Before Warren Buffett and his special conglomerate, the compounding machine Berkshire Hathaway, there was a CEO of Teledyne called Henry Singleton—who pioneered prudent capital allocation inside of a conglomerate with stock buybacks and issuance.

Henry Singleton was profiled in the excellent book, The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success. In the book, William Thorndike shares that stock buybacks were relatively unused in the corporate world—Singleton used them religiously to earn superior returns for Teledyne shareholders.

But it wasn’t just a blind allegiance to buybacks which made the strategy so successful.

In a stroke of genius, Henry Singleton made capital allocation decisions based on Teledyne’s stock price and the current environment, selling shares when they were expensive and buying them back when they are cheap.

Even today this is not a common strategy with companies; most managements approve share buyback plans regardless of the company’s stock price in the market.

Not to say that these kinds of buyback plans are always bad for shareholders, and they might work better for the majority, but every once in a while you get a special breed of CEO who proves prescient in their abilities to buy low and sell high, and one of the best was Henry Singleton.

The Basics of Stock Buybacks

To understand stock buybacks we need to understand how a company’s profits and reinvestments work.

Basically, a company’s primary goal is to eventually turn a profit. With those profits, a company can choose to do one of these things:

- Keep the profits as cash on the balance sheet (as retained earnings)

- Reinvest back into the business for future growth (investments in working capital or capex)

- Buy another business with the funds (make an acquisition)

- Return the capital back to shareholders (through a dividend or share buyback)

Returning capital to shareholders is a fantastic way to create returns for those shareholders especially if the prospects for future growth are less attractive.

When a company buybacks its shares, it basically makes each share more valuable, which pushes company’s share price up.

Think of it this way.

Say that we were part-owners of an ice cream shop with three other partners, and we each owned 25% of the business.

Say that one of the partners wants to be bought out.

If the business is worth $1 million, then each partners’ stake is worth $250,000.

In order to properly buyout the partner, the other partners will need to come up with $250,000. The partners buyout the partner’s stake for $250,000, and now the ice cream shop is held by 3 partners instead of 4.

Each partner now owns 33.3% of the business, rather than 25%, and will have claim to 33.3% of the profits now instead of 25%.

Buybacks in the Stock Market

With the stock market, the exact same concept is applied just on a much larger scale.

Each share of stock is simply a part-ownership claim to a business, similar to the partners example each share represents a (usually small) % ownership stake.

The total number of ownership stakes leads to shares outstanding.

It doesn’t matter whether shares outstanding are 4 or 4 million, what matters is the total number of shares outstanding and how many you own.

Going back to our partners example, if each partner owned 1 share and there were 4 shares outstanding in the business, or if each partner owned 1 million shares and there were 4 million shares outstanding, it represents the same 25% ownership either way.

What the partners did when they bought out the exiting partner was to use cash to reduce the shares outstanding, and so if there were once 4 shares outstanding now there are 3. And so if you own 1 share and there are 3 shares outstanding instead of 4, your share is now 33.3% instead of 25%.

In the stock market, companies use earnings to buyback shares of stock, which reduces shares outstanding. This makes everybody’s shares more valuable, which pushes the price of the stock up (since each share now represents a higher % ownership in the business).

Total shares outstanding determine, in a big way, how much each individual share is worth.

For the partners, their percent ownership in the business determines how much claim to the profits they have; the higher the percentage the more each share is worth.

Buybacks in the Stock Market: EPS

The next key concept of shares outstanding has to do with Earnings Per Share (EPS).

If each share represents a part ownership stake in a business, and your ownership stake determines your claim to the earnings of a business, then the EPS determines your percentage of claims to the profits of a business.

Earnings per share is simply calculated by taking a company’s profits (earnings) and dividing them by its total shares outstanding.

Earnings Per Share = Earnings / Shares Outstanding

The math of how share buybacks affect EPS is simple—by reducing shares outstanding a company’s EPS increases (because the denominator of EPS is shares outstanding).

The logic behind this makes sense as well.

Because your ownership stake of each share goes up when shares outstanding decreases, that means your claim to the profits goes up. Each individual share is worth more because it is a higher % ownership stake and higher claim to the profits.

Which is why stock prices follow EPS; EPS is your claim to the profits and it increases either when the company makes more profit, or you own a higher % of the business, or both.

The vitriol behind buybacks drives me nuts.

Buybacks are really just current owners who want to be bought out, and are happy when they receive cash to be bought out, interacting with current owners who want to stay invested long term in the business, and watch their profits grow as the business (and their ownership stakes) grow together.

