Updated 2/19/2024

If you’re familiar with the Investing for Beginners community, you know that we are all HUGE fans of contributing to your retirement accounts consistently.

The biggest key to this is that you can average out your investments to reduce volatility, but how do you know you’re doing this? Well, you must know how to calculate the average cost of your investments!

Click to jump to a section:

- Why Is Average Cost Important?

- The Power of Average Cost & RLS Investing

- How to Utilize Average Cost & RLS Investing

- Calculating Average Cost

- Average Cost Calculator

- Using Average Cost: Yield On Cost

- Using Average Cost to Shift Your Investing Mindset

Why Is Average Cost Important?

First, let me explain the importance of knowing this, and by the time we get to the end of the blog post, I will provide you with a free calculator that you can use to calculate it yourself.

You might be thinking of the term “dollar cost averaging” from the first paragraph as that has become synonymous with this strategy of investing X amount every X period, such as $100/paycheck or $150/month like Andrew does in his real-money portfolio.

RLS Investing

The issue is that this is not technically dollar-cost averaging. This is what I would say is ratable lump sum investing. I’m not going to go super in-depth on this and annoy the heck out of you (because I have done that previously), so instead, I’m just going to say we’re investing via this RLS approach – aka Ratable Lump Sum (RLS).

And yes – I am going to coin that phrase…lol.

So, the idea of RLS is quite simple – with every paycheck you get, find out what amount of money you need to stash away. Then, figure out how much you would have left over, assuming your discretionary spending doesn’t go off the deep end.

Let’s say that leaves you with $150. What do you do with it?

Well, maybe you want to save $50 for some fun and then invest the rest. You dump all that money into your favorite stock or ETF (and hopefully not a regular savings account because that interest is trash!), and then you let your money do what it does best – go to work for you!

You see, by investing everything that you have left over, you’re going to give that money as much time as possible to compound and reap the rewards later in your life.

The Power of Average Cost & RLS Investing

Now, I don’t want to go super into the details of why you want to do RLS, but let me provide a couple quick reasons:

Chances are, the stock market is your best opportunity for returns

You might have other amazing options, and if so, go ahead, but for most of us – this is our best opportunity to maximize the compound interest on our dollars.

By consistently adding to our positions, we can smooth out the volatility in our portfolio

Sure, this might mean that you’re going to ride it all the way up and get in at higher prices than you have in the past, but that’s a good thing! That means that the rest of your portfolio has increased in value consistently.

And if you’re buying in at a lower price than you did previously and you still have a lot of faith in that stock or ETF, then you’re getting nothing less than a clearance price on that asset.

As Warren Buffett once said,

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

That’s straightforward: just because you’re buying lower than you did previously doesn’t mean it’s a bad thing if you still have faith!

How to Utilize Average Cost & RLS Investing

Let’s dive in on exactly how this might work for you.

As you likely know, the stock market has historically gone up 10%+ each year on average, which means that you’re most likely going to be buying in at a higher time than you did the previous month. But, at the same time, that means that you’re going to likely be buying in at a cheaper time than you will the month after…so put your money into the market and let it work!

The adage “The best time to start was yesterday” is true, but the next best time is today.

If you were to invest $100 each month into a total stock market ETF like SPY since 1/1/2015, then you would have a total of 52.61 shares of SPY. While that might not sound like an absolute ton of shares since you started accumulating them 9 years ago, you’ve invested a total of $11,300, and now that investment is worth $22K!

Calculating Average Cost

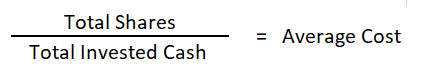

And the cool part is that your average cost for each share is only $214.77! But, the question to all of this was how to calculate the average cost for your investments. The formula is very simple to understand:

This formula is so straightforward that many brokerages will calculate it for you. I focus so much on this number because, in my eyes, it’s a tangible way to realize how successful you have been in your investing journey.

Average Cost Calculator

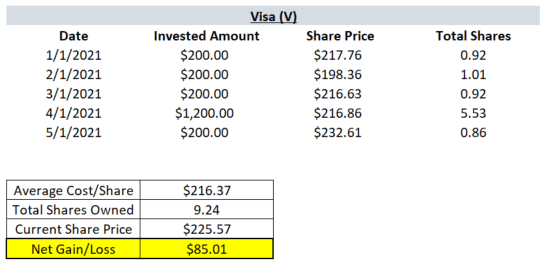

Personally, you all likely know that I am a nerd and like to calculate this on my own, so I created a very simple calculator for you to do the math yourself.

All that you need to know is:

- Your investment date

- The amount you invested

- The share price that you bought at

- The current share price

If you input these few pieces of information into the calculator, then you can see your Average Cost/Share and your Net Gain/Loss, noted below:

As you can see, I assumed that I was going to invest $200/month into Visa on the first day of each month, except in April, where I received a $1000 bonus (this is all made up), or maybe even a tax return, that I wanted to put into Visa. By doing so, I was able to capitalize on the share price being essentially flat since I first invested and now see the share price about $9/share higher than if I had invested at that time.

