Updated 5/29/2023

Most valuation models begin with earnings to arrive at the cash flows, and when using this method, we assume that the earnings stem from expenses related to operations. But in today’s age of intangibles, those assets creating revenues are different. We must examine Items like research and development (R&D) and treat them differently. Capitalizing the R&D is a better way to treat those expenses.

When we look at the company’s operations, capital expenditures such as buying a building have those costs spread over years as their impact is felt over a longer period. The same idea applies to R&D; for example, consider Facebook investing billions in R&D on augmented reality.

The company likely won’t see returns on those R&D expenses for years of those investments, but they are capital expenditures for Facebook, and we should treat them the same.

The accounting rules have not adapted over the years as intangibles have evolved to become larger portions of the asset pie.

Think about companies such as Microsoft, Amazon, Google, Facebook, and Apple. They all have large intangibles and spend billions on R&D. It is better to treat them as capital expenditures for valuation as these can significantly impact operating income, capital, and growth expectations.

In today’s post, we will learn:

Should R&D Be Capitalized or Expenses?

Before diving into how to capitalize on R&D, let’s consider why we should make this adjustment. First, we need to realize this is not a part of GAAP accounting rules; instead, it is a method of adjusting numbers to fit a company’s financials better and valuing that company.

Adjusting the R&D expenses to capital expenditures will significantly impact the company’s capital structure, but it will not affect the cash flows. I will say that again, it will not affect the company’s cash flows. We will come back to that again in a few minutes.

GAAP accounting classifies all expenses into three categories:

- Operating expenses

- Financing expenses

- Capital expenses

Let’s learn a bit more about each item:

- Operating expenses – The operating expenses create a benefit in the current period, for example, the cost of labor and materials used to create and sell products in the current period.

- Financing expenses – These are expenses stemming from raising non-equity capital for the business, such as interest expenses.

- Capital expenses – These expenses include buying buildings and land, and the expectation is they will last for years.

The process to arrive at net income or earnings is to subtract the operating expenses from the revenues; next, the financing expenses subtract from the operating earnings to arrive at net income or equity earnings. We then write off the capital expenses over their useful life as depreciation and amortization.

The tax treatment of operating and finance expenses is insignificant as both are tax-deductible. But the tax treatment of operating and capital expenses is a bigger deal.

Accountants write off operating expenses during the expensed period and capital expenses during their useful life over many periods.

Remember that operating expenses don’t create assets and impact capital only through retained earnings. Capital expenses, however, create assets and affect capital directly.

As we mentioned in the intro, with the rise of intangible assets such as goodwill, brands, and other intangibles, the assets that drive Apple’s growth are far different from General Motors. True, there is an aspect of tech now in the automotive industry, but in large part, Apple’s growth comes from the brainpower of its developers, not the equipment it buys.

Treating the R&D as an expense makes sense for General Motors because the equipment needed to make the cars is expensive, and capitalizing those expenses makes sense.

But, treating the R&D for Apple as an expense makes little sense when the benefit from the expenditure is likely to happen years from now. And the expense’s accounting treatment doesn’t align with Apple’s benefit.

Is R&D Considered Capex?

GAAP accounting rules consider capital expenditures as expenses create benefits over multiple periods. According to this definition, land, property, and equipment are capital investments.

But so is research and development.

In fact, we could argue research and development expenses are more of a long-term investment than a physical plant in many companies, such as AMD. Many in the tech and pharmaceutical industries spend billions on R&D and don’t see the benefits for years.

Therefore, it makes sense for these companies to treat these expenses as capital expenditures.

Despite the logic, GAAP accounting rules still consider R&D as operating expenses.

Before 1975, companies were allowed by accounting rules to capitalize on research and development expenses. But the rule changed with accounting rule SFAS 2, which requires expensing all R&D expenses in the current period.

