The attached calculator can be used by investors to estimate the weighted average cost of capital (WACC) for publicly traded companies. For a larger discussion on WACC and some of the various methods that can be used to calculate the cost of equity and cost of debt, readers are encouraged to explore our larger article on WACC.

Example Calculation with Walmart

To get readers comfortable using the attached WACC Calculator, we will calculate the WACC of Walmart as an example . The weighting and cost of capital is calculated on the first tab entitled WACC Summary with the cost of equity calculated in the second tab using the CAPM method and the after-tax cost of debt calculated in the third tab using the historic method. There are no preferred shares with Walmart but this has been included in a fourth tab of the calculator in case investors ever run across a company with some preferred equity outstanding. In each tab the red highlighted cells can be updated with data from sources for the company being analyzed. The sources and links provided for Walmart can be used as an example for where to look when plugging in data for a new company being analyzed. Now let’s get into the details with Walmart.

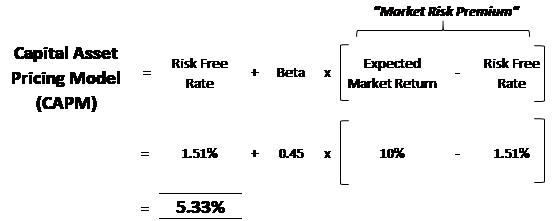

Cost of Equity – CAPM

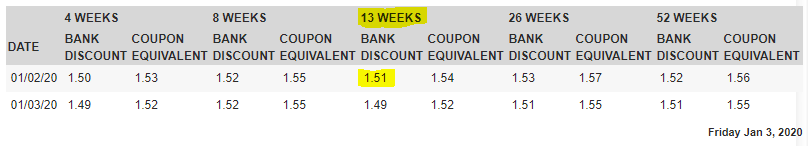

- Risk-Free Rate: As a U.S. domiciled company, the risk-free rate used has been the short-term 3-month rate (13-week) as found from the U.S. Department of the Treasury website seen below.

Sourced from U.S. Department of the Treasury website

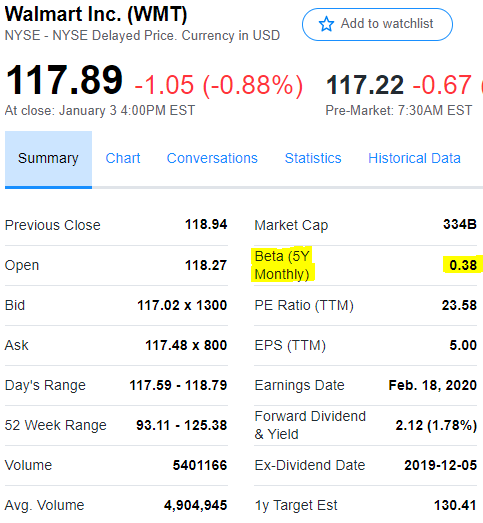

- Beta: As a consumer staple company, Walmart would be expected to have market risk and a beta of lower than 1. As mentioned earlier, it is best to use the average of a few sources for beta as calculation methods can vary. For the 3 sources used as a beta for Walmart, beta ranged from 0.35 to 0.62 for an average beta of 0.45. Below is a screen shot from one of the sources.

Sourced from Yahoo Finance

- Expected Market Return: The expected market return used has been the previously mentioned 10% which is widely quoted as the historical return for U.S. markets since 1926.

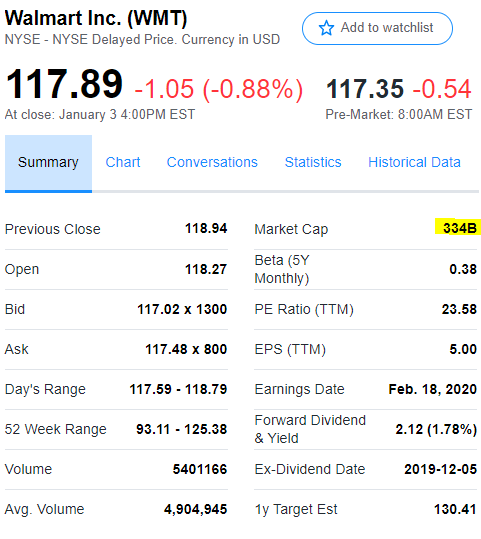

- Market Capitalization: In order to find the weighted average (which takes place on the first summary page) each source of capital needs to be weighted by its use in the capital structure. For equity, this means that we have to multiply the cost of equity by Walmart’s market capitalization divided by the total capital in the business. The market capitalization can be found from numerous financial websites such as Yahoo Finance as seen below.

