Turnover of investment holdings is a natural occurrence in any portfolio that triggers realized capital gains and taxes, which can eat into a portfolio’s return. The larger the profits from the investment, the larger the capital gains tax that needs to be paid.

The turnover rate is of particular importance when considering a relative value investing approach where similar assets are constantly being compared and substituted for whichever is cheaper.

By considering capital gains taxes and EVALUATING THE NEXT INVESTMENT IN TERMS OF AFTER-TAX DOLLARS that are available, investors will be reducing the turnover rate of the portfolio by creating a higher threshold to sell one investment for the next and in doing so, minimizing taxes. Imagine Warren Buffett’s case with Coke where the share price has increased around 1,750% since Berkshire’s initial investment. The capital gains tax implications would be huge when considering relative value between investment alternatives.

As the famous quote from Benjamin Franklin goes,

“Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes”

While investors cannot avoid paying taxes, we can certainly try to delay paying them. This article is a follow-up to our Should I Lock in Profits or Let My Stock Ride? – 3 Important Considerations. Here we will go into more details on one of those considerations which is capital gains tax implications.

The below Excel file can be used to aid investors in their analysis of at what valuation would they would be indifferent between selling their shares for a new investment or continuing to hold on to the current investment. For our readers in both the United States and Canada, we have included two separate tabs to take into account the tax difference on capital gains from each country.

Quick Intro to “Marginal” Tax Rates

When we talk about having to pay tax on capital gains, the tax rate that investors should apply is the tax rate that will be charged on the next dollar of income. This is called the “marginal” tax rate. Unlike the effective-tax rate which is essentially the average tax rate, the marginal tax rate is the known by looking at the most upper tax bracket the investors falls into and the rate at which the investors’ next dollar of income will be taxed at.

U.S. Investors

For U.S. investors, capital gains are taxed by both the federal and state governments. State tax rates can obviously vary, but federal tax rates will be taxed at either 0%, 15% or 20% depending on your income level. Most states tax capital gains at the same rate they do for regular income, but some investors may be fortunate enough to live in a state with no taxes on capital gains. For the version of our indifference calculator for relative value investing taking into account capital gains tax, we will use an imaginary investor in New York state, but of course readers can punch in their own state’s marginal tax rate for their level of income.

Short-term vs. Long-term: The U.S. tax code distinguishes capital gains on investments between short-term and long-term determined according to if the investment was help for less than or more than one year. Short-term capital gains are taxed at much higher rates as if they were business income. While this might seem unfair, think about all those day traders out there who do literally make “trading” their full-time job. In regards to capital losses, both short and long-term capital losses are treated the same and can be used to offset future capital gains on long-term investments.

Canadian Investors

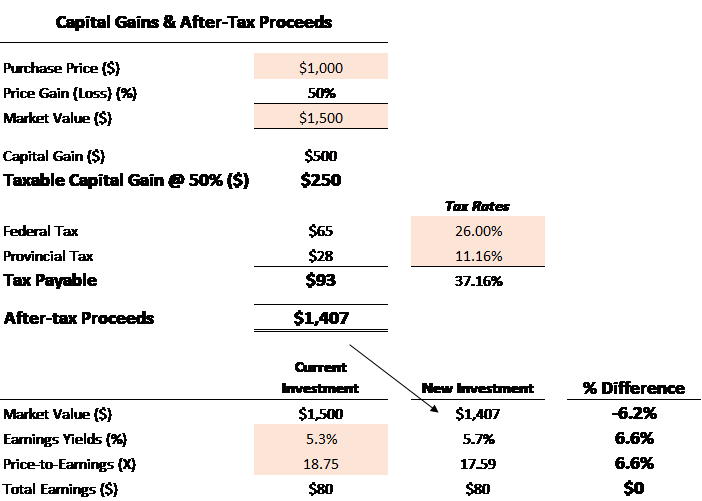

For Canadian investors, only 50% of capital gains are taxable at the investor’s tax rate by both federal and provincial governments. This means that if one has capital gains of $1,000, only 50% or $500 will be taxable at the investors’ tax rate. Federal tax in Canada currently varies between 15% and 33%. For the version of our indifference calculator, we will use an imaginary investor in the province of Ontario, but of course readers can punch in their own province’s marginal tax rate for their level of income.

