Updated 1/5/2024

C-level management, or the C-suite, includes any company’s top managers, such as Microsoft, Berkshire Hathaway, and Tesla.

The C-level management remains responsible for the company’s path and its choices. The C level has many different roles within the C level, with each playing its part in the business.

Most investors or laypeople understand the term CEO or chief executive officer. Typically, these people are magnetic, charming, and brilliant. Some, more than others, stay out in front of their companies.

Elon Musk certainly encompasses all those characteristics and is the face of the company’s brand. Differently, Warren Buffett continues to be the face of Berkshire Hathaway, like Bill Gates for Microsoft.

The CEO’s role has evolved, and in recent times, there has been pressure to open up the upper levels of management to become more diverse for the good of all.

Recently, Citibank announced the first woman to ascend to CEO for the bank.

Along with those calls for more diversity, there are more calls for changes to upper-level pay, and I thought we should cover those topics in today’s post.

The upper management impacts any company’s direction and culture, and as investors, what do we know about these positions and their impacts?

In today’s post, we will learn:

- What is a C Level Employee?

- Understanding the C-Level

- Roles of the C-Level Executives

- What Are the Different Levels of Executives?

- How Much Do C-Level Executives Make?

Okay, let’s dive in and learn more about C-level management.

What is a C Level Employee?

The C-suite or C-level management slang describes any corporation’s upper management, most importantly senior management.

The C level gets its name from the titles associated with the top management, beginning with the letter C.

The C stands for “chief,” such as the chief executive officer (CEO), chief financial officer (CFO), and chief information officer (CIO).

There are other designations for other management levels throughout the company, which we will cover.

The managers or executives who hold the C-level positions are the bosses of each department within the business.

Many of their responsibilities include influencing and strategic opportunities for the business:

- Strategic planning.

- Task delegations.

- Stock decisions.

- The gathering of info from lower-level management to assist in decision-making.

- Hiring and firing employees, including management positions.

Let’s look next to a little deeper dive into the C level.

Understanding the C Level

C-level management is considered the most important and influential group in any company. Reaching this high echelon typically requires experience, talent, and leadership skills.

Many C-level managers relied on the know-how and operational skills to climb the rungs of the corporate ladder. But in recent years, the focus on more visionary concepts has risen to the fore.

Not all C-level managers have backgrounds in management or have risen through the ranks, with the rise in technology firms in the stock market.

Many of these companies are run by the founder and CEO. Mark Zuckerburg of Facebook comes immediately to mind. As Facebook grew, Zuckerburg became the default CEO, a position he still holds today.

As tech continues to rise globally, we will find more upper management throughout those companies with no prior management history.

As those companies grow, they might experience growing pains as the C-level management learns “on the job.”

When most people think of C-level management, positions such as CEO, CFO, and COO emerge, and most understand easily.

However, many other positions fit into this executive level. Other positions in the C level management are:

|

The number of C-level management at each company will vary. Variables include the company’s size, number of departments, and business sector.

Larger companies require a chief human resources officer (CHRM) and a chief operation officer (COO), but smaller companies might only need a COO to oversee both duties.

The bottom line is that the C-level is important to the company’s success and continued growth. C-level management provides leadership and ideas, which help the companies run smoothly.

Because of the level of responsibility and higher workload levels, the C-level management typically carries higher salaries than other employees in the company.

C-level management makes important decisions that guide the business and is responsible to employees, shareholders, and investors.

It usually takes years of experience with the company to rise to the C level, and the pay is commensurate with that time and experience. We will have more on this subject in a few minutes.

Roles of the C-Level Executives

Position Title | Company Role |

Chief Executive Officer (CEO) | The big boss has the highest-ranking position in the company—all C-level management reports to the CEO. Responsibilities include overseeing the entire business, top-level planning, establishing the company’s goals and strategies, and making all the final decisions on any of the above processes. |

Chief Operating Officer (COO) | They are considered by many as the second in command. CFO’s responsibilities include the day-to-day ops for the company and ensuring the execution of the CEO’s business plans and strategies. |

Chief Financial Officer (CFO) | I am in charge of financing and accounting departments, including forecasting, budgeting, reporting, and compliance. Also, track long-term financial planning and risk analysis. The CFO manages the overall financial status of the business. |

Chief Information Officer (CIO) | I am in charge of the information technology department and oversee the company’s computers. Oversee all strategic planning, hardware and software selections, and improving customer service interactions through technology. |

Chief Technology Officer (CTO) | The CTO oversees information systems and the technology department. If a company has a CIO, the CTO focuses on innovation instead of IT infrastructure. The CTO’s responsibilities include adopting new technology, developing products, and developing features. |

Chief Marketing Officer (CMO) | The CMO is in charge of the marketing department. Their responsibilities include managing the brand, product positioning, client communications, email campaigns, and creating marketing strategies. The CMO also conducts market research and analyzes all marketing activities’ ROI (return on investment). |

Chief Human Resources Officer (CHRO) | The CHRO oversees all HR matters for the company. Their responsibilities include all matters related to hiring, training, and evaluating employees, employment development, retention strategies, and maintaining HR strategies with a long-term view. |

What Are The Different Levels of Executives?

