggets of wisdom in there it’s just it could probably spend the rest of my life just trying to nitpick not nitpick but pick out the little different nuggets that he offers up in his letters to help me become a better investor.

And I think those are definitely a must read as you get more confident with your investing skills and abilities definitely dive into reading them even if it’s something you feel like it’s a little bit over your head. it still is going to help make you a better investor because there’s just so much wisdom in all those letters.

Andrew: by the way like what he’s so good at making it simpler – yeah not only a brilliant mind and is he able to really practice what he preaches but here’s what just a way of making it so simple and saying that in such a matter-of-fact way where you’re like I was really smart and that made a lot of sense and I understand what he said. I mean I think that’s a very cool aspect of him that’s not really talked about too much.

Dave: yeah I totally agree the other book that I’d like to recommend would be the Manual of Ideas by a gentleman named John Mijalevic and that is not easy to for me to say and a fantastic book. And he has a podcast that he does as well as well as a newsletter that he writes and John has been able to in interview some of the smartest brightest minds in the investing world and his book really kind of delves into all the different aspects of value investing.

And it’s just fantastic Andrew was talking about kind of broadening your horizons and kind of taking a bigger look at different types of things and value investing it’s not just all one cookie cutter thing there are all different kinds of little nooks and crannies the directions you can go with this. and this book kind of it’s not a how-to book it’s not a formula book but it’s just kind of a broad overview of all these different aspects of value investing and it’s just it’s fantastic it’s so easy to read and I did it over audible I also read it as well and fantastic its podcast is awesome I’m a big fan of this guy I really enjoy his stuff.

And it really taught me a lot about different aspects of value investing and helped me kind of again kind of formulate some of my ideas as I was really getting going with this and I recommended it to Andrew and I remember he read it as well.

Andrew: yeah I did actually I was going to mention it and you stole it.

Dave: sorry.

Andrew: well alright I definitely have a couple more I think we definitely be remiss if we didn’t mention Seth Klarmann Margin of Safety. That’s another one of those which I’m still I haven’t finished it yet but up to now, it’s been fantastic. It’s like everything we know about value investing reconfirmed and what the part I’m at now which I think’s very interesting is he’s talking about the bankruptcy cases it just brings up a lot of different opportunities of value that you wouldn’t really think of and he you’ll have to correct me if I’m wrong Dave because I haven’t finished the book but I don’t think he ever like gives a definite thing where he says well this is how you find margin of safety.

Dave: nope he’d ever does.

Andrew: but he the way he like kind of talks about it over and over again it’s like well there are so many opportunities where you can find margin of safety here’s how you can do it here’s when the opportunities might happen and here’s the mindset behind that what you need to do it.

I think the results that he’s made at Baupost just speak for themselves outside of the fact that it’s one of those investing treasures where if you can pick up a physical copy it’s worth thousands of dollars exactly.

Back to Buffett I really enjoyed this one this one’s more of a biography but it’s called the Snowball Warren Buffett in the Business of Life written by Alice Schroeder. That one was really cool it’s really inspiring because you hear while it wasn’t like he was living in the streets or anything but he did have somewhat humble beginnings and I mean he definitely didn’t start as a millionaire or billionaire or anything of that nature and it was cool to hear him grow and how he was able to organize all this capital himself and really grow the business to such a massive proportions that he was able to do.

Kind of talk about some of his successes some of his failures and get some insight on how he spends his day today and what kind of personality he had some of the stuff that happened in his personal life and then it was just a cool book.

And one of those that’s like really easy to listen to I listen to that one on audible and I remember just being excited every time I would get in the car because I was just fun to hear about.

Another one, One Up on Wall Street I think so good follow-up to being the street this one’s also Peter Lynch the audible version was very short but he puts a lot of good lessons in there a lot of general rules and a lot of things that you can use that are applicable as whether your value or growth person it has a lot of good stuff in there.

I think one of the I’ll leave with this because I can’t have a book list like this and not include this book What Works on Wall Street by James o Shaughnessy I’ll have to say that the Intelligent Investor What Works on Wall Street I guess Beating the Street I guess you could put that in there but we’re talking about like these are the foundational things that really set my own personal stock picking strategy into what it is today.

It’s a super number based he ran a ton of backtests before the technology was really there where we can do it so easily like we can today. And just spits out the data and like look this is how it is this is how stocks historically are performed and it just gives you the data it’s like okay well this is this is what we can expect if we invest with these certain characteristics.

And there’s a lot of different metrics in there a lot of different valuations and a lot of different he looked over many years and so but I thought was really cool as the market goes along it kind of cycles between times where growth stocks outperform value stocks and value stocks outperform growth stocks. And so that kind of thing can go can go on as the years go by.

But a lot of studies have shown that over the very long term by you outperforms growth and what O’Shaughnessy found was a lot of these value-based metrics outperform growth over the very long term. over a lot of different time periods and yeah you have to make sure that these backtests aren’t constricted and kind of cherry picking and skewed based on what time you’re what year what year-to-year you’re running them.

He found that these value metrics over the very very long term also tended to outperform the growth metrics and you can run back tests today and then there’s a couple people who write about it on the on blogs where they show these similar type of backtests that still roll still ring relevant and true to what a lot of the findings that was Shaughnessy had in his book.

