Updated 3/6/2024

Changes in working capital help explain how a company uses its assets to generate growth. Some companies build inventories, pay down liabilities, or extend their repayments to vendors to growt their cash flows. The better we understand how a company uses its assets and liabilities, the better we can predict changes in value.

Please read the page slowly and take your time as we discuss the topic. Some of the information we will cover can be confusing, but it is important to understand.

Understanding the topic will give you a great insight into the company’s free cash flow, their use of the cash flow, and where it comes from.

In today’s post, we will learn:

- What Changes in Working Capital: A Definition

- Differences Between Working Capital and Changes in Working Capital

- What is Operating Working Capital?

- Breaking Down the “Change” in Working Capital

- How to Calculate Changes in Working Capital

- Real-life examples of Changes in Working Capital

Let’s get started, shall we?

What Are Changes in Working Capital: A Definition

So what are changes in working capital, and what does it mean?

Working capital is not changes in working capital.

The simple definition of working capital is:

Current assets – current liabilities

Unfortunately, this is a little too simple. What we are looking for is the how and why of working capital.

According to Investopedia:

“Working capital is the difference between a company’s current assets, such as cash, accounts receivable (customers’ unpaid bills), and inventories of raw materials and finished goods, and its current liabilities, such as accounts payable.

Working capital measures a company’s liquidity, operational efficiency, and short-term financial health. A company with substantial working capital should have the potential to invest and grow. If a company’s current assets do not exceed its current liabilities, it may have trouble growing or paying back creditors or even bankruptcy.”

That explains working capital and how it helps a company grow nicely and tidily.

However, we need to look beyond the accounting standpoint and understand what the “change” in changes in working capital means.

Beyond a formula or equation defining working capital, the important issue remains what the change part means and how to interpret and use those changes in valuing companies.

Difference between Working Capital and Changes in Working Capital

Remember that:

working capital = current assets – current liabilities.

Working capital is a balance sheet that only gives us value at a certain time.

Changes in working capital are an idea that lives in the cash flow statement.

Companies need working capital to survive and continue their operations; it is a necessary ingredient and remains the real reason for working capital, its raison d’etre.

As a business owner, it makes little sense to constantly look at your balance sheet to determine your current assets minus your current liabilities.

Changes in working capital will help you determine where Microsoft is in its working capital cycle. Companies will try to shorten their working capital cycle by collecting receivables sooner or extending accounts payable.

This cycle is what all companies strive to shorten instead of looking at the balance sheet definition, which defines only one certain point in time.

What is Operating Working Capital?

When discussing working capital, we need to determine the capital needs of operating the business and the business cycle.

All companies strive to shorten their business cycle by collecting their receivables sooner or extending their accounts payable. This ebb and flow of their business cycle gives them more “cash” to operate their company.

When examining working capital needs, we must consider only those that affect operational needs.

We could also refer to this as non-cash working capital because the company’s current assets include cash, which we must exclude. After all, non-cash doesn’t drive Visa.