C-level management is usually at the top of a company’s hierarchy. I only reported to the board of directors and the company’s founders.

The employees that fall under the C level will depend on the structure of the company but usually include:

- V-level management: Vice presidents (VP) and any Senior Vice Presidents (SVP) that report to the C-level management.

- D-level management: Directors in the various departments, such as the Director of Sales, that report to the V-level managers. Think of directors such as HR, Marketing, Compliance, and Technology.

- B-level management: These are mid-level managers who report to the D-level, such as a Sales Manager, Marketing Manager, or HR Manager

These levels work differently in different companies. Typically, the rock rolls down the mountain from the C level to the V level, the D level, the B level, and the staff.

However, not all companies use these designations; many will mix and match the different levels.

For example, when I worked at Wells Fargo, we had store managers who reported to the District Manager, who reported to the Vice-President of the District, who reported to the President of the District, who reported to the Area Manager, who reported to the Vice-President of the Area, who reported to the COO of the company.

As investors, we remain focused on C-level management because they are the most visible and the company’s leaders and visionaries. But as many of us know, the boots on the ground make the magic happen at our jobs, so they stay just as important.

But our job as investors equals investigating the company, culture, and management team. Analyzing the C-level management helps us determine the company’s future path and culture.

When companies discuss cutting costs or improving efficiencies, they often discuss removing different management layers to cut costs and streamline the company. Both help reduce costs and streamline flow and efficiency.

Let’s move on and look at what kind of pay the C-level managers receive.

How Much Do C-Level Managers Make?

The pay C-level management is a touchy subject and has been the subject of constant debate in both Congress and the press. There are many reasons for this, such as “golden parachutes” offered to outgoing CEOs who have failed at their jobs but receive huge payouts.

Much focus on pay surrounds the discussion of stock-based compensation, which is most wealth distributed to C-level management.

The theory behind this reasoning is that the officers should benefit from the growth and wealth of the company they are running; it gives them some “skin in the game.”

However, granting stock-based compensation has also led to some shady dealings with unscrupulous C-level management, most recently at Caterpillar, McDonald’s, and Boeing.

All three companies had a management that manipulated earnings, stock buybacks, and other items, allowing them to earn more stock compensation and benefits directly from those steps.

The CEO would enable the company to meet earnings targets or goals that would grant them more company shares at higher prices, turn around and buy back shares, and lower the average cost and profit from the stock compensation.

Bad news, which gives many on Wall Street indigestion and bad reputations.

C-Level Management Salaries

Okay, let’s look at some stats on the average salaries for C-level management, according to salary.com:

- CEO – $754,713

- COO – $457,468

- CFO – $363,559

- CIO – $266,171

- CTO – $234,700

- CMO – $230,735

- CSO – $217,144

Remember that the above figures are all base salaries that the C-level management earns.

The majority of the large numbers of wealth you hear about on the news are from stock-based compensation.

Of course, a company with a market cap of billions will have higher salary considerations.

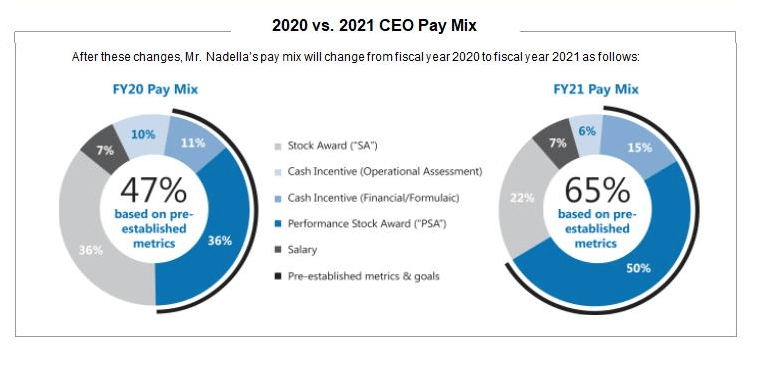

For example, let’s look at the compensation package for Satya Nadella, CEO of Microsoft:

The above chart highlights the sources of Microsoft’s CEO’s pay; as you may notice, only 7% of his pay stems from the salary portion of his pay.

