Cisco reported quarter ending results for April 25, 2020, on May 13, 2020. The following report is a summary of those results, no opinion on those financial results will be offered, just the facts as reported on the quarterly report. If you would like additional details, you can find the quarterly report below:

Cisco 10Q Report Third-Quarter 2020

Selected Finacial Highlights from the Third Quarter 2020

A note about all comparisons unless notated will be the previous year’s quarter of 2019.

- Cisco reported revenue of $12 for the quarter, which was a decline of 8%.

- Net GAAP income was reported of $2.8 billion, with GAAP earnings of $0.65 per share and Non-GAAP earnings of $0.79 per share.

- Cisco also offered guidance for the rest of the year, expecting declines in revenue in the 8.5 to 11% range, with GAAP earnings in the $0.57 to $0.62 range, and Non-GAAP earnings in the $0.72 to $0.74 range.

Select Financial Ratios from the Third-Quarter 2020:

- Market Cap – $179.8 Billion

- Market Price at quarters end – $42.38

- Enterprise Value – $181.2 Billion

- P/E Ratio – 18.17

- P/B Ratio – 5.46

- Return on Equity – 31.15

- Return on Assets – 12.21

- Return on Invested Captial – 16.04

- Debt to Equity – 0.45

- Earnings per share – $0.65

- Dividends per share – $0.36

- Dividend payout ratio – 0.55

Financial Summary

Revenue

The total revenue for Cisco for the quarter was $12 billion, which was down 8% from 2019, with product revenue down 12% and service revenue up 5%. Cisco breaks out revenue by geographic region:

- Americas – down 8%

- EMEA – down 7%

- APJC – down 9%

Product revenue saw some growth in Security, which was up 6%. While Infrastructure Platforms declined 15% and Applications saw a 5% decrease.

Gross Margin

On a GAAP basis, Cisco reported total gross margins of 64.9%, gross product margins of 63.7%, and service gross margins of 67.7%. All reported gross margins were an increase over the gross margins of the third-quarter of 2019.

On a Non-GAAP basis, Cisco reported total gross margins of 66.6%, gross product margins of 65.8%, and service gross margins of 68.9%, with again all gross margins showing improvement over the prior-year quarter.

On a geographic segment reporting basis, total gross margins for the Americas were 67.8%, EMEA was 65.7%, and APJC was 65.7%.

Operating Expenses

Cisco reported on a GAAP basis operating expenses of $3.4 billion, which was down 3%, with a GAAP operating margin of 28.5%. Non-GAAP operating expenses were even at $4.2 billion, with an operating margin of 34.9%.

Provision for Income Taxes

The provision for income taxes for Cisco was reported at 19.4% for the quarter and non-GAAP provision of 20%.

Net Income and EPS

On a GAAP basis, Cisco reported a net income of $2.8 billion, which was down 9% from the previous quarter, and GAAP earnings per share of $0.65, which was down 6%. On a non-GAAP basis, net income was reported of $3.4 billion, down 2%, and the earnings per share of $0.79, which was down 1%.

Cash Flow from Operating Activities

Cisco reported cash flow from operating activities of $4.2 billion for the quarter, compared to $4.3 billion of 2019, which was a decrease of 2%.

Balance Sheet and Other Financial Highlights

Cisco reported cash and cash equivalents of $28.6 billion at the end of the third-quarter, which compared to $33.4 billion from the third quarter of 2019.

Deferred revenue was up 7% for a total of $18.6 billion, of which deferred product deferred revenue was up 17% and deferred revenue for service up 1%.

Cisco has $25.5 billion in remaining performance obligations for the third quarter of 2020, which was an increase of 11%.

Acquisitions

At the end of the third quarter of 2020, Cisco closed the acquisition of Exablaze, a privately held designer and manufacturer of advanced network devices designed to reduce latency and improve network performance.

Guidance for fourth-quarter 2020

- Revenue – 8% to 11.5% decline year over year

- Non-GAAP gross margin rate – 64% to 65%

- Non-GAAP operating margin rate – 31.5% to 32.5%

- Non-GAAP tax provision rate – 20%

- Non-GAAP earnings per share – $0.72 to $0.74

Cisco is estimating that GAAP earnings per share will be $0.57 to $0.62 in the fourth quarter of 2020.

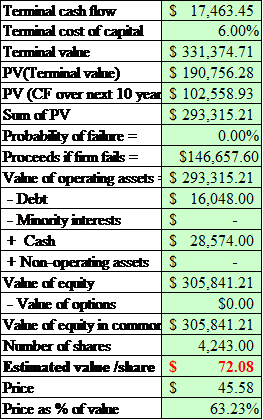

Valuation

Below is a discounted cash flow valuation of Cisco based on the latest trailing-twelve-month numbers. The valuation is not meant as buying or selling advice, rather as an educational tool to find a possible price point. I will include my assumptions so you can follow along with the valuation, as well as several optional discount rates to see a range of possible values.

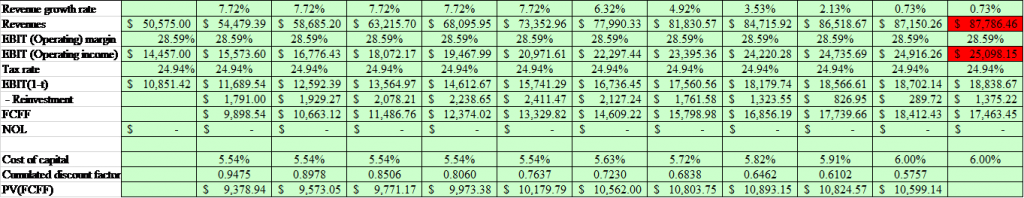

Growth rate of free cash flow: 7.72%

Discount Rate: 5.54%

Terminal Rate: 0.73%

We are adjusting the discount rates slightly higher and lower to give you an idea of possible price ranges.

5% – $74.34

5.54% – $72.08

6% – $$70.22

Final Thoughts

That wraps up the Cisco 10Q summary of the company’s third-quarter results for 2020. The above summary is not meant as investment advice or guidance, rather as an overview of the company for you to review. If you find something you like about Cisco or any company, please do your due diligence and analyze the company using your process.

The above valuation is meant as a price guide based on the current financial data available when the discounted cash flow was prepared. The data is taken from the trailing-twelve-months data, which includes the above summary data.

As always, thank you for taking the time to read this report.

Until next time.

Take care, and stay safe out there,

Dave

Related posts:

- Kontoor Brands (KTB) 10Q Summary for First Quarter 2020 Kontoor Brands (KTB) announced its first-quarter results on May 7, 2020. The following report will be a summary of those results for the first quarter....

- Pulte Group 10Q Summary of First Quarter 2020 Pulte Group (PHM) announced its first-quarter earnings of 2020 on April 23, 2020. The following report will be present a summary of those results; there...

- Markel 10Q Summary First-Quarter 2020 Markel 10Q Summary Markel (MKL) reported first-quarter earnings on April 28, 2020, for the quarter ending March 30, 2020. The following report is a summary...

- Prudential (PRU) 1st Quarter 2020 10Q Summary Prudential (PRU) 1st Quarter 2020 10Q Summary Prudential Financial Inc announced its first-quarter 2020 results on May 5, 2020. The quarter was as expected, given...