Need money now? Cashing out a 401K is an option, but not the first option you should consider when liquidating assets.

All of us, at one point in time, have gone through a rough patch. Whether that be a mental, financial, or physical issue, we have all gone through something.

What I want to focus on today is a financial rough patch that may have you considering cashing out a 401K. Maybe you have a big expense that popped up like a medical bill, funeral, or even a wedding. Maybe you recently lost your job where you were a high earner and you know you are going to take a pay cut in your next venture.

It doesn’t matter the situation on why you need money, but if cashing out a 401K retirement plan is an alternative you are considering, you need to know all the consequences that come with that. You certainly aren’t the first person to evaluate such an option, and you wouldn’t be the last one to ever execute it either.

On one side of the coin, a retirement account is meant exactly for that. Retirement. If at all possible, you want to do everything in your power to not touch the account and let it grow as long as possible so you can live comfortably after working.

However, there is another side to all stories as well. It’s tough to justify going without and struggling to make ends meet if there is money available to you during a difficult time. The key to the situation is understanding the risks to both sides of cashing out a 401K before the retirement age of 59 and a half years old.

Keep reading to see if an early cash-out makes sense or is worth the downside to you.

- Evaluating Options

- Downside of Early Withdrawal

- Cash Out Strategy (If Necessary)

- Summary

Evaluating Options:

First things first when it comes to cashing out a 401K retirement account. You must evaluate every single option that you have before pursuing it. I’m not talking about finding $100 in a suit jacket, I’m talking about evaluating every single asset you own.

Can you downgrade your car and come up with some money? Does it make sense to sell your house and recoup some cash? Do you have a family member or friend who can loan you money, even if it’s at a higher interest rate? Lastly, can you consider a home equity line of credit?

If you own a home, you can likely get a home equity line of credit at an interest rate of three percent or less. Typically, that will give you a five-year payback plan. You are also only required to pay the interest on the loan (keep in mind it all has to be paid back at some point), so you can pay back less in the beginning and then make bigger payments down the road once your situation passes.

Again, I’m not saying it will never make sense to cash out a 401K account, but it is one of the last options you want to fall to. There is a lot of downside to the strategy, but it can be the best option for some.

When I first met my wife, she made more than enough money but wasn’t great at tracking her finances. She had been taken advantage of when filing her taxes previously. Long story short, the lady filed her as a W2, and she was a 1099 employee. This was a total mess, but she was given a tax return, and technically owed the government a good chunk of money.

This happened two years in a row and then all of a sudden, she gets a letter from the IRS that her wages are about to be garnished. At the time, they were going to take 25 percent. As you can imagine, she didn’t save 25 percent of her check each week, and this was going to be a major issue.

She didn’t have any assets, so the best option was cashing out a 401K to make ends meet. She was able to avoid the early penalty (which I’ll cover later), and basically only lost 20 percent in taxes.

The money she lost could have been earning interest for years which could have made her a fortune, but she needed the money to pay her bills and survive. This was a scenario where cashing in a 401K was the best option available.

I understand none of these options provided are picture-perfect, but they are all worth considering before diluting what you have built for your future. Not everyone has a ton of options, but it’s important to run through every possible scenario.

The Downside of Early Withdrawal:

As I mentioned above, cashing out a 401K is the last resort option, but certainly, an option if needed. Please keep in mind, you can get cash reasonably quickly, but it will typically take at least five business days for you to get your money. That typically isn’t a deal-breaker, but it isn’t an instant withdrawal of cash.

The biggest downside of cashing out a 401K is the taxes that are withheld. Typically (not always), the IRS will require you to set aside 20 percent right off the bat if you are below retirement age. That means if you want to take out $5,000 to pay a bill, you truly will only be getting $4,000 of cash.

You will have the ability to recoup some of this money when you file your taxes, but for the purposes of instant liquidity, there is some downside. The IRS typically doesn’t make a ton of mistakes, so the 20 percent number should be assumed accurate.

On top of the taxes, there is also an early withdrawal penalty that you will need to pay. When cashing out a 401K before the age of 59 and a half, the IRS will typically assess a 10 percent penalty when you file your tax return for that year.

The good news is, you won’t be penalized on the initial withdrawal, but you will be required to pay the penalty later. That $5,000 withdrawal is now only $3,500 in value after taxes and penalties.

As you can see, these two items can eat up 30 percent of your cash out, which is a huge chunk. But perhaps the biggest downside of cashing out a 401K before retirement is the lost return you will miss out on.

So not only are you missing out on the money you set aside because of taxes and fees, you are missing out on the returns of the money, which is as close to free money as you can get.

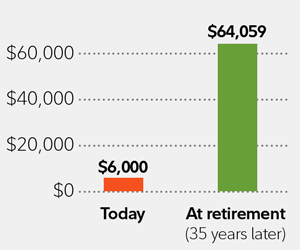

Let’s say at age 29 and a half you take out $10,000 from your 401K because of a major medical bill that was unexpected. You’ve tried everything but unfortunately, you don’t have the cash to pay it so as a last resort, you make an early withdrawal from your 401K.

