Calculating portfolio return should be an important step in every investor’s routine. Efficient wealth management means to allocate money where it is generating the greatest long-term returns and for that reason alone, return is important.

This lesson will discuss the technical formulas in calculating portfolio return as well as the theory behind them and practical tips for retail investors.

How to Calculate Portfolio Return

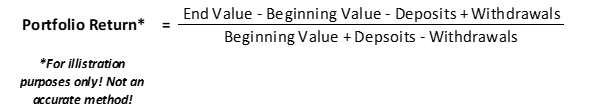

Essentially the calculation is a simple growth formula with a little twist. The difference is that one also has to also take into account the external cash flows on the portfolio.

This means that deposits and withdrawals from the portfolio have to be adjusted for as they do not contribute to the return of the portfolio.

Investors can adjust for net deposits into the portfolio by both subtracting them in the numerator and adding them to the denominator as will be shown more when the different calculation methods are discussed later.

For net withdrawals, these external cash flows would be added to the numerator and subtracted from the denominator.

The Importance of External Cash Flows

The cash flows we are concerned about are essentially external capital from investors flowing into and out of the fund.

While some cash flows, such as dividends and interest, are generated internally within the portfolio and should be included, others are external and fall outside the return calculation.

Like a business, the return on invested capital (ROIC) is crucial in judging the profitability of any fund or investment.

Knowing the exact amount of time (days in some methods) that each amount of capital is invested can pinpoint the accuracy of this equation. If external cash flows are not properly accounted for in the return calculation, the effect can be misleading to investors.

For example, in an upward market, a withdrawal from the portfolio near the end of the period will create an upward bias on the return of the portfolio as it makes it look like the return was generated with less capital invested. The larger the external cash flow, the larger the potential bias.

The Main Methods to Calculate Portfolio Return Covered in the CFA

There are a few methods of calculating portfolio return as listed below. The one we will cover with an example in this article is the Modified Dietz method which is also my personal favorite. The person who the main methods are named after is Peter Dietz.

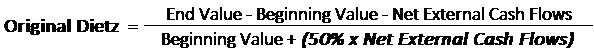

1. Original Dietz: In an attempt to simplify the time consuming and onerous task of keep track of when external cash flows were received during the period, the formula simply multiplies the net external cash flows by 50% to assume that they were received in the middle of the period and available for investment during half of the time.

2. Modified Dietz: This calculation improves on the accuracy of the original as it gets more precise by weighting the capital invested by the number of days it is within the portfolio. This ensures that capital which is in the fund longer has a responsibility to generate more return.

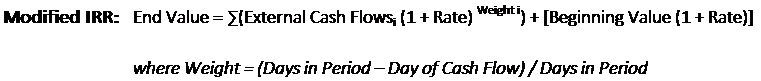

3. Modified Internal Rate of Return. This is an IRR calculation that finds the rate at which each cash flow would need to grow by for the beginning value to equal the end value. This could be done manually through an iterative process of guessing rates, but this is largely impractical. In Microsoft Excel, the IRR formula or a What If analysis could be used to make this calculation.

What’s the Big Deal about Knowing Portfolio Return with These Calculations?

Without knowing the return their portfolio is generating, how can one make asset allocation decisions to improve one’s situation? Comparing the portfolio’s return to the benchmark’s return is a must for every investor and it should not be overlooked.

Being able to calculate return is the first step in attributing where portfolio returns are coming from in order to make asset allocation decisions and focus the portfolio on what is working.

Whether a pension fund, endowment fund or retail investor, knowing your return can help you know which funds and managers to allocate money to, compare how your portfolio is measuring up against the benchmark, what percentage of return fees eating up, and the big question of whether one should be managing their own wealth or outsourcing most of it to an advisor.

Personally, I track my return across my various portfolios as a sanity check so that I can answer the big question of whether I am beating or matching my benchmark, or if the majority of my money should be in low-cost ETFs.

On a practical level, retail investors might have multiple accounts (especially including one’s spouse) with different brokerages that they would need to calculate a consolidated return on.

Even if the accounts are at the same brokerage, I have seen some online platforms which do not show a consolidated portfolio return across all accounts. Luckily, many brokerages are seeing the need and are getting better.

Industry Practices

In the investment industry, the majority of funds simplify the return calculation process by only allowing subscriptions and redemptions at month end.

Having all cash flows occur at the beginning of one day simplifies not only the return process, but the administrative process as well.

Individual Retail Investors

For individual investors, the Modified Dietz and IRR method are too much administrative work and would be a deterrent to keeping proper records of portfolio returns.

The Original Dietz method, with its assumption that cash flows occur in the middle of the period, offers the best trade-off between accuracy and administrative work and as such is the method I use to calculate my consolidated returns and would recommend to others.

That being said, any large external cash flows representing a significant amount of the portfolio’s value (greater than 10%) could have its time in the portfolio weighted according to the Modified Dietz method in order to improve accuracy.

Related posts:

- How to Use Return Attribution to Compare Portfolio Return Being able to attribute the sources of portfolio return is an important aspect in the decision making process surrounding portfolio management. The process of return...

- Portfolio Leverage Portfolio leverage is the classic double-edged sword, magnifying returns to the upside and cutting deep on the downside too. Portfolio leverage needs to be understood and...

- The Information Ratio – CFA Level 2 An investor’s Information Ratio is a measure of the Active Return that is being achieved per unit of Active Risk. The Information Ratio is important...

- How Most Total Return Calculations Don’t Report An Investor’s True Results The returns in the stock market and an investor’s actual total return can be very different. If the investor plays his cards right, his total...