The justification for the rule is the belief the benefits from R&D are uncertain and only arise from creating a commercial product, such as Google’s Gmail. Another argument is R&D-created assets don’t allow borrowing against the asset.

Accounting rules outside of the US allow for capitalizing R&D. According to IAS 9, development costs, including all costs to turn research into a commercial product, are amortizable.

The immediate impact of expensing R&D lowers the company’s net income and operating income. But treating R&D as an expense implies that R&D expenditures will never create an asset. Everyone would agree the iPhone is an asset for Apple, highlighting the issue with the rule.

We can all agree that R&D expenses help generate future growth and should treat them as capital expenditures.

How to Capitalize R&D Expenses

Moving research and development from an operating expense to a capital expense is not complicated, but we must walk through the process.

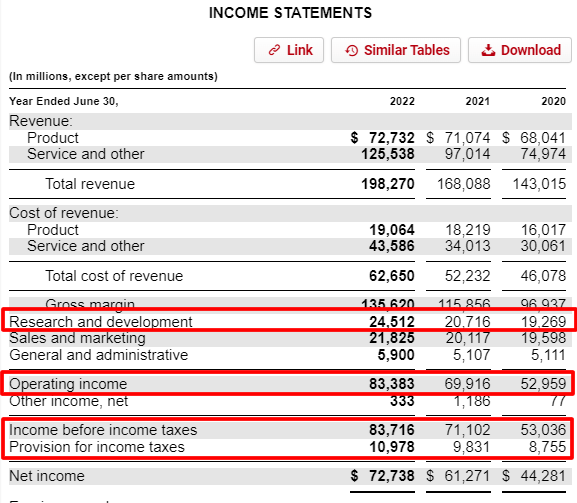

For our example of how to change R&D expenses to capital expenditure, we will use Microsoft. The data we will use will come from its latest 10-k, dated July 28, 2022, and all numbers will be listed in millions unless otherwise stated.

The first step in our reclassification is to remove R&D expenses from operating expenses and show them as a capital expenditures. When we remove the R&D expenses, it adjusts the operating income and the creation of an asset.

The after-tax R&D expense will be accumulated over time to create an asset referred to as a research asset. Remember that none of this is GAAP accounting and will not add to the balance sheet. Instead, we do all of this to get a truer valuation of Microsoft. And, like other assets, we will amortize the asset’s value (R&D) over its useful life. We will use straight-line amortization to make the process simpler.

When we treat R&D as a capital expenditure, we must remain consistent and treat accumulated R&D as an asset, similar to the treatment of depreciation of a building, the same concept.

The easiest way is to increase the R&D expenses over time and create a new research asset. We will amortize the asset in straight-line amortization, with the industry’s amortization length and schedule.

For example, if we were adjusting the pharmaceutical R&D expenses, the FDA has a longer period before approval. Therefore, we would have to amortize that research asset over a longer period, say ten years. And for Microsoft, the payoff for the research is quicker, three years.

If the amortization of the R&D is only one year, there is no benefit to changing it from an expense to an item of capital expenditure.

Okay, let’s examine how this impacts the operating and net income.

Conventional R&D Treatment | R&D as CapEx |

Revenues | Revenues |

|

|

|

|

= Operating income | = Operating income |

|

|

= Operating income after taxes | = Operating income after taxes |

How much the amortization of R&D impacts the operating income will depend on the level of R&D for the company. Higher R&D expenses tend to grow for a high-growth company, and the reclassification will increase operating income. And likewise, for more mature companies, as the growth slows, the growth of R&D will slow, and operating incomes will decline.

Okay, let’s start with Microsoft and walk through the process of reclassifying the R&D expenses to capital expenditures. We will need to gather some numbers from the 10-k to calculate the change and see its impacts in numbers.

