There is a time and a place for a Certificate of Deposit (CD) and there is a time and a place for a high-yield savings account. In all actuality, the two are very similar but they do have some distinct differences that can drastically impact which is most beneficial for you.

I personally view a CD as being riskier. Not because the actual investment is risky, but because when you signup for a CD, you’re usually committing to lend out your money for a certain amount of time and given a fairly high interest rate that is usually higher than a savings account.

The pro is that you gain more interest, the con is that you have to commit to not having that money for a certain amount of time. In all actuality, the con isn’t a con at all, until you need that money for some unforeseen circumstance.

On the other hand, a high-yield savings account has no time restriction and in turn has a lower interest rate (and the interest is able to change/variable), usually. So, it really boils down to this:

Do you place more value on the higher APR or the liquidity of your cash?

Any normal person would say, “sign me up for that CD, and the higher APR, so I can STACK THAT CA$H,” right? First off, I’m not sure why I said that, because I don’t talk like that lol. Second, again, this sounds right in theory, until you need that money for something.

So, let’s run across a few situations and think about where to put that money…

- Emergency Fund

- High-Yield Savings Account. This is the easiest one of them all. It’s literally called an EMERGENCY fund. Don’t be the person that is like, “I can’t use my emergency fund for another three months because it’s tied up in a CD, so I could earn that extra .1%”

- Housing Down Payment

- Depends! Are you buying a home in a certain time period or are you actively looking right now? If you’re ready to pull the trigger whenever that house comes about, go the High-Yield Savings Account path. If you know you won’t buy a house for a few years but want to save, then put it in a CD. If you think you won’t buy for 8+ years, put the money into the market. 8-10 years should give you enough time to invest safely to maximize returns but be smart with the market trend. In this case, it’s better to pull out early than it is too late and not be able to afford your house.

- Saving for a vacation that’s 1+ years away

- CD. Easy. Put the money into a CD for a 12-month term to maximize the gains. This is, assuming, that there is essentially no case that you can imagine where you will be forced to take this money out. This is an extremely important thing to remember.

So, a CD can get you a higher APR, but it is a little riskier. But, how much more money can we actually get?

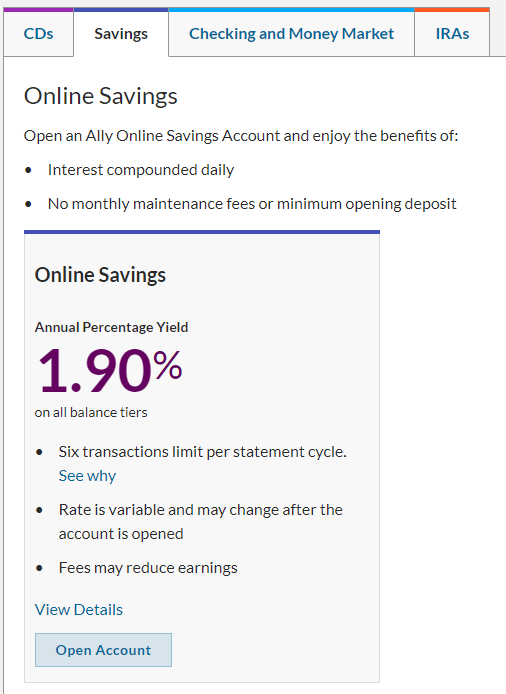

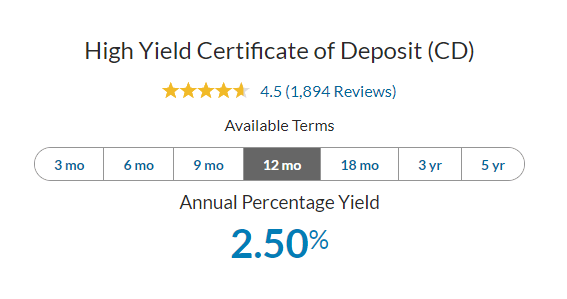

Well, let’s take a look at the current offering from Ally Bank. You can look at the rates for yourself at https://www.ally.com/bank/view-rates/ but I’ll show them to you as well.

As you can see below, the APR for a High-Yield Savings Account is currently 1.9% while a 12-month CD is 2.5%.

Is this some astronomical difference? No, not really. But, if you’re wanting to put 20% down on a $300,000 house in two years, you would need $60,000 to do so. So, let’s take a look at the difference between a CD and the High-Yield Savings Account:

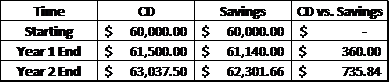

You’ll notice that your interest was the $1,500 in Year 1 and $1,537.50 in Year 2 for the CD while it was $1,140 in Year 1 and $1,161.66 in Year 2 for the High-Yield Savings Account… that, is compound interest my friends. While I’ve talked about that a ton in my recent posts… just know that it is allowing you to essentially earn interest on your previously earned interest from Year 1 with either method.

You’ll also notice that the CD provides a significant advantage over the High-Yield Savings Account…in the amount of $735 and change for two years of saving $60,000. I know that’s not much on a percentage basis, but it’s a way to maximize your interest for doing no extra work at all.

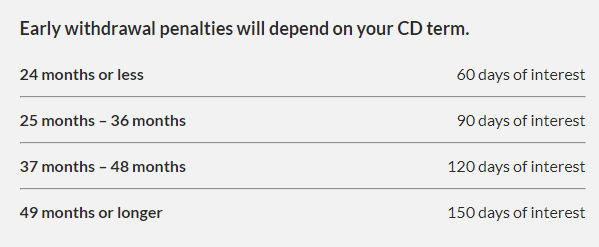

The key, again, is to avoid the potential for having to withdraw early. Ally has fees if you have to withdraw early, and they definitely are not anything to just gloss over:

In summary, the answer for what method you should use to save really just is that it all depends. It depends on your financial status, your goals, your timeframe, your appetite for risk (or lack thereof), and many other things.

If you’re debating which method to use to save for retirement, that is a very easy answer – NEITHER!

Unless, you’re very close to retirement.

Similarly, to my thought process on saving for a housing down-payment where you have 8-10+ years, you should put that money into the market, so it can experience the Compound Annual Growth Rate average since 1950 of 11%.

Yes, I said eleven percent. It wasn’t a typo.

With that being said, High-Yield Savings Accounts and CDs both have their own place, and both are great tools when used properly.

How I’m Applying the CD vs. Savings Dilemma

My Emergency Fund will always be in in a High-Yield Savings Account in case there is truly an emergency. Currently, I’m saving up so that I can pursue my MBA. That money is put into a High-Yield Savings Account because I will have to use it in less than 6-months. If I was over a year away from school, it would 100% go into a 12-month CD.

The moral of the story is that personal finance is personal – it’s not a 1 size fits all approach.

I encourage you to continue to learn about all tools and apply them to your lifestyle to impact your financial goals in the best way that you can.

Related posts:

- The Surprising Disadvantages of a Savings Account (A Secret of the Rich) A lot of people will think that the best place for their money to be is in a savings account, but that’s just not accurate,...

- Regular Savings Accounts are Trash! Say Hello to a High-Yield Account! Have you ever heard some of the horror stories of regular savings accounts? Maybe that was a bit harsh, but there is really nothing in...

- Hey Andy – Does HSA Roll Over My Savings from Year to Year? Recently I was having a conversation with a friend and they told me that they didn’t use an HSA because they didn’t want to lose...

- How to Open an Investment Account for a Child I talk a lot about the power of compound interest and how time in the market is better than timing the market, and I feel...