I have frequently been told that buying a new car is a huge financial mistake but honestly, sometimes I wonder if that actually is the case. So often I will see offers that sound like a really good deal so it makes me wonder – If I bought a new car, would that be a mistake?

The thing that sparked my interest is that I recently was watching TV and I saw an advertisement saying that you could get 0% interest for 72 months. I mean…if you have to take out a loan to pay for a car for whatever reason, 0% interest is a pretty dang good rate!

The thing that I kept hearing from people is that the dealership is still making up that money but they’re just making it on the cost of the car.

Well, ok that’s fine, but is a $20K car now cost $21K if you do 0% interest? Personally, I kind of feel like that’s a moot point to be honest, but I get where they’re coming from. It’s not like auto dealerships are unique in this stance though.

I mean Kroger gives you $.10 off for up to 25 gallons of gas for every $100 you spend in the store. So, that’s a 2.5% savings. Restaurants will commonly do a deal where you can get a free $10 gift card if you buy a $50 gift card, so that’s basically a 20% free bonus for you.

Companies frequently do this sort of thing to get people enticed to buy their product so I think that the conversation really comes down to two factors:

- How much are you saving on interest from buying this new car with 0% vs. a used car with a higher interest rate?

- What is the resale value in a certain amount of time vs. the resale of a used car in that same amount of time?

To evaluate this further, I want to go through three different exercises with different cars. Since the advertisement that I saw was for a Ford Dealership, I am going to focus on a F-150 and a Fusion as I think those are probably the two most common vehicles that they have, although I have no data on that.

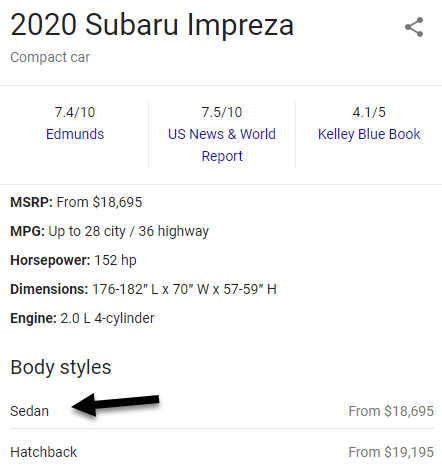

The third vehicle that I want to evaluate is a Subaru Impreza 4 Door because I previously ranked this as the #1 car for Uber, so I think it would be really interesting to see how it shakes out with that car.

Even if you don’t like any of these cars, the process that I am going to go through is going to be one that is easily repeatable and one that you can do for any car and any situation – just takes a little effort on your part!

So, let’s start with Step 1 and figure out how much money we’re actually going to save with this 0% interest rate!

There are a few pieces of information that I will need to know first before being able to effectively analyze this, including:

- MSRP of the New Car

- Approximate Price of the Used Car

- Interest Rate for the Used Car

- Resale Value in 5 years

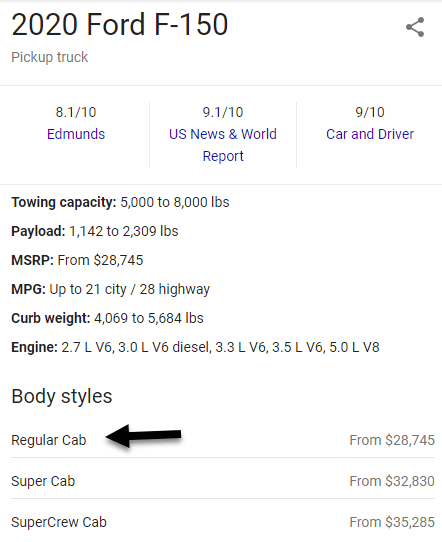

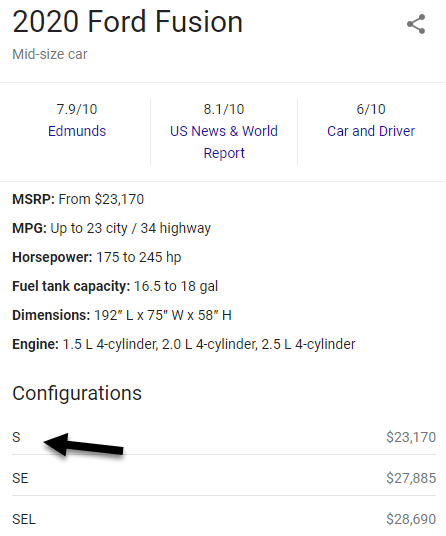

For the MSRP of the cars, I have found that if you simply google the year of the car then it will come up with the MSRP. Also, note that I am picking the cheapest option in all situations simply because if you’re doing this analysis, you’re likely a cost-focused person, and it also is the easiest for analysis purposes!

Let’s check it out:

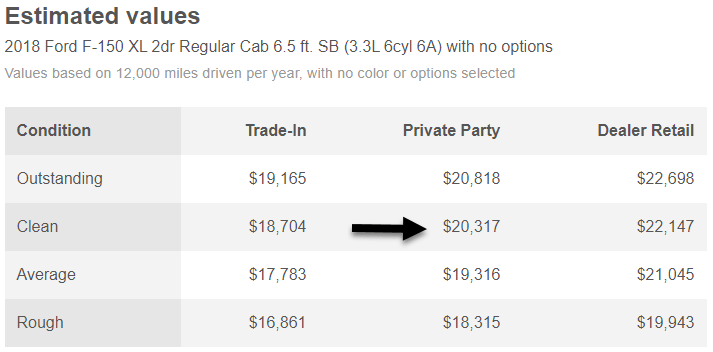

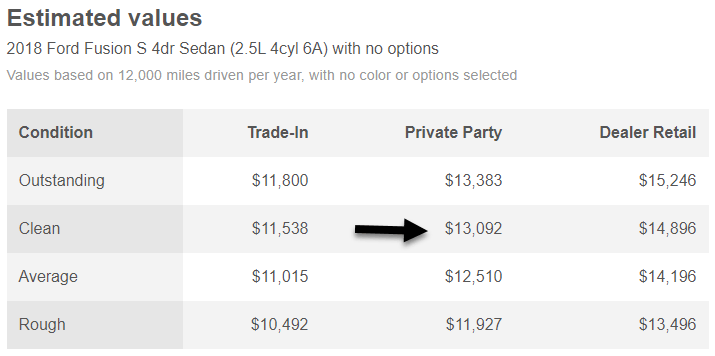

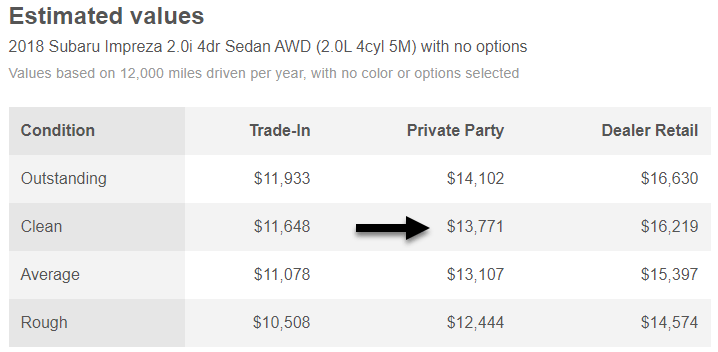

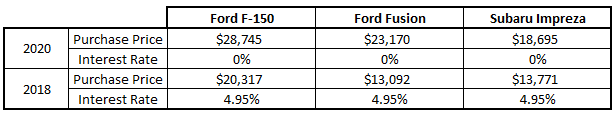

Well, that was pretty easy! Now, the next step is for us to determine the value of the used car. For all intents and purposes, I am going to look for a car that is 2 years older, so in this case it would be a 2018 Ford F-150 and Fusion, and a 2018 Subaru Impreza.