How Henry Singleton Used Buybacks

As I mentioned at the top, Singleton was one of the first pioneers to really use buybacks to increase share (and shareholder) value, and he was not bashful about it.

I won’t go into the specifics about it, you can Google it if you’re curious, but he bought back gobs of stock and shareholders earned ungodly returns during his tenure.

Not only was Singleton a leader in buybacks, but he was also unique in that he issued shares when the company’s stock price got too high.

Now, issuing shares is the exact opposite of stock buybacks.

In this case, the company sells shares to buyers and receives cash, rather than using cash to buy shares.

This has the opposite effect of buybacks, every shareholder’s ownership stake reduces as the shares outstanding decrease.

Share issuance is not this overly evil thing either, it is the backbone of the stock market itself. When a company goes public, it’s usually a few owners who split their ownership stake into millions of shares, and get a fat payout when they do so.

This is a great option for a cash starved growth company who has extremely strong momentum and needs to make significant investments to get to a large enough scale to have longevity and/or market dominance.

What Henry Singleton realized is that he could buyback stock when Teredyne’s shares were cheap, and issue stock when their shares were expensive, to create the optimal mix of capital management for long term shareholders.

Let’s illustrate just how effective this kind of a capital allocation strategy can be with another simple example.

Capital Allocation: Buying Low and Selling High

Say we have a company with 2 million shares outstanding. Let’s say this company earned $8 million last year. This makes its Earnings Per Share = $4.00.

How much would a share of this company be worth?

Well, the long term Price to Earnings (or P/E) of the stock market has been around 17 for a very long time (decades and decades).

If we were to overly simplify the example, and say that the stock trades at a 17 P/E, then we can take that 17 and multiply it by our EPS ($4.00) to come up with a share price of $68.00.

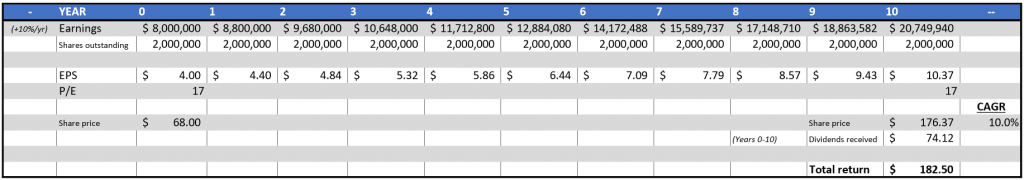

With these inputs, let’s take one last one: say the company grows earnings 10% per year. We won’t play with shares outstanding, yet, here’s the hypothetical:

We can see how EPS follows earnings growth, and so does the share price, since we’re going to assume for now that P/E = 17 at year 1 and year 10. Assume all of the earnings went back as a dividend for simplicity sake, which you can see adds to our total return of $156.09 (today’s share price minus our starting share price plus dividends).

Now let’s throw some Henry Singleton magic into the mix, and see how buybacks can juice a stock price.

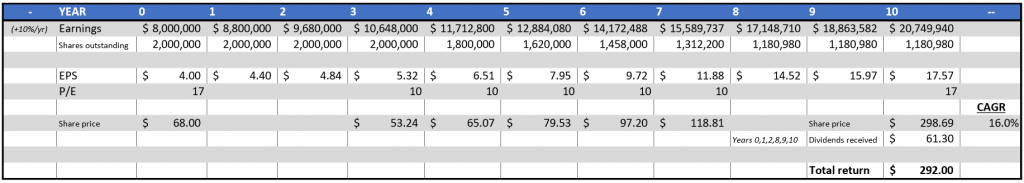

Say that there were 5 years where the stock’s price got really beaten up, so that shares were available at a P/E = 10. At this point we’ll take all of the available earnings and buyback shares. Then the P/E goes back to 17 at the end of our period:

Total return has skyrocketed, as the compounded annual growth of the stock price is now 16.0% rather than just the 10% from our 10% earnings growth. Sure, dividends are a bit lower, but the buybacks were a great use of shareholder capital since they were purchased at a great price.

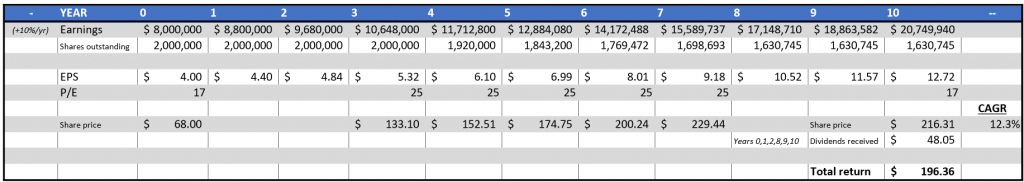

What if we ran the same experiment, but shares were purchased at expensive prices (like most companies seem to do today)…

Instead of the P/E being 10 for 5 years, say it was at 25:

Returns are still better than receiving all of the earnings back in dividends, but this is primarily because of compound interest (if the investor was reinvesting dividends in the 1st example it would be a wash).