Definitely I think if you’re going to include a book that’s meaty and one that really gets to numbers financial statements and valuation metrics you have to include What Works on Wall Street even though I don’t necessarily see it recommended to too much and I kind of stumbled on it and I didn’t get it recommended to me by anybody else.

But I just think there’s so much good wisdom in there that it should be a must read if you’re going to get into financial statements if you’re going to try to take a very numerical approach to finding a margin of safety.

Dave: yeah that’s a fantastic book I have not read that yet that is definitely on my list I have you talked about that before and I’ve just not gotten around to reading it but after listening to you talk I’m like why haven’t I that has to be next to so I think I’ll move that up that sounds like a fantastic book.

The last one that I’d like to out there is if I’m I guess is Poor Charlie’s Almanac and this is a collection of Charlie Munger’s wit and wisdom through the years. And it’s kind of a compilation of his writings his speeches that he’s given different interviews that he’s given and it’s just a collection of kind of his thoughts along the same lines as Warren Buffett’s shareholder letters but not quite as formal.

And it’s fantastic it it’s very much more of a psychological book where he talks a lot about how we think and the decisions we make and trying to educate ourselves and learning how to make better decisions. and it was really kind of my eye-opening of how I think about not just investing but just everything in life and my attitude about doing things and how I make decisions and what causes me to trigger on certain things and it really makes you think.

I just really enjoyed the book and it’s fantastic as long it’s a longer book and there are lots of speeches in there that have been transcribed which I find fantastic. And there’s one on Spotify that I listen to all the time and its fantastic stuff. and another plug for the book is that Monish Pabrai has read at nine times and I thought well guys that smart, accomplished as him has read at nine times that probably should take a stab at it so I really enjoyed it I don’t know if I’m going to read it nine times but I really enjoyed the book so that would be the last thing that I would want to throw on there for my list.

Andrew: that one gets into like the whole mental model stuff too right?

Dave: yeah exactly perfect yep that’s exactly right.

Andrew: yeah that’s like it’s it’s great to see the way Charlie and Warren complement themselves so much the way that they’re able to use their various skill sets to really get great success in the market.

One last one I think I’d like to leave us with I don’t know have you heard of Value Trap Indicator if you read that one no idea what.

You’re talking about so I guess there’s okay there’s two Value Trap Indicator written by yours truly I just took like a backwards approach I looked at something that people never really look at when they when they write these books and I want to look at the bankruptcies why the stocks fail why the companies go bankrupt.

Basically, that’s what I did I did some research on the most recent bankruptcies really from the early 2000s and just looked at the numbers and looked at similarities and share what I learned on in the book and so that one was I think it’s a good read obviously.

It is and then Seven Steps to Understanding the Stock Market also written by yours truly that’s one that I offer for free for people that go the stockmarketpdf.com you probably hear it on the closing of the show all the time.

But it’s one of those where I like to think of it as another what’s talking, in the beginning, the episode about books that are like baby food that can give you confidence and really start to teach you little things to get you to the more meaty stuff.

I felt like 7 steps is one of those, I teach you about price to earnings price to book price to sales and price to cash along with like EPS and dividend yield and teach you the basics show you some real-life examples of how you can apply it and how it’s been used and how you can use in the future to find stocks that are that have these good financial characteristics right.

And this the same seven steps that are in the e-book are the same seven categories I use for Value Trap Indicator so those two kinds of go hand-in-hand have nice synergy. I think those are great books and at least one of them is free so you got no excuse to not read that one.

Dave: absolutely those are great books and they’ve helped shape me a lot for sure I talked about this before I use Andrews seven steps formulas or ratios for my screening that I do every week so it’s been fantastic for me I really I really enjoyed them it really helped me start down the path to being successful with what I’m doing for sure.

Alright, folks well that is going to wrap up our discussion of books that have helped shape Andrew and I’s investing thoughts and ideas in our education.

I hope you enjoyed our discussion of these books hopefully you found something that you may not have read that kind of piques your interest and reading is the key to success that’s the knowledge is power the more you know the better you could do.

And along those lines we really enjoy talking about books and reading them and if you guys had any ideas of books that you really like we do have to hear about those as well.

Without any further ado, I’m going to sign us off you guys go ahead and have a great week go out and find some intrinsic value invest with the margin of safety emphasis on the safety.

Have a great week and we’ll talk to you next week!

Related posts:

- IFB120: 4 New Companies Added to the Dividend Aristocrat List for 2019 Announcer: 00:00 You’re tuned in to the Investing for Beginners podcast. Finally, step-by-step premium investment guidance for beginners led by Andrew Sather and Dave Ahern,...

- IFB139: Beginners Guide to Investing in Bonds Announcer (00:00): You’re tuned in to the Investing for Beginners podcast. Finally, step by step premium investment guidance for beginners led by Andrew Sather and...

- IFB27: 6 Unconventional Investing Principles for Beginners Welcome to episode 27 of the Investing for Beginners podcast. In today’s show, we will be discussing six unconventional investing principles. These are ideas...

- IFB97: A List of Really Unwise Financial Decisions Announcer: 00:00 You’re tuned in to the Investing for Beginners podcast. Finally, step by step premium investment guidance for beginning led by Andrew Sather and...