To find this info I simply went to Edmunds.com to find the approximate values. I decided to assume that the car is in ‘clean’ condition and that you’re buying from a ‘private party’ as that seemed like a middle of the road type of value.

Take a look:

So, now that we have the value of the new car and the values of the used car, the next step is to get the interest rates.

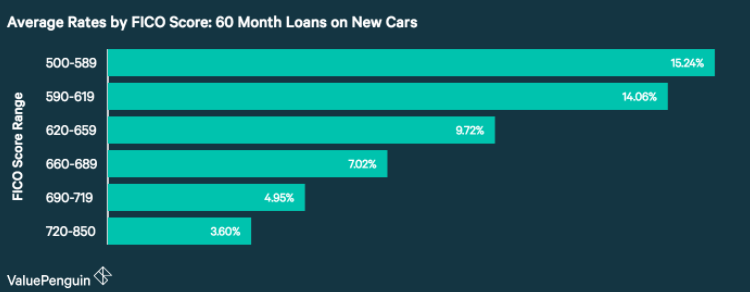

I went to Value Penguin, and I absolutely love their stuff because I think they do a really, really thorough job, and they have this neat chart to show the most realistic interest rate that you would have, by credit score, as of mid-2020 when I am writing this:

A lot of the things that I have been seeing is that to qualify for the 0% interest rate promotions that dealerships offer, you likely will be required to have a credit score that is 700+. Because of this, I am going to assume that your credit will fall into the 690-719 range noted above, meaning that you’re going to pay 4.95% interest on your loan.

The last of the four things that we need to uncover is the resale value of the car!

Now, that’s obviously going to be impossible for us to find out with 100% accuracy, but I think that the best way for us to try to uncover this data is by simply looking at what we have currently, but first we need to know the length of the loan.

The offers that I saw for 0% interest all were for 72 months so I am going to use that as the term on my loan comparison. This is a very important piece of information for you to know because it can greatly vary the results of your analysis. Obviously, the longer that you’re going to be offered 0% interest, the better for you because you can pay a lower monthly amount and then do other things with that money.

Such as, maybe invest some of it! I am a huge fan of paying the minimum on any loan under 6% and then investing the rest and a 0% loan is, well, exactly 6% under my 6% trigger threshold!

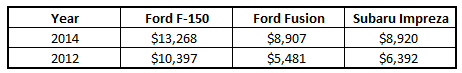

Since we are using a 6-year (72 months) term for the loan, I am simply going to look at the resale value of a car that is 6 years older for simple comparison purposes.

So, I am going to assume that the value of a 2014 Ford F-150 is what we could sell the 2020 Ford F-150 at in 6 years, and a 2012 Ford F-150 is what we could sell the 2018 Ford F-150 at in 6 years…make sense?

This is the best way (in my eyes) to make it be an apples-to-apples comparison and does seem very reasonable to me. So, let’s do it the same way that I did the 2018 data by going to Edmunds.com.

To save space, I’m not going to provide the pictures but rather just a chart that shows how the resale values look:

The reason that the resale values are so important is because I am going to assume that after 6 years and the vehicle is paid off, I am going to sell the car. So, I need to know how well that car holds their value in comparison to other years to see what sort of cash I will get back at the end of those 6 years.

Also, something that stood out when I was doing this is that the Subaru Impreza value in later years is more than the Ford Fusion is, despite the Fusion being a higher price now! Maybe that means that the Fusion is now simply a better car and charging more, but I would be willing to bet that it’s just because the Impreza holds its value a bit better.

I know that there has been a lot of information going on in this article, so let’s take some of this data and get it in Excel so we can easily read it and interpret it. I am a huge fan of Excel because it just so easily can organize the data that I need to see and I urge you to play around with it if you’re not as familiar in Excel.

To make it easy, I created a chart to summarize the data that we uncovered below that shows the purchase price and interest rates for the 2020 and 2018 vehicles:

Now is the fun part! Now we actually get to start to crunch the numbers a bit and see what makes the most sense.