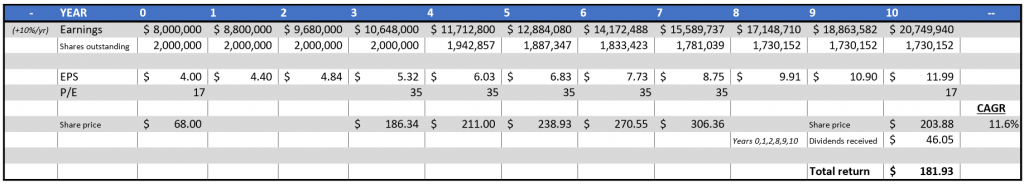

Now is there way for a company to destroy value by paying too high a price? Glad you asked, here’s the situation with the P/E at 35:

In this situation, with buybacks done over only a 5 year period of an expensive stock price, the investor actually earns less of a total return than if the dividends were distributed instead ($181.93 vs $182.50). Sure, EPS growth and share price is higher, but total return was lower as management essentially destroyed value for shareholders by paying too high of a price to juice EPS. This value destruction gets worse the higher the P/E paid to buyback the shares.

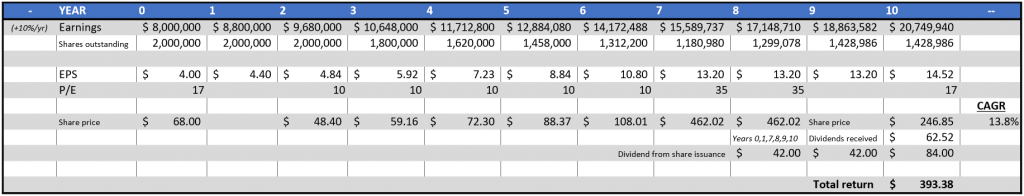

Now let’s go to the most fun example, the Henry Singleton approach.

In this case we’ll have both an expensive stock price and a cheap stock price.

Say that management bought shares when they were cheap and issued shares when they were expensive. To keep things simple, we will add the proceeds from share issuances to our dividends received, and of course we won’t receive dividends on the years where the company buys back shares (like in the previous examples).

Notice how our EPS growth declines a little, but our total return was so much greater because of the extra funds from the stock issuance in years 7 and 8.

In the real world, stock buybacks and issuances are applied a little differently than this simplified example, and managers (like Singleton) will use cash from stock issuances to increase earnings faster rather than pay it back as a dividend (usually).

And the compounding effect has a huge influence here, which skewed the results slightly since we kept Earnings growth steady at 10%, whether there was an influx of capital with share issuance or not.

Regardless of the imperfections of this example, we can see how simple math dictates that returns can really be amplified for investors when management allocates capital by buying low and selling high.

It’s a big reason why Warren Buffett, one of the greatest CEO capital allocators of our time, teaches that prudent capital allocation does depend on the price of one’s stock, and that it is wasteful to buy stock back at prices that are too high.

Determining what price is too high, how future growth will look like, and a myriad of other factors (including time horizon) makes analyzing CEO capital allocation much easier said than done.

Because of that, I generally don’t have too much qualms with managements who return capital to shareholders through buybacks even when prices seem a little high; key word there “a little”.

But at the extremes investors should steer clear of the obvious capital destroyers.

And if you can pick out the master CEO allocator ala Henry Singleton before a great run like this, more power to you.

Related posts:

- The 7 Types of Capital Allocation and What They Mean for Shareholders Updated 9/3/2023 “Capital allocation is a senior management team’s most fundamental responsibility. The problem is that many CEOs don’t know how to allocate capital effectively....

- The Real Benefits of Share Buybacks as Explained by Warren Buffett In Section 5, Part B of the book, “The Essays of Warren Buffett”, Buffett talks about how they support sensible stock repurchases but not greenmail. ...

- Assessing The Capital Allocation Skills of Management Updated 9/15/2023 Capital allocation is job number one for any management team. The problem is that most CEOs lack this skill, intending to build long-term...

- Guide: How to Read Google Finance Google finance is a great tool to use in your investing arsenal. It’s a great way to get updated ticker information, as well as news,...