From the income statement, we will need the following:

Operating income | $83,383 |

Provision for taxes | $10,978 |

Net income | $72,738 |

R&D expenses | $24,512 |

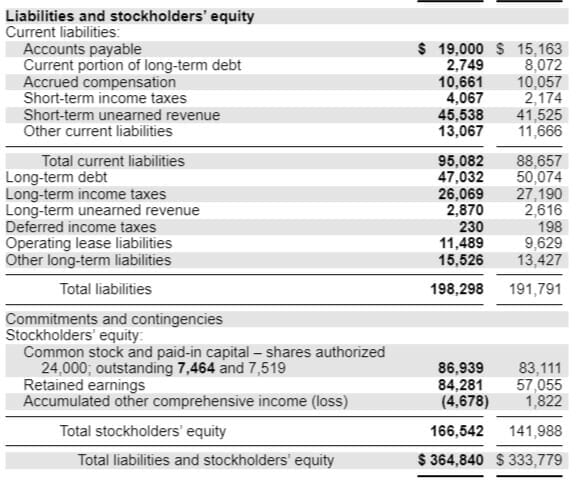

Next, we will get the numbers from the balance sheet:

Current portion long-term debt | $2,749 |

Long-term debt | $47,032 |

Shareholders’ equity | $166,542 |

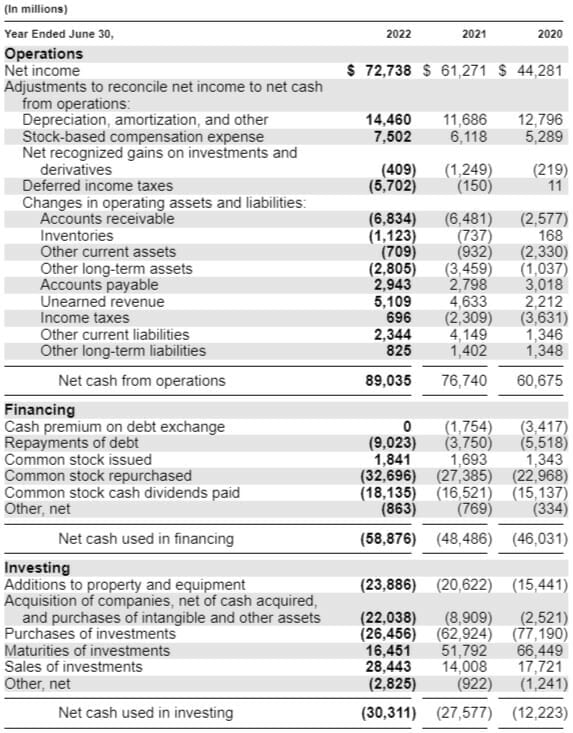

And finally, from the cash flow statement:

Depreciation | $14,460 |

PP&E | $23,886 |

Acquisitions | $22,038 |

We will also need the last three years of R&D expenses, of which two we can get from the above 10-k; for the third year, we will need to pull from the 2019 10-k, and here are the following numbers.

Year | R&D expenses |

-1 (2021) | $20,176 |

-2 (2020) | $19,269 |

-3 (2019) | $16,876 |

Now that we have all of our numbers, we need to decide how long we will amortize the R&D expenses for Microsoft. According to Professor Aswath Damodaran, who has a table set up for this purpose, Microsoft should amortize over three years.

If the company had a longer amortization period, we would use a longer ten-year period. If that were the case, we would need more data for our amortization table. The data must match the time to amortize the R&D expenses.

Next, I will set up a table showing how we will amortize the R&D expenses over the three years.

Year | R&D Expenses | Unamortized Portion | Amortization this year | |

Current | 24512 | 1.0 | 24512 | 0.00 |

-1 | 20716 | 0.67 | 13810.67 | 6905.33 |

-2 | 19269 | 0.33 | 6423 | 6423 |

-3 | 16876 | 0.00 | 0.00 | 5625.33 |

Value of Research Asset | 44,754.67 | 18,953.67 |

The table above shows in straight-line amortization how we would amortize the R&D expenses each year for Microsoft. But what do we do with this information?