First, let’s take a look at the Ford F-150. I used a simple ‘PMT’ function to determine the monthly payment of each vehicle but you also can use a loan calculator from Google.

As you can see in the chart above:

- You will pay $72.50 more each month than you would vs. the 2018 Ford F-150 even though the interest rate is 0% because the starting value of the car is more

- The total paid over the course of the loan is going to be $5,220.23 more than the 2018 Ford F-150

- The resale value of the 2020 vehicle is $2,871 more, which makes sense as it’s the same vehicle but just 2 years newer

- The total spent on the 2020 vehicle is $2,349.23 more than the 2018 vehicle after taking all factors into account

Now, $2,349.23 is a lot of money to save over the course of a car loan, but it comes out to be $32.63/month, or just over $1/day. Do you get an extra $1 worth of enjoyment from having the new car vs. the old one?

If so, and you can make the higher payments without ease, I have no issues with buying the new car. You just really need to do your own analysis so you trust the data.

But this is just for the F-150! Let’s check out the other two vehicles:

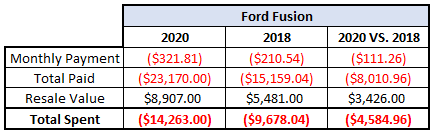

As you can see, the spread for the Ford Fusion is even higher than it is for the F-150. In this case, the cost of you having the new Ford Fusion is $4,584.96 is $83.68/month. Now, that’s still just over $2/day extra, but that’s also double the cost of the new F-150.

Personally, I think I would love to just not spend that extra money for the new Ford Fusion and just invest it, but that’s all about personal preference and your own personal finances.

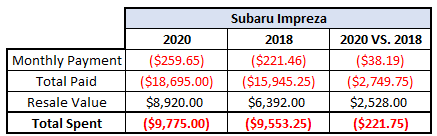

So, what do you think the Subaru Impreza looks like now that we’ve seen both the Ford vehicles show that the math favors the old vehicle?

Yup, you’re right! But barely…

The 2018 Subaru Impreza is a savings of $221.75 over the brand new, 2020 Impreza. Is that worth it?

I mean, it’s $3/month. $.10/day. Personally, I would buy the Brand spankin’ new 2020 Subaru Impreza in this case! It will cost me $222 over 6 years to have a brand new, never-been-used car!

That is definitely worth it for me.

And honestly, the vehicle has 2 less years of wear and tear by being brand new, meaning two extra years of the tires, brakes, windshield wipers, everything! I guarantee that the maintenance cost is going to make that up fairly easily, so I am pretty confident saying that the 2020 Subaru Impreza is likely a better deal, mathematically, when you’re utilizing a 0% APR loan and buying a car brand new.

Honestly, when I saw the commercial for the 0% offer, I wondered if the math would make sense but I assumed that it wouldn’t, and that’s exactly why we do the analysis on our own.

Just like with investing, you always have to do the analysis on your own or you’re going to miss those diamonds in the rough. If I had just taken the blanket advice that a brand-new car is an awful investment then I would’ve completely missed out on an opportunity for a new car AND likely an opportunity to actually save money. That would’ve been tragic.

So, summary here is to never just listen to what people say and accept it. And it’s not just with cars or anything like that – it even applies to these naughty nine investing myths that I debunked!

Related posts:

- The Best Car for Uber When Accounting for Expenses and Other Features So, you’re like one of the 900,000 people (literally) that have decided to drive for Uber, so how do you know what the best car...

- Calculating the Annualized Rate of Return for Good Financial Planning Have you ever tried planning for your financial future, only to realize how difficult it is to project into it? This post will cover how...

- How to Save For Your Short-Term Financial Goals We spend a lot of time talking about saving and investing for retirement but one topic that we don’t touch on much is the importance...

- No-Nonsense Financial Planning Guide for the DIY Individual (Pt1: Expenses) Success in financial planning comes down to a few key principles. Define your goals, curb your desires, and have patience and discipline. Make the right...