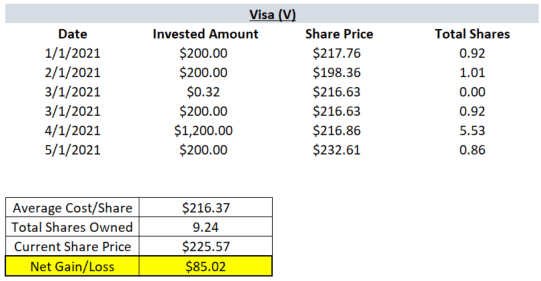

Note that this doesn’t include dividends either, which admittedly isn’t huge for Visa, but if you earned $.32/share for every share as Visa paid out on 3/1, you can enter that amount in as a dividend as I have done below:

Those dividends are extremely small because Visa isn’t known as a dividend stock, but I view them as a blend of all the intriguing companies.

They’re a tech company (check) that’s not insanely overvalued (check) and pays a dividend (check) along with a high ROIC, which is one of my favorite quantitative metrics to evaluate the management of a company (check).

For that reason, I love Visa. I view them as very similar to Apple in this sense of being a blended company as Apple pays a dividend too, believe it or not.

Using Average Cost: Yield On Cost

Another way you can take this average cost for your shares and use that information to better understand your investments is a term I heard a couple of years ago: yield on cost.

For instance, a stock that is trading at $100/share might give you a $4 dividend each year, meaning your dividend yield is 4%, right? But if you bought those shares at $50, then your Yield on Cost is 8% because you’re getting $4 in dividends yearly for a stock you bought at $50. Huge win!

I think it’s extremely important to have this perspective because it keeps you in line with how your investments are doing, but I highly encourage you to evaluate your stocks based on where they currently are rather than what you bought them at.

For instance, every single day that you choose not to sell your shares, you’re effectively choosing to buy shares at that same price. Taking taxes out of the equation, you should always want to be in the best investments. If you see better opportunities out there, you should jump on those opportunities rather than stay with your current investments just because those may have doubled.

Sure, your yield on cost is 8% in the example that I gave, but you could sell those shares, purchase a different company that is paying out a 4% dividend yield, and be in the same spot from the total dividends that you’re earning even though your yield on cost is much higher now because you recently acquired these new shares.

The thing that is important, in my eyes, about knowing how to calculate your average cost is that you understand the value of sticking to the plan and being opportunistic in your buying.

Using Average Cost to Shift Your Investing Mindset

Just because the shares are down doesn’t mean that you need to panic sell your holdings, and in fact, it might mean the exact opposite if you still have conviction in the company.

Andrew and Dave recently addressed a listener question on the podcast about this where he owned PLTR, a very volatile stock, and was wondering what he should do with his shares as they would increase and decrease massive amounts in a short period.

The key is conviction: hold for the long term and practice Ratable Lump Sum investing.

As I mentioned before, I don’t think you must use a calculator to track all of your stocks in Excel to calculate your average cost when your brokerage firm likely does it. However, I firmly believe that understanding how this works is a major factor in being a successful investor.

I have talked previously that when COVID-19 was hitting the U.S. initially in March 2020, I emptied my rainy-day fund to take advantage of the 20-30% drop in the stock market. I knew that this decrease in the market would either be completely temporary or the pandemic would be extremely brutal, and chances are I wouldn’t need that rainy-day fund anyway.

I found an opportunistic time in the market to load up on some of my favorite holdings and ETFs, and now we find the stock market right at all-time highs. Hopefully, I didn’t just jinx it…

Once you can master the understanding of the average cost of your shares, you’re going to be a far better investor, and you’re going to hope the market goes down in the short term so you have opportunities to buy even more shares than you did the previous month with the same amount of money.

Your friends might think you’re crazy for it, but sometimes those massive pullbacks are nothing less than a great buying opportunity!

My take-home advice is this – make sure that you’re practicing your RLS investing strategy because that is the hardest part to master. Set an amount that you want to save each period (month/week/paycheck/etc.), and DO NOT waiver from that. If you can do that, you’re going to be golden.

Even if you’re not a stock picker like I am, there are other ways that you can invest with a great deal of confidence, such as buying a total stock market ETF or my personal favorite, becoming a subscriber to the Sather Research eLetter!

Related posts:

- Understanding Where Investment Returns Come From: Yield, Growth, and Multiple Expansion Achieving financial success in the stock market demands a profound grasp of the three sources of investment returns: Yield, Growth, and Multiple expansion. But how...

- Dividend Reinvestment Calculator to Plan Your Expected Returns (Excel) One of the most powerful forces behind building wealth in the stock market comes from the compounding effects of reinvested dividends. As investors, it’s important...

- 7 Compelling Arguments for Dividend Reinvestment vs a Payout in Cash Is the income stream from dividend payouts the best part of dividend stocks? Not always. Taking that cash instead of reinvesting it leaves serious returns...

- Handy Andy’s Lessons – Starting a Dividend Portfolio I’ve decided that I’m going to start a few “hot tip” type blogs and call them “Handy Andy’s Lessons.” This is likely to change because I...