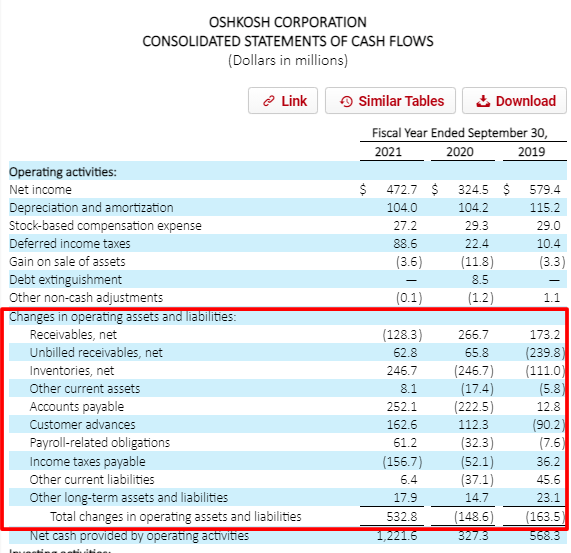

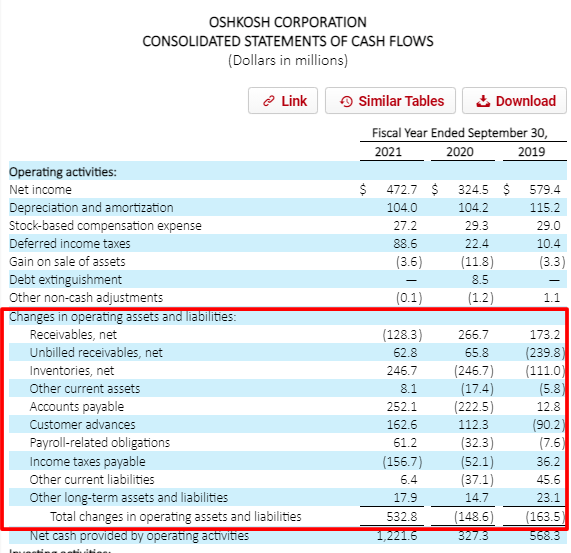

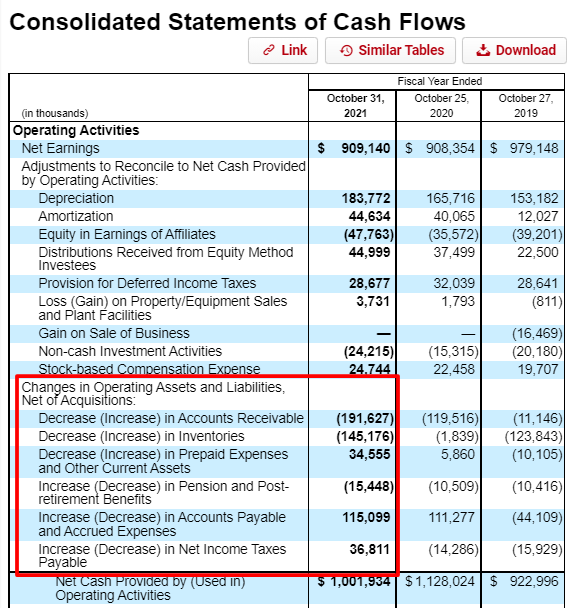

Let’s examine an actual cash flow statement from Oshkosh Corp. as an example of how we break down the changes.

For the remainder of the post, the section we will focus on is the Changes in Operating Assets and Liabilities. The section of the cash flow statement is where the changes in working capital live and breathe.

Breaking the sections down by generalities:

The operating part of the asset side of working capital will include the following:

- Accounts receivable

- Inventories

- Prepaid expenses

- And some uncommon current assets found in the financials

The big point of the working capital section is increasing any of these requires cash, a very important point that we will return to many times.

Current liabilities are the next section, including debt, which is not an operating factor of the business.

Remember that debt is a choice each business will make for financial reasons.

Items that are categorized as operations on the liabilities side of the ledger:

- Accounts payable

- Accrued expenses

- Deferred revenue

- Income taxes payable

- And some uncommon liabilities found in the financials

Increasing any of these liabilities decreases the use of cash, which all companies like.

We referenced the business cycle earlier; stretching accounts payable and collecting our receivables earlier helps increase our cash available for operations.

Breaking down the “Change” in Working Capital

This section can be a little difficult to understand, so please read through it carefully and return to it as often as needed.

Most people assume the change in working capital means you calculate the change from one year to the next via these items from the balance sheet.

The wrong calculation method is to use the working capital from the balance sheet in year one, calculate the working capital in year two, and then subtract to get the change.

Change in working capital is a cash flow item that reflects the actual cash used to operate the business.

To explain this further, I will quote Jae Jun, who has written several great articles on this subject.

“The “change” refers to how cash flow has changed based on working capital changes. You must consider and link what happens to cash flow when an asset or liability increases.

If current assets are increasing, cash is being used.

If current liabilities are increasing, less cash is being used as the company extends payments or gets money upfront before the service is provided.

To tie this together, the “change” determines whether current operating assets or liabilities increase.

If the final value for Change in Working Capital is negative, the change in the current operating assets will increase more than the current operating liabilities. Cash has been used, reducing Free Cash Flow.

If changes in working capital are positive, the change in current operating liabilities will increase more than the part of the current assets. This means the use of cash has been delayed, which increases Free Cash Flow.