Right off the bat, you will likely lose $3,000 for taxes and penalties. Then after that, if you assume 30 years of compounding interest at a five percent return, that $10,000 could have turned into over $41,000 if left alone. That means you are losing out on over $30,000 by not letting the money do the work for you. That could be a new car at retirement if you wanted, that is now gone.

I’ll say it once more, you can absolutely use the strategy of cashing out a 401K for cash if needed, but please make sure you understand all the risks before doing so. It’s often easy to rob your future to live a lifestyle now that you may not have earned.

Cash Out Strategy:

However, if you do conclude that cashing out a 401K is the best option for you, there are a few strategies you should try to save yourself as much as possible. Even a financial decision that may not make the most sense, has options to make it better.

The first item to check is to see if you qualify for an exception to the 10 percent early withdrawal penalty. At times, the IRS will waive this if certain situations apply to you.

One situation is you agree to receive equal payments before retirement. This means if you stop working and take the money in equal chunks before hitting 59 and a half (retirement age), you can avoid the 10 percent tax. This one has a lot of finicky rules, so you’ll want to consult a financial advisor first.

Another situation where you can avoid the 10 percent penalty is if you leave your job when you are age 55 or older. There are also certain jobs where you may qualify if you leave your job at age 50 or older like federal law enforcement, firefighters, etc.

Cashing out a 401K because of a divorce is another scenario that will allow you to avoid the penalty. If you are forced to cash it out in order to pay an ex, there is a good chance it will be tax-free.

A disability, giving birth or adoption, a victim of a disaster, overcontribution to an auto-enrolled 401K, or military personnel called to active duty could all find themselves avoiding a penalty on early withdrawal of their funds.

Again, many of these options aren’t completely cut and dry, and you will want to work with a financial advisor to make sure you truly qualify for an exception before moving any money around.

There is also a scenario of cashing out a 401K and avoiding the penalty if you qualify for a hardship withdrawal. This is typically something your employer would have to approve before processing, but if you are able to prove you need the money for certain situations, you can sometimes avoid the 10 percent penalty.

Hardship Withdrawal Items include:

- Funeral expenses

- Money to buy a house (cannot be mortgage payments) or repair your existing home

- College tuition or other expenses for you or a dependent

Typically, on a hardship withdrawal, you can only take the principal amount, meaning you can’t touch the gains from the account. There may also be a scenario where you can’t touch employer-contributed money in the account. As with the exception rules above, a hardship withdrawal is also very grey. You’ll want to make sure that you work with a financial advisor and your company for the correct approval.

Another big thing to consider when cashing out a 401K fund is to make sure you take out the absolute least amount possible. Remember, we have covered all the reasons of why you don’t want to take anything extra. Withdrawing money from a 401K is an absolute last resort that should be used for emergencies only.

Taking out additional money for a nice dinner, new clothes or anything material is just plain silly. Please don’t fall victim as you have seen the penalties that you will pay on this money. Not only are you paying up to 30 percent in taxes and penalties, but you are also losing the growth of that money over a number of years, which can be huge. Remember, once you take it out, you can’t put it back in.

I doubt this is the case for many folks reading, but I do at least want to cover it. What if you leave a job that offers a 401K retirement plan? Don’t worry, you don’t just have to cash that out if you leave the company, you are able to roll it into an IRA that you create on your own or with a financial advisor and there is no cost.

I left a job about two years ago that had a pension, and two 401K accounts. I was able to work with my financial advisor and company to roll both with a few phone calls, and it didn’t cost me anything. Now, my old company is no longer contributing, but the new account is still invested in funds and has the potential to continue growing.

Summary:

Everyone’s life is full of different situations. I’ve stated a lot of facts on why cashing out a 401K should be the last alternative in a situation where you are in need of cash, but I also don’t know every reader’s full story.

Evaluate your options, calculate your risks, and do what’s best for you. Remember, I’ve taken from my 401K in my past because it was necessary. Don’t forget to use the tips above to lessen the burden if at all possible as well.

Related posts:

- Sure I Save Taxes, but is the 401k Worth It? Updated 3/28/2024 The 401k is one of the most popular tools for investing for retirement because so many employers offer it. But, believe it or...

- There are Several 401k Alternatives Available to You Are you stressed about your company not offering a 401K retirement plan? Don’t worry, there are tons of 401k alternatives for you to choose from....

- Make Sure You Find Companies with the Best 401K Match and Benefits Before Accepting a New Job When looking for a new job, it isn’t just about salary anymore. Companies with the best 401K match can be equally attractive as a strong...

- The Key to Using the Rule of 25 to Plan Your Retirement Properly As a young teenager, all you can think about is moving out of your parent’s house. Then as you hit your early twenties, it turns...