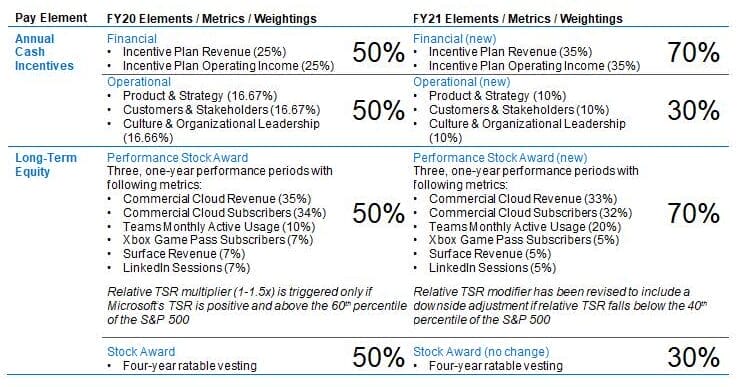

The above chart outlines the metrics and goals Mr. Nadella needs to achieve to receive his contracted bonuses.

Most S&P 500 CEOs have targets and goals like the above to achieve their bonuses. Many of those bonuses tie back to the performance of the company.

As you can see, Microsoft ties much of its CEO’s pay to revenue and leadership goals.

To help determine reasonable goals for any company, such as Microsoft, the Board of Governors set up peer groups for the company to compare itself.

In Microsoft’s case, their peer group contains companies such as:

- Alphabet (Google)

- Amazon

- Apple

- Cisco

- IBM

- Oracle

All the big hitters in cloud computing, software, and the computer universe.

They use these peer groups to set goals for the C-level management to achieve and then tie their compensation to those goals. They do not always have to be number one, but rather, they maintain market share or grow their piece of the pie.

PROTiP: Warren Buffett repeatedly mentions studying the competition to know what they do in their businesses. It is a great way to determine your company’s competitors by looking at the proxy statement for any company.

Here is Microsoft’s 2020 Proxy for you to look through.

For example, in 2019, Mr. Nadella earned

- Base salary – $2.5 million

- Stock awards – $30.72 million

- Cash incentives – $10.9 million

- Total pay – $44.2 million

That increased 66%, compared to his total pay of $25.8 million in 2018. Much of that increase occurred because he hit the targets and stock awards, as Microsoft had a successful operation year.

Not all CEOs take their pay this way; I give you Warren Buffett and Charlie Munger.

Both earn exactly $100,000 in based pay from Berkshire Hathaway and have for the last 25 years, with no raises.

Berkshire does pay their two top executives $16 million a year, Greg Able and Ajit Jain, who are vice-chairmen of the company in their respective departments.

Warren receives additional benefits of $278k in security, but Charlie receives only his base pay.

Now, Buffett and Munger have all of their wealth tied up in the ownership of Berkshire Hathaway, valued at over $524.68 billion. And Buffett is worth $84 billion, and Munger is worth $1.6 billion.

Buffett and Munger chose to own the company and derive their wealth from the growth of their company’s value, which is a turn away from most management. But that is what makes them unique and drives their company’s value in many ways.

Final Thoughts

The C-level management drives the businesses they run with their ideas and leadership. Many companies take on the personas of their leaders, Tesla being a prime example.

Management impacts much of what happens at every company level and bears a large responsibility for that.

There are many different types of leaders, and not everyone has the same persona or leadership style, but the great ones can lead their companies to new heights.

Take Sayta Nadella; when he took over Microsoft, it was a floundering company with little or no focus. He pointed the company towards the future of cloud-based software with Azure, and Microsoft hasn’t looked back since.

Companies like Berkshire Hathaway would be nothing without the leadership of Buffett and Munger. In many ways, the company’s success becomes synonymous with the leaders.

Much of the focus on leadership surrounds the CEOs, but the other roles are important; after all, you can’t have great financials without a great CFO.

Focusing on the great teams and those that stick together for long periods tells another story: great execution and culture.

Take the Omega Healthcare Inc (OHI) team, a healthcare REIT. The top three C-level managers have been with the company for over 19 years.

Studying the leadership structure of any company can go a long way toward helping us understand Google. Looking at the C-level’s experience, tenure with that company, and pay helps us understand their motivations and goals.

According to Warren Buffett, finding great companies with great management is one of the keys to successful investing.

With that, we are going to wrap up our discussion for today.

Thank you for reading this post, and I hope you find something of value in your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Disney Board of Directors, Management Decisions: Analyzed [Investor Guide] As investors seeking to understand the companies that we trust our hard earned money to, a great way for us to evaluate leadership can be...

- Asset Management Stocks: Business Overview and Changing Trends Trillions of dollars move around in markets, and many of these flow through large asset management companies. To understand these stocks, and invest in them,...

- Taking Peer Group Analysis One Step Further for Analyzing Competitors There’s many superficial ways to make a peer group analysis as part of evaluating an industry, or a company’s competitive advantage against its competitors. I...

- The Rise, Fall, and Rise Again of Warren Buffett’s GEICO Investment Warren Buffett’s GEICO investment was pivotal for two of the greatest investors of all-time. The history of GEICO’s stock is fascinating, with many ups and...