Some of the hottest renewable energy stocks which are working to fight climate change can be found in the biofuel, or biodiesel and renewable diesel, industry.

Learning about this complicated industry can be a challenge especially if you have no background in the energy sector, so I will attempt to do a complete breakdown from a beginner’s viewpoint, so that you can analyze the many biofuel, biodiesel, and other related stocks to this high potential industry.

When diving into an industry as interwoven into a large sector (energy) as biofuel, it’s important to get as granular as possible with your understanding.

Unfortunately, major conglomerates with many segments and vertical integrations such as those you’ll see in the energy sector don’t usually provide detailed breakdowns into the entirety of each segment. Even if they do, it’s not often they will provide detailed outlooks and explanations about each market—this would take hundreds of pages for a conglomerate like ExxonMobil.

And to be clear, the difference between the markets for one piece of an industry, such as natural gas, can be completely different from one like biofuel, even though the end uses are very similar (and biodiesel can even be different from biofuel!).

So to get great information about a specific industry and market within a larger one, such as the semiconductor industry among tech giants or various renewable energies among oil majors, it helps to first analyze a company that is a “pure play” in a specific market.

In other words, to get a good grasp of the biofuel industry, we will examine one of the smaller companies who are primarily focused on this market.

From there, we can backtrack to examine the bigger players when it comes to picking an investment, but the understanding and circle of competence comes from learning from as close to a pure play company that you can find, regardless of how small it is.

A company who fits this definition perfectly is one called Renewable Energy Group (ticker: $REGI). Let’s pull up the company’s latest 10-k in order to glean as much information on the industry as we can.

From the company’s first couple of sentences in their business overview:

We focus on providing cleaner, lower carbon transportation fuels. We are North America’s largest producer of advanced biofuels. We utilize a nationwide production, distribution and logistics system as part of an integrated value chain model designed to convert natural fats, oils and greases into advanced biofuels.

I’ve bolded what I thought to be a key sentence in there, and will start our base of knowledge into our biodiesel industry map.

The Basics of the Biofuel Industry: Key Definitions

Before we completely dive into the extensive 10-k, let me set the table with a few simple, yet key and distinct definitions that we’ll come across during this industry breakdown.

First, biofuels and biodiesels.

Both of these words are similar, in that it’s diesel or fuel that is produced “naturally”, in other words from plants or animal fats.

Just to be clear, from my understanding, a diesel is a fuel but a fuel isn’t necessarily diesel. Types of fuel include:

- Gasoline

- Ethanol

- Biodiesel

- Diesel

- Liquefied Petroleum

I’m sure there are others.

So, we should also make clear that not all diesel is biodiesel—diesel can be made from oil (petroleum diesel) or as a biodiesel (from plants or animals) or a hybrid of both.

These definitions are super key to understand because within the biofuel industry, you have two types of biofuels:

- Biodiesel (“BD”)

- Renewable diesel (“RD”)

As you’ll see as we get further down the line, these terms can be easy to confuse because both BD and RD can be mixed with petroleum diesel to make a diesel-blend, and all of those types of diesel can in-fact serve to qualify for government tax credits or subsidies as a renewable energy.

One last caveat…

Throughout the 10-k for $REGI, they refer to “biomass-based diesel” often, which you can think of to simplify as “biofuel”, since biomass-based diesel can be BD, or RD, or a blend.

And the degree of concentration vs a blend when it comes to diesel is abbreviated in the following way:

- B100 = a diesel that is 100% BD; $REGI’s main product

- R100 = pure renewable diesel (RD)

- R20 = 20% RD and 80% petroleum diesel

- R5 = blend of 5% RD and 85% petroleum

If you’re still confused about the difference between traditional biodiesel (BD) and renewable diesel (RD), you can refer to this Q&A from RD leader Neste, though I highly recommend just reading my explanation again carefully (as their Q&A has all sorts of jargon in it too).

The Basics of the Biofuel Industry: Inputs

Now let’s go into a simple overview of how biofuels are made. Like I said, they tend to be made from plants or animals. More specifically, it can be made from fats, oils and even grease.

According to $REGI, the more common raw materials which become biofuels seem to be refined vegetable oils, like canola oil and soybean oil.