Sourced from Yahoo Finance

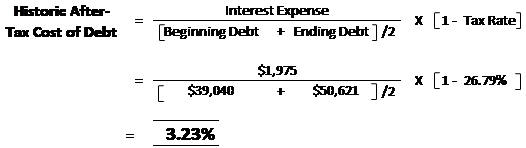

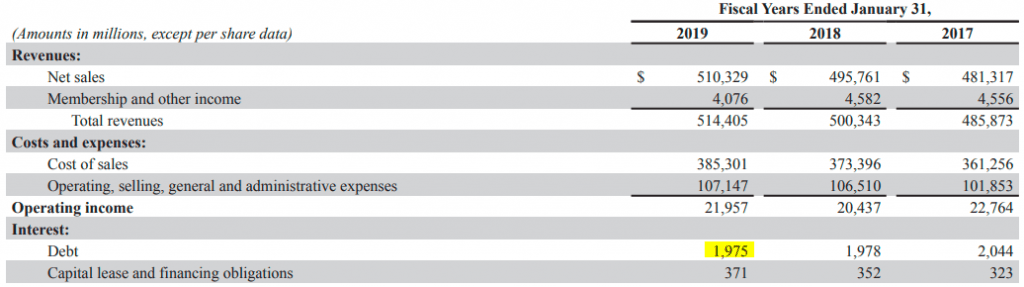

Cost of Debt – Historic

- Interest Expense: To build the cost of debt using the historic approach we need to look at Walmart’s latest annual financial report which can be found from a company’s Investor Relations website. Looking at the income statement, we see that Walmart had $1,975M of interest expense during 2019. Also note that for a retailer with lease obligations, these will also now be shown on the financial statements since IFRS 16 and ASC 842 accounting standards came into use and made it mandatory for business to capitalize and expense almost all lease obligations. However, as these lease obligations do not represent actual capital which a company has received and the money that would be needed to start a similar business, they should be excluded from our cost of debt calculation.

Sourced from Walmart’s 2019 Annual Report

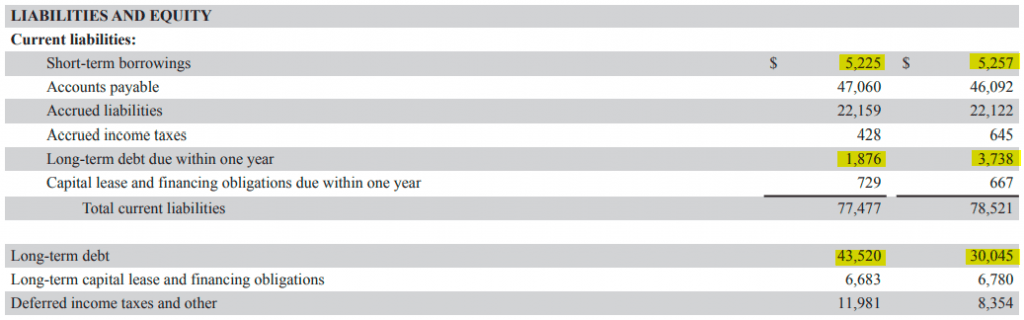

- Beginning and Ending Debt: To transform the interest expense into a percentage form, we need to divide it by the average amount debt outstanding over the year. Looking at the balance sheet of Walmart below, we want to take the average of all the interest bearing debt outstanding over the two periods.

Sourced from Walmart’s 2019 Annual Report

- Debt Outstanding: In order to find the weighted average which takes place on the first summary page, each source of capital needs to be weighted by its use in the capital structure. For debt using the historic approach, this means that we have to multiply the cost of debt by Walmart’s debt outstanding at the latest reporting period divided by the total capital in the business.

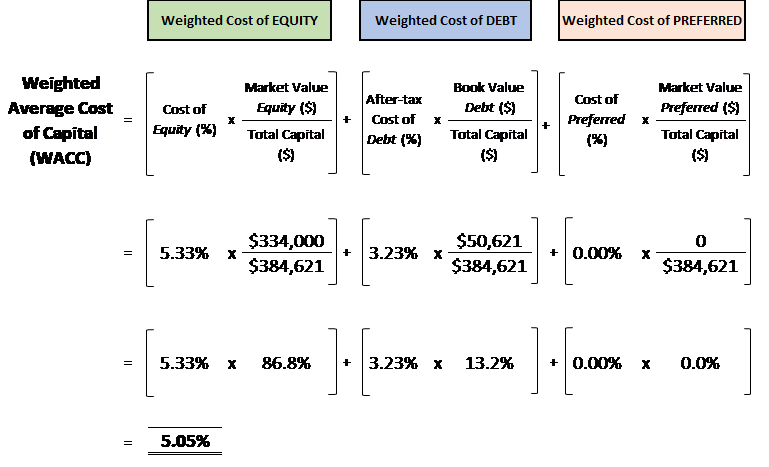

Weighing It All Together

Now that both the cost of equity and debt have been calculated, we can put them together in a weighted average. As can be seen below, the market capitalization and total debt outstanding form the numerator in each respective capital weighting and the sum of them together forms the denominator. As Walmart is a trusted consumer staple company, its WACC would reasonably be expected to be on the low side of things and, as calculated at 5.05%, that expectation would appear correct.

Related posts:

- Weighted Average Cost of Capital Guide (+WACC Calculator Excel Download) The weighted average cost of capital (WACC) is a cornerstone of any discounted cash flow valuation and a fundamental learning for every investor’s toolbox. This...

- Average Discount Rate for the Top Companies in the S&P 500 Setting a reasonable discount rate is critical to getting a reasonable valuation. Like with history, I believe that getting context on averages, in this case...

- The 3 Inputs for the Cost of Equity Formula Updated 12/19/2023 The value of any financial asset is the present value of its future cash flows discounted to the present. That is the basis...

- Required Rate of Return: A Guide to Determine Discount Rate for a DCF Great investors from Warren Buffett, Charlie Munger, Mohnish Pabrai, and Peter Lynch all have different required rates of return they demand before investing. Using these...