We are going to compare the current R&D to the amortized amount.

- Expenditure on assets in the current year = $24,512

- Amortization of asset for current year = $18,953.67

As we can see from above, the amortization amount is smaller. Adding the difference between the current R&D and amortized R&D to our operating income affects both the EBIT and the NOPAT for ROC or ROIC calculations.

The chart below will pull together all the numbers we pulled from the above financials; I used those financials as an example of where to find the data.

The book value below will combine the current long-term debt, long-term debt, and shareholders’ equity.

- + Current portion of long-term debt = $2,749

- + Long-term debt = $47,032

- + Shareholders’ equity = $166,542

- Total book value = $216,323

We will also see the capex increase by adding the current R&D and depreciation and amortization increase by the amortized R&D.

We can see that there are some changes from the amortization of the R&D. First, we need to talk about the operating income; it adjusts upward from the difference of current R&D and amortized R&D:

R&D Difference = 83,383 + 24,512 – 18,954 = 88,941

The same rules will apply to both NOPAT and net income, but both line items include the impact of taxes, which for Microsoft is 13.1%, so that NOPAT would be:

NOPAT = EBIT(1-t) = 83,383(1-13.1%) = $72,459

But the biggest impact of the adjustment of R&D classifications is on the reinvestment for the company. By adjusting NOPAT by the difference of two R&D (current and amortized) and then adding the accumulated amortization to the capital of Microsoft, we lower the return on capital ratio.

That lowering of return on capital impacts the reinvestment rate of Microsoft because that ratio indicates how efficiently the company can reinvest its assets to generate more cash flows and revenues. A lower ROC or ROIC, if we subtract the cash from the capital, drives lower revenues and cash flows for Microsoft, making it less valuable now and into the future.

For example, below are two charts showing a DCF (discounted cash flow) for Microsoft with some base assumptions, but by capitalizing on the R&D, we can see a lower value.

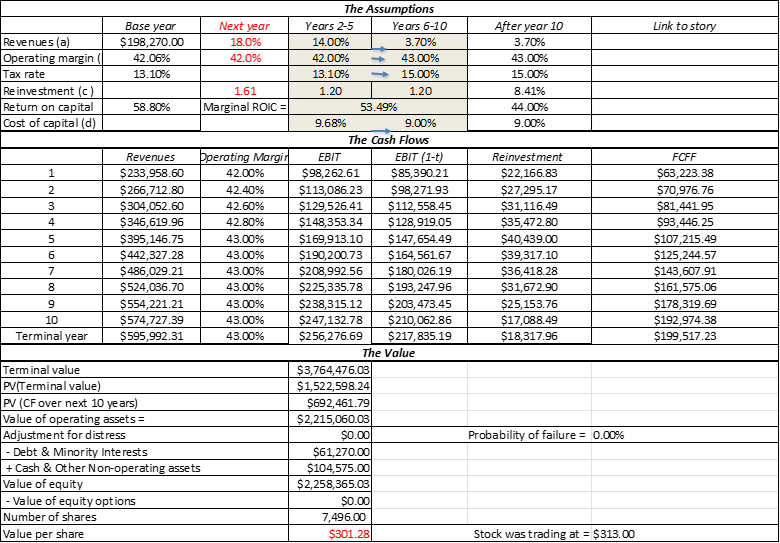

First is the value with R&D as an expense:

The per-share value is $301.28, compared to the current market value of $331.