But, they can also be made from cheaper feedstocks like (low cost) distillers corn oil, used cooking oil, or rendered animal fat feedstock.

$REGI is even working on research to possibly source a next generation feedstock like algae or camelina in order to make a biofuel, but that largely remains to be seen for now.

The problem with some of these feedstocks is that a certain raw material may be needed for a certain type of biofuel—in other words, some of the feedstocks I mentioned above can only be used in either renewable diesel or biodiesel but not both.

Also, while traditional vegetable oils trade on a futures market, some of the lower cost feedstocks like used cooking oil have no futures market, and less of the material available in general.

That means that not only are there possible supply constraints to biofuels in the form of feedstock, but the biofuel industry also faces heavy competition for their raw materials from the more traditional agriculture that ends up on people’s plates and in their bellies.

Some of that risk is mitigated, like in $REGI’s case in the re-use of wastes like cooking oil and grease, but it again has its own limitations like availability and (current) scalability.

The Market for Biofuel

One big problem for the biofuel industry today—which applies to both BD and RD—is that as-of the release of $REGI’s 10-k (in 2020), biofuels are not cost competitive with petroleum fuels.

So if it were apples-to-apples, a petroleum based diesel would beat a biofuel (BD or RD) any day, because it is cheaper to produce.

Of course, we all know the problem with petroleum-based products… they are terribly bad for the environment and emit lots of greenhouse gases (or “GHG”).

To try and drive the world (especially in the US and EU) towards less GHG emissions, various Federal and State Government programs have been introduced to financially incentivize biofuels. You have:

- RFS = Renewable Fuel Standard Program (today it’s RFS2)

- BTC = Biodiesel Tax Credit (U.S. Federal Program)

- LCFS = Low Carbon Fuel Standard (in states like CA and OR)

- RED = Renewable Energy Directive (EU Program)

This is not an all-inclusive list, as various states today have their own tax incentives and there’s various other programs, subsidies, and credits (and even debits) out there today and into the future.

Each of RFS2, BTC, and LCFS are critical financially to companies like $REGI.

But, for the market of biofuels itself, probably the most impactful is RSF2.

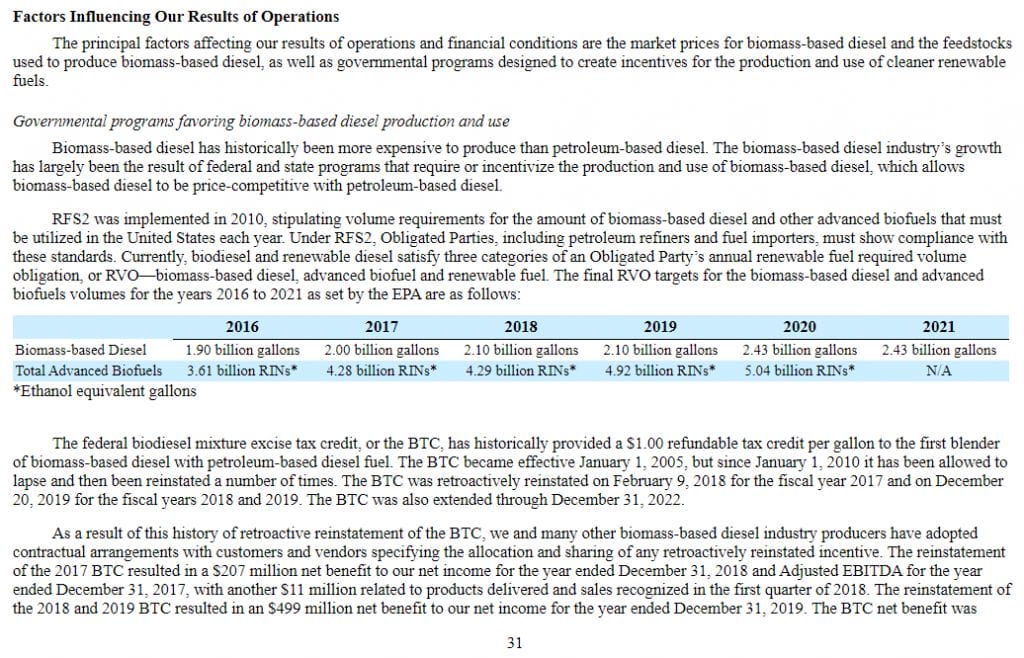

As $REGI described it (see screenshot below), the U.S. government (EPA) created specific targets for the amount of biofuel that must be produced in totality per year.