Capital Gains vs. Active Trading: While the Canadian tax code does not differentiate between short and long-term capital gains like the U.S. does, Canadian investors still need to be sure not to trade too actively in their accounts (even including registered accounts such as tax-deferred RRSPs and tax-expempt TFSAs) as the taxman could deem this be a business activity which then makes capital gains taxable at the investors personal marginal tax rate. While the determinants of what constitutes active trading are a grey area compared to the U.S. system or short and long-term, it is said the Canadian taxman considers the frequency of transactions, the duration of the holdings, the intention to acquire the securities for resale at a profit, the nature and quantity of the securities, and the time spent on the activity.

Example with the Indifference Calculator

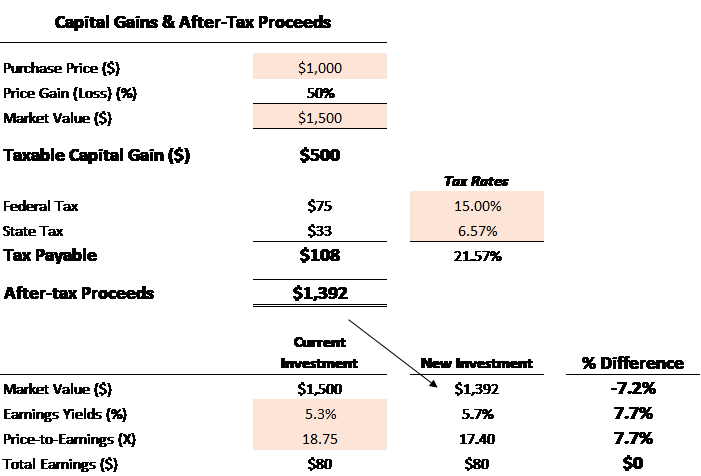

As example, let’s imagine an investment that was originally purchased at an 8% earnings yield (12.5x P/E). After two years, the investment has now increased 50% to trade at a 5.3% earnings yield (18.8x P/E) and at a price that the investor calculates to be the company’s intrinsic value. The investor in our scenario earns a regular salary of $USD 100,000 for the rough equivalent of $CAD 130,000. Lets go through the steps to use the attached capital gains calculator to determine the point of indifference. The areas where the inputs can be updated in the calculator are highlighted in red. With this, we will be able to solve for what valuation is needed to keep total earnings from the investment the same given the after-tax proceeds that can be invested.

- First, the investor wants to determine their capital gains which is the current market value of the investment less the cost base of the investment (cost includes not only the purchase price but also commission which can be meaningful for some retail investors).

- Next, we want to be sure that we are using the appropriate marginal tax rates for the place of residence and income level. As tax rates are constantly changing, be sure to use up-to-date and reliable sources.

- Lastly, we need to add in valuation metrics of the current investment that is held.

Implications for the U.S. Investor

For the New York investor facing a 21.6% combined federal and state tax rate, there would be $108 tax payable on the $500 capital gain. This means that $1,392 will be able to be invested in a new stock. In order to keep the dollar amount of earnings the same, the new investment would need to trade at a valuation that is around 7.7% cheaper which in this case would be an earnings yield that is a least 5.7% for a P/E ratio of 17.4x.

Implications for the Canadian Investor

While the Canadian living in Ontario does face a higher combined tax rate of 37.2%, only 50% (or $250) of the capital gain is taxable which really means the tax rate on capital gains will be 18.6%. This means that $1,407 will be able to be invested in a new stock. In order to keep the dollar amount of earnings the same, the new investment would need to trade at a valuation that is around 6.6% cheaper which in this case would be an earnings yield that is a least 5.7% for a P/E ratio of 17.6x.

Take Away

With investing, there is always a certain turnover rate of the holdings and unfortunately, this can trigger capital gains tax if held outside of a registered account. The bigger the taxable capital gains as a percent of the investment and the higher the tax rates, the bigger the point of indifference will be. Investors should always remember Warren Buffett’s case with Coke where the share price has increased around 1,750% since Berkshire’s initial investment. This would make taxes a huge consideration in the decision to continue to let the stock ride!

Related posts:

- Should I Lock in Profits or Let My Stock Ride? – 3 Important Considerations Investors fortunate enough to see the share price of an investment increase up to their calculated intrinsic value are then faced with the hard dilemma...

- Lump Sum Calculator: Investing Now vs Later (with Dollar Cost Averaging) If there’s one thing that I really have picked up on in my investing journey and I try to preach to you all is that...

- Dividend Reinvestment Calculator to Plan Your Expected Returns (Excel) One of the most powerful forces behind building wealth in the stock market comes from the compounding effects of reinvested dividends. As investors, it’s important...

- How to Find the ADR Dividend Tax Policy of a Company in Minutes An ADR, or American Depositary Receipt, is a simple type of share that allows U.S. investors to invest in companies headquartered outside the U.S. But...