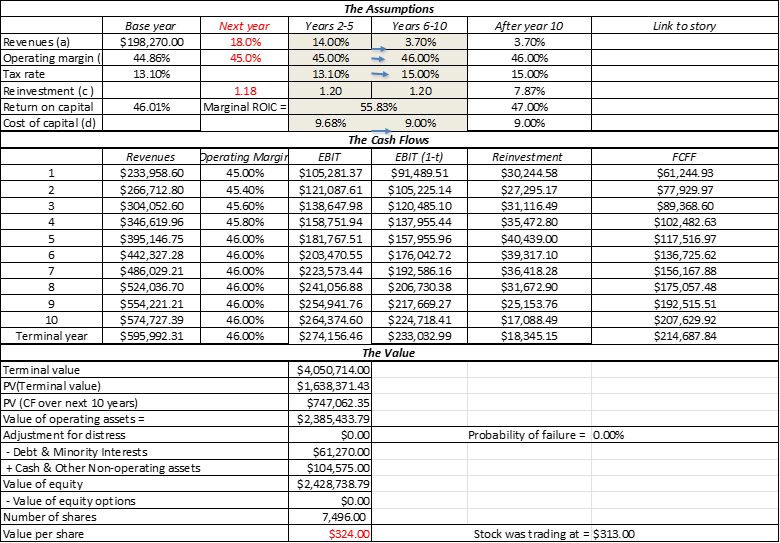

Next is the same chart with the R&D expenses amortized over three years:

And the above valuation came in a little higher, as the impact of lower ROC shows up. The valuation with the R&D amortized is $324, which is lower than the current market price.

From the above valuation, we can see amortizing R&D impacts the value, driving it lower. The result makes sense because the increase in capital levels with the addition of amortized assets offset the increases in NOPAT. All of which flow to lower cash flows from less efficient reinvestment.

I will include Professor Damodaran’s spreadsheet for download, which you can use to calculate your amortization of R&D expenses. He includes it on his site too, which is a great resource. I take no credit for the spreadsheet; I only include it to make your life easier.

Again, reclassifying R&D expenses does not impact the cash flows before reinvestment. The following chart helps outline this idea:

Normal R&D | Capitalized R&D |

EBIT (1-t) | EBIT (1-t) |

+ depreciation | + R&D Expenses |

|

|

| = Adjusted After-tax Operating income |

= Free Cash Flow to the Firm | + R&D Amortization |

+ depreciation | |

| |

| |

| |

= Free Cash Flow to the Firm |

As we can see from above, the free cash flows don’t change, but again it impacts the reinvestments to generate those cash flows. It leads to a truer number, as R&D is a capital expense for a company like Microsoft.

Investor Takeaway

A key determinant of cash flow is a company’s ability to allocate capital to investments that create value. As we have seen, the current GAAP accounting rules do a poor job of splitting investments and expenses.

In today’s world of tech superpowers, the rules have changed in how we value companies and how we treat the capital investments of these companies. Even though the accounting rules have changed, it doesn’t mean we can make some adjustments to reflect the economic reality of these companies.

Capitalizing R&D expenses is not difficult as long as we follow the process and consistently adjust. It allows us to get a truer number for the current valuations of various companies ranging from tech to pharmaceuticals.

As the world has moved from tangible to intangible assets, accounting rules have not changed, but we can adjust R&D to match the economics of the companies, giving us the ability to value a company on its real economics.

And with that, we will wrap up our discussion on capitalizing R&D.

I appreciate you taking the time to read this post, and I hope it helps you in your investing journey. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Depreciation and Amortization – A Complete Financial Statements Guide Updated 8/7/2023 Buying businesses and equipment for operations is a part of business, and using depreciation and amortization is how companies account for those purchases....

- How Amortization of Intangible Assets Works; When it Unleashes Higher ROIC The amortization of intangible assets can sometimes be hidden in the consolidated financial statements because amortization is grouped in with depreciation. But as the economy...

- Simple Income Statement Structure Breakdown (by Each Component) Updated 8/7/2023 The income statement is the first of the big three financial documents that all public companies must file. But what do we know...

- Operating Leverage Formula: How to Calculate It with the Income Statement Updated 9/3/2023 “For a fundamental investor, anticipating revisions in expectations is the key to generating attractive returns. Sources of those revisions include fundamental outcomes (typically...