Both petroleum refiners and petroleum fuel importers in the U.S. must adhere to this requirement, and their contribution to the U.S. total depends on how much they produce or import.

To meet their RSF2 requirements, these refiners and importers must meet a certain amount of RINs (or Renewable Identification Numbers).

Essentially, to qualify as a RIN, a biofuel (biomass-based diesel) must be produced and have a certain amount of renewable component to it. In general, the higher the quality and greater the renewable nature of a fuel, the more RINs it qualifies for.

What’s very interesting about this is that a petroleum refiner like Valero doesn’t necessarily need to refine or import a biofuel—these RINs can be bought and sold as commodities.

So if incorporating the biofuels into a company’s infrastructure is too worrisome, the company can essentially trade in some of its cash for some RINs (from a company who produces RINs like $REGI and other biofuel producers).

Why RSF2 Sets the Ceiling of the Biofuel Market

So in a sense, you have a hard cap on the potential of biofuels. Once companies have met their RINs requirements, it doesn’t make much sense for them to buy more biofuels like BD and RD instead of petroleum diesel—since it’s currently not cost effective. Yet.

I suppose it’s always possible to have some companies who might go “above and beyond” the RSF2 standards for positive PR or to appease the ESG investor community, but the business reality is that as the prices stand now for biofuels vs petro-diesel, companies are probably better off without BD and RD.

To give you a sense of some of the limitations of the biofuel market, again as it stands today, here is a great snippet from $REGI’s risk factors:

If additional volumes of advanced biofuel RIN production come online and the EPA does not increase the RVO in accordance with the increased production, the volume of advanced biofuel RINs generated could exceed the volume required under the RFS2. In the event this occurs, biomass-based diesel and advanced biofuel RIN prices would be expected to decrease, potentially significantly, harming demand for our products and our profitability.

According to the EPA, in 2018, 4.1 billion gallons per year of biomass-based diesel production capacity in the United States were registered under the RFS2 program. This amount far exceeds both historic consumption of biomass-based diesel in the United States and required consumption under the RFS2.

Again I bolded a key part, and compare that number to the one from the chart above (for 2018). It’s almost double (4.1 billion gallons vs 2.1 billion gallons).

As the price of RINs and thus biofuels are a commodity like any other, they are determined by supply and demand.

And so as supply goes up (without matching demand), which often happens in commodity businesses as companies become too eager and overbuild, the prices can drop, which kills profits and revenues.

The BTC Program in a Nutshell

I’ll try not to spend too much time on this, but the BTC program is the only thing keeping small biofuel producers like $REGI afloat right now.

As the company explains (bolded emphasis mine):

The most significant tax incentive program has been the federal biodiesel mixture excise tax credit, referred to as the Biodiesel Tax Credit (“BTC”). Under the BTC, the first person to blend pure biomass-based diesel with petroleum-based diesel fuel receives a $1.00-per-gallon refundable tax credit.

Because of the cost attributes to produce and sell biofuels and how they compare to petroleum today, this credit has critical importance for the company’s survival.

But company survival also depends on other factors, such as the cost of feedstocks, and the competitive forces of the market (supply and demand) and prices.

That synergy of competitive forces in un-avoidable, and will set the relative importance of any one of the factors discussed in this biofuels industry overview at any given time.

Brief BTC History and Risks

The BTC has historically been a tax credit which has been retroactively reinstated when Congress didn’t pass an extension immediately.

In other words, when the last BTC expired, and Congress didn’t immediately extend the program, the subsequent years for biofuel producers like $REGI were tough. But then in December 2019, the BTC did get approved and retroactively reinstated for fiscal years 2019 and 2018. At that point, $REGI was able to add the benefits to its financial statements and receive the benefits to its business. In December 2019, the length of the program also was extended to December 31, 2022.

Investing in a small company which relies on the BTC comes with serious regulatory risks, as there’s no guarantee that Congress will extend the BTC past the 2022 date.