Put another way, if changes in working capital are negative, the company needs more capital to grow, and therefore, working capital (not the “change”) is increasing.

If the change in working capital is positive, the company can grow with less capital because it delays payments or gets the money upfront. Therefore, working capital is decreasing.”

He says that far more eloquently than I could have, and the last two sentences are key to understanding this concept.

Please re-read that part again until you understand the concept of changes in working capital; until you do the math, the above part will not make much sense.

How to Calculate Changes in Working Capital

Calculating the changes in working capital is relatively easy once you understand the principles behind the theory.

Not all financial filings list every line item the same, i.e., not all list every asset or liability. Their terminology may vary from company to company or industry to industry.

If you remain unsure of any line item, I suggest using either our friend Mr. Google or email me, and I will give you a hand unless you have your handy accounting 101 books lying around.

To calculate our change in working capital, we will add all the items from the assets together; then, we will do the same for the liabilities.

Once we have tallied the assets and liabilities, we can subtract the liabilities from the assets to arrive at our number for the change in working capital.

The math portion of this calculation remains very simple; the harder part is understanding where the numbers come from and why it is essential to focus on the change in working capital and interpret the result.

To make the changes in working capital a bit easier to calculate, I am including an Excel calculator for you to use. It is adaptable for you to add or subtract any line items you wish, but the calculator will make understanding the changes in working capital easier.

Changes in Working Capital Calculator

Next, look at some examples from actual companies to find our changes in working capital.

Real-Life Examples of Changes in Working Capital

Example: Oshkosh Corp

For our first example, I would like to return to my old friend, Oshkosh Corp; we can revisit their cash flow statement and look at our math.

To review the items from Oshkosh Corp that are assets are:

- Receivables

- Inventories

- Other Current assets

From the current liabilities:

- Accounts payable

- Customer Advances

- Payroll-related obligations

- Income taxes

- Other long-term liabilities and assets

Taking the numbers from the cash flow statement and adding them up, we get:

|

Oshkosh Corp Changes in Working Capital | |

|

Assets: | |

|

Receivables + |

($128.3) million |

|

Unbilled receivables + |

$62.8 million |

|

Inventories + |

$246.7 million |

|

Other current assets + |

$8.1 million |

|

Total current assets = |

$189.3 million |

Next, looking at the liabilities from the cash flow statement, we get:

|

Liabilities | |

|

Accounts Payable + |

$252.1 million |

|

Customer Advances + |

$162.6 million |

|

Payroll-related obligations + |

$61.2 million |

|

Income taxes payable + |

-$156.7 million |

|

Other current liabilities + |

$6.4 million |

|

Total current liabilities = |

$325.6 million |

Now, adding the current assets to the current liabilities, we get:

Changes in working capital = $189.3 million + $325.6 million = $514.9 million

That was pretty easy. It was just some easy math for a change, and all the numbers were laid out nicely for us.

What does this negative number mean? This means that the changes in working capital are negative and that Oshkosh Corp needs more capital to grow; therefore, working capital is increasing. Notice one thing about Oshkosh Corp’s cash flow statement: they already do the math for you.

Oshkosh Corp lists it as Total Changes in Operating Assets and Liabilities or changes in working capital.

Not all companies will do this for you; most won’t.

Let’s look at a few more to help nail down this idea.

Next, let’s look at Hormel, which we have used for examples of our owner earnings.

First, I will pull the cash flow statement, and then we can go from there.

Now, I will build our chart based on the numbers from above.

|

Assets: | |

|

Receivables + |

-$191,627 thousand |

|

Inventories + |

-$145,176 thousand |

|

Prepaid Expenses + |

$34,555 thousand |

|

Pension and Post-retirement + |

-$15,448 thousand |

|

Total current assets = |

-$317,696 thousand |

Next, current liabilities:

|

Liabilities: | |

|

Accounts payable + |

$115,099 thousand |

|

Net income taxes payable + |

$36,811 thousand |

|

Total current liabilities = |

$151,910 |

Now, we will calculate Hormel’s changes in working capital:

Changes in working capital = ($317,696) + $151,910 = ($165,786) thousand

Notice the different language for the assets and liabilities; it can get confusing; why spend a few minutes double-checking our terminology?

Also, we have excluded the net cash at the bottom of the cash flow statement because we do not use cash as working capital.

The negative changes in working capital tell us Hormel uses its current cash flow to grow the assets, either buying more inventory or extending its receivables to receive better pricing on its inventories.

The bottom line is that a negative change in working capital tells investors that the company hopes to generate growth by spending cash on inventories or receivables.

Example: Verizon

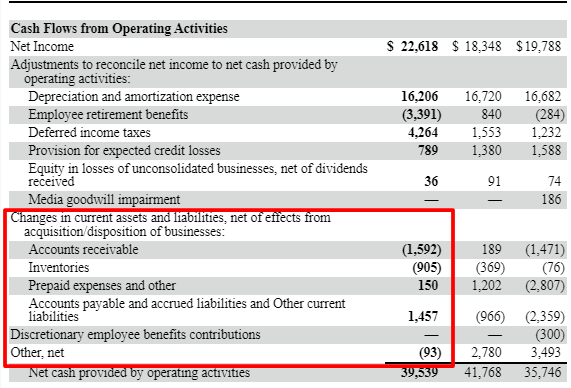

Next up, let’s look at Verizon; we have used companies with a strong manufacturing base, whereas Verizon would be far more tech-based.

Now that we have our cash flow statement for Verizon, we can put together our chart.

|

Accounts receivable + |

$1,592 million |

|

Inventories + |

-$905 million |

|

Prepaid expenses + |

$150 million |

|

Total current assets = |

$837 million |

And now current liabilities:

|

Accounts payable + |

$1,457 million |

|

Other, net + |

-$93 million |

|

Total current liabilities |

$1,364 million |

Verizon Changes in working capital = $837 + $1,364 = $2,201 million

Again, notice the similarities in each company’s language when differentiating between assets and liabilities.

As before, with Hormel, we exclude net cash. We also exclude employee benefits and net as they can’t be included in our liabilities because they don’t contribute to our working capital.

Our chart shows that Verizon has a negative number regarding its change in working capital.

Today, I want to focus on how the changes in working capital work and how we understand the concept.

Final Thoughts

We have covered a lot of ground today, discussing the particulars of changes in working capital and what they mean for our business.

To drive the point home, I will include the quote from Jae Jun because I think it bears repeating and remains critical to understanding its impact on our business.

“The “change” refers to how cash flow has changed based on working capital changes. You must consider and link what happens to cash flow when an asset or liability increases.

If current assets are increasing, cash is being used.

If current liabilities are increasing, less cash is being used as the company extends payments or gets money upfront before the service is provided.

To tie this together, the “change” determines whether current operating assets or liabilities increase.

If the final value for Change in Working Capital is negative, the change in the current operating assets will increase more than the current operating liabilities. Cash has been used, reducing Free Cash Flow.

If changes in working capital are positive, the change in current operating liabilities will increase more than the part of the current assets. This means the use of cash has been delayed, which increases Free Cash Flow.

Put another way, if changes in working capital are negative, the company needs more capital to grow, and therefore, working capital (not the “change”) is increasing.

If the change in working capital is positive, the company can grow with less capital because it delays payments or gets the money upfront. Therefore, working capital is decreasing.”

The key is to remember how the positive and negative numbers correspond to our company and what they mean for the growth of our company.

I have tried to include many different examples from various industries so you can get an idea of how this will work for you.

As with everything I try to teach, please let me know if you have any questions or if there is anything I can make clearer for you.

Thanks for reading, and I hope you found some value in this post.

Take care,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Simple Balance Sheet Structure Breakdown (by Each Component) “Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets.” Peter Lynch The ability...

- Working Capital vs Current Ratio – Don’t Calculate WC the Wrong Way! There’s a subtle difference between working capital and current ratio. Though both can be calculated from the same place in the balance sheet, they are...

- Basic Cash Flow Statement Breakdown (by Each Component) Updated 4/21/2023 Cash is king, and finding companies that generate cash is the holy grail of investing. The basic cash flow statement provides answers to...

- Accounting for Operating Leases in the Balance Sheet – Simply Explained Updated 9/25/2023 Operating lease accounting can be confusing. Especially when you have to sift through multiple financial statements to quantify its impact. The latest FASB...