And even if they do after an expiration, there’s no guarantee that they’ll include a similar retroactive reinstation.

Biodiesel (BD) vs Renewable Diesel (RD)

After all of my research, I see the future of the biofuel industry as dependent on the competitive forces between BD and RD, and of course between biofuels and petroleum as well.

But you really need to understand the major differences between BD and RD as well.

As it stands today, RD trades at a premium to BD.

That’s because RD has some superior features:

- Shares very similar chemical characteristics to petroleum diesel

- Does not “cloud” up and cause performance issues in cold weather (like BD does)

- Can be easily blended with petroleum diesel (because of its characteristics)

- Can use the same storage and logistics infrastructure as petroleum diesel

- Higher renewable content than BD, causing it to include more RINs per gallon

Coming from a mostly BD producer like $REGI, you get a glaring reality about the diverging differences in potential between the (seemingly superior) RD versus BD:

Renewable diesel can also be used in its pure form in modern engines rather than as a blend with petroleum diesel and has similar cold weather performance as petroleum diesel. Renewable diesel and co-processed renewable diesel may receive 1.6 or 1.7 RINs per gallon, whereas biodiesel receives 1.5 RINs per gallon. As the value of RINs increases, this RIN advantage makes renewable diesel more cost-effective, both as a petroleum-based diesel substitute and for meeting RFS2 requirements.

In fact, although $REGI has 627.9 million gallons per year (mmgy) effective capacity for biofuels in total, making them again North America’s largest biofuel producer, the company only has 97.4 mmgy effective capacity for renewable diesel, in its lone RD plant in Geismar, Louisana.

It appears that the leaders for renewable diesel capacity today are as follows:

- Neste Corporation = 882 million gallons

- Diamond Green Diesel, LLC = 275 mmgy, expanding to 675 mmgy

- (Joint venture between Valero and Darling Ingredients)

- World Energy = 45 mmgy, expanding to 300+ mmgy

- $REGI = 97.4 mmgy effective capacity

Investor Takeaway

The biofuel industry is indeed still a very young one, with many of the major petroleum refiners not yet processing this energy source in great quantity compared to petroleum.

However, as $REGI warns, refiners and importers are slowly starting to change their ways—either increasing capacity through capex, converting some of their petroleum capacity into biofuel capacity, and/or doing a “co-processing” (both instead of petro or bio).

If you’re going to make a bet into either RD or BD, these are huge potential competitors to keep cognizant of.

I’d also highly recommend reading through all of $REGI’s risk factors extensively, as they really lay out some of the other key risks nicely.

One that stood out in particular to me was how biofuel producers need to compete for the same infrastructure and logistics resources that the petroleum (oil) industry does.

That means if oil production, particularly in the U.S. Bakken, picks up steam again, it will likely drive up the prices of leasing pipelines, railcars, underwater storage tanks and other key terminals and resources.

If you’re struggling with the 10-k…

(I don’t blame you, it’s a lot)…

Then make sure you check out our in-depth guide on dissecting the 10-k, and also a few we did on analyzing particular 10-k sections, like the MD&A and financial statement footnotes.

An investment in something as complex as energy should never be done without great efforts in research, and even then, it’s no guarantee you’ll make money.

But that’s how it goes with all investing, and I just hope that I’ve encouraged you, educated you, and inspired you, on some of the great opportunities in biofuel, renewable diesel, the energy sector and beyond.

Related posts:

- How Electricity Generation Works Updated 11/24/2023 Consumers have begun to embrace the many forms of renewable energy despite rising environmental concerns. Investments in electricity generation are increasing tenfold, with...

- What to Know Before Investing in Solar Energy Updated 11/24/2023 Solar power, wind, and hydro are the leaders among energy investments globally, with over $175.8 billion in solar. But what do we know...

- Understanding the Electric Power Grid to Make Better Investments Updated 11/24/2023 The electric power grid is like the air we breathe; we don’t think about it much until something goes wrong. The power appears...

- Berkshire Hathaway 10Q Summary First Quarter 2020 Berkshire Hathaway reported its first-quarter earnings on May 2, 2020. This report is a summary of those first-quarter results and